Can I withdraw money from my 401k for divorce?

For a 401 (k) withdrawal due to divorce to take place without penalties, the spouse that holds the 401 (k) is responsible for submitting it to the plan administrator in a timely manner. If you’re the receiving spouse, the plan should get back to your spouse with a response in a matter of days.

Can 401k be part of divorce settlement?

Generally, taking money from a 401(k) before the age of 59 ½ would have a 10% penalty fee. However, early withdrawals can be made as part of a divorce settlement without this fee by following a set of specific rules, including using a Qualified Domestic Relations Order (read more below).

How are 401(k) assets split in a divorce?

This often happens if:

- If each party has contributed about the same amount and each retirement account is similar in value, then each person may be allowed to keep their respective 401 (k).

- There were protections in place stated in a prenuptial agreement.

- The parties come up with a divorce settlement on their own and agree to the terms.

What happens to 401k divorce?

The division of retirement accounts might be one of the most complex divorce issues because:

- Special rules and laws apply

- Your investment accounts are affected by changes in the stock market

- The divorce decree uses specific language related to retirements accounts

- You have to pay a penalty fee and tax if you try to cash out your 401k or individual retirement arrangement account before or during your divorce

Who pays taxes on a 401k divorce settlement?

If the person who owns the account chooses to tap into 401K funds to pay alimony, the spouse who receives the money will be responsible for taxes.

Who pays the taxes on a QDRO distribution?

A QDRO distribution that is paid to a child or other dependent is taxed to the plan participant. An individual may be able to roll over tax-free all or part of a distribution from a qualified retirement plan that he or she received under a QDRO.

How much taxes do you pay on a QDRO?

20%There are several options for QDRO distributions. You can take the funds as a lump sum but will be subject to a mandatory withholding tax, which is 20% for federal taxes.

Is money from a divorce settlement taxable income?

Under the current federal income tax laws, alimony or spousal maintenance is non-taxable and the party paying the alimony or spousal maintenance does not receive a tax deduction. Spousal support or alimony is paid with after-tax dollars like child support is paid with after-tax dollars.

How can I avoid paying taxes on a divorce settlement?

Primary Residence If you sell your residence as part of the divorce, you may still be able to avoid taxes on the first $500,000 of gain, as long as you meet a two-year ownership-and-use test. To claim this full exclusion, you should make sure to close on the sale before you finalize the divorce.

Is a lump sum payment in a divorce settlement taxable?

Generally, lump-sum divorce settlements are not taxable for the recipient. If the lump-sum payment is an alimony payment, it is not deductible for the person who makes the payment and is not considered income for the recipient.

Is QDRO considered income?

Yes. You will have to pay ordinary taxes based on your own personal tax bracket.

Can I cash out my QDRO?

In most cases, it is possible to cash out your interest in your former spouse's retirement plan via Qualified Domestic Relations Order (QDRO). A QDRO is a legal document used in a divorce or legal separation to split retirement plans without tax penalties.

How is a QDRO paid out?

A QDRO allows a former spouse to receive a predefined amount of their spouse's retirement plan assets. For example, a QDRO might pay out 50% of the account's value that has grown during the marriage. The funds, as a result of the QDRO, could then be transferred or rolled over into an IRA for the beneficiary spouse.

Is money received in family settlement taxable?

Therefore, the family arrangement is not taxable - Tri. Income Tax - Taxation on amount received on family settlement - accrual of income - entire property was in existence at the time of partition in which concerned family members were having their interest/shares, therefore, it was clearly a family settlement.

How does divorce affect Capital Gains Tax?

If you and your spouse sell your house at the time you're getting divorced, the capital gains tax applies. But you're entitled to exclude a total of $500,000 of gain from tax if you lived there for two of the five years before the sale.

Are divorce expenses tax deductible in 2020?

So, can you deduct divorce attorney fees on your taxes? No, unfortunately. The IRS does not allow individuals to deduct any costs from: Personal legal advice, which extends to situations beyond divorce.

