What exemptions are available for a personal injury lawsuit?

The exemptions available for a personal injury recovery varies widely from state to state. There is also a federal exemption available for proceeds from personal injury lawsuits but, like most of the state exemptions, it's for a limited amount. You might have a wildcard exemption available to exempt additional portions of the proceeds.

What happens to my personal injury settlement in bankruptcy?

Part of filing for bankruptcy is being bankrupt. That said, it depends on the laws of your state. Since the injury occurred before you filed for bankruptcy, your $75,000 settlement is an asset of the bankruptcy estate.

Can the bankruptcy trustee take money I win in a lawsuit?

Can the bankruptcy trustee take money I win in a personal injury lawsuit? The trustee can take nonexempt portions of a personal injury lawsuit or claim to pay your creditors in bankruptcy. Learn more. Please answer a few questions to help us match you with attorneys in your area.

What happens to a lawsuit in Chapter 7 bankruptcy?

If the lawsuit or claim amount is likely to be more than the amount you can exempt, the Chapter 7 trustee will take control of the claim or lawsuit and make decisions regarding how it should proceed. Once the trustee collects the money, the trustee will disburse the exempt portion to you and the remainder to your creditors.

What claims are not discharged in bankruptcy?

Debts Never Discharged in Bankruptcy Alimony and child support. Certain unpaid taxes, such as tax liens. However, some federal, state, and local taxes may be eligible for discharge if they date back several years. Debts for willful and malicious injury to another person or property.

What is an exempted asset in bankruptcy proceedings?

Property That Is Exempt Reasonably necessary clothing. Reasonably necessary household goods and furnishings. Household appliances. Jewelry, up to a certain value.

Are personal injury settlements exempt from creditors in Florida?

Personal Injury Settlement Exemption For residents in Florida, the federal exemptions do not apply, but rather you are required to use the Florida exemptions in your bankruptcy. These exemptions only apply to those who have lived here for at least two years.

How can I protect my settlement money?

Keep Your Settlement Separate Rather than depositing the settlement check directly into your standard bank account, keep the settlement money in its own separate account. This can help you keep it safe from creditors that may try to garnish your wages by taking the money you owe directly out of your bank account.

What assets Cannot be touched in bankruptcy?

However, exempt property in a California bankruptcy is generally described as:Your main vehicle.Your home.Personal everyday items.Retirement accounts, pensions, and 401(k) plans.Burial plots.Federal benefit programs.Health aids.Household goods.More items...

What are exceptions in bankruptcy?

Bankruptcy exemptions are laws that protect your property in bankruptcy. Exemption laws exist in both the Bankruptcy Code and in state law. The exemptions contained in state law often protect your property from creditors even if no bankruptcy case is filed.

Can personal injury settlement be garnished in Florida?

In Florida, F.S. 409.25656 allows for the garnishment of any personal injury or wrongful death damages for certain financial obligations, including child support.

Can child support Take My personal injury settlement in Florida?

If a parent who owes past-due support receives a personal injury settlement, the Child Support Program may receive part of the settlement to pay child support. The Child Support Program mails a notice to the parent who owes support informing them of their rights and responsibilities.

Is my spouse entitled to my personal injury settlement in Florida?

As a very general rule, a personal injury settlement award will not be considered a marital asset during a Florida divorce. This is clearly the case when the injured spouse had already received the settlement award before the couple was married and the asset remained separate throughout the marriage.

What to do with a $100000 settlement?

What to Do with a $100,000 Settlement?Sort Out Tax Implications.Find a Financial Advisor.Pay Off the Debts.Invest in a Retirement Home.Start a Business or Help Friends and Family.Donate the Money to the Needy.Final Words.

What do I do if I have a large settlement?

Here is a list of steps to take once you receive a settlement.Take a Deep Breath and Wait. ... Understand and Address the Tax Implications. ... Create a Plan. ... Take Care of Your Financial Musts. ... Consider Income-Producing Assets. ... Pay Off Debts. ... Life Insurance. ... Education.More items...

Can the IRS take my personal injury settlement if I owe back taxes?

If you have back taxes, yes—the IRS MIGHT take a portion of your personal injury settlement. If the IRS already has a lien on your personal property, it could potentially take your settlement as payment for your unpaid taxes behind that federal tax lien if you deposit the compensation into your bank account.

What is an exempt asset?

Exempt assets include those properties that a debtor is allowed to keep with him/her irrespective of the bankruptcy proceeding. Such property is free from claims of a creditor, who do not have a lien on the property.

What are considered assets when filing bankruptcy?

