Divorce & Taxes: The 4 Things You Must Know

- There is No Difference Between Alimony and Child Support Concerning Taxes. ...

- The Tax Impact of Dividing Property. Thanks to §1041 of the Internal Revenue Code, the division of property in a divorce is not a taxable event.

- Understanding Your Filing Status. ...

- Which of Your Divorce Attorney’s Fees Are Tax Deductible. ...

Is money paid in a divorce settlement taxable?

Under the current federal income tax laws, alimony or spousal maintenance is non-taxable and the party paying the alimony or spousal maintenance does not receive a tax deduction. Spousal support or alimony is paid with after-tax dollars like child support is paid with after-tax dollars.

Is a lump sum payment in a divorce settlement taxable?

Generally, lump-sum divorce settlements are not taxable for the recipient. If the lump-sum payment is an alimony payment, it is not deductible for the person who makes the payment and is not considered income for the recipient.

How can I avoid paying taxes on a divorce settlement?

Primary Residence If you sell your residence as part of the divorce, you may still be able to avoid taxes on the first $500,000 of gain, as long as you meet a two-year ownership-and-use test. To claim this full exclusion, you should make sure to close on the sale before you finalize the divorce.

Is property settlement taxable income?

Lump-sum property payments have always been taxable, however. They never got the favorable tax treatment that alimony/spousal maintenance payments once did. If you agree to pay or receive a lump sum of property in the divorce rather than a smaller monthly payment structure, you will have to pay taxes on that payment.

Who pays capital gains in divorce?

Property Settlements When this occurs and the property has increased in value since the time of the divorce, the seller may owe capital gains taxes based on the value of the property at the time of acquisition.

How is Capital Gains Tax split after divorce?

If the home is sold not too long after the divorce, each spouse can exclude up to $250,000 of their respective share of the capital gain, provided: (1) each owned their part of the home for at least two years during the five-year period ending on the sale date; and (2) each used the home as a principal residence for at ...

Is a house buyout taxable?

Generally, you don't have to pay taxes on any gain or loss you have from the buyout. That's true even if the house is just one part of the bigger plan to divvy up your assets and debts — for example, if you get the house because you agreed to give your ex-spouse cash or to pay off debt you both owe.

Is money received in family settlement taxable?

Therefore, the family arrangement is not taxable - Tri. Income Tax - Taxation on amount received on family settlement - accrual of income - entire property was in existence at the time of partition in which concerned family members were having their interest/shares, therefore, it was clearly a family settlement.

Are legal settlements tax deductible?

Generally, if a claim arises from acts performed by a taxpayer in the ordinary course of its business operations, settlement payments and payments made pursuant to court judgments related to the claim are deductible under section 162.

What type of settlement is not taxable?

personal injury settlementsSettlement money and damages collected from a lawsuit are considered income, which means the IRS will generally tax that money. However, personal injury settlements are an exception (most notably: car accident settlements and slip and fall settlements are nontaxable).

Do you need to issue a 1099 for a legal settlement?

The IRS requires the payer to send the recipient a 1099-MISC, as long as the settlement meets the following conditions: The payee received more than $600 in a calendar year. The settlement money is taxable in the first place.

Are divorce expenses tax deductible in 2020?

So, can you deduct divorce attorney fees on your taxes? No, unfortunately. The IRS does not allow individuals to deduct any costs from: Personal legal advice, which extends to situations beyond divorce.

Are divorce expenses tax deductible in 2020?

So, can you deduct divorce attorney fees on your taxes? No, unfortunately. The IRS does not allow individuals to deduct any costs from: Personal legal advice, which extends to situations beyond divorce.

Can you file married if you were divorced during the year?

Filing status Couples who are splitting up but not yet divorced before the end of the year have the option of filing a joint return. The alternative is to file as married filing separately. It's the year when your divorce decree becomes final that you lose the option to file as married joint or married separate.

How are QDRO distributions taxed?

