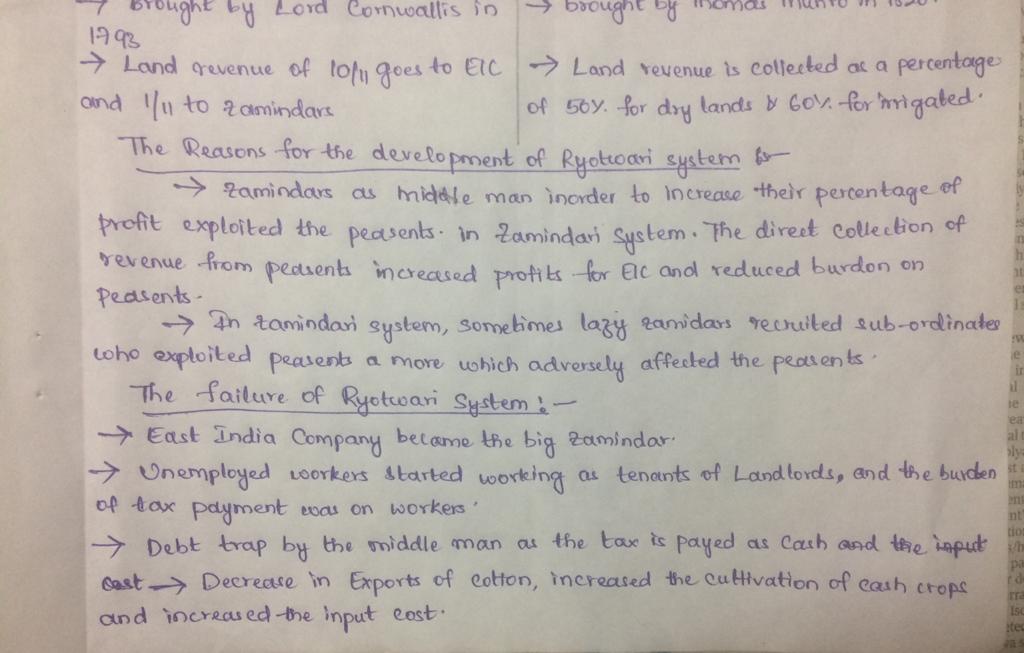

Under the Mahalwari system, the land revenue was collected from the farmers by the village headmen on behalf of the whole village. Under the Ryotwari system, the land revenue was paid by the farmers directly to the state. The Zamindari system was started by the Imperialist East India Company in 1793.

What is ryotwari settlement?

Ryotwari Settlement was implemented in 52 per cent of British India. 50 per cent of the net produce was fixed as land revenue. Under the Ryotwari system, the cultivators were recognized as the owner of their land. Each field was to be surveyed, its output estimated and then converted into cash.

What were the revenue rates of the ryotwari system?

The revenue rates of the Ryotwari System were 50% where the lands were dry and 60% in irrigated land. The villages committee was held responsible for collection of the taxes. Sir Thomas Munro introduced the Ryotwari System in the Madras and Bombay presidencies between 1792 and 1827.

Who introduced ryotwari system of division of land?

Ryotwari System was introduced by Thomas Munro in 1820. Mahalwari system was introduced in 1833 during the period of William Bentick. Also known as the Permanent Settlement System. It was also known as Munro system. In this system, the land was divided into Mahals.

What are ryotwari and Mahalwari systems?

These were the Ryotwari and the Mahalwari systems. Download the Land Revenue Systems In British India notes PDF from the link provided below. This system of land revenue was instituted in the late 18th century by Sir Thomas Munro, Governor of Madras in 1820.

Where was the Ryotwari system of revenue collection introduced?

The system was devised by Capt. Alexander Read and Thomas (later Sir Thomas) Munro at the end of the 18th century and introduced by the latter when he was governor (1820–27) of Madras (now Chennai). The principle was the direct collection of the land revenue from each individual cultivator by government agents.

What was the rate of revenue in Ryotwari settlement?