Do I have to pay taxes on my ex husband's pension?

PAYMENTS FROM EX-SPOUSE'S MILITARY RETIREMENT PAY INCLUDABLE IN GROSS INCOME AS ALIMONY; TAX WITHHELD IS NOT AVAILABLE FOR CREDIT. Tax Notes.

How is a QDRO paid out?

A QDRO allows a former spouse to receive a predefined amount of their spouse's retirement plan assets. For example, a QDRO might pay out 50% of the account's value that has grown during the marriage. The funds, as a result of the QDRO, could then be transferred or rolled over into an IRA for the beneficiary spouse.

What happens after QDRO is approved?

After the QDRO has been filed with the court and Special Claims receives a certified copy, UC will determine the benefits payable to the alternate payee and the effect on the member's account(s). Here's how the process, which may take up to 90 days, works.

Can I cash out a QDRO?

In most cases, it is possible to cash out your interest in your former spouse's retirement plan via Qualified Domestic Relations Order (QDRO). A QDRO is a legal document used in a divorce or legal separation to split retirement plans without tax penalties.

What happens if my spouse withdraws from my 401(k)?

Similarly, if a spouse who receives a percentage of a 401k makes a withdrawal from the account, that person must pay income taxes on the amount withdrawn. And if the withdrawal is made before age 59 1/2, that person must also pay a 10% penalty on top of the taxes. In short, 401k and other retirement transfers pursuant to a divorce are generally ...

Is retirement transfer taxable?

There are a couple of things you can do to lower the risk of a tax issue. First, although this seems obvious, to ensure the event is not taxable, the transfer must be included in the divorce agreement and/or court judgment. Retirement transfers are generally included in every agreement.

Is retirement money taxable after divorce?

Finally, although transfers of retirement money pursuant to a divorce are non-taxable events , regular tax and penalty rules do still apply to any withdrawals or payments from the plan after the transfer is complete.

Is retirement money transferred to a divorce taxable?

Finally, although transfers of retirement money pursuant to a divorce are non-taxable events, regular tax ...

Is Uncle Sam's 401(k) taxable?

Generally, any transfer pursuant to a divorce, including 401k or other retirement money, is non-taxable. Therefore, poor Uncle Sam usually gets nothing. If pursuant to a divorce agreement or judgement, a certain portion of a retirement account, including but not limited to a 401k, 403 (b), IRA ...

Is a 401(k) transfer taxable in divorce?

In short, 401k and other retirement transfers pursuant to a divorce are generally non-taxable. However, once the money is transferred, regular tax rules apply to payouts or withdrawals from the account. If you have any questions about 401k transfers in divorce or any other divorce questions, feel free to contact us.

How to take out 401(k) in divorce?

To take advantage of this, when dividing a 401K in divorce, have the portion you need, paid directly from the account to you. It does not need to be the full amount that you are receiving. This is important, though. Don't roll it into an IRA first and then take it out because if you do, then you will be subject to the penalty. You only avoid the penalty when the distribution is made directly from your former spouse's 401K to you directly.

How do I know how to best divide the 401K in my divorce?

The best way to divide accounts in your divorce is going to be based on your financial situation. There is no one-size-fits-all approach. It is best to consult with your financial advisor and/or tax professional to determine what is in your best interest. A CDFA (Certified Divorce Financial Analyst), who has specialized training in divorce financial planning can be especially helpful. A CDFA can help you make the right decisions when dividing your 401K and other assets in a divorce.

What age can you withdraw from a 401(k)?

Rember that withdrawals from a 401K prior to age 59.5 are subject to a 10% early withdrawal penalty. The withdrawal will be reported as income on your tax return. If the withdrawal happens before the divorce is final, the owner is responsible for the taxes and penalties unless you negotiate otherwise. If you are cashing out a portion of the 401K ...

What are the most common financial mistakes made during divorce?