A QDRO distribution that is paid to a child or other dependent is taxed to the plan participant. An individual may be able to roll over tax-free all or part of a distribution from a qualified retirement plan that he or she received under a QDRO.

Is a lump sum divorce settlement taxable in California?

If you accept a lump sum alimony payment, you may face tax consequences. For example, if you receive a lump sum payment that's referred to as "alimony" in your divorce decree, you may be subject to taxes on the full amount for that year. But if the same payment is called a "settlement," you may not be taxed.

The Key Difference Between Alimony and Child Support

Alimony (support paid from one spouse to another for the benefit of the receiving spouse), is different from child support (support paid from one s...

The Tax Impact of Dividing Property

Thanks to §1041 of the Internal Revenue Code, the division of property in a divorce is not a taxable event. There is, however, a potentially huge t...

Understanding Your Filing Status

There are different filing statuses available (depending on certain factors) for those going through divorce: single, married, or head of household...

Which of Your Divorce Attorney’S Fees Are Tax Deductible

Unfortunately, most of the fees paid to a divorce attorney are not tax deductible. There is, though, one loophole: §212 of the Internal Revenue Cod...

Who pays tax on divorce settlement?

Marital property is commonly described as property acquired by the spouses during their marriage (for example, a family home or retirement plan assets).

Who is responsible for proving the presence of property in divorce?

It is the responsibility of the divorced parties to recognize and prove the presence of properties.

What is equitable distribution?

As a result, equitable distribution refers to a fair, but not strictly equal, division of marital assets.

What to do when you are approaching the end of your divorce?

If you’re approaching the end of your divorce, it may be a good idea to consult with your partner to get formal appraisals or estimates on the more valuable items.

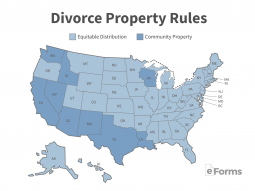

How many states have community property laws?

Nine states (listed below) have community property laws, while the other 41 have common law laws.

Why is it important to provide an extra copy of a settlement proposal?

It is beneficial to provide an extra copy for your partner during negotiations so that he or she can see what basis you are working on when making settlement proposals.

Who has more say in how the property is shared whether they signed a prenuptial agreement or an agreement during?

The spouse has more say in how the property is shared whether they signed a prenuptial agreement or an agreement during the marriage. The following are some other elements of a fair distribution that should not be overlooked:

Who should discuss fraudulent tax returns?

There are provisions to protect spouses who are, or have been, married to individuals who have filed fraudulent tax returns. The innocent spouse should discuss this with a qualified tax expert or legal counsel.

Can a couple dispute taxes?

There are times when a couple may be in dispute with the IRS over taxes that are due. In other cases, the couple may not have filed tax returns for one or more years. These situations create contingent tax liabilities.

Is the assignment of exemptions a financial decision?

However, the assignment of exemptions is a financial decision, not a parenting decision. The earned income credit and the daycare credit are related to parenting time. However, as in the case of child support, the parenting plan should be developed first and the tax consequences anticipated. The parenting of the children should not be dependent on the associated tax consequences.

Can a divorced person own a corporation?

In some cases, one or both of the parties in a divorce can own a part or all of a corporation. There can be significant tax consequences involved in transferring assets from corporations to divorcing parties in order to divide marital estates. Reference to financial experts is strongly advised if this type of arrangement appears likely.

Do divorces have tax consequences?

Divorces, in and by themselves, do not usually create tax consequences. That is, the transfers of assets and liabilities between spouses do not create taxable events. However, there are tax consequences associated with payments made after a divorce (alimony/maintenance). There may also be tax consequences involved with sales of property that occur as a result of, or incident to, a divorce.

Is alimony taxable income?

Alimony is normally a deduction from taxable income for the spouse paying it and an inclusion in the taxable income of the spouse receiving it.

What is the filing status for divorce?

