In West Virginia, pensions and 401k plan funds earned during a marriage are considered marital property and must also be divided fairly. Retirement plan assets accumulated before marriage or after the date of legal separation are considered separate assets and are not subject to division.

How is a 401 (k) divided in a divorce in Virginia?

Virginia has specific procedures to ensure the fair division of 401 (k) plans, Individual Retirement Accounts (IRAs), and pensions. When dividing assets in Virginia, the courts decide which assets legally belong to both spouses together and which belong to each spouse individually.

Is a 401k plan considered marital property in West Virginia?

In West Virginia, pensions and 401k plan funds earned during a marriage are considered marital property and must also be divided fairly. Retirement plan assets accumulated before marriage or after the date of legal separation are considered separate assets and are not subject to division.

How is a retirement account valued in a Virginia divorce?

Virginia Courts Value Retirement Accounts as Either Separate or Marital Property. When dividing assets in Virginia, the courts decide which assets legally belong to both spouses together and which belong to each spouse individually. This is commonly known as valuation, which separates assets into marital and separate property.

How is property divided in a West Virginia divorce?

When a couple divorces in West Virginia, the court will divide the marital property based on equitable distribution. Equitable division does not have to be equal, but the court must start by presuming that all the marital property will be split equally between the spouses.

Is spouse entitled to 401K in divorce in Virginia?

In Virginia, 401(k)s, IRAs, 403(b)s, and other retirement plans are considered marital property. However, there are some specific rules about how these plans are divided during a divorce: Defined contribution plans are only marital property for the time that you are married.

Can 401K be touched in a divorce?

Any money invested in a 401k plan before the marriage is not considered community property and is thus not subject to division in a divorce.

Is 401K money split in a divorce?

You Need a Court Order to Divide a 401(k) Pulling money out of a 401(k) to finalize your divorce isn't something you can do on a whim. First, a judge has to sign off on a Qualified Domestic Relations Order, which confirms each spouse's right to a portion of the money.

How long do you have to be married to get half of 401K in Virginia?

If the marriage lasted 20 years, and the employee spouse contributed to the 401(k) for 25 years, then the contributions made to the account in the years preceding the marriage are exempt from division of assets. Those five years of individual contributions are protected as separate property. The 50 percent rule.

How can I hide my 401K in a divorce?

It is illegal to hide your financial assets during a divorce, but not in the way you might think. There are no laws that explicitly say hiding assets is illegal; however, you are asked to present the truth during a divorce. To hide a bank account would be perjury, a crime.

Should I cash out my 401K before divorce?

Withdrawing money from your 401(k) prior to a divorce doesn't offer financial advantages, since the money you withdraw remains a marital asset that will be considered in your final divorce settlement.

How much of my 401k will my wife get in a divorce?

If you decide to get a divorce from your spouse, you can claim up to half of their 401(k) savings. Similarly, your spouse can also get half of your 401(k) savings if you divorce. Usually, you can get half of your spouse's 401(k) assets regardless of the duration of your marriage.

When getting a divorce who gets the 401k?

In California Law, marital assets and retirement plans must be divided in half. This state community property rule means that the non-participating spouse shall receive 50% of the retirement plan value accumulated during the marriage.

Who pays taxes on 401k in divorce?

Generally, any transfer pursuant to a divorce, including 401k or other retirement money, is non-taxable. Therefore, poor Uncle Sam usually gets nothing.

Can ex wife claim my 401k years after divorce?

Your desire to protect your funds may be self-seeking. Or it may be a matter of survival. But either way, your spouse has the legal grounds to claim all or part of your 401k benefits in a divorce settlement.

How does adultery affect divorce in West Virginia?

West Virginia law is very clear that in fault-based divorces, the judge shall (must) take adultery into account when making alimony decisions. The judge can adjust the amount or duration of an alimony award when a spouse has committed adultery.

Can you date while separated in West Virginia?

No. As long as the spouses consider the marriage over, do not intend to reconcile, and do not have a sexual relationship, they may seek a divorce even if they are living under the same roof. Divorce paperwork is filed in the Circuit Clerk's office in the county courthouse.

