So yes: A closing disclosure and a settlement statement are the same thing. However, just because the new CD is easy to read does not mean you don’t need to take your time carefully combing through it page by page. Reading a Closing Disclosure Page by Page

Is the settlement statement the same as a closing statement?

Yes, a settlement statement is the same as a closing statement, though “settlement” is the formal term most likely to be used by the real estate industry. What’s the difference between a Closing Disclosure and settlement statement?

What happens after Closing Disclosure?

What happens after signing closing disclosure? After the lender receives the signed Closing Disclosure from all borrowers, they can begin preparing loan documents. Once the loan documents are prepared, they are delivered to the escrow company. Signing. Signing typically takes place 1-2 days before closing.

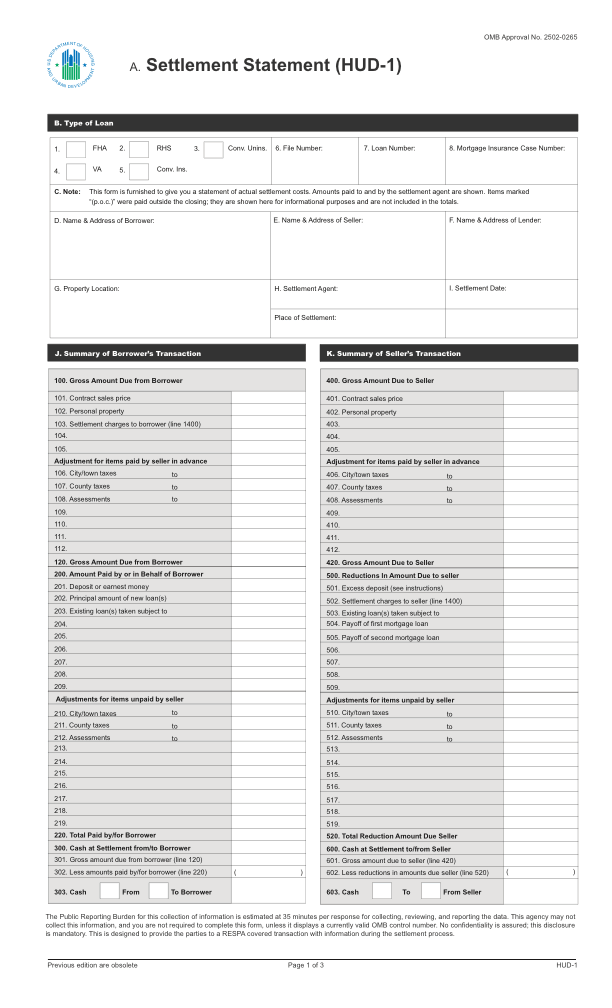

Which type of loan will use A HUD-1 in place of a Closing Disclosure?

A HUD-1 form is most commonly used for reverse mortgages and mortgage refinance transactions. As of Oct. 3, 2015, the Closing Disclosure form replaced the HUD-1 form for most real estate transactions; however, if you applied for a mortgage on or before Oct. 3, 2015, you would receive a HUD-1.

What is the 3 Day Closing Disclosure rule?

Your lender is required by law to give you the standardized Closing Disclosure at least 3 days before closing. This is what is known as the Closing Disclosure 3-day rule. This requirement is thanks to the TILA-RESPA Integrated Disclosures guidelines, which went into effect on October 3, 2015.

What is a settlement statement called now?

What Is a HUD-1 Form? A HUD-1 form, also called a HUD-1 Settlement Statement, is a standardized mortgage lending document.

Is a closing disclosure a closing statement?

The closing statement or closing disclosure is intended to share the details of a loan right before closing so both the buyer and lender are on the same page. You can receive a closing statement for various types of loans issued, but a mortgage closing statement is the most recognizable and commonly discussed.

Is there another name for a closing disclosure?

Prior to these rules, home buyers received two documents: the HUD-1 Settlement Statement and the Truth in Lending Disclosure Statement (instead of the Closing Disclosure).

What is final settlement statement?

A settlement statement is a document summarizing all costs owed by or credits due to the homebuyer and seller (or borrower if refinancing). The document also includes the purchase price of the property, loan amount and other details.

