June 6, 2019 1:40 AM. Generally, money that is transferred between (ex)spouses as part of a divorce settlement—such as to equalize assets—is not taxable to the recipient and not deductible by the payer. This is different than alimony, also called spousal maintenance, which is taxable (and deductible) unless the settlement specifies that it is not.

Do you have to pay taxes on a divorce settlement?

You do not usually have to pay Capital Gains Tax if you give, or otherwise ‘dispose of’, assets to your husband, wife or civil partner before you finalise the divorce or civil partnership. Assets...

Do you pay taxes on divorce settlements?

This means that every individual has their own personal tax allowance and pays personal tax on their own income. Separation or divorce does not affect this. Note that there is no Income Tax to pay when you transfer assets under a divorce settlement.

What is money paid out on settlement of a divorce?

Alimony is paid usually on the basis of the length of the marriage, the usual formula for alimony is that it is paid for half the years of the length of the marriage. For example, if the marriage lasted twenty-two years, what to expect in a divorce settlement would be alimony for eleven years.

Is a lump sum payment in a divorce settlement taxable?

In some cases, a settlement might include an asset transfer and a lump sum of alimony instead of periodic payments—in that case the alimony will generally be taxable. However, if the asset transfer includes a tax-advantaged retirement fund like a pension, annuity, IRA or 401(k), then the money will be taxed by the spouse when they withdraw it.

Is money paid in a divorce settlement taxable?

Under the current federal income tax laws, alimony or spousal maintenance is non-taxable and the party paying the alimony or spousal maintenance does not receive a tax deduction. Spousal support or alimony is paid with after-tax dollars like child support is paid with after-tax dollars.

How can I avoid paying taxes on a divorce settlement?

Primary Residence If you sell your residence as part of the divorce, you may still be able to avoid taxes on the first $500,000 of gain, as long as you meet a two-year ownership-and-use test. To claim this full exclusion, you should make sure to close on the sale before you finalize the divorce.

Who pays capital gains tax in a divorce?

If you and your spouse sell your house at the time you're getting divorced, the capital gains tax applies. But you're entitled to exclude a total of $500,000 of gain from tax if you lived there for two of the five years before the sale.

Is money received in family settlement taxable?

Therefore, the family arrangement is not taxable - Tri. Income Tax - Taxation on amount received on family settlement - accrual of income - entire property was in existence at the time of partition in which concerned family members were having their interest/shares, therefore, it was clearly a family settlement.

Is a lump sum spousal support payment taxable?

Lump sum payments are generally not taxable, unless they are made to bring overdue periodic payments up to date or are specifically ordered as retroactive payments. Therefore, lump sum payments may also be useful for the recipient's tax purposes.

What are the tax implications of a divorce?

The general rule is that asset transfers at divorce or related to a divorce result in no tax consequences. However, depending upon you and your spouse's basis in different assets allocated at dissolution, the subsequent selling of assets awarded at divorce could result in disparate tax consequences.

What is the 2 out of 5 year rule?

During the 5 years before you sell your home, you must have at least: 2 years of ownership and. 2 years of use as a primary residence.

Is it better to sell your house before or after divorce?

Selling Your House Before Divorce Many times, couples will wait until the divorce is finalized to sell the house, but it is not necessary to do it that way. If both parties can find substitute housing and can agree to sell the home, then there is no better time than the present.

Are legal settlements tax deductible?

Generally, if a claim arises from acts performed by a taxpayer in the ordinary course of its business operations, settlement payments and payments made pursuant to court judgments related to the claim are deductible under section 162.

Are divorce expenses tax deductible in 2020?

So, can you deduct divorce attorney fees on your taxes? No, unfortunately. The IRS does not allow individuals to deduct any costs from: Personal legal advice, which extends to situations beyond divorce.

Can you file married if you were divorced during the year?

Filing status Couples who are splitting up but not yet divorced before the end of the year have the option of filing a joint return. The alternative is to file as married filing separately. It's the year when your divorce decree becomes final that you lose the option to file as married joint or married separate.

How are QDRO distributions taxed?

A QDRO distribution that is paid to a child or other dependent is taxed to the plan participant. An individual may be able to roll over tax-free all or part of a distribution from a qualified retirement plan that he or she received under a QDRO.

Who pays tax on divorce settlement?

Marital property is commonly described as property acquired by the spouses during their marriage (for example, a family home or retirement plan assets).

Who is responsible for proving the presence of property in divorce?

It is the responsibility of the divorced parties to recognize and prove the presence of properties.

