- First Paragraph. Your opening paragraph should quickly state the purpose of your letter, which is a proposal to settle the account for less than the full amount.

- Second Paragraph. You’ll use this paragraph to present the details of your settlement offer. This will include the dollar amount you’re proposing to pay.

- Final Paragraph. In this paragraph, you’re making the assumption that the creditor is accepting your settlement proposal.

- Your Signature. Your letter will require your signature because you’ll be offering the creditor a contract, which is settlement of the debt.

How to write a debt settlement proposal letter?

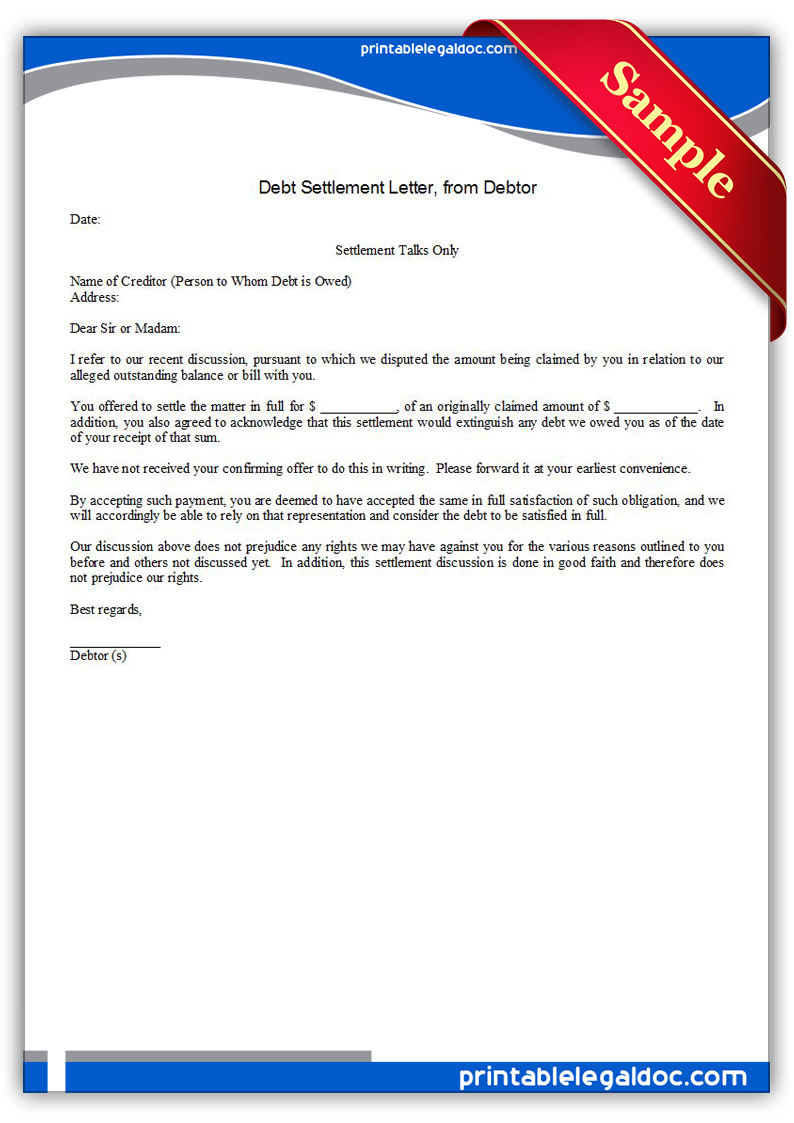

Sample Debt Settlement Proposal Letter Your debt settlement proposal letter should be formatted as a formal business letter, with your name and complete mailing address in the top left corner of the page, followed by a blank line, your account number, another blank line, and the date listed beneath it.

What is a settlement proposal?

Edit Article. A settlement proposal most commonly refers to an attempt by a person in debt to reduce or eliminate their debt by proposing an alternative to paying the full debt to the creditor.

How do you ask a creditor to accept a settlement proposal?

Close the letter by reiterating that you are not able to pay off the debt, and that this settlement proposal represents your best effort to give the creditor something. Request that the creditor respond in writing to your proposal, indicating their acceptance, refusal, or request for new terms.

What should I consider when writing a settlement offer letter?

[1] Figure out a realistic offer before beginning your letter. As with any negotiation, you don’t want your settlement offer to be so low that the creditor refuses to even consider it, but also no higher than it needs to be in order for them to accept it.

What percentage should I offer to settle debt?

When you're negotiating with a creditor, try to settle your debt for 50% or less, which is a realistic goal based on creditors' history with debt settlement. If you owe $3,000, shoot for a settlement of up to $1,500.

How do I write a debt settlement agreement?

The following terms and conditions should be included in a settlement.Original creditor and collection agent's company name.Date the letter was written.Your name.Your account number.Outstanding balance owed on the account (optional)Amount agreed to as settlement.More items...