What is a closing statement called?

What is a closing statement? A closing statement, also called a HUD-1 statement or settlement sheet, is a form used in real estate transactions with an itemized list of all the costs to the buyer and seller.

Which two items will appear on a closing disclosure?

Credits and debits appear on the closing statement.

How do you explain closing disclosure?

A Closing Disclosure is a five-page form that provides final details about the mortgage loan you have selected. It includes the loan terms, your projected monthly payments, and how much you will pay in fees and other costs to get your mortgage (closing costs).

How can I get a copy of my closing documents?

You can obtain a certified copy of these documents from the closing agent or from your real estate agent if you lose the originals. The closing disclosure contains all the official charges and credits of your home purchase.

Is a closing disclosure the same as a mortgage note?

Your Closing Disclosure. Your promissory note, which is your promise to repay the mortgage loan to your lender. The mortgage, also known as the security instrument or deed of trust. By signing this document, you agree that the lender may foreclose on your home if you fail to repay your mortgage.

What is estimated Settlement Statement?

The Estimated Settlement Statement lists all of the costs and credits associated with the purchase of a home showing the buyer their total costs to close the transaction and showing sellers their net profit (or loss). Think of it as your detailed receipt that details information from various places on one page.

What is a Settlement Statement for taxes?

The HUD-1 Settlement Statement is a standard government real estate form that was once used by settlement agents, also called "closing agents," to itemize all charges imposed upon a borrower and seller for a real estate transaction.

What is a closing statement example?

An example of a closing argument is the lawyer opening with a statement, "How can my client be in two places at once?". The lawyer could then incorporate the theme of an alibi, arguing that the defendant could not have possibly committed a crime because they weren't even in the country when the crime took place.

What is a closing statement look like?

3:5913:06How To Read A Closing Statement - YouTubeYouTubeStart of suggested clipEnd of suggested clipAlso called alta is widely used across the nation for real estate transactions. And is the mostMoreAlso called alta is widely used across the nation for real estate transactions. And is the most common closing statement. Used so let's take a closer look at a blank alta closing statement this works

What is a closing statement in a disciplinary hearing?

Closing arguments are crucial to confirm your version and at the same time refute the version of your opponent. The main purpose of closing arguments is to sensibly summarise your matter by focusing on all the facts that were proven in your favour during the hearing/arbitration by confirming the facts.

What is the purpose of the closing statement?

What is the purpose of the closing statement? To summarize and simplify the financial transaction on the day of closing.

What is LE disclosure?

The LE outlined the approximate fees you would be expected to pay if you move forward with a lender to close on a home. But your closing disclosure is the real deal, which is all the more reason to scrutinize it carefully.

What is closing disclosure form?

What is a closing disclosure form? Put simply, it’s a form outlining the terms and costs of your mortgage—and one of the most important pieces of paperwork to check before you close on a home.

How much does closing cost for a home?

But in general, home buyers can expect typical closing costs to amount to about 3% to 4% of the home’s sale price.

Where is Daniel Bortz?

Daniel Bortz has written for the New York Times, Washington Post, Money magazine, Consumer Reports, Entrepreneur magazine, and more. He is also a Realtor in Virginia. Get Pre-Approved Connect with a lender who can help you with pre-approval. I want to buy a home. I want to refinance my home.

Why do mortgage rates change?

Many of the numbers and terms should match up (or close), but some may change because weeks or even months may have passed since you first applied for you loan. Unless you locked in your mortgage interest rates, those rates may have changed. The title company or attorneys involved may have nudged up their fees.

What type of loan is a fixed interest rate?

Loan type: There are many types of loans, although conventional loans typically come with either a fixed interest rate or an ARM (or adjustable-rate mortgage for which rates remain the same for only a certain number of years.

Why has my loan amount increased?

One possible reason could be that closing costs have been rolled into your loan, which reduces your upfront costs but adds to your overall costs because of the added interest you’ll pay over the life of the loan. If you’re not sure why this amount has changed, ask your lender.

What is closing disclosure?

The closing disclosure is a type of settlement statement that was created and is regulated for the mortgage lending market. The closing disclosure is provided by the lender, closing attorney or title company to a borrower about three days before the closing on real estate. It outlines the final version of the loan terms and costs. Items in the closing disclosure include clauses like:

What is included in HUD-1?