Ryotwari System In Ryotwari System the ownership rights were handed over to the peasants. British Government collected taxes directly from the peasants. The revenue rates of the Ryotwari System were 50% where the lands were dry and 60% in irrigated land.

What are the main features of Ryotwari settlement?

The main feature of the Ryotwari System is that in this System there was no intermediary between the King and the cultivators as in the zamindari System. The peasants were recognised as the owner of the land. The tax was levied at a rate of 50% for drylands and 60% for wetlands.

What was the impact of Ryotwari settlement?

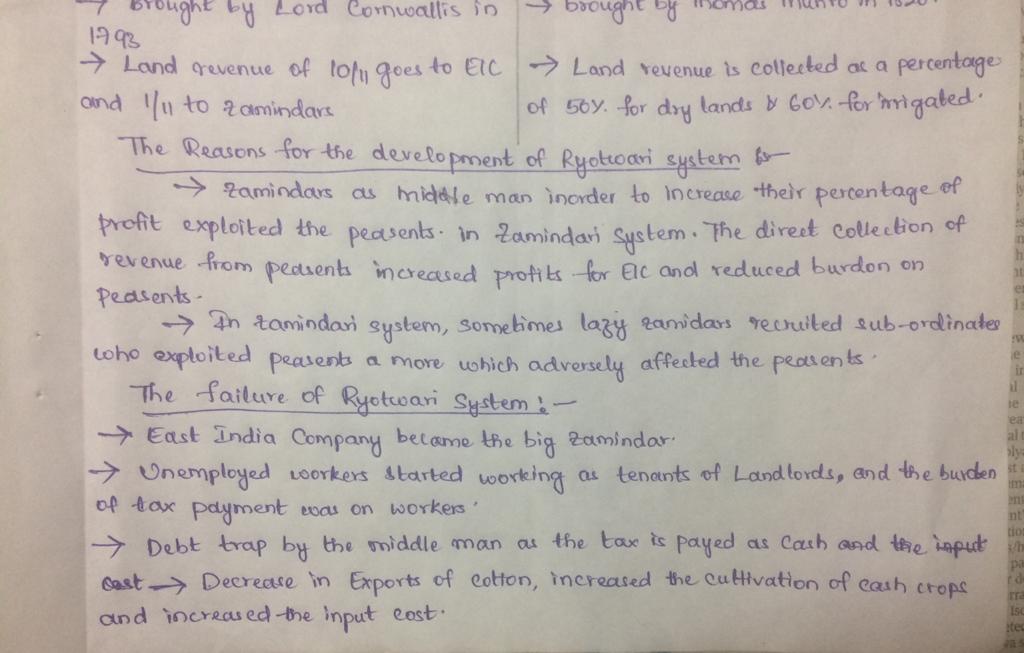

In the Ryotwari system, revenues were collected by the Company directly from the ryots (farmers). There was no intermediary like a Zamindar between the peasant and the government. So long as he paid the revenue in time, the peasant was not evicted from the land.

Why the revenue collected would be large in the Ryotwari system?

Ryotwari system They had ownership rights, could sell, mortgage or gift the land. The taxes were directly collected by the government from the peasants. The rates were 50% in dryland and 60% in the wetland. The rates were high and unlike the Permanent System, they were open to being increased.

What is Ryotwari system Short answer?

The ryotwari system was a land revenue system in British India which was introduced by Thomas Munro allowed the government to deal directly with the cultivator ('ryot') for revenue collection and gave the peasant freedom to cede or acquire new land for cultivation.

What revenue was introduced by the British?

The zamindari system was introduced by Lord Cornwallis in 1793 through Permanent Settlement that fixed the land rights of the members in perpetuity without any provision for fixed rent or occupancy right for actual cultivators.

What were the limitations of Ryotwari system?

The rate of taxation was quite high. The tax was not based on the actual revenues from the produce of the land. It was based on an estimate of the potential of the soil. In some cases, the tax was more than 50% of the gross revenue.

