CFE calculates settlement price from quotes whether there was trading or not. "The daily settlement price for each VIX futures contract will be the average of the final bid and final offer for the VIX futures contract at the close of trading." CFE rule 1202 (p) http://cfe.cboe.com/publish/cferulebook/cferulebook.pdf

Full Answer

What is the final settlement value for VIX futures?

The final settlement value for VIX Futures is a Special Opening Quotation (SOQ) of the VIX Index. The SOQ is calculated using opening prices of constituent SPX or SPX Weeklys options that expire 30 days after the relevant VIX expiration date.

How do I know when the VIX futures expire?

You can easily recognize it not only because it is at the end, but also because all prices (Open, High, Low, Close) except the "Settle" price are zero, as well as Volume. The number in the "Settle" column is the final settlement value of the futures contract. Here you can find VIX futures expiration calendar and expiration dates history.

How to recognize the final settlement value of a futures contract?

You can easily recognize it not only because it is at the end, but also because all prices (Open, High, Low, Close) except the "Settle" price are zero, as well as Volume. The number in the "Settle" column is the final settlement value of the futures contract.

Where can I find historical data of individual Vix contract months?

Historical data of individual VIX futures contract months are in the .csv format. The columns in the spreadsheet are: For contracts which have already expired, the last row of data in the CSV file is the final settlement day.

How are VIX futures settled?

The VIX Index settlement process is patterned after the process used to settle A.M.-settled S&P 500 Index options. The final settlement value for Volatility Derivatives is determined on the morning of their expiration date (usually a Wednesday) through a Special Opening Quotation ("SOQ") of the VIX Index.

How are futures settled daily?

Finally, what exactly is the daily settlement price and how is it calculated. It is simply the closing price of the specific futures contract on that day. The closing price for a futures contract is calculated as the weighted average price of the contract in the F&O Segment of NSE in the last half hour.

How is VIX settlement calculated?

The settlement amount of a particular VIX option is the difference between the Special Opening Quotation and the option's strike price, times 100 dollars.

How is futures settlement price determined?

Typically, the settlement price is set by determining the weighted average price over a certain period of trading, typically shortly before the close of the market.

Are futures cash settled daily?

Futures markets have an official daily settlement price set by the exchange.

What is daily settlement in futures contract?

Daily-settlement definition The amount of money that has to be paid at the end of each trading day by a futures trader in order to make an additional margin payment required by the price change of the futures contracts.

How is daily VIX calculated?

The VIX Index is a financial benchmark designed to be an up-to-the-minute market estimate of expected volatility of the S&P 500 Index, and is calculated by using the midpoint of real-time S&P 500® Index (SPX) option bid/ask quotes.

What time does VIX settle?

Trading hours for expiring VX futures contracts end at 8:00 a.m. Chicago time on the final settlement date....Cboe Volatility Index® (VX) Futures.Type of Trading HoursMonday - FridayExtended5:00 p.m. (previous day) to 8:30 a.m.Regular8:30 a.m. to 3:00 p.m.Extended3:00 p.m. to 4:00 p.m.

Is VIX option cash settled?

11:2112:30VIX Options Settlement Explained | What You Need to Know - YouTubeYouTubeStart of suggested clipEnd of suggested clipNext VIX options and futures are cash settled which means they do not settle to shares of stock. SoMoreNext VIX options and futures are cash settled which means they do not settle to shares of stock. So any VIX options that are out of the money will just expire worthless. And any VIX options that are

What is the daily settlement price?

Daily settlement price for futures contracts is the closing price of such contracts on the trading day.

How is final settlement price calculated?

The final settlement price for a single stock futures or equity option contract shall be determined by the arithmetic mean of the prices of the underlying security on the securities market during the last 60 minutes of trading before market close on the final settlement day.

What is the difference between closing price and settlement price?

Closing price of any scrip on any day is the weighted average price of last 30 minutes of trading for that day. But daily settlement is only for future contracts and daily settlement price is based on closing price of futures contract.

How are futures settled?

Futures contracts have expiration dates as opposed to stocks that trade in perpetuity. They are rolled over to a different month to avoid the costs and obligations associated with settlement of the contracts. Futures contracts are most often settled by physical settlement or cash settlement.

How long does futures trades take to settle?

The settlement date is the date when a trade is final, and the buyer must make payment to the seller while the seller delivers the assets to the buyer. The settlement date for stocks and bonds is usually two business days after the execution date (T+2).

What is daily settlement of profits and losses in futures contract called?

One of the important features of Futures contracts is that gains and losses are settled on each trading day. This exercise is called Mark to Market (MTM) settlement. This means that the value of the contract is marked to its current market value.