Emotions are running high and it's common not to want to engage a financial professional if you are already paying legal fees. That said, the cost of a financial professional relative to the amount they can save you in financial mistakes is minimal. One of the most common financial mistakes I see is how money is withdrawn from a traditional pre-tax 401K in a divorce.

Does 401(k) work in divorce?

If you are under age 59.5, this is an important tip you need to know about a 401K in divorce. This only works if you are awarded all or part of your spouse's 401K. It does not work on your own retirement account.

Is a pre-tax distribution taxable?

Keep in mind, though, if the funds are in a pre-tax account, they will still be taxable when withdrawn. The plan administrator will withhold taxes when the distribution is made. However, it may not be enough to cover your tax liability, depending on your marginal tax rate, so you’ll want to plan accordingly.

Should you cash out a 401K in a divorce?

Am I suggesting that retirement plans are a good source of cash when going through a divorce? Let me be clear. No, I am not suggesting that at all. I simply want to share that if you have a cash need and it makes the most sense to take it from a retirement account, the IRS does allow you to take money from a 401K without penalty.

Who pays tax on divorce settlement?

Marital property is commonly described as property acquired by the spouses during their marriage (for example, a family home or retirement plan assets).

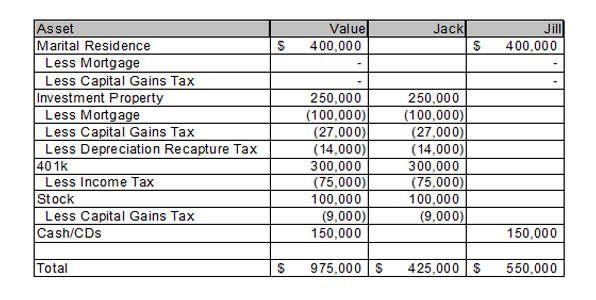

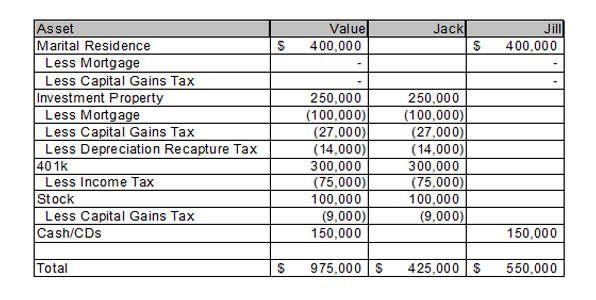

Why is it important to provide an extra copy of a settlement proposal?

It is beneficial to provide an extra copy for your partner during negotiations so that he or she can see what basis you are working on when making settlement proposals.

What is equitable distribution?

As a result, equitable distribution refers to a fair, but not strictly equal, division of marital assets.

What to do when you are approaching the end of your divorce?

If you’re approaching the end of your divorce, it may be a good idea to consult with your partner to get formal appraisals or estimates on the more valuable items.

Who has more say in how the property is shared whether they signed a prenuptial agreement or an agreement during?

The spouse has more say in how the property is shared whether they signed a prenuptial agreement or an agreement during the marriage. The following are some other elements of a fair distribution that should not be overlooked:

Is cash traded between spouses deductible?

Cash traded between (ex)spouses as a component of a separation repayment—for instance, to adjust resources—is for the most part not available to the collector and not duty deductible to the payer.

Is Uncle Sam's 401(k) tax free?

According to the lump-sum divorce settlement calculator, any transfer made as a result of a divorce, whether 401k or other retirement funds, is generally tax-free. As a result, Uncle Sam normally ends up with nothing.

How to get 401(k) after divorce?

The first option is to roll the assets over into your own qualified retirement plan by requesting a direct transfer. This allows you to avoid having to pay a penalty on the money.

When to take distributions from a pension plan?

If you leave the money in the plan, you’ll have to begin taking required minimum distributionsstarting at age 70 1/2 to avoid a penalty.

What does the court look for in equitable distribution?