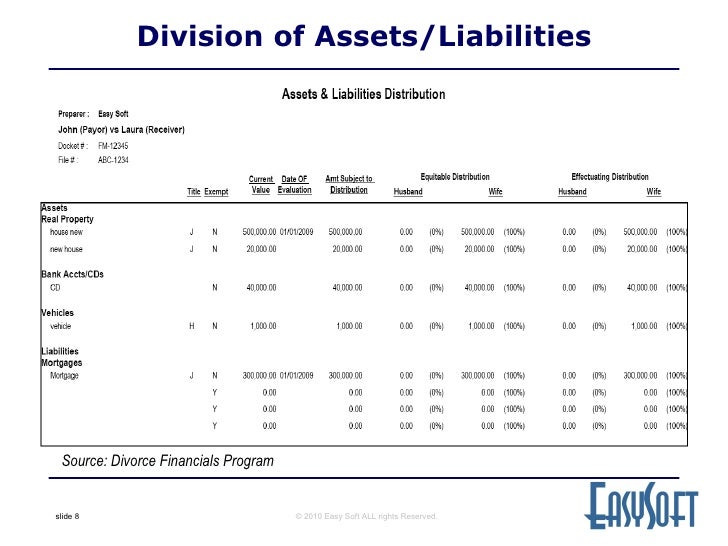

What is equitable distribution?

As a result, equitable distribution refers to a fair, but not strictly equal, division of marital assets.

What to do when you are approaching the end of your divorce?

If you’re approaching the end of your divorce, it may be a good idea to consult with your partner to get formal appraisals or estimates on the more valuable items.

Why is it important to provide an extra copy of a settlement proposal?

It is beneficial to provide an extra copy for your partner during negotiations so that he or she can see what basis you are working on when making settlement proposals.

Who has more say in how the property is shared whether they signed a prenuptial agreement or an agreement during?

The spouse has more say in how the property is shared whether they signed a prenuptial agreement or an agreement during the marriage. The following are some other elements of a fair distribution that should not be overlooked:

Is cash traded between spouses deductible?

Cash traded between (ex)spouses as a component of a separation repayment—for instance, to adjust resources—is for the most part not available to the collector and not duty deductible to the payer.

Alimony and its effect on taxes

Alimony is also another major issue that can have drastic tax consequences after divorce.

Tax consequences in the initial year of the divorce

After the initial year of divorce or when your marriage legally ceases to exist, you will not able to file your taxes under the “Married Filing Jointly” clause. This can significantly increase your tax obligations. The increase in tax liability might be as a result of;

Tax implication on community properties

Division of properties during a divorce is usually governed by local state laws. Some states enforce common property laws while others enforce community property laws. Community properties are those assets that are co-owned by both partners during their marriage. Nine states have already passed this law into a statute.

Marital property laws and their implication

Marital property laws are generally referred to as the equitable distribution laws. The courts base their decisions regarding what is just, reasonable, fair and equitable to divide the property.

Tax implication on child support

If a divorce occurs and children are involved the court usually grants some amount of money for the upbringing of the children. This amount is usually referred to as child support, the amount is not considered ordinary income to the party who receives the money and hence it is not deductible.

Tax implication on the transfer of joint property

There are basic guidelines that are usually considered when the property has been transferred from one person to another before, during or after the divorce.

Taxable Divorce Issues Lawyer Free Consultation

If you have a question about divorce law or if you need to start or defend against a divorce case in Utah call Ascent Law at (801) 676-5506. We will help you.

What is the tax rule for settlements?

Tax Implications of Settlements and Judgments. The general rule of taxability for amounts received from settlement of lawsuits and other legal remedies is Internal Revenue Code (IRC) Section 61 that states all income is taxable from whatever source derived, unless exempted by another section of the code. IRC Section 104 provides an exclusion ...

What is employment related lawsuit?

Employment-related lawsuits may arise from wrongful discharge or failure to honor contract obligations. Damages received to compensate for economic loss, for example lost wages, business income and benefits, are not excludable form gross income unless a personal physical injury caused such loss.

What is the exception to gross income?

For damages, the two most common exceptions are amounts paid for certain discrimination claims and amounts paid on account of physical injury.

Is emotional distress excludable from gross income?

96-65 - Under current Section 104 (a) (2) of the Code, back pay and damages for emotional distress received to satisfy a claim for disparate treatment employment discrimination under Title VII of the 1964 Civil Rights Act are not excludable from gross income . Under former Section 104 (a) (2), back pay received to satisfy such a claim was not excludable from gross income, but damages received for emotional distress are excludable. Rev. Rul. 72-342, 84-92, and 93-88 obsoleted. Notice 95-45 superseded. Rev. Proc. 96-3 modified.

Is a settlement agreement taxable?

In some cases, a tax provision in the settlement agreement characterizing the payment can result in their exclusion from taxable income. The IRS is reluctant to override the intent of the parties. If the settlement agreement is silent as to whether the damages are taxable, the IRS will look to the intent of the payor to characterize the payments and determine the Form 1099 reporting requirements.

