Full Answer

What is the minimum amount of settlement required for an MSA?

To have an MSA reviewed by CMS, the minimum amount of the total settlement must be more than $25,000 for a Medicare beneficiary, or $250,000 for a claimant with reasonable expectation of Medicare enrollment within 30 months of the settlement date.

What is an MSA in a workers’ compensation case?

If future medical care related to a workplace injury is necessary, the carrier must take measures to ensure that Medicare remains the secondary payer and that there’s funding available for the injured employee to pay for their future care in the settlement. An MSA is the tool designed to pay those expenses and “protect Medicare.”

What is an MSA and do I need one?

An MSA is the tool designed to pay those expenses and “protect Medicare.” Submitting an MSA to the Centers for Medicare & Medicaid Services (CMS) is a voluntary process and is not required. Some payers view CMS review as a “safety net” to ensure they are protecting Medicare.

Do I need to submit my MSA to the CMS?

Submitting an MSA to the Centers for Medicare & Medicaid Services (CMS) is a voluntary process and is not required. Some payers view CMS review as a “safety net” to ensure they are protecting Medicare. However, once one goes down this route, they must adhere to Medicare’s specific guidelines regarding the MSA review process.

Is MSA mandatory?

Submitting an MSA to the Centers for Medicare & Medicaid Services (CMS) is a voluntary process and is not required.

When MSA is not needed?

According to CMS, an MSA is not necessary if ALL of the following criteria are met: (1) The facts of the case demonstrate that the injured individual is only being compensated for past medical expenses (i.e., for services furnished prior to the settlement);

What is the MSA rule?

The rule of thumb for acceptance of a measurement system is a total Gage R&R of 30% or less of the lessor of Total Variation or the Specification Tolerance. In this case, the measurement system is capable, and can be used as a basis of decision making.

What is a non submit MSA?

A Non-Submit Medicare Set-Aside (MSA), sometimes called an Evidence-Based MSA, may be appropriate when the settlement does not meet the Centers for Medicare and Medicaid Services (CMS) Workers' Compensation Medicare Set-Aside Arrangement (WCMSA) review thresholds or in situations where the settling parties have decided ...

Why is an MSA necessary?

An MSA is never required, but workers' compensation insurance companies usually want to have this process completed as a way to prove no one is trying to shift the burden of medical treatment from private insurance to the public medicare system without some payments to medicare.

How is Medicare Set Aside calculated?

The professional hired to perform the allocation determines how much of the injury victim's future medical care is covered by Medicare and then multiplies that by the remaining life expectancy to determine the suggested amount of the set aside.

Why MSA is mandatory before carrying out SPC?

So it is essential to assess measurement systems statistically prior to implementing SPC. Since trends and changes apparent in SPC charts can come from the measurement system itself, it is important when trying to track down issues to understand the effect of measurement variation.

What are the 3 main elements of master services agreement?

It spells out: Confidentiality: The parties both agree they won't share any secrets of the company with outside parties. Delivery requirements: The businesses decide who will deliver what and when. Dispute resolution: Should issues come up, the MSA outlines how the parties will resolve their conflict.

How do you qualify a system of measurement?

Measurement System Analysis aims to qualify a measurement system for use by quantifying its accuracy, precision, and stability. 1-Measurement are said to be accurate if their tendency is to center around the actual value of the entity being measured.

What is MSA in workers comp?

A Workers' Compensation Medicare Set-Aside Agreement (MSA) is a financial agreement that allocates a portion of a workers' compensation settlement to pay for future medical services related to the work injury that Medicare would have otherwise paid.

How long is CMS approval good for?

CMS has issued a conditional approval/approved WCMSA amount at least 12 but no more than 48 months prior to filing of an Amended Review request. The case has not yet settled as of the date of the request for re-review.

What is CMS approval?

CMS approvals are issued at a local level by the Medicare Administrative Contractor (MAC) or are reviewed an approved through a centralized process by CMS. Studies approved through the centralized process are listed here.

What is MSA and how is it calculated?

MSA is a collection of experiments and analysis performed to evaluate a measurement system's capability, performance and amount of uncertainty regarding the values measured. We should review the measurement data being collected, the methods and tools used to collect and record the data.

What is an example of a MSA?