In equitable distribution states, the court looks at factors like each spouse’s financial situation, ability to earn income and the length of the marriage in order to divide a couple’s assets in a manner that’s fair to both parties.. That doesn’t mean, however, that it’s an automatic 50-5o split.

Can a financial advisor help you after divorce?

Divorce could disrupt your retirement plans. Not only could lose (or gain) assets during the process, but it can also get expensive. A financial advisor can help you create a financial plan for your needs and goals after divorce. SmartAsset’s free tool matches you with up to three financial advisors in your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

Can you divide retirement assets together?

Even though state laws specify how much of your retirement assets a spouse is entitled to, you still have the option of working out an independent agreement together. Unless you and your spouse can’t see eye to eye, coming up with a fair division on your own can often save you time, money and frustration as you wrap up your divorce. Make sure, though, that you know how the laws differ by state.

Do you need a court order to divide 401(k)?

1. You Need a Court Order to Divide a 401(k) Pulling money out of a 401(k) to finalize your divorce isn’t something you can do on a whim. First, a judge has to sign off on a Qualified Domestic Relations Order, which confirms each spouse’s right to a portion of the money.

Can divorce be emotionally messy?

Divorces can be emotionally and financially messy. To avoid unnecessary drama, it might be helpful to understand how you can go about splitting a 401(k)... Menu burger. Close thin. Facebook.

What is the recapture rule in divorce?

For instance, if a divorce decree orders the husband to pay his wife a large amount of alimony for one year with a lower amount to follow, the IRS uses the “recapture rule.”. This requires the paying party to “recapture” some of the money as taxable income. As if a divorce is not complicated enough, it is challenging to understand what part ...

Do you have to live separately to exchange money?

To begin, the exchange must be in cash or an equivalent, payment must be made under a court order, the parties must live separately, there are no requirements of payment after the receiving party dies and each party files tax returns separately.

Is it better to give one party a lump sum settlement?

For instance, when the couple has a home with a mortgage, it is common for one party to keep the house and pay the other spouse the equity as a property settlement. No taxable gain or loss is recognized.

Is child support deductible in divorce?

When a divorcing couple has children, child support is often part of the settlement. This money is not deductible. Besides alimony, divorce usually contains a property settlement as well. Many times, it is not recommended for a couple to equally divide marital assets.

Is alimony settlement taxable?

Is Divorce Settlement Money Taxable? After a divorce is final, assets change hands. It is important to understand what part of the settlement is taxable and to what party. In the case of alimony, the amount is taxable to the person who receives the support. In return, the person paying the money receives a tax deduction.

Is a 1099R taxable?

If you got the 1099R for it then it is taxable to you. If she got the 1099R it is taxed to her.

Is 401(k) income taxable during divorce?

Normally, assets distributed during a divorce are not taxable income. However, 401 (k)s and similar plans are different because the money was never taxed when it was contributed to the account.

What happens to a retirement plan if you get divorced?

If a plan participant gets divorced, his or her ex-spouse may become entitled to a portion of the participant’s retirement account balance. Depending on the type of plan and the amount of benefits, the ex-spouse may have immediate access to his or her portion of those assets or at some point in the future ...

Do ex spouses have to file a domestic relations order?

Most plans require an ex-spouse to file a Qualified Domestic Relations Order with the plan administrator before the plan can pay any portion of a participant’s retirement plan benefits to that ex-spouse.

Can a court award a retirement plan to a spouse?

A court can award all or a portion of participant’s retirement plan assets to his or her spouse, former spouse, child or other dependent by issuing a QDRO, which must be honored by the plan. The QDRO can order the plan to pay the participant’s retirement plan benefits to an alternate payee. The court's order can be in the form of a state court judgment, decree or order, or court approval of a property settlement agreement.

Can a divorced person change the beneficiary of his or her retirement plan?

A participant who gets divorced may also want to change the beneficiary of his or her retirement plan. To do this, the participant should: contact his or her employer or plan administrator to request change of beneficiary forms; complete those forms in accordance with their instructions; and.