Why was the ryotwari system better than permanent settlement of revenue?

On the contary, under the Ryotwari system, the government got tax from those who cultivated lands with their own hands. Under the Ryotwari system, all the middlement were removed. This system was better than the Permanent Settlement of revenue. It increased the rights of the farmers.

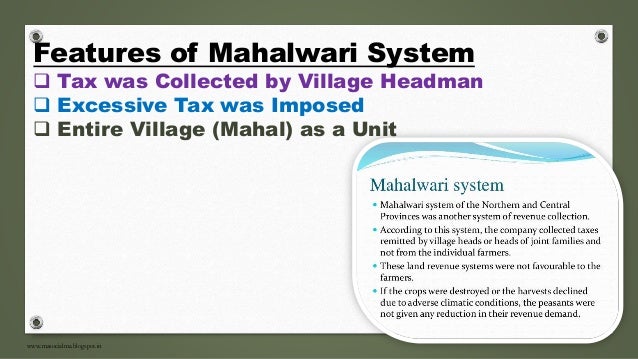

What is the difference between Mahalwari and ryotwari system?

Under the Mahalwari system, the land revenue was collected from the farmers by the village headmen on behalf of the whole village. Under the Ryotwari system, the land revenue was paid by the farmers directly to the state.

Who is the owner of the land in the ryotwari system?

While in ryotwari system, the Ryot (prasant) who owned the land was considered the owner and he had to pay the revenue directly to the government.

Who introduced ryotwari system in India?

This system of land revenue was instituted in the late 18th century by Sir Thomas Munro, Governor of Madras in 1820. This was practised in the Madras and Bombay areas, as well as Assam and Coorg provinces. What is the difference between the Ryotwari and Mahalwari system?

How was the system different from the Permanent Settlement?

In Permanent Settlement, there was no provision of any revision of the revenue. But in Mahalwari System the revenue was to be revised periodically. In Permanent Settlement the zamindars collected the revenue. But in Mahalwari systern the village headman had to collect the revenue.

How were the Ryotwari and Mahalwari settlement different from Permanent Settlement?

What is the difference between the Ryotwari and Mahalwari system? Under the Mahalwari system, the land revenue was collected from the farmers by the village headmen on behalf of the whole village. Under the Ryotwari system, the land revenue was paid by the farmers directly to the state.

How is the Ryotwari system different from other systems?

In Ryotwari System the ownership rights were handed over to the peasants and the British Government collected taxes directly from the peasants. The revenue rates of Ryotwari System were 50% where the lands were dry and 60% in irrigated land.

Who introduced the Permanent Settlement and Ryotwari system?

The zamindari system was introduced by Lord Cornwallis in 1793 through Permanent Settlement that fixed the land rights of the members in perpetuity without any provision for fixed rent or occupancy right for actual cultivators.

What was the Ryotwari system Class 8?

Ryotwari system is the system in which the peasants were considered as the owners of the land. They had a license to sell, mortgage or gift the land. The taxes were directly obtained by the government from the peasants. The taxes were 50% in dryland and 60% in the wetland.

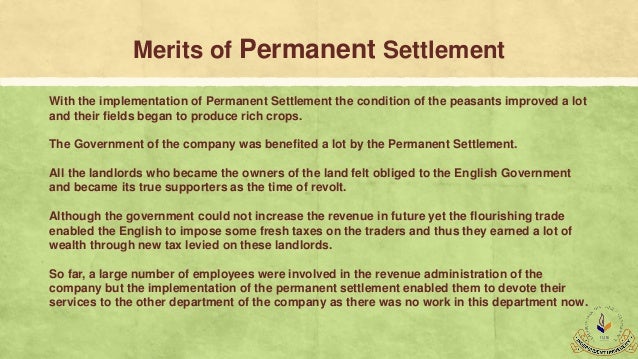

What were the main features of the Permanent Settlement Class 8?

The main features of the Permanent Settlement system were: The amount of the revenue was fixed permanently, that is, it was not to be increased ever in future. Since the revenue demand of the state would not be increased, the zamindar would benefit from increased production from the land.

Who introduced Ryotwari System Class 8?

The system was devised by Capt. Alexander Read and Thomas (later Sir Thomas) Munro at the end of the 18th century and introduced by the latter when he was governor (1820–27) of Madras (now Chennai). The principle was the direct collection of the land revenue from each individual cultivator by government agents.

What is Permanent Settlement system?

The Permanent Settlement, also known as the Permanent Settlement of Bengal, was an agreement between the East India Company and Bengali landlords to fix revenues to be raised from land that had far-reaching consequences for both agricultural methods and productivity in the entire British Empire and the political ...

What were the disadvantages of Ryotwari System Class 8?

The rate of taxation was quite high. The tax was not based on the actual revenues from the produce of the land. It was based on an estimate of the potential of the soil. In some cases, the tax was more than 50% of the gross revenue.

What were the main features of Ryotwari settlement?