There are different filing statuses available (depending on certain factors) for those going through divorce: single, married, or head of household. Different statuses (as well as the decision whether to file jointly or separately with a spouse) may yield significantly different tax liabilities.

Is property division taxable in divorce?

Thanks to §1041 of the Internal Revenue Code, the division of property in a divorce is not a taxable event. There is, however, a potentially huge tax impact hidden within: tax basis. Tax basis is, simply put, the price used to determine the capital gains tax when property is sold (usually the purchase price). While some property (such as cash) carries no capital gain when sold and other property (such as a residence owned by the taxpayer) has an exemption from capital gain up to a given dollar amount, many forms of investment will be hit with a capital gains tax when sold.

Is a divorce attorney's fee deductible?

Unfortunately, most of the fees paid to a divorce attorney are not tax deductible. There is, though, one loophole: §212 of the Internal Revenue Code allows that fees paid to a divorce attorney in the production or collection of gross income are tax deductible.

Is there a difference between child support and alimony?

1. There is No Difference Between Alimony and Child Support Concerning Taxes. Alimony (support paid from one spouse to another for the benefit of the receiving spouse), is different from child support (support paid from one spouse to another for the benefit of the child) in several ways, but taxes is not one of them.

Is Apple stock worth the same as a $250,000 divorce settlement?

So, in a divorce settlement $250,000 worth of Apple stock is not worth the same as a $250,000 marital residence because the stock will be subject to capital gains tax when sold while the residence will not. 3. Understanding Your Filing Status.

Does cash carry capital gains tax?

While some property (such as cash) carries no capital gain when sold and other property (such as a residence owned by the taxpayer) has an exemption from capital gain up to a given dollar amount, many forms of investment will be hit with a capital gains tax when sold.

Is alimony tax deductible?

Before 2018, alimony was tax deductible by the payer and child support was not. Now, both alimony and child support are not tax deductible to the payer, and the recipient owes nothing in terms of taxes. All agreements going forward will fall under these terms.

When property is transferred incident to a separation or divorce agreement, what is the federal tax requirement?

Important Tax Compliance Tip: When property is transferred incident to a separation or divorce agreement, federal income tax regulations require the transferor to provide the transferee with detailed records that evidence tax basis and other tax attributes ( holding period, etc.). Consulting with an experienced divorce tax attorney during a divorce will ensure that tax law requirements, like this one, are followed.

What is the 1041 tax code?

In an effort to show empathy for taxpayers that are going through a very difficult period and to provide uniformity among the taxation of transfers pursuant to a divorce in all 50 states, Congress enacted Section 1041 of the Internal Revenue Code .

What are the considerations regarding interspousal transfers?

Considerations Regarding Interspousal Transfers. There are a few important considerations that taxpayers should bear in mind when they are transferring property incident to a separation or divorce. The first is when a transfer for property actually takes place. Although this element of Section 1041 is typically straightforward and ...

Is property transferred in divorce taxable?

While that case law was in effect, transferors of property incident to a divorce were simply treated as making a taxable disposition of assets, paying tax on the difference between the transferor’s basis and the fair market value of the property being transferred.

Is a divorce taxable?

Traditionally, property that was transferred incident to a divorce or separation was considered a taxable transaction. In United States v. Davis, the Supreme Court made the determination that the transfer of property from a husband to a wife in exchange for the wife’s agreement to not pursue a court-ordered division of assets was ...

Do husband and wife own a car in California?

Under Cali fornia community property law, the husband and wife are each considered to own half of the collector car. Pursuant to a settlement agreement, the husband agrees to transfer his 50% interest in the car to the wife. Although the sale of any portion of the antique collector car would have yielded taxable capital gain under normal ...

Can a spouse transfer property to another spouse?

Under Section 1041 (a) of the Internal Revenue Code, spouses can transfer property to each other (or ex-spouses if the transfer is pursuant to a divorce) without recognizing gain (or loss) on the transaction. Thus, this rule covers both separations and divorces.

When is property transfer incident to divorce?