Part of the HUD-1 includes a borrower’s list which contains charges related to the mortgage such as a loan origination fee, discount points, payment for a credit report, and fees for the appraisal and flood certification. It also may include any prepaid interest charges, homeowner’s insurance fees, property taxes, owner’s and lender’s title insurance, and the closing agent’s fees.

What are disclosures regarding escrow accounts?

Disclosures regarding escrow accounts and if the lender will collect and distribute property taxes and insurance, total payments and finance charges, as well as appraisals, and lack of payment.

What is a HUD-1 settlement statement?

Both settlement statements, including HUD-1 settlement statements, and closing disclosures are a statements prepared by the closing attorney or title company giving a complete breakdown of costs involved in a real estate transaction. While closing disclosures provide information about a borrower’s loan, settlement statements do not include loan information.

What is reverse mortgage?

A reverse mortgage is a loan available to homeowners, 62 years or older, that allows them to convert part of the equity in their homes into cash. That way, they may access the value of their homes that is unencumbered in order to get a loan. In addition, these loans typically do not require monthly payments.

Who can review a reverse mortgage settlement?

Most buyers and sellers review the settlement statement or the closing disclosure form with a real estate agent, attorney, or settlement agent because it is important that the terms and costs are correct including spelling of the parties’ names, loan types, amounts to close the transaction, the loan term and amount, and estimated costs for closing, payments, and insurance. If you are obtaining either a reverse mortgage, buying or selling real estate the attorneys at Smith-Weiss Shepard & Spony, P.C. can assist you in reviewing these documents to ensure your financial interests are protected.

What is closing disclosure?

A Closing Disclosure is a five-page form that provides final details about the mortgage loan you have selected. It includes the loan terms, your projected monthly payments, and how much you will pay in fees and other costs to get your mortgage (closing costs).

How long do you have to give closing disclosure?

The lender is required to give you the Closing Disclosure at least three business days before you close on the mortgage loan.

Do you get a HUD-1 or Truth in Lending disclosure?

If you are applying for a HELOC, a manufactured housing loan that is not secured by real estate, or a loan through certain types of homebuyer assistance programs, you will not receive a HUD-1 or a Closing Disclosure, but you should receive a Truth-in-Lending disclosure.

Do you get a closing disclosure on a reverse mortgage?

Note: You won't receive a Closing Disclosure if you're applying for a reverse mortgage. For those loans, you will receive two forms-a HUD-1 Settlement Statement and a final Truth in Lending Disclosure —instead of the Closing Disclosure.

Can I share my PII with my employer?

Yes. No. Additional comment (optional) Please do not share any personally identifiable information (PII), including, but not limited to: your name, address, phone number, email address, Social Security number, account information, or any other information of a sensitive nature.

What is the Closing Disclosure?

The closing disclosure is a 5 pager document that is given to the buyer by the lender. The closing disclosure shows the final closing costs for the mortgage along with some terms and conditions established by both parties for the transaction.

What is the closing cost section in a loan disclosure?

This section gives an itemized list of costs that changed compared to the loan estimate, making it an important block in the disclosure. This section includes total closing costs, seller credits, downpayment, adjustments, and many others. The column on the right says if the cost changed or not.

What is total cash to close?

Total Cash to Close consists of, total closing costs, closing costs to be financed, down payment and other funds from the borrower, deposits to seller or escrow for the borrower, Seller credits, adjustments and other credits paid by persons other than the originator, creditor, borrower or seller.

What is the H section of the escrow?

The second one is an itemized list of prepaid costs. There could be multiple parties that could show up in this section. The 3rd section includes an itemized list of aggregate costs included in the escrow. The subsection 'H' shows us an itemized list of costs the buyer owes to third parties for the home inspection, warranty fees, broker's commission, etc.

What is origination charge?

The origination charges are paid by the buyer that includes an underwriting fee, application fee, and certain percentage (0.25%) of the loan amount that is transferred to the originator from the buyer’s account. Section B and C of Loan Costs refer to the costs paid to third parties who assist in the closing process. Section D gives the consolidated amount for all the loan costs paid by the buyer.