Everything you own or have an interest in is considered an asset in your Chapter 7 bankruptcy. In other words, all your belongings are “assets” even if they're not really worth much. That doesn't mean that the bankruptcy trustee will sell everything you have, though.

What property is exempt from creditors in Missouri?

Personal Property Exemptions Personal property includes clothes, furniture, books, crops, animals, musical instruments, appliances and more. Up to $3,000 of personal property can be considered exempt during bankruptcy.

What is Chapter 7 bankruptcy in Oregon?

When a Chapter 7 bankruptcy is necessary, a bankruptcy trustee will typically take control of nearly every asset of the person filing. This trustee will then decide which debts will be paid in which ones should be discharged. There are various types of assets that the person filing for bankruptcy will get to hold onto, though these assets are limited to what the person needs to survive day to day life.

Will a personal injury settlement be taken as part of the bankruptcy?

If you have already received a personal injury settlement, then any compensation you have gained will be counted towards your total assets in respect to the bankruptcy.

Whether you can keep your personal injury settlement award in Chapter 7 bankruptcy depends on state law

Whether you can keep your personal injury settlement award in Chapter 7 bankruptcy depends on state law.

Free Case Evaluation

Please answer a few questions to help us match you with attorneys in your area.

What happens to the debtor in Chapter 13?

In a Chapter 13 bankruptcy, a debtor is usually required to change their repayment plan to account for the additional funds, and then turn over any nonexempt funds to creditors.

Does Florida have a Chapter 7 bankruptcy?

State and federal exemptions exist to help debtors protect some or all of their claim compensation, both for chapter 7 and chapter 13 bankruptcy. For residents in Florida, the federal exemptions do not apply, but rather you are required to use the Florida exemptions in your bankruptcy. These exemptions only apply to those who have lived here for at least two years. While Florida does not offer a blanket personal injury exemption, the law does provide you with all of the settlement money if your injury occurred working in a hazardous occupation.

Can I Keep My Personal Injury Settlement in Bankruptcy?

For most people in this situation, their biggest concern is whether they will be able to keep their personal injury settlement in the bankruptcy. The answer lies in understanding whether your arrangement is eligible for a personal injury settlement exemption.

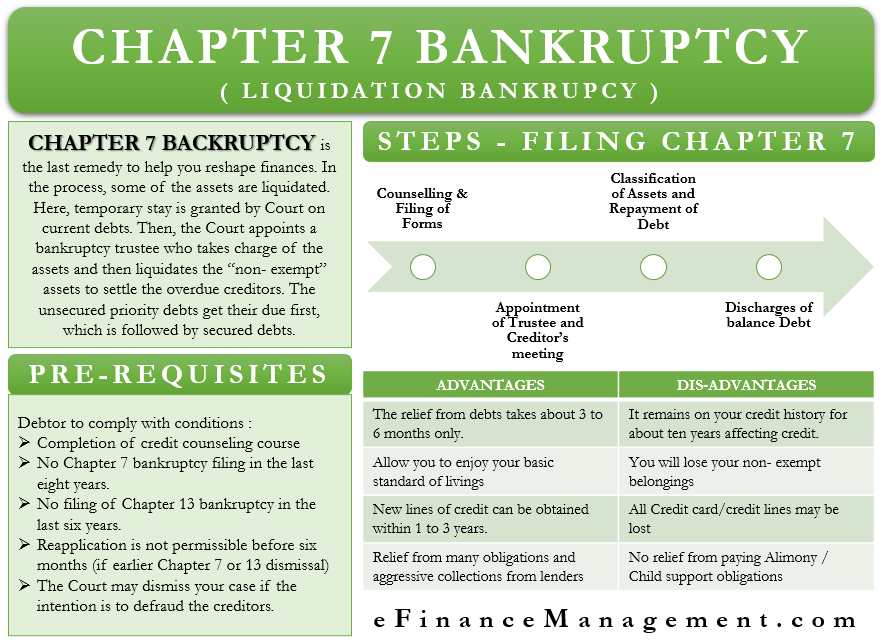

Chapter 7 Bankruptcy

In a Chapter 7 bankruptcy, you are asking the court to discharge the majority of your debt. Child support, student loans, and most forms of tax debt are the most notable types of debt that can’t be discharged by bankruptcy.

Chapter 13 Bankruptcy

In a Chapter 13 bankruptcy, you’re asking the court to allow you to repay your debts over a period of time. The amount you are required to pay to settle the debt is often less than face value, but it depends on your current income, the value of your property, and the specific types of debt you have.