1:5732:11All You Need To Know About MSA (Measurement System Analysis)YouTubeStart of suggested clipEnd of suggested clipSo what is msa the measurement system analysis msa is a set of entities used in the combination toMoreSo what is msa the measurement system analysis msa is a set of entities used in the combination to take a measurement of products.

What are the types of MSA?

There are two types of MSA : parkinsonian and cerebellar. The type depends on the symptoms you have when you're diagnosed.

What is MSA Six Sigma?

Often used at the measure phase of Six Sigma methodology, Measurement System Analysis (MSA) is a statistical and scientific tool to ensure the measurement done to collect data is consistent, reliable, unbiased and correct. It emphasizes on standardization of data collection method and assessment of the collected data.

What is an MSA for Medicare?

An MSA is the tool designed to pay those expenses and “protect Medicare.”. Submitting an MSA to the Centers for Medicare & Medicaid Services (CMS) is a voluntary process and is not required. Some payers view CMS review as a “safety net” to ensure they are protecting Medicare.

What is Medicare set aside?

In its simplest form, the Medicare Set-Aside (MSA) is a pool of funding reserved for future accident‑related treatment once a workers’ compensation case is settled . However, because of its complex nature, some employers will go the MSA route when there are better options available, or they’ll falsely believe a settlement agreement will cover these ...

How long does it take to get MSA approved?

The approval process for a MSA may vary somewhat based on the type of plan and jurisdiction. Workers’ compensation plans may be approved in under 30 days, but review may run longer if the reviewing office is inundated, the review contractor seeks additional medical information from the parties, or CMS experiences an unusual delay. Liability plans are submitted directly to each Regional Office of CMS and therefore review is at the discretion of the individual office.

How to contact Atlas Settlement Group?

Please email [email protected]. A referral form is here. Or, please call our office at (404)926-4160 and we will be happy to send you a request for the necessary information and discuss your claim with you. We will confirm receipt of all materials and advise as to further handling. Medical records, prescription and payment histories may be emailed to [email protected] or mailed to: Atlas Settlement Group Medicare Compliance Services 3565 Piedmont Road NE Building 1, Suite 525 Atlanta, GA 30305

What is Medicare set aside?

The purpose of the Medicare Set-Aside arrangement (MSA) is to provide funds to the injured party to pay for future medical expenses that would otherwise be covered by Medicare, known as “qualified medical expenses”. If the injured party incurs qualified medical expenses that exhaust the anticipated set-aside sum, Medicare will pay for allowable expenses in excess of the properly exhausted MSA funds. By establishing a Medicare Set-Aside Account, parties to a settlement are protecting Medicare’s interest and complying with the Medicare Secondary Payer Act.

How does Atlas Settlement Group work?

Atlas Settlement Group works to provide MSA and Structured Settlement Annuity services from start to finish through your claim resolution process . It is our belief that early involvement is critical. This allows ample time to review the medical records to determine if the injured individual has a substandard life expectancy (rated age) and time to verify Medicare and/or Social Security Disability eligibility. If the individual meets the eligibility requirements, the completion of an MSA early in the life of the file assists with reserving and settlement negotiations. Further cost savings can be achieved through funding the MSA annual obligation with a Structured Settlement Annuity. Atlas Settlement Group’s Structured Settlement Annuity services are offered at no additional cost to the employer/insurer or the injured individual. Finally, Atlas Settlement Group will assist in preparation of settlement documents to ensure that Medicare’s interests are properly addressed and parties to the claim are properly protected.

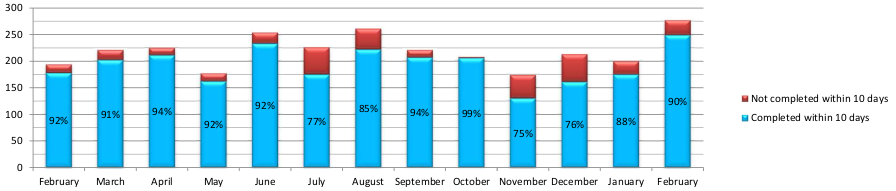

How long does it take to get Medicare set aside report?

Atlas Settlement Group knows that time is of the essence. Therefore we and our partners are committed to provide Medicare Set Aside reports within 10 business days of receipt of all required information. RUSH reports can be prepared where necessary. Please contact our office for availability and fees.

