Tax on a settlement agreement when you are leaving or have left the job

- Payment for wages owed will be taxed. Because wages due to you are part of your earnings, and not really to do with your leaving, they will be taxed as ...

- Payment for holiday not taken will be taxed. ...

- Compensation is usually tax free. ...

- Compensation for discrimination. ...

Do I have to pay tax on a settlement agreement?

Many people believe that if money is paid under a settlement agreement it must be tax free. However, this not necessarily the case. The key issue is the nature of the payment. Make sure you obtain legal advice about which payments are taxable and which are not. Which payments are taxable and which are not?

Are settlements taxed like income?

Settlements themselves are not taxed because the CRA does not consider a personal injury settlement to be “income.” Your settlement is considered “compensation” for expenses incurred by another person’s negligence. Indeed, personal injury settlements rarely function as any kind of windfall.

Are settlements from lawsuits taxable income?

The general rule of taxability for amounts received from the settlement of lawsuits and other legal remedies is Internal Revenue Code (IRC) Section 61, which states that all income is taxable “unless a specific exception exists from whatever source derived unless exempted by another section of the code.”

Does money paid in a legal settlement get taxed?

The settlement money is taxable in the first place; If your legal settlement represents tax-free proceeds, like for physical injury, then you won't get a 1099: that money isn't taxable. There is one exception for taxable settlements too. If all or part of your settlement was for back wages from a W-2 job, then you wouldn't get a 1099-MISC for that portion.

How can I avoid paying taxes on a settlement?

How to Avoid Paying Taxes on a Lawsuit SettlementPhysical injury or sickness. ... Emotional distress may be taxable. ... Medical expenses. ... Punitive damages are taxable. ... Contingency fees may be taxable. ... Negotiate the amount of the 1099 income before you finalize the settlement. ... Allocate damages to reduce taxes.More items...•

What types of settlements are taxable?

Settlement money and damages collected from a lawsuit are considered income, which means the IRS will generally tax that money. However, personal injury settlements are an exception (most notably: car accident settlements and slip and fall settlements are nontaxable).

How is money from a settlement taxed?

Settlements for automobile and property damages are not taxable, but there are exceptions. Like medical expenses, the IRS and the State of California consider these damages as reimbursement for a car or home previously paid.

Will I get a 1099 for a lawsuit settlement?

You won't receive a 1099 for a legal settlement that represents tax-free proceeds, such as for physical injury. A few exceptions apply for taxed settlements as well. If your settlement included back wages from a W-2 job, you wouldn't get a 1099-MISC for that portion.

Can the IRS take my settlement money?

If you have back taxes, yes—the IRS MIGHT take a portion of your personal injury settlement. If the IRS already has a lien on your personal property, it could potentially take your settlement as payment for your unpaid taxes behind that federal tax lien if you deposit the compensation into your bank account.

How can you avoid paying taxes on a large sum of money?

Research the taxes you might owe to the IRS on any sum you receive as a windfall. You can lower a sizeable amount of your taxable income in a number of different ways. Fund an IRA or an HSA to help lower your annual tax bill. Consider selling your stocks at a loss to lower your tax liability.

Are settlements tax deductible?

Generally, if a claim arises from acts performed by a taxpayer in the ordinary course of its business operations, settlement payments and payments made pursuant to court judgments related to the claim are deductible under section 162.

Is a lump sum payment in a divorce settlement taxable?

Generally, lump-sum divorce settlements are not taxable for the recipient. If the lump-sum payment is an alimony payment, it is not deductible for the person who makes the payment and