Settlements for Children

The property of a minor child is exempt from your bankruptcy estate under Louisiana law. This would include any personal injury settlement your child receives after being injured in an accident caused by another party’s negligence.

Bankruptcy Cases Involving Personal Injury Claims Are Complex

You are not required to have a lawyer to file for bankruptcy. However, since cases involving pending personal injury claims are quite complex, it’s recommended that you consult a bankruptcy lawyer in addition to your personal injury attorney.

Honesty Is the Best Policy

If you’re thinking about filing for bankruptcy, be honest with your personal injury attorney upfront. Even though your financial problems don’t affect your legal right to compensation for injuries caused by another party’s negligence, your attorney needs to know they might be mentioned.

Have You Been Injured In A Louisiana Car Accident?

If you’ve been hurt in a car accident you need to speak with an experienced car accident attorney as soon as possible. Please contact us online or call our Alexandria office directly at 318.541.8188 to schedule your free consultation.

What is required when filing for bankruptcy?

There is a requirement when bankruptcy is filed that the debtor list all the property and assets they own. Failure to disclose, even if not intentional can constitute bankruptcy fraud.

Do you lose money if you file bankruptcy?

Just because you are required to list your lawsuit or claim does not automatically mean you will lose the money if you file bankruptcy. As with all assets, the question to ask is whether an exemption is available to protect the assets.

Do you have to disclose a Chapter 7 claim?

If you are injured after your Chapter 7 bankruptcy has been filed, you do not need to disclose the claim and can keep all of the money you receive from the lawsuit or settlement.

What happens if you can't claim a personal injury lawsuit?

If, however, you can't claim the potential lawsuit recovery as exempt, the trustee will take the money you win in the personal injury lawsuit and pay your creditors in the bankruptcy.

What happens next in Chapter 7 bankruptcy?

What will happen next will depend on the type of bankruptcy you file. Chapter 7. If the lawsuit or claim amount is likely to be more than the amount you can exempt, the Chapter 7 trustee will take control of the claim or lawsuit and make decisions regarding how it should proceed. Once the trustee collects the money, ...

What happens if you pay creditors in full in Chapter 13?

If funds still remain after paying all creditors in full, the trustee will return the remaining portion to you. Chapter 13. In a Chapter 13 bankruptcy, you can pursue the claim on your own.

What can you protect in Chapter 7?

In both a Chapter 7 or a Chapter 13 case, you'll be able to protect property that your state believes you'll need for a fresh start. For instance, state exemptions usually allow you to protect things such as: your qualifying retirement account.

Can a trustee take a personal injury lawsuit?

The trustee can take nonexempt portions of a personal injury lawsuit or claim to pay your creditors in bankruptcy. Learn more.

Do you have to list a lawsuit in bankruptcy?

Listing the Lawsuit in Your Bankruptcy Papers. Even if you can claim the proceeds as exempt, you still must list the personal injury judgment, lawsuit, or claim (if the lawsuit has not been filed as of the date you file for bankruptcy) in your bankruptcy schedules. (To learn more about the bankruptcy schedules, see Completing the Bankruptcy Forms .)

Can you get money from a personal injury lawsuit before filing for bankruptcy?

If you're involved in a personal injury claim or lawsuit that results from an event that happened before you filed for bankruptcy, any money you might receive will be a part of the bankruptcy case—regardless of whether you filed the claim or lawsuit before or after bankruptcy. It's likely that you'll be able to protect (exempt) ...

Common Types of Personal Bankruptcy

When Personal Injury Payouts Are Bankruptcy Assets

- Your personal injury award or settlement counts as an “asset” in your Chapter 7 bankruptcy case when the injury occurred before you filed bankruptcy. It doesn’t matter if you wait to file an injury claim or lawsuit until after the bankruptcy. Your injury payout counts toward the bankruptcy. Compensation for physical injuries that happen after your ...

State and Federal Exemptions For Injury Settlements

- It pays to fully disclose all your assets and debts when filing bankruptcy and to work with an experienced bankruptcy attorney. There are Federal and local laws that may protect some or all of the proceeds of your personal injury case, depending on your unique situation. Exemptions in bankruptcy cases are rules that spare some of your property or assets from being used to satisf…

Get Help to Protect Your Settlement

- Talk to an experienced bankruptcy attorney to help you decide if bankruptcy makes sense for your situation, and what type of bankruptcy may be appropriate. Discuss your potential injury compensationand ask if your settlement will qualify for a bankruptcy exemption. Most personal injury attorneys offer a free consultation to accident victims. During your initial consultation, tell …