Who administers Medicare set aside accounts?

A Medicare Set Aside Account can be administered by the injured individual (self-administered) or by a Professional Administrator. The account administrator, whether the individual, custodian, or professional vendor, is charged with keeping accurate accounting records of all disbursements from the account. An annual statement of disbursements must be provided to CMS for review and appropriateness. If expenditures are deemed outside of Medicare’s coverage, Medicare may deny future claim-related benefits. CMS notes that MSAs must be administered by a competent administrator (the representative payee, a professional administrator, etc.) When an individual has a designated representative payee (for Social Security purposes), an appointed guardian/conservator, or has otherwise been declared incompetent by a court, the settling parties must provide this information in the MSA proposal submitted to CMS. 10/15/04 Memorandum, Q2

Is a MSA required for a longshore claim?

A MSA should be obtained in a Longshore or Coal Act claim if the CMS thresholds are met. Please see below for suggestions regarding a liability claim, as while not required, certainly liability MSAs are encouraged where appropriate.

How many tobacco companies have settled under the MSA?

Eventually, more than 45 tobacco companies settled with the Settling States under the MSA. Although Florida, Minnesota, Mississippi, and Texas are not signatories to the MSA, they have their own individual tobacco settlements, which occurred prior to the MSA.

What is the purpose of the MSA?

The MSA’s purpose is to reduce smoking in the U.S., especially in youth , which is achieved through: Raising the cost of cigarettes by imposing payment obligations on the tobacco companies party to the MSA.

How does MSA work?

The MSA’s purpose is to reduce smoking in the U.S., especially in youth, which is achieved through: 1 Raising the cost of cigarettes by imposing payment obligations on the tobacco companies party to the MSA. 2 Restricting tobacco advertising, marketing, and promotions, including:#N#Prohibiting tobacco companies from taking any action to target youth in the advertising, promotion or marketing of tobacco products.#N#Banning the use of cartoons in advertising, promotions, packaging, or labeling of tobacco products.#N#Prohibiting tobacco companies from distributing merchandise bearing the brand name of tobacco products.#N#Banning payments to promote tobacco products in media, such as movies, televisions shows, theater, music, and video games.#N#Prohibiting tobacco brand name sponsorship of events with a significant youth audience or team sports. 3 Eliminating tobacco company practices that obscure tobacco’s health risks. 4 Providing money for the Settling States that states may choose to use to fund smoking prevention programs. 5 Establishing and funding the Truth Initiative, an organization “dedicated to achieving a culture where all youth and young adults reject tobacco.”

How does the MSA affect smoking?

The MSA continues to have a profound effect on smoking in America, particularly among youth. Between 1998 and 2019 , U.S. cigarette consumption dropped by more than 50%. During that same time period, regular smoking by high schoolers dropped from its near peak of 36.4% in 1997 to a low 6.0% in 2019. As advocates for the public interest, state attorneys general are actively and successfully continuing to enforce the provisions of the MSA to reduce tobacco use and protect consumers.

What is the purpose of entering into agreements with major retail chains?

Entering into agreements with major retail chains to ensure that retailers comply with state laws setting the minimum age at which tobacco products may be purchased and limiting the quantity and content of tobacco advertising at retail locations.

Is the MSA subject to constitutional defenses?

Also, because the contractual requirements of the MSA are in some ways broader than the authority granted to the FDA and are not subject to constitutional defenses, state attorneys general continue to step in where the FDA may be unable to act.

Do tobacco companies have to pay settlements?

Under the MSA, tobacco manufacturers are obligated to make annual payments to the Settling States in perpetuity, so long as cigarettes are sold in the United States by companies that have settled with the States. The NAAG Center for Tobacco and Public Health makes certain such payments are made.

How to submit a WCMSA?

If you decide to submit a WCMSA for review, it can be submitted electronically through the WCMSA Portal (WCMSAP) or by paper/CD through the mail. The portal submission is the recommended approach for submitting a WCMSA as it is significantly more efficient than sending this information via the mail. For more information about this application, please see the WCMSAP page.

How to get notifications from WCMSA?