Can my wife take my retirement in a divorce?

Under the law in most states, retirement plan assets earned during a marriage are considered to be marital property that can and should be divided. It's therefore advisable for couples to make these assets part of their property settlement agreement negotiations and their divorce decree.

How long does it take to get 401k after divorce?

You can typically expect the entire process to take between six and eight months, but it can be as fast as two months or take as long as two years or more. If your divorce lawyer has done most of the steps necessary to draft your QDRO the process will likely take three months at the most.

How are retirement accounts handled in divorce?

In a divorce, only "marital property" is divided. The spouses keep their own separate property. As a general rule, contributions to one spouse's retirement account (along with other increases in value) before the marriage are the separate property of that spouse and wouldn't be divided in the divorce.

Are retirement accounts protected in divorce?

How to Protect Your Pension Assets in a Divorce. According to most state laws, pension assets that are in the plan during the marriage are joint or marital property. So the court would typically split distributions of these assets in half. However, you keep the portion you contributed and earned before the marriage.

You Need A Court Order to Divide A 401(k)

Pulling money out of a 401(k) to finalize your divorce isn’t something you can do on a whim. First, a judge has to sign off on a Qualified Domestic...

State Law Dictates Division Rules

States have different laws regarding the treatment of property acquired prior to and during a marriage. In equitable distribution states, the court...

Working Out Your Own Agreement

Even though state laws specify how much of your retirement assets a spouse is entitled to, you still have the option of working out an independent...

How to get 401(k) after divorce?

The first option is to roll the assets over into your own qualified retirement plan by requesting a direct transfer. This allows you to avoid having to pay a penalty on the money.

When to take distributions from a pension plan?

If you leave the money in the plan, you’ll have to begin taking required minimum distributionsstarting at age 70 1/2 to avoid a penalty.

What is a CDFA in divorce?

But if you do decide to work it out on your own, you might still consider working with a certified divorce financial analyst (CDFA). Financial professionals holding this certification have expertise in dividing retirement funds, investments and other assets, as well as advising on tax structuring and other financial complexities in the divorce process.

What does the court look for in equitable distribution?

In equitable distribution states, the court looks at factors like each spouse’s financial situation, ability to earn income and the length of the marriage in order to divide a couple’s assets in a manner that’s fair to both parties.. That doesn’t mean, however, that it’s an automatic 50-5o split.

Can a financial advisor help you after divorce?

Divorce could disrupt your retirement plans. Not only could lose (or gain) assets during the process, but it can also get expensive. A financial advisor can help you create a financial plan for your needs and goals after divorce. SmartAsset’s free tool matches you with up to three financial advisors in your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

Can you divide retirement assets together?

Even though state laws specify how much of your retirement assets a spouse is entitled to, you still have the option of working out an independent agreement together. Unless you and your spouse can’t see eye to eye, coming up with a fair division on your own can often save you time, money and frustration as you wrap up your divorce. Make sure, though, that you know how the laws differ by state.

Do you need a court order to divide 401(k)?

1. You Need a Court Order to Divide a 401(k) Pulling money out of a 401(k) to finalize your divorce isn’t something you can do on a whim. First, a judge has to sign off on a Qualified Domestic Relations Order, which confirms each spouse’s right to a portion of the money.

How to split 401(k) during divorce?

There are three steps involved in splitting a 401 (k) during a divorce. First, the court will order the division to take place in the divorce decree. At that point, you and your attorney will draw up a QDRO, which describes to the plan administrator how it should be split to remain compliant with the Employee Retirement Income Security Act. The judge will sign off on the QDRO, as will the plan administrator, and at that point, the receiving spouse is known as the alternate payee.

How to get 401(k) back after divorce?

If you’re the receiving spouse, the plan should get back to your spouse with a response in a matter of days. So if significant time passes and you’ve heard nothing, get in touch with your attorney for a follow-up. If a QDRO is in place, you have the right to contact the plan yourself as a prospective alternate payee and ask about your spouse’s benefits. If you get pushback, remind the representative that laws under the Department of Labor give you a right to this information.