What is the 3 day rule for closing disclosure?

TheThe 3 day rule for closing disclosure means that the closing is scheduled in 3 days counted from the day they receive the closing disclosure. For example, closing disclosures delivered by hand or email will reach the same day. Hence, if they are Emailed or hand delivered on a Monday, the signing date will be scheduled on Thursday in the same week, and Friday will be the loan funding date.

How long does it take for a closing disclosure to be sent?

On the other hand, if they are sent by US mail (USPS), It will take 2-3 days for the closing disclosure to reach the buyer. For example, if the disclosure is mailed on a Thursday, it will possibly reach the buyer the next week Monday. According to the 3 day rule then, the closing will take place on Thursday.

Does the seller get a closing statement?

Buyers tend to sign the bulk of the paperwork at closing, making some sellers wonder if they will even receive a settlement statement.

Is a settlement statement the same as a closing statement?

Yes, a settlement statement is the same as a closing statement, though “settlement” is the formal term most likely to be used by the real estate industry.

What is an ‘excess deposit’ at closing?

A particular line item that causes confusion on the seller’s settlement statement is the “Excess Deposit.” What is an excess deposit, and who will receive the funds listed on that line?

What is a settlement statement?

A settlement statement is an itemized list of fees and credits summarizing the finances of an entire real estate transaction. It serves as a record showing how all the money has changed hands line by line.

What does an impound account do at closing?

At closing the buyer sets up an impound account that allows them to bundle the cost of their mortgage principal, taxes, mortgage insurance, and other monthly costs into one payment. The lender likes this because they can make sure the new owner will keep up to date with all the payments associated with the home.

What information is needed to complete a closing document?

At the top of the document (before you get to the portion that looks like a spreadsheet) you’ll see a few boxes for inputting information that records basic details about the transaction, such as the names of the buyer and seller, the property address, and the closing date.

What is a seller's net sheet?

The seller’s net sheet is not an official document but an organizational worksheet that your agent will fill out to estimate how much you’ll pocket from your home sale after factoring in expenses like taxes , your real estate agent’s commission, your remaining mortgage, and escrow fees.

What Is A Loan Estimate?

The Loan Estimate is a three-page document you receive three days after applying for a mortgage. It provides a summary of the loan terms, the costs associated with the mortgage, the loan size, interest rate and payments. It lays out whether there are any balloon payments, prepayment penalties or more. The document also includes a schedule of your payments and the estimated taxes and insurance payments. Closing costs are outlined in the Loan Estimate as well.

What to do if you find a discrepancy between closing disclosure and loan estimate?

If you find a discrepancy between the Loan Estimate and the Closing Disclosure, the first step is to contact your lender or real estate agent immediately to correct the errors. These mistakes can be as minor as misspelled names or as serious as a change in the interest rate.

What is closing disclosure?

The Closing Disclosure is a five-page form that describes, in detail, the critical aspects of your mortgage loan, including purchase price, loan fees, interest rate, estimated real estate taxes and insurance, closing costs and other expenses. It’s important that you review it thoroughly – in fact, it’s one of the most important steps you can take ...

Why is negative amortization risky?

This can be a risky feature because a negative amortization loan is never paid in full. For example, you may make partial interest payments during the first 5 – 10 years of the loan, and any remaining interest payments are added to the original principal balance of the loan.

How long do you have to give closing disclosure?

Your lender is required by law to give you the standardized Closing Disclosure at least 3 days before closing. This is what is known as the Closing Disclosure 3-day rule. This requirement is thanks to the TILA-RESPA Integrated Disclosures guidelines, which went into effect on October 3, 2015.

Why is it important to read the closing disclosure?

The reason for this is that once you sign, you’re committing to the conditions presented, regardless of whether there are any mistakes in the paperwork. That means it’s crucial that you carefully read the Closing Disclosure your lender sends you.

How long does it take to get a loan estimate?

It should look similar to the Loan Estimate. You’re required by law to receive the Loan Estimate 3 days after you submit a loan application. Take the time to look over both your Loan Estimate and Closing Disclosure in detail to make sure everything you see makes sense.