How do you write a full and final settlement letter?

The language can be as simple as: In order to settle this matter amicably, I offer you the sum of [amount] (inclusive of interests and costs) as the full and final settlement of the above [claim/debt].

How do you negotiate a full and final settlement?

What percentage should I offer a full and final settlement? It depends on what you can afford, but you should offer equal amounts to each creditor as a full and final settlement. For example, if the lump sum you have is 75% of your total debt, you should offer each creditor 75% of the amount you owe them.

How do I write a final payment letter?

How to Write a Final Demand LetterStep 1 – Enter the Header Information. ... Step 2 – Enter the Amount Due. ... Step 3 – Complete the Debtor's Details. ... Step 4 – Enter the Payment Option. ... Step 5 – Detail the Consequences and Sign.

How do I write a one time settlement letter?

1) 2) I intend to settle the account under One Time Settlement Scheme. Therefore if you could offer some interest concession, I shall arrange to repay the dues on or before ________________. am agreeable to pay Rs. _____________ as one time settlement of dues.

How do I write a letter to a bank settlement?

I have sent a letter of settlement to all the creditors offering them 20% of my debts. If they agree to settle with this amount, I shall be clearing their dues within the next 5 business days. More than 20% is not affordable for me in the present situation.

What is a debt settlement contract?

A debt settlement agreement is a legal document that outlines an arrangement between a creditor and debtor where the creditor forgives part of the debt in exchange for immediate payment. It's important to note that this is not bankruptcy, it is just one more option you can use to get out of debt.

What is calculated in your debt to income ratio?

To calculate your DTI, you add up all your monthly debt payments and divide them by your gross monthly income. Your gross monthly income is generally the amount of money you have earned before your taxes and other deductions are taken out.

What is the purpose of a settlement letter?

A settlement letter is a letter that provides a quote for the amount you need to pay in order to settle your vehicle finance account in full.

How can a debt lawsuit be dismissed?

In a motion to dismiss, you can ask the judge to throw out any or all of the claims in the lawsuit. The judge will review your claims and issue a ruling. Use SoloSuit to respond to a debt collection lawsuit and win your case.

When proposing a full and final settlement offer to a creditor, is it important to explain?

Therefore, when proposing a full and final settlement offer to a creditor, it’s important to be thorough in conveying exactly how much you offer to pay, exactly when you offer to have it paid, and the concessions you want your creditor to grant. It is also very important to explain to the creditor the nature of your current circumstances ...

What happens if a creditor accepts a settlement offer?

If the creditor ultimately accepts your offer for debt settlement, make certain that the acceptance is made in writing prior to sending the creditor any amount of money. A written acceptance will serve as confirmation in the event that there are any future disputes.

What is debt settlement?

Debt settlement occurs when a debtor successfully negotiates a payoff amount for less than the total balance owed on a debt. This lower negotiated amount is agreed to by the creditor or collection agency and must be fully documented in writing. The settlement is often paid off in one lump sum, although it can also be paid off over time.

What does it mean when a debt settlement is negotiated?

It is also important to understand that the nature of a negotiated debt settlement implies that you will have paid less than the full amount of the debt, and that the settled account is likely to be marked on your credit report as “settled,” as opposed to “paid in full.”.

How to contact a debt settlement company?

To learn more about debt settlement or to schedule a free consultation, please contact us online or call us today at 888-574-5454.

How long does a settlement stay on your credit report?

Accounts marked as “settled” will remain on a credit report for seven years, and often have a detrimental impact on a credit score and profile.

Can creditors accept debt settlement offers?

Although creditors are under no legal obligation to accept debt settlement offers, negotiating and paying lower amounts to settle debts is far more common than many people realize. For those individuals who wish to pursue debt settlement on their own, without the aid of an experienced debt settlement company, contacting creditors with a carefully crafted debt settlement proposal letter is an absolute must. Fortunately, the debt settlement experts at United Settlement can help you write an effective debt settlement proposal letter.

What should be included in a debt settlement letter?

You should also include all the key information your creditor will need to locate your account on their system, which includes: Your full name used on the account. Your full address.

When proposing a full and final debt settlement to creditors, it’s important you go about this in the right?

When proposing a full and final debt settlement to creditors, it’s important you go about this in the right way. This means sending a written letter explaining how you wish to settle your debt, how much you are offering to pay and when this can be paid by.

What is debt settlement?

Debt settlement is something many people consider if they are able to offer a lump sum of money up front – usually less than the total amount owed – in the hope the creditor will agree to this and accept the debt as settled.

What to do if creditor accepts offer?

If the creditor accepts your offer, ensure this is in writing before you send any money to them. Keep this written confirmation safe too in case there is any dispute in the future, so you can offer this as proof of the agreement.