If you have not already signed up for these notifications, please enter your e-mail address in the “Receive E-Mail Updates” box at the bottom of this page . Next, select “Worker’s Compensation Agency Services” and any other topics you would like to receive notifications on. When notifications and new information, regarding WCMSA are available, you will be notified at the provided e-mail address.

What is a WCMSA?

A Workers’ Compensation Medicare Set-Aside Arrangement (WCMSA) is a financial agreement that allocates a portion of a workers’ compensation settlement to pay for future medical services related to the workers’ compensation injury, illness, or disease. These funds must be depleted before Medicare will pay for treatment related to the workers’ compensation injury, illness, or disease.

What is the recommended method to protect Medicare's interests?

The recommended method to protect Medicare’s interests is a WCMSA. The amount of the WCMSA is determined on a case-by-case basis. To assist you in determining if a WCMSA is reasonable, please review Section 15.1 (Criteria) in the WCMSA Reference Guide.

Is WCMSA a CMS submission?

While there are no statutory or regulatory provisions requiring that a WCMSA proposal be submitted to CMS for review, submission of a WCM SA proposal is a recommended process. More information on this process can be found on the WCMSA Submissions page.

What is MSA settlement?

A: The MSA set up initial, annual, and “strategic contribution” payments from Participating Manufacturers to the Settling States. Each year, an independent auditor calculates the settlement payment to be made by each Participating Manufacturer and the amount to be received by each Settling State.18 If parties disagree with the auditor’s calculations, the matter is submitted to binding arbitration by three neutral arbitrators who must be former federal judges.19

What is the MSA?

] The MSA created the American Legacy Foundation (now known as the Truth Initiative), a research and educational organization that focuses its efforts on preventing teen smoking and encouraging smokers to quit. The foundation is responsible for “The Truth” advertisement campaign,30 which has had success in reducing youth smoking.31

What is the purpose of Section VII of the MSA?

A: Under Section VII of the MSA, each Settling State may bring an action to enforce the Agreement or the Consent Decree (the settlement contained in a court order) with respect to disputes or alleged breaches within its territory. The court that entered a Settling State’s Consent Decree has exclusive jurisdiction to implement and enforce the MSA with respect to that state. Section VIII(a) of the MSA places responsibility on the National Association of Attorneys General (NAAG) to coordinate and facilitate the MSA’s implementation and enforcement on behalf of the attorneys general of the Settling States . NAAG carries out this mandate through an attorney general-level Tobacco Committee and an Enforcement Working Group, which consists of attorney general office staff working on tobacco issues, and the NAAG Tobacco Project, which is comprised of staff attorneys within NAAG who support state enforcement efforts. (The NAAG Tobacco Project is now known as the NAAG Center for Tobacco and Public Health.) Enforcement typically begins when a state attorney general office or NAAG observes a potential violation of the MSA, or a member of the public or a public organization complains about a Participating Manufacturer’s marketing practices to a state attorney general or NAAG. If the matter is not resolved through negotiation, one or more Settling States may decide to bring an enforcement action against the Participating Manufacturer.

What is MSA in manufacturing?

A: The MSA is a settlement agreement between the Settling States, the Original Participating Manufacturers, and the Subsequent Participating Manufacturers.13 The number of Participating Manufacturers remains fluid as, over the years, some additional manufacturers have settled with the states and others have gone out of business. As of October 2018, there are more than 50 Participating Manufacturers who are bound by the terms of the MSA.14

Does the MSA limit how the settlement states use their funds?

A: As noted above, the MSA does not limit how the Settling States may use their funds. Some state and local governments have securitized their future MSA payments in which they issue a bond backed by future payments. In other words, “By securitizing … the state trades a potentially risky future stream of payments for a certain lump-sum payment,” often to generate short-term cash to cover budget shortfalls.58 Securing bonds has allowed state governments to finance capital improvements, fund health-care projects, and receive an upfront lump sum of cash rather than waiting each year for the MSA payments.59 By 2010, eighteen states, the District of Columbia, and three U.S. territories securitized some or all of their revenue entitlements from the MSA payment schedule into bonds.60 The issued bonds totaled $40 billion and are backed by expected future MSA payments.61

What happens if you have no beneficiary on MSA?