How was land revenue collected from different categories of land?

Answer. Akbar's revenue minister Todar Mal carried out a survey of crop yields, prices, and areas cultivated for a 10-year period, and then fixed taxes on each crop. Each province was divided into revenue circles with its own rates of revenue for each crop and this revenue system was known as zabt.

Who introduced Ryotwari system Class 8?

Ryotwari System was introduced in India in 1820 by Thomas Munro and Charles Reed. It was first introduced in Madras presidency. Under this British Government collected taxes directly from the peasants.

Who founded Ryotwari system?

Sir Thomas Munro, Governor of Madras in 1820, established this system of land revenue in the late 18th century.

Can we buy Ryotwari land?

Since the Inam land is allotted for occupancy or ten ency rights only, the inamdar cannot alienate the proeprty by sale without the permission of the Commissioner of the land revenue. Under the Ryotwari System every registered holder of land is recognised as its proprietor, and pays direct to Government.

What is land revenue in India?

Land revenue is a tax or revenue levied on land-based agricultural production. The main burden of providing money for the Company's trade and profits, administration costs, and the wars of British expansion in India had to be borne by the Indian peasant or ryot.

What revenue was introduced by the British?

The zamindari system was introduced by Lord Cornwallis in 1793 through Permanent Settlement that fixed the land rights of the members in perpetuity without any provision for fixed rent or occupancy right for actual cultivators.

What is land revenue system?

Land revenue was paid directly to the government by farmers under the Ryotwari system. In this system, a single cultivator known as Ryot held complete control over the land sale, transfer, and lease. As long as the ryots maintained their rent, they could not be expelled from their land.

Which of the following statement is correct about Ryotwari system?

The correct answer is In principle, it strengthened the former elite, the zamindars and weakened the peasantry. Ryotwari system, one of the three principal methods of revenue collection in British India.

Who collected land revenue in Mahalwari?

Under the Mahalwari system, the land revenue was collected from the farmers by the village headmen on behalf of the whole village. Under the Ryotwari system, the land revenue was paid by the farmers directly to the state. The Zamindari system was started by the Imperialist East India Company in 1793.

What were the two states that were part of the Ryotwari system?

It covered the states of Punjab, Awadh and Agra, parts of Orissa, and Madhya Pradesh.

What were the land revenue systems under the British?

Apart from the Permanent Settlement, there were other kinds of land revenue systems under the British in India. These were the Ryotwari and the Mahalwari systems.

What led to more indebtedness among farmers?

Insistence on cash payment of revenue led to more indebtedness among farmers. Moneylenders became landowners in due course.

Why did the British make bonding labour so high?

Moneylenders became landowners in due course. Bonded labour arose because loans were given to farmers/labourers who could not pay it back.

What percentage of land did the villagers own in India?

When India achieved freedom from colonial rule, 7% of the villagers (Zamindars/landowners) owned 75% of the agricultural land.

Why did farmers resorted to growing cash crops instead of food crops?

Due to the very high taxes, farmers resorted to growing cash crops instead of food crops. This led to food insecurity and even famines. Taxes on agricultural produce were moderate during pre-British times. The British made it very high.

What is the Ryotwari System of Land Revenue?

Ryotwari system was one of the three principal methods of revenue collection in British India. It was common in most of southern India. It was the standard system of the Madras Presidency. Sir Thomas Munro devised this system at the end of the 18th century.

Who were the owners of the lands in the Ryotwari system?

Zamindars were recognized as the owners of the lands. They were given the right to collect the revenue from the farmers. In the Ryotwari System, the ownership rights were handed over to the peasants. British Government collected taxes directly from the peasants. Ownership rights were vested with the peasants.

What are the three major land revenue systems in India?

Three major systems of land revenue collection existed in India. They were – Zamindari, Ryotwari, and Mahalwari. Thomas Munro introduced the Ryotwari System in 1820. It was introduced in areas of Madras, Bombay, parts of Assam, and Coorgh provinces of British India. In the Ryotwari System, the ownership rights were handed over to the peasants.