The main feature of the Ryotwari System is that in this System there was no intermediary between the King and the cultivators as in the zamindari System. The peasants were recognised as the owner of the land. The tax was levied at a rate of 50% for drylands and 60% for wetlands.

How was the Mahalwari system different from the Ryotwari System Class 8?

As in Mahalwari system it is the responsibility of village headman to collect the tax ,And lands were divided into mahals,which contain one or more villages but In ryotwari system ,Farmers own responsible for tax they itself had go and pay and no land was divided into mahals.

What were the main features of the Permanent Settlement?

Key Features of Permanent Settlement were:Landlords or Zamindars were recognised as the owners of the land.They were given hereditary rights of succession of the lands under them.The amount to be paid by the landlords was fixed.It was agreed that this would not increase in future (permanent in nature).

How was the Mahalwari system different from the other two systems?

Under the mahalwari system, it was the village headman who had this responsibility. 2. Under the permanent settlements, revenue was fixed with zamindars. Under the ryotwari system, individual landholdings held by ryots were the unit of settlement.

What were the disadvantages of the Ryotwari System Class 8?

The rate of taxation was quite high. The tax was not based on the actual revenues from the produce of the land. It was based on an estimate of the potential of the soil. In some cases, the tax was more than 50% of the gross revenue.

What were the main features of the Ryotwari settlement?

The main feature of the Ryotwari System is that in this System there was no intermediary between the King and the cultivators as in the zamindari System. The peasants were recognised as the owner of the land. The tax was levied at a rate of 50% for drylands and 60% for wetlands.

Which country introduced the permanent settlement system?

The permanent settlement system was introduced in bengal while the ryotwari system was introduced southern india including Madras,Bombay and parts of Assam.

Which system of revenue collection introduced by British favoured the interests of Indian farmers?

Thought no system of revenue collection introduced by British favoured the interests of Indian farmers ,but ryotwari system achieved the need puri some extent.

Which system had the right to change the rates of revenue as per their needs?

While in ryotwari system, the company had the right to change the rates of revenue as per their needs.

Who was the middleman in the Peasant and Government system?

In the former system,zamindar acted as the middleman b/w the peasant and government,while in latter the peasant and government were directly linked.

Who introduced the Zamindari system?

Thus in 1792 lord Cornwallis introduced the zamindari system through the permanent settlement act. Further in 1820 ,ryotwari system of revenue collection was introduced in southern india by Thomas Munro. Though both the systems were introduced for the same aim, but they were introduced in different areas with certain differences which are discussed below:

Was exploitation less than the former?

Though exploitation was also involved in latter but it was less compared to the former due to no Involvement of a middleman.

Who was the Ryotwari system?

The Ryotwari system is associated with the name of Thomas Munro, who was appointed Governor of Madras in May 1820. Subsequently, the Ryotwari system was extended to the Bombay area. Munro gradually reduced the rate of taxation from one half to one third of the gross produce, even then an excessive tax. <ref>Amelia (Shipley) Heber, Life of Reginald Heber, D.D., The Lord Bishop of Calcutta by his Widow with Selections.

Who owned the land lost their ownership and became tenants in their own land?

The farmers and cultivators who owned the land lost their ownership and became tenants in their own land.

How did Zamindari work?

In Bengal and Northern India the zamindari system was as follows: 1 To collect tax from a land, the British had zamindars bid for the highest tax rates; i.e., zamindars quoted a tax rate that they promised to obtain from a particular land. 2 The highest bidder was made the owner of the land from which they collected the taxes. 3 The farmers and cultivators who owned the land lost their ownership and became tenants in their own land. 4 They were to pay the landlords/zamindars the tax for the land only in the form of cash and not in kind. 5 If a zamindar was not able to collect the quoted amount of tax, he lost the ownership.

What was the system of assessment in India?

These taxes included undifferentiated land revenue and rents, collected simultaneously. Where the land revenue was imposed directly on the ryots (the individual cultivators who actually worked the land) the system of assessment was known as ryotwari. Where the land revenue was imposed indirectly—through agreements made with Zamindars -- the system of assessment was known as zamindari. In Bombay, Madras, Assam and Burma the Zamindar usually did not have a position as a middleman between the government and the farmer.

Why did Colebrooke and the Governor Generals implore the Court of Directors of the East India Company?

In Northern India, dward Colebrooke and successive Governor-Generals had implored the Court of Directors of the East India Company, in vain, to redeem the pledge given by the British government, and to permanently settle the land-tax, so as to make it possible for the people to accumulate wealth and improve their own condition.

What was the payment in kind of the King?

Payments in kind were mostly in the form of land which was given to the king. The king never made use of those lands, which could be bought back by the farmers after they got back some money. The farmer owned his land. Tax rates were reduced in case of a famine, bad weather or other serious event.

Who was the Governor of Madras in 1820?

The Ryotwari system is associated with the name of Thomas Munro, who was appointed Governor of Madras in May 1820. Subsequently, the Ryotwari system was extended to the Bombay area.