If there is no named beneficiary, then these funds would pass in accordance with state intestacy statutes. The majority of MSAs are set up with life-only annuities with no re- mainder interest to beneficiaries – a potential windfall to the insur- ance company who wrote the annuity, but not to the beneficiary. Brokers often set up the cheapest annuities as a duty to the work- ers’ compensation carrier. However, MSAs funded with cash can be passed onto a beneficiary of the account when the plaintiff passes.

What are the two types of MSAs?

There are two types of MSAs: liability MSAs and Workers’ Compensation Medicare Set-Aside Arrangement s (WCMSA). There are a few differences between them. For example, Medicare cannot deny pay- ment for WCMSAs, but it can deny pay- ment for liability MSAs. The Centers for Medicare and Medicaid Services’ “WCMSA Reference Guide” provides an overview of WCMSAs and explains when they are necessary, how to fund them, and what the submission and approval process looks like. In the guide, CMS discusses two meth- ods of funding WCMSAs: with a lump sum or a structured arrangement. Per the guide, ”When a WCMSA is designated as a lump-sum commutation settlement, Medicare will not make any payments for the claimant’s medical expenses (for work-related injuries or diseases) until all the funds within the MSA (including any interest earned on funds in the account) have been completely exhausted.” Note that the reference to “all the funds” means that until the entirety of the WCMSA allocation is exhausted, Medicare is not responsible for making any payments. For those claimants involved in Workers’ Comp cases who need WCMSAs, funding with structured arrangements can allow them to retain more of their settlement recov- ery over the long-term.

What is a SPIA?

The Single Premium Immediate Annuity (SPIA) is essentially a lump sum of money used to purchase an annuity from a life insurance company, who in exchange funds the MSA account. The payments are made annually over a specific period of time.

What is Medicare Secondary Payer?

All parties in liability or workers’ compensation cases are responsible under Medicare Secondary Payer laws to protect Medicare’s interests when resolving cases involving future medical expenses. These laws apply when a person has beeninjured and has insurance coverage in ad-dition to Medicare.

What is a set aside account?

A Medicare set-aside (MSA) is an account created from a settlement of a workers’ compensation case or a liability case (medical malpractice, auto accident, etc.). The account is funded by using a portion of the settlement proceeds that were award- ed to the claimant or plaintiff in order to pay for future medical expenses related to the injury or illness. Those expenses would otherwise be paid for by Medicare, but be- cause Medicare is a “secondary payer,” adequately complying with Medicare means a beneficiary’s settlement must help cover those expenses. There is a very specific set of steps beneficiaries must take to properly set up an MSA and comply with Medicare. Funds must be established in in- sured bank accounts, health care providers must be notified, and claims must be properly paid and recorded. The claimant must decide whether to manage the account alone or set up the MSA in a custodial ac- count. A custodial account is a financial account set up for the benefit of a beneficiary, and administered by a responsible person, known as a custodian. Taking a streamlined, systematic approach to the MSA process will ensure benefi- ciaries set up their program properly and keep their Medicare eligibility. It can sound overwhelming, but it’s very manageable, especially with the help of a seasoned pro- fessional.

What is structured settlement annuity?

A structured settlement annuity (SSA) is a financial solution that allows the injured party a means of deferring part or all of the settlement, which provides significant tax advantages. Per the terms of the settlement agreement, the defense directly purchases an annuity from a life insurance company, which then uses the funds to replenish the MSA ac- count for the plaintiff, plus interest, through a series of annual payments across a set period of time. Both SSAs and SPIAs offer considerable cost and tax savings over using a lump sum to fund an MSA.

What is the benefit of a SPIA?

Another benefit of a SPIA is that it offers living commutation, meaning the ability to commute all or a portion of the annuity’s present value during the beneficiary’s lifetime.

How often can a RRE submit multiple claims?

Indicated that while an RRE may submit multiple claim input files during the quarter, it is limited to one file submission every 14 days and not until the prior file is completely processed. This type of multiple file reporting would most commonly be done to report TPOC termination that cannot wait until the next quarterly reporting cycle.

Do you have to report indemnity only settlements?

Payers do not need to report indemnity only settlements (no release of medicals) through Section 111 Mandatory Reporting because they are not considered a Total Payment Obligation to Client (TPOC). This reporting question that had long plagued/confused workers’ compensation payers.was recently clarified by CMS during the Q & A portion of the Section 111 NGHP Webinar.