Is emotional distress taxable?

Damages received for non-physical injury such as emotional distress, defamation and humiliation, although generally includable in gross income, are not subject to Federal employment taxes. Emotional distress recovery must be on account of (attributed to) personal physical injuries or sickness unless the amount is for reimbursement ...

Does gross income include damages?

IRC Section 104 explains that gross income does not include damages received on account of personal physical injuries and physical injuries.

How does alimony affect taxes?

Income tax is another factor which can seriously affect the settlements. All alimony payments are liable to taxes just like any normal income. Usually, a thirty percent tax is cut from the total amount of money the payee receives. Also, the payer faces a tax deduction amount as well. Usually, the percentages are the same. The dependency deduction plays an important role here. Although it is usually resolved by couples by themselves, it can result in a large percentage of tax savings. Dependency deduction is a term that refers to tax exemptions when an individual has custody of one or more children. There are cases where the couple decides to split the children in order to benefit from tax reductions. Also, if the children cannot be evenly split, then couples are advised to evenly divide the children and then the remaining child lives with his/her father and mother from year to year. The same solution is for those couples who have one child. They may wish to alternate. However, in cases where a spouse has the main custody of all the children, no alternatives can be used. In cases where one spouse is receiving the alimony that is taxable, that person might use the dependency claim to reduce the overall taxes.

What are the factors that affect a financial settlement?

In order to understand the taxable aspect in a better way, one must understand two important factors which affect the financial settlement: capital gains and income taxes. Capital gains taxes is a term which is used to describe the market value of an asset; the cost of the item is not taken into account. If an individual bought a home for $200,000 for example, and the current value of the house is, let’s say, $300,000, then the capital gain would be equal to $100,000. This equation can be applied to other assets as well whose market value has increased and is more than the price the item was bought. Funds such as investment funds and mutual funds fall under this category. In divorce settlements, capital gains tax is inevitable. Individuals must consider how much capital gain their partner is paying.

What is financial agreement in divorce?

Financial agreements form a crucial part of divorce settlements all around the globe. A couple must decide how the assets and money need to be split among them to avoid any future issues. Money, property, jewelry, savings, investments, shares, etc. all come under the umbrella of this process. In cases where a prenuptial agreement is already in place, it is responsible for determining how all the assets have to be divided. However, one thing is important. Divorce settlements need to be discussed in detail with the lawyers as once in motion, they are legally binding. If the papers are approved by the assigned judge, there is no going back.

Is alimony taxable on taxes?

Not all parts of the financial settlement are taxable. In alimony, the person who receives the amount has to pay the tax and the person who gives the money receives a tax deduction. Furthermore, the settlement regarding alimony takes into account numerous factors as well. Not all money can be considered alimony. Cash exchange must occur and the payment must be done under a proper court order. Moreover, both individuals must live independently once the alimony orders are underway. The tax returns are filed separately by both the parties and no payments are made if the payee or the payer dies. In cases where children are involved, the money offered for child support is not deductible.

When is property transfer incident to divorce?

A property transfer is incident to your divorce if the transfer: Occurs within one year after the date your marriage ends, or Is related to the ending of your marriage. If it is a division of the marital estate it is NOT taxable -- it was already yours in the first place.

Can you transfer your spouse to your divorce?

Your former spouse, but only if the transfer is incident to your divorce.

Is property settlement taxable?

If it is a division of the marital estate it is NOT taxable -- it was already yours in the first place.

IRC Section and Treas. Regulation

- IRC Section 61explains that all amounts from any source are included in gross income unless a specific exception exists. For damages, the two most common exceptions are amounts paid for certain discrimination claims and amounts paid on account of physical injury. IRC Section 104explains that gross income does not include damages received on account of personal phys…

Resources

- CC PMTA 2009-035 – October 22, 2008PDFIncome and Employment Tax Consequences and Proper Reporting of Employment-Related Judgments and Settlements Publication 4345, Settlements – TaxabilityPDFThis publication will be used to educate taxpayers of tax implications when they receive a settlement check (award) from a class action lawsuit. Rev. Rul. 85-97 - The …

Analysis

- Awards and settlements can be divided into two distinct groups to determine whether the payments are taxable or non-taxable. The first group includes claims relating to physical injuries, and the second group is for claims relating to non-physical injuries. Within these two groups, the claims usually fall into three categories: 1. Actual damages re...

Issue Indicators Or Audit Tips

- Research public sources that would indicate that the taxpayer has been party to suits or claims. Interview the taxpayer to determine whether the taxpayer provided any type of settlement payment to any of their employees (past or present).