A property transfer is incident to your divorce if the transfer: Occurs within one year after the date your marriage ends, or Is related to the ending of your marriage. If it is a division of the marital estate it is NOT taxable -- it was already yours in the first place.

Can you transfer your spouse to your divorce?

Your former spouse, but only if the transfer is incident to your divorce.

Is there gain or loss on a transfer of property?

Generally, no gain or loss is recognized on a transfer of property from you to (or in trust for the benefit of):

Is property settlement taxable?

If it is a division of the marital estate it is NOT taxable -- it was already yours in the first place.

What is the law on marital assets in divorce?

With the exception of qualified retirement plan assets covered under the Employee Retirement Income Security Act (ERISA), state laws ultimately govern the division of marital assets in a divorce, and state laws differ radically on who gets what when the marriage ends.

When is a property transfer incident to divorce?

A transfer of property is incident to a divorce if the transfer occurs within one year after the date on which the marriage ceases or is “related to the cessation of the marriage,” which requires that the transfer: Is pursuant to a divorce or separation instrument, and.

What are the emotional aspects of divorce?

The emotional aspects of a divorce often interfere with planning for the efficient distribution of the marital estate. The shock and ill feelings may create a barrier between spouses that prevents even discussing issues. Tax practitioners need to know how to explain to a divorcing client the tax realities, to avoid any post-divorce tax ...

Why is it important to consider intangible assets in a settlement?

Consideration of intangible assets in property settlements is becoming more important as courts express an increased willingness either to classify the intangibles as property subject to distribution or to require spouses to pay for reimbursement.

How many states have equitable distribution?

EQUITABLE DISTRIBUTION STATES. In the 41 equitable distribution states, the courts decide what is a fair, reasonable, and equitable division of assets. A court may decide to award a spouse anywhere from none to all of the property value.

What is PFP in divorce?

One is “a member has provided tax or personal financial planning (PFP) services for a married couple who are undergoing a divorce, and the member has been asked to provide the services for both parties during the divorce proceedings” (see also the sidebar, “Divorce Issues Checklist”).

How many states are common law in divorce?

Currently, nine states (listed below) are community property states, and the remaining 41 are common law states.

What is the responsibility of a divorced spouse?

If you are divorced, you are jointly and individually responsible for any tax, interest, and penalties due on a joint return for a tax year ending before your divorce. This responsibility applies even if your divorce decree states that your former spouse will be responsible for any amounts due on previously filed joint returns.

Who is responsible for taxes on joint return?

Both you and your spouse may be held responsible, jointly and individually, for the tax and any interest or penalty due on your joint return. This means that one spouse may be held liable for all the tax due even if all the income was earned by the other spouse.

When will alimony be increased?

On December 2, 2013, a court executed a divorce decree providing for monthly alimony payments beginning January 1, 2014, for a period of 8 years. On May 15, 2020, the court modified the divorce decree to increase the amount of monthly alimony payments.

What is overpayment on joint tax return?

The overpayment shown on your joint return may be used to pay the past-due amount of your spouse's debts. This includes your spouse's federal tax, state income tax, child or spousal support payments, or a federal nontax debt, such as a student loan.

What form do you file if you have an annulment?

You have obtained a decree of annulment, which holds that no valid marriage ever existed. You must file amended returns (Form 1040-X , Amended U.S. Individual Income Tax Return) for all tax years affected by the annulment that aren’t closed by the statute of limitations.

Is a widow filing a joint return?

If you are unmarried, your filing status is single or, if you meet certain requirements, head of household or qualifying widow (er). If you are married, your filing status is either married filing a joint return or married filing a separate return. For information about the single and qualifying widow (er) filing statuses, see Pub. 501, Dependents, Standard Deduction, and Filing Information.

Can you file a joint tax return if you are married?

If you are married, you and your spouse can choose to file a joint return. If you file jointly, you both must include all your income, deductions, and credits on that return. You can file a joint return even if one of you had no income or deductions.