How old do you have to be to take 401(k)?

The minimum age to take distributions on a 401 (k) account is 59½. So whatever tax bracket you’re in at the time will be the amount you pay.

How much do you owe on 401(k) if you made $50,000 in 2017?

If you’re single and you made $50,000 in 2017, including your post-divorce 401 (k) distribution, you’ll owe $5,226.25 plus 25 percent of the amount over $37,950.

What is the process of splitting an IRA?

Splitting an IRA. If your retirement plan is an IRA instead of a 401 (k), the process is called “transfer incident to divorce,” which is so similar to a QDRO, often courts will call it that unofficially. But when you submit your assets to the court, you’ll need to make sure you distinguish between different types of plans.

When do you have to take your spouse's distributions?

You’ll both need to begin taking required minimum distributions by the time you reach 70½ to avoid paying a penalty.

What are the most contentious items in divorce?

In fact, the top three most contentious items in divorces, ranked in order, are alimony, retirement accounts and business interests. But one of the costliest aspects of this could be the mandatory tax withholding that comes as a result.

What assets can be split in a divorce in Virginia?

Those assets that may be split during a Virginia divorce include retirement accounts . Virginia family law has specific procedures to ensure the fair division of pensions, 401 (k) plans, as well as Individual Retirement Accounts (IRAs).

How Are Contribution Plans Divided in a Virginia Divorce?

For contribution plans, both employees and employers contribute a predetermined amount or a percentage of a paycheck every month. These funds go to an account. Employees accumulate these account funds until they go into retirement.

What are the different types of retirement accounts?

Typically, retirement accounts established during the marriage are considered marital property and are split between spouses in a divorce. Most retirement accounts are broken down into two types: 1 Contribution plans (IRAs, Thrift Savings Plans (TPSs), and 401 (s) plans) 2 Defined benefit plans or pensions

What is the maximum amount of 401(k) contributions a spouse can get in Virginia?

However, the maximum a spouse can get of the other spouse’s retirement account is 50% of the marital share of the account.

How to split a pension between spouses?

A common way to split a pension between spouses is by having the account’s present value calculated by an expert. After the valuation has been completed, the non-employee spouse may choose to incorporate his or her share into the overall value of asset division. Divide upon retirement.

Is a retirement account considered marital property?

Typically, retirement accounts established during the marriage are considered marital property and are split between spouses in a divorce. Most retirement accounts are broken down into two types: Generally, these two types of retirement accounts are viewed by Virginia courts as marital property, even if the accounts are in the name of one spouse.

Can you split a pension in Virginia?

Defined benefit plans, aka pensions, can also be split between spouses during a Virginia divorce. A spouse may have a pension from serving in the military, being a union member, or working for the federal or state government.

What is considered a 401(k) in Virginia?

If, during the course of a marriage, the employee spouse contributes to a 401 (k) or other retirement account such as an IRA or a 403 (k), Virginia courts consider the following when dividing its value between spouses: The dates of the marriage.

How much of a retirement account can a non-employee spouse receive in Virginia?

While allocating assets from the 20 years of eligible retirement account contributions, Virginia holds that the non-employee spouse must not receive more than 50 percent of the marital value. Therefore, if the non-employee spouse is eligible for a full 50 percent of the retirement account’s value, she will receive 10 years’ worth of contributions.

How long does a spouse have to contribute to 401(k)?

If the marriage lasted 20 years, and the employee spouse contributed to the 401 (k) for 25 years, then the contributions made to the account in the years preceding the marriage are exempt from division of assets. Those five years of individual contributions are protected as separate property. The 50 percent rule.

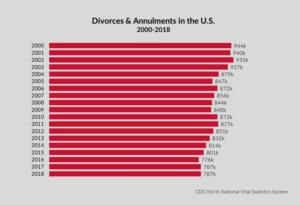

How many divorces were there in 2015?