What happens if you settle early on a debt?

It’s important to remember that if you settle early on your debt, this means you are not paying it in full and so it will show as partially settled on your credit report instead of settled. This can affect your ability to obtain credit in the future, as it suggests to future creditors that you may not be able to pay back the full amount borrowed.

How to contact PayPlan?

If you are looking for guidance when dealing with creditors and proposing a debt settlement, our team here at PayPlan can help. Speak to our experts on 0800 280 2816 or use our contact form to get in touch.

Why do people settle debt?

The main reason many people choose debt settlement is so that they can avoid declaring bankruptcy. Filing for bankruptcy is a debt solution that stays on your credit record for 10 years, but even after 10 years, many creditors and employers will ask applicants for loans or jobs if they have ever filed for bankruptcy.

Why are creditors happy to settle a debt?

This is because it is worth getting part of a debt repaid than getting nothing.

How long does a debt settlement stay on your credit report?

Debt settlement will stay on your credit report for seven years, and there is no public record of debt settlement, so once a debt settlement is agreed upon by the debtor and creditor, the debtor can request that the debt be removed from his or her credit report. Creditors are Happy to Reach an Agreement.

What should be hammered out before writing a settlement agreement?

For example, payment arrangements and logistics should be hammered out before you write the settlement agreement.

How to resolve a claim in a settlement agreement?

Negotiate the scope of the release. You must negotiate the scope of the release in the agreement to determine which claims will be resolved, and whether any future claims are also resolved by this settlement agreement. You can negotiate a provision stating that the settlement agreement applies to all claims arising out of the dispute, whether they are current or not yet realized, or the settlement may resolve just one aspect of a suit or a single claim. This will depend on your needs.

How to settle a dispute between two parties?

1. Decide whether you have the need for a settlement agreement. A settlement agreement is a legally enforceable contract. They can be used in a variety of situations where two parties are in dispute about something and they wish to compromise on how that dispute will be resolved.

What is a settlement agreement?

A settlement agreement is a legally binding contract meant to resolve a dispute between yourself and another party so you do not have to go through the judicial process (or extend the judicial process if you are already in court).

How to settle a dispute with a mediator?

1. Agree on a statement of the dispute. Both parties are likely to have a differing view of the dispute. Before writing your settlement agreement, you must come to an agreement of the factual terms of the dispute. A mediator may be helpful in determining this.

What are the situations where a settlement agreement is used?

Some of the most common situations in which a settlement agreement is utilized include: disputes over damaged property; employment disputes between employers and employees; marriage disputes; and medical malpractice disputes.

What does "unconscionable" mean in a settlement agreement?

A settlement agreement must also not be "unconscionable.". This means that it cannot be illegal, fraudulent, or criminal. For example, you could not agree to settle a lawsuit in exchange for six pounds of cocaine, because the sale of cocaine is illegal in the United States. [11]

What is a settlement offer letter?

A Settlement Offer Letter is a communication between two parties in a dispute. The dispute does not have to be in a court of law, although most of the time, it is. One party sends the other party this Settlement Offer Letter, with the proposed terms for a complete settlement between the parties. Rather than a formal legal document, this letter can ...

What information is entered in a settlement agreement?

The parties' identifying details and contact information will be entered, as well as the proposed settlement terms.

What happens if a dispute is not litigated?

If the dispute is not being litigated, details of the incident at the heart of the parties' dispute will be entered.

Is a settlement agreement a legal document?

Although the terms listed in this letter will generally become the terms of the Settlement Agreement, this letter does not create a legally binding contract.

Is a settlement offer letter legal?

Although settlement agreements can be governed by both state and federal law, this Settlement Offer Letter is not a legal document, so it is simply a best practice to give the recipient of the letter as much information as possible about the terms of the proposed settlement.

What is the purpose of the settlement paragraph?

You’ll use this paragraph to present the details of your settlement offer. This will include the dollar amount you’re proposing to pay.

What to do if your proposal is not read?

If that happens, your proposal will never be read, let alone acted upon. You should send a letter to the person you’ve been dealing with at the company. If there’s no specific individual, make a phone call and get the name of a person likely to be in a capacity to work with your proposal.

What is the most important part of a debt settlement letter?

One of the most important components of your debt settlement letter is a single number: the amount you decide to offer. You’ll base that number on your assessment of two considerations. Affordability. Never offer more than you can afford to pay.

How many paragraphs should be in a proposal letter?

The body of your letter should be brief, two or three paragraphs at most. It should spell out the main points of your proposal. Anything more is unnecessary and could be misinterpreted.

What should be the opening paragraph of a letter?

First Paragraph. Your opening paragraph should quickly state the purpose of your letter, which is a proposal to settle the account for less than the full amount. In the next sentence, you’ll explain why you can’t pay the full amount.