What is the purpose of the Ryot system?

The principle was the direct collection of the land revenue from each individual cultivator by government agents. For completing this purpose, The government gave the ownership rights to the peasants and the government collected ...

Which system gave an exclusive right to the landholders?

Hence, the Ryotwari system gave an exclusive right to the landholders.

What happened to cotton after the Civil War?

After the end of the American civil war, cotton export declined but the government didn’t reduce the revenue. And according to the system, the government expelled most of the farmers from their lands. The government transferred these lands from farmers to moneylenders. It led to the impoverishment of the farmers.

Where was the Munro system introduced?

Each Mahal comprises one or more villages. It was introduced in the provinces of Bengal, Bihar, Orissa, and Varanasi. Major areas of introduction include Madras, Bombay, parts of Assam and Coorgh provinces of British India.

What were the primary aims of the Ryotwari Settlement?

The primary aims of the Ryotwari Settlement were the regular collection of revenue and amelioration of the conditions of the ryots. The first aim was realized but the second remained unfulfilled. Since the settlements of the land revenue in money were fixed for several years, the prolonged fall in prices increased the real burden of the land revenue on the peasant on a particular plot. As there was no fixity of rental, no security against enhancement of rent and no adequate motive for spending money and labour for the improvement of cultivation, the value of agricultural output shrank.

When was Ryotwari established?

Ryotwari Settlement was first introduced in Tamil Nadu (former Madras) by Thomas Munro and Captain Read in 1820; and then it was gradually extended to Maharashtra (former Bombay Presidency), East Bengal and portions of Assam and Coorg (part of present Karnataka).

What were the defects of the recurring settlement system?

One great defect of the system was that the cultivator had no voice in the settlement; he was simply called to pay the tax or to quit his land. ‘Under such a system, where the cultivators were not consulted and could appeal to no Land Courts, the revenue demand was increased at each recurring settlement, and the peasantry remained resourceless and poor’.

Why did the Ryot introduce private ownership?

Another reason for introducing private ownership in the land was provided by the belief that only the right of ownership would make the landlord or the ryot exert himself in making improvements.

What percentage of the net produce was fixed as land revenue?

50 per cent of the net produce was fixed as land revenue.

Who is responsible for paying taxes in Ryotwari?

In the Ryotwari system, the company directly made the contract with the farmers instead of Zamidaars to collect tax/land revenue. Now it is every farmer’s responsibility to submit tax directly to the company at regular intervals.

What was India's traditional revenue system?

In which farmers were the owners of their land, and they used to pay some portion of their crop revenue as tax. After the Allahabad pact of 1965, the East India Company got the right to collect taxes from Bengal, Bihar, and Odisha’s presidency.

What happens if farmers are delayed in paying taxes?

The farmers were given the ownership of land up till they pay taxes on time, and if delayed, the farmers are evicted from their own land.

Features of Ryotwari System

Land ownership and occupancy rights were transferred to the ryot, and there was no limit to the amount of land they could own. They could sublet, transfer, or sell their land at any time.

Ryotwari Settlement In Madras

When Thomas Munro became governor of Madras Presidency in 1820, he introduced the system which came to be known as the Ryotwari System.

Drawbacks of Ryotwari System

Overestimation of revenue was a major issue. The fixed land revenue was frequently greater than the land's capacity.

Issue with Ryotwari System

This system delegated a great deal of authority to subordinate revenue officials, whose activities were not adequately monitored.

Conclusion

The burden of land revenue was somewhat reduced under the reformed ryotwari system. The purchaser could now expect to profit from owning land because the state would not take all of it as tax. As a result, moneylenders began seizing the lands of their peasant debtors and either evicting them or reducing them to tenants.

MCQs

The Ryotwari System was a method of collecting revenue in British India. It was the standard system of the Madras Presidency and was used throughout most of Southern India. Alexander Read and Thomas Munro devised the system. When Thomas Munro was Governor of Madras in 1820, he instituted it.