The year 2015 saw 813,862 divorces in the U.S ., according to the Centers for Disease Control and Prevention (CDC). Of the many stresses of a divorce, a couple must face dividing financial assets, including retirement accounts.

Can you divide a pension after valuation?

Divide after valuation. Courts may order, or both spouses may elect, to have the pension’s present value calculated by an actuary service. Then, the two parties may choose to incorporate the eligible portion of the pension into the overall value of asset division.

Can you divide assets differently in divorce?

It’s important to note that if both spouses can agree on a method of distribution, they may choose to divide assets differently than the court would —to more closely meet their individual needs at the time of divorce.

Can a spouse receive a pension?

One spouse may have a pension from acting as a civil servant, serving in the military, or being a part of foreign service. Employers contribute a predetermined amount to an employee’s pension each month based on a special and unique formula, and the employee has access to the account when she goes into retirement.

How does property division work in West Virginia?

Property Division in West Virginia. When a couple divorces in West Virginia, the court will divide the marital property based on equitable distribution. Equitable division does not have to be equal, but the court must start by presuming that all the marital property will be split equally between the spouses. From there, a set of factors will be ...

What happens if you divorce your spouse?

Throughout the process, the divorcing spouses will have opportunities to agree between themselves on what is a fair division. If they decide, for example, to sell the house and split the sale proceeds, let the wife keep her retirement benefits and give the husband the family cabin, then they could submit their wishes to the court in a separation agreement. In most cases, a court will accept this type of agreement without further involvement. On the other hand, if the spouses cannot work together, or if there are certain items of property that they cannot agree on, then the court will decide for them.

What is the most common property divided in divorce?

The most common types of property divided at divorce are real property like the family home, personal property like jewelry, and intangible property like income, dividends, and benefits. Marital property must be divided between the spouses when the marriage ends.

Does spousal support affect property?

It's possible, however, that a spousal support award could affect the separate property of the paying spouse, because spousal support is based on income. If the paying spouse does not earn enough to cover a fair support payment, then the court can order that spouse's separate property to be used to satisfy the payment.

Is spousal support determined separately?

Spousal Support Determined Separately. Spousal support is a payment from one spouse to the other to help the recipient spouse maintain a lifestyle as close as possible to the one they had during marriage. In West Virginia, an award of spousal support does not impact the amount of marital property a spouse will receive.

Can a spouse pay higher support if they are at fault?

Though it's not relevant to the division of marital property, a spouse who is at fault in ending the marriage may pay a higher support amount as a result, or find support reduced for that reason.

Can spousal support be based on income?

It's possible, however, that a spousal support award could affect the separate property of the paying spouse, because spousal support is based on income. If the paying spouse does not earn enough to cover a fair support payment, then the court can order that spouse's separate property to be used to satisfy the payment.

What is the divorce rate for military retirement?

In most cases military divorce rate equate to U.S. civilian divorce rate of approximately 50 percent . The U.S. Supreme Court deemed military retirement pay couldn’t be divided as community property by state divorce courts in 1981 because current federal laws at that time constrained the handling of military retired pay as joint property.

What percentage of retired pay is paid to the first ex spouse?

The division of retired pay of a service member with two ex-spouses, then, could result in the court awarding the first ex-spouse 40 percent and the second ex-spouse 40 percent. The DOD directly pays the first ex-spouse 40 percent and the second ex-spouse 10 percent.)

How long does an ex spouse have to be married to receive military retirement?

The ex-spouse has been married to the service member for at least 10 years, with at least 10 of the marriage years taking place during a period of military service applicable to retired pay. Direct payments won’t be made for the division of retired pay for more than 50 percent.

Can the state divide military retirement pay?

Depending on the reservations of the state law , the state could effectively divide military retired pay 50-50, decide to award a majority of the retired pay to a former spouse, or treat the retired pay as the exclusive property of the military member.

Can the DOD pay an ex spouse?

These provisions constrain only when the DOD can pay the ex-spouse directly, whereas, in alternative circumstances, the service member obtains the retirement pay and must subsequently pay the ex-spouse their share or be subject to contempt of court.