What is a CD in real estate closing?

Closing Disclosure (CD - formerly HUD-1) The Closing Disclosure (CD - formerly the HUD-1 Uniform Settlement Statement) is a three-page, government-mandated form that details the costs associated with a real estate transaction. The borrower should receive a copy of the CD at least one day prior to the closing.

What is the difference between a settlement statement and Closing Disclosure?

The Closing Disclosure contains almost the exact same information as the settlement statement, but it is specific to the borrower and their fees. The Closing Disclosure is issued by the buyer’s lender, and is designed to be compared to the Loan Estimate, which is the first estimate of fees the buyer gets when they borrow money.

What is a settlement statement?

Updated Mar 23, 2018. A settlement statement is a document that summarizes all of the fees and charges that a borrower and lender face during the settlement process of a loan transaction. Different types of loans have varying requirements for settlement statement documentation. Settlement statements can also be referred to as closing statements.

What is a comprehensive settlement statement for a mortgage?

Comprehensive settlement statement documentation is required for mortgage loan products. It is also usually required for other types of loans as well. Commercial and personal loan borrowers will usually work with a loan officer who presents them with the closing, settlement statement.

Is a disclosure statement the same as a settlement statement?

While closing disclosures provide information about a borrower's loan, settlement statements do not include loan information. Settlement statements are used for commercial transactions and cash closings.

What is a CD statement in real estate?

A Closing Disclosure is a five-page form that provides final details about the mortgage loan you have selected. It includes the loan terms, your projected monthly payments, and how much you will pay in fees and other costs to get your mortgage (closing costs).

Is a closing disclosure the same as a closing statement?

A closing statement or credit agreement is provided with any type of loan, often with the application itself. A seller's Closing Disclosure is prepared by a settlement agent and lists all commissions and costs in addition to the net total to be paid to the seller.

What is another name for a closing disclosure?

Lenders must provide borrowers with a closing disclosure (also called a CD) at least three business days before closing—that day when all the remaining paperwork is signed and you get the keys to your new home.

What is a CD document?

A closing disclosure (CD) is a standardized document from the lender that provides final details about the mortgage loan. It includes the loan terms, projected monthly payments, fees, and other closing costs.

What does CD stand for in Title?

Commanders of the Order of Distinction are entitled to use the post-nominal letters CD in the case of Members, or CD (Hon.) in the case of Honorary Members. Officers of the Order of Distinction are entitled to use the post-nominal letters OD in the case of Members, or OD (Hon.)

How many days after signing a CD can you close?

three business daysLike a re-disclosed TIL, the CD has to be delivered three business days before closing (the signing date of the note). Like the HUD-1, if anything changes, a corrected CD must be delivered at or before closing. Like a re-disclosed TIL, a loan may not close within three business days after the CD is delivered.

What is a closing statement called?

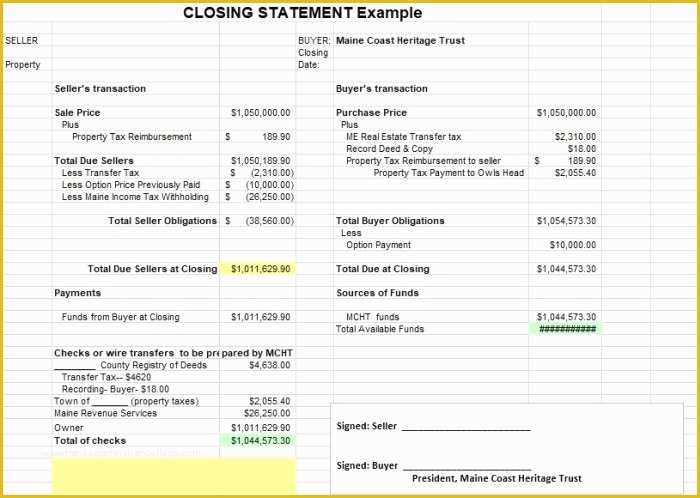

A closing statement is a statement that outlines the final details of a real estate transaction. It lists all the costs of the transaction and indicates the ones the seller is paying and the ones the buyer is paying. Another name for a closing statement is a settlement sheet.

Is settlement the same as closing?

A closing is often called "settlement" because you, as buyer, along with your lender and the seller are "settling up" among yourselves and all of the other parties who have provided services or documents to the transaction.

Which two items will appear on a closing disclosure?

Closing disclosure form sectionsLoan information. This section should match your loan estimate regarding the loan term, loan purpose and loan program (conventional, FHA, VA or USDA).Loan terms. ... Projected payments. ... Costs at closing. ... Late payment fee. ... Escrow account.

When should I receive the HUD-1 Settlement Statement?

In such case, the completed HUD-1 or HUD-1A shall be mailed or delivered to the borrower, seller, and lender (if the lender is not the settlement agent) as soon as practicable after settlement.

What is the purpose of the closing statement?