How do you calculate futures MTM?

What is Mark to Market (MTM)?Change in futures contract value. = Future contract Price of Current Day – Closing Price as of Prior Day.P&L for the day = Price Change in futures contract value * Number of lots.Total P&L = the sum total of all the daily P&L until the futures contract position is held.

When is the settlement price determined?

The settlement price will be determined on the settlement date of a particular contract.

What Is the Settlement Price?

The settlement price, typically used in the mutual fund and derivatives markets, is the price used for determining a position's daily profit or loss as well as the related margin requirements for the position.

What happens if you own a call option with a strike price of $100?

If you own a call option with a strike price of $100 and the settlement price of the underlying asset at its expiration is $120, then the owner of the call is able to purchase shares for $100, which could then be sold for a $20 profit since it is ITM. If, however, the settlement price was $90, then the options would expire worthless since they are OTM.

How are settlement prices calculated?

Settlement prices are typically based on price averages within a specific time period. These prices may be calculated based on activity across an entire trading day—using the opening and closing prices as part of the calculation—or on activity that takes place during a specific window of time within a trading day.

Is the settlement price the same as the opening price?

While the opening and closing prices are generally handled the same way from one exchange to the next, there is no standard on how settlement prices must be determined in different exchanges, causing variances across the global markets.

What format is VIX futures?

Historical data of individual VIX futures contract months are in the .csv format.

Can you see all futures contracts for a particular day?

Alternatively to the CSV files, which have the disadvantage that there is a separate file for each contract month, you can see an overview of all future s contracts for a particular day (not just VIX futures but also mini-VIX and futures on other indices like OVZ, GVZ, VXEEM).

What is VIX futures?

VIX Futures are AM settled contracts. The final settlement value for VIX Futures is a Special Opening Quotation (SOQ) of the VIX Index. The SOQ is calculated using opening prices of constituent SPX or SPX Weeklys options that expire 30 days after the relevant VIX expiration date. The final settlement value for VIX futures is disseminated using the ticker VRO. The last trading day for VIX Futures is the day before settlement so a contract that is due to expire on Wednesday morning will cease trading at 3:15 pm Chicago time the day before settlement. This means a contract set to expire will not trade during non-US hours the day of settlement.

How often do VIX futures expire?

In addition, there are standard VIX Futures contracts that expire each month.

What is VIX Q6?

VIX/Q6 is the standard August VIX contract. The quotes that begin with numbers are VIX Weeklys Futures and the numbers actually represent which week of the year these contracts expire. 1. The VIX Settlement Process.

What is VIX in stock market?

VIX is a consistent measure of near term volatility determined using S&P 500® (SPX) option pricing . There are two different expiring sets of SPX options feeding into the VIX calculation with the two series being time weighted to determine a consistent 30-day measure of implied volatility. When the S&P 500 comes under pressure the demand for SPX put options increases which often pushes VIX higher. VIX was given the nickname, “The Fear Index” because of this increased demand for portfolio protection at times when the market is under pressure.

When did VIX start trading?

Financial futures trading based on the CBOE Volatility Index® (VIX®) was introduced in 2004. This milestone was the first instance of a listed derivative available for trading that gave investors direct exposure to expected market volatility. If you are considering adding volatility to your toolbox of trading and portfolio management methods, there are a few things you should know as you get started.

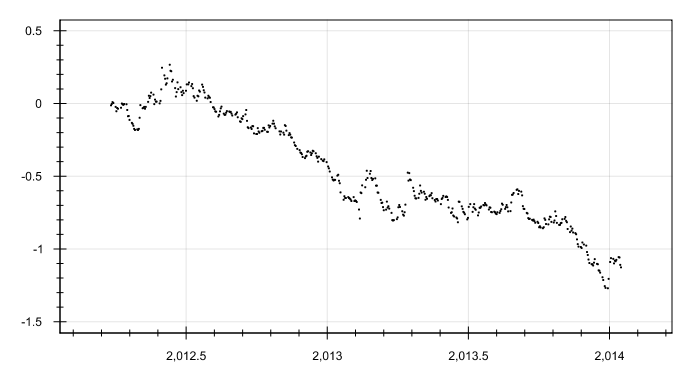

Is VIX futures a premium?

VIX Futures contracts may trade at a premium or discount to spot VIX and other VIX futures. The majority of trading days VIX Futures are at a premium to spot VIX as well as at a premium to the futures contracts that expire before the expiration date for the individual contract. Figure 3 shows spot VIX and the standard VIX futures contract pricing ...