The purpose of a closing statement is to summarize the transaction. The sales contract negotiated between the seller and buyer controls all aspects of the closing. Virtually every item in a closing is subject to negotiation and all costs and charges will be allocated on the basis of that negotiation.

How many days after signing a CD can you close?

three business daysLike a re-disclosed TIL, the CD has to be delivered three business days before closing (the signing date of the note). Like the HUD-1, if anything changes, a corrected CD must be delivered at or before closing. Like a re-disclosed TIL, a loan may not close within three business days after the CD is delivered.

What if closing disclosure is wrong?

If you find an error in one of your mortgage closing documents, contact your lender or settlement agent to have the error corrected immediately. Common errors in your documents can be as simple as a name misspelled or a wrong number in an address, or as serious as incorrect loan amounts or missing pages.

How do you review a closing disclosure?

How to Check Your Closing DisclosureDouble-checking your loan amount, type, term, interest rate, monthly payment and key details, such as whether you are paying points or receiving closing cost credits.Comparing the APR on the closing disclosure with the APR on your loan estimate. ... Asking a lot of questions.More items...

What is a closing statement?

A closing statement is a form used in a real estate transaction that includes an itemized list of all the buying or selling costs associated with that transaction. It's a standard element of home sales, especially those that involve mortgages, and refinancings.

When is closing disclosure required?

The new “Closing Disclosure” replaces the Housing and Urban Development settlement statement (HUD-1) and final Truth in Lending (TIL) statement that must be provided to the consumer at least three business days prior to loan closing.

What is escrow disclosure?

New escrow disclosure forms have been introduced in the hope that they will help simplify the complex process of taking out a loan. The Consumer Financial Protection Bureau (CFPB) refers to the new disclosure forms as the “Know Before You Owe” forms. The new disclosure rules grew out of the Dodd-Frank Act requirements that addressed two sets of disclosures that consumers usually receive under the Truth in Lending Act (TILA) and Real Estate Settlement Practices Act (RESPA) in connection with application for and closing of mortgage loans.

When are settlement statements created?

Beyond just loans, settlement statements can also be created whenever a large settlement has taken place, such as with a large business transaction or potentially in the legal, insurance, banking, and trading industries.

What Is a Settlement Statement?

A settlement statement is a document that summarizes the terms and conditions of a settlement, most commonly a loan agreement. A loan settlement statement provides full disclosure of a loan’s terms, but most importantly it details all of the fees and charges that a borrower must pay extraneously from a loan’s interest. Different types of loans can have varying requirements for settlement statement documentation. Generally, loan settlement statements can also be referred to as closing statements .

What is included in HUD-1?

These forms also include comprehensive information about the borrower’s loan, detailing the principal and interest as well as all of the upfront costs, commission charges, service costs, and any deductions associated with the loan. Loan terms are also included, such as details on principal, interest, variable rates, prepayment penalties, and any special clauses associated with a loan such as escrow requirements.

What is debt settlement?

Debt settlement: A debt settlement statement can provide a summary of debts written off, reduced, or otherwise amended after a debt settlement has completed. Lawyers and debt settlement companies work on behalf of borrowers with overwhelming amounts of debt, in order to help them reduce some or all of their obligations.

What is a settlement statement in stock trading?

Trading: In financial market trading, settlement statements provide proof of a security’s ownership transfer. Typically, stocks are transferred with a T+2 settlement date meaning ownership is achieved two days after the transaction is made.

What is insurance settlement?

Insurance settlement: An insurance settlement is most commonly documentation of the amount an insurer agrees to pay after reviewing an insurance claim. Banking: In the banking industry, settlement statements are produced on a regular basis for internal banking operations.

Does a reverse mortgage require a HUD-1 settlement statement?

RESPA requires a HUD-1 settlement statement for borrowers involved in a reverse mortgage. For all other types of mortgage loans, RESPA requires the mortgage closing disclosure. Both the HUD-1 and mortgage closing disclosure are standardized forms.

What is closing disclosure?

A Closing Disclosure is a five-page form that provides final details about the mortgage loan you have selected. It includes the loan terms, your projected monthly payments, and how much you will pay in fees and other costs to get your mortgage (closing costs).

How long do you have to give closing disclosure?

The lender is required to give you the Closing Disclosure at least three business days before you close on the mortgage loan.

Do you get a closing disclosure on a reverse mortgage?

Note: You won't receive a Closing Disclosure if you're applying for a reverse mortgage. For those loans, you will receive two forms-a HUD-1 Settlement Statement and a final Truth in Lending Disclosure —instead of the Closing Disclosure.

Do you get a HUD-1 or Truth in Lending disclosure?

If you are applying for a HELOC, a manufactured housing loan that is not secured by real estate, or a loan through certain types of homebuyer assistance programs, you will not receive a HUD-1 or a Closing Disclosure, but you should receive a Truth-in-Lending disclosure.

Why was the HUD-1 Settlement Statement required in 2010?

The reason behind all of these amendments and changes was to create more transparency and progress in consumer protection, which leads us into the 1986 HUD-1 Form.

What is the real estate settlement procedure act?

1974: The Real Estate Settlement Procedures Act (RESPA) was created to help protect consumers from foul practices, forcing lending institutions to disclose settlement costs upfront. This act is enforced by the Consumer Financial Protection Bureau (CFPB) and includes all types of mortgages. RESPA requires different disclosures during different parts of the home closing process and also offers protection to consumers in areas including: 1 Limiting the amount put into escrow for real estate charges 2 Allowing buyers to use their own title company and title insurance 3 Prohibiting lenders from receiving a fee in exchange for a referral

What is RESPA disclosure?

RESPA requires different disclosures during different parts of the home closing process and also offers protection to consumers in areas including: Limiting the amount put into escrow for real estate charges. Allowing buyers to use their own title company and title insurance.

How long does a loan estimate need to be in the hands of the buyer before closing?

These two documents must be in the hands of the buyer at least 3 days prior to the closing date in order to find any errors or issues before closing. If certain changes are made to the disclosure, the 3-day waiting period starts over. This is one big change with the new TRID rules.

What to do if you make a mistake in closing disclosure?

Mistakes happen, so don’t be afraid to ask questions or seek clarification before you sign the paperwork at closing. If it is a major mistake, the buyer can obtain an explanation, and even negotiate a deal or walk away from the loan.

What is HUD-1 form?

1986-2015: Prior to October 2015, the Settlement Statement was known as the HUD-1, which is a standard government form issued by the Closing Agent that lists all credits, charges and home loan terms for both the buyer and the seller in all real estate transactions that required a mortgage. The charges for both the borrower and seller were listed on the same form, with borrower charges on one side of the form and seller charges on the other.

When did the HUD-1 change to the closing disclosure?

The Consumer Financial Protection Bureau (CFPB) took over administration from HUD and replaced the HUD-1 with the Closing Disclosure in October of 2015. It is similar to the HUD-1 in that it details the loan terms and costs, including the interest rates, closing costs, taxes, monthly payments, and more.

What is a settlement statement?

A settlement statement is an itemized list of fees and credits summarizing the finances of an entire real estate transaction. It serves as a record showing how all the money has changed hands line by line.

Who is responsible for preparing the settlement statement?

Whoever is facilitating the closing — whether it be a title company, escrow firm, or real estate attorney — will be responsible for preparing the settlement statement.

Is a settlement statement the same as a closing statement?

Yes, a settlement statement is the same as a closing statement, though “settlement” is the formal term most likely to be used by the real estate industry.

What is an ‘excess deposit’ at closing?

A particular line item that causes confusion on the seller’s settlement statement is the “Excess Deposit.” What is an excess deposit, and who will receive the funds listed on that line?

What does an impound account do at closing?

At closing the buyer sets up an impound account that allows them to bundle the cost of their mortgage principal, taxes, mortgage insurance, and other monthly costs into one payment. The lender likes this because they can make sure the new owner will keep up to date with all the payments associated with the home.

What information is needed to complete a closing document?

At the top of the document (before you get to the portion that looks like a spreadsheet) you’ll see a few boxes for inputting information that records basic details about the transaction, such as the names of the buyer and seller, the property address, and the closing date.

What is a seller's net sheet?

The seller’s net sheet is not an official document but an organizational worksheet that your agent will fill out to estimate how much you’ll pocket from your home sale after factoring in expenses like taxes , your real estate agent’s commission, your remaining mortgage, and escrow fees.

How long does it take for a CD to settle?

Most financial instruments have a settlement date ranging from three days to one week. For example, if a stock is traded on a Monday, the seller has three days from the trade date (Thursday) to get the stock to the buyer, and the buyer has three days from the trade date to receive her stock. If a CD has a known CUSIP, or security identification number, then it should settle almost instantly once the trade is complete. When a CD has an unknown CUSIP, it can take up to a week or more for the trade to settle.

What is a certificate of deposit?

A Certificate of Deposit is a type of high-yield deposit account not unlike a savings account. When an individual opens a CD account he is agreeing to keep a fixed amount of money in that account for a specified period of time. In exchange for keeping money in this account, the account holder earns a relatively high interest rate on his money. Most banks and financial institutions require a minimum deposit of $500 to $1,000, with investment times frames ranging from three months to five years.

Can you cancel a CD at any time?

As a result, there may be penalties for early withdrawal or termination (call) features attached to your CD. If your CD comes with a call feature, your bank or financial institution can cancel your CD at any time, which means that you may earn less interest than anticipated. You can purchase a CD at most banks or financial institutions.

Can CDs be bought and settled in the same day?

Unlike many other types of investments, CDs can be bought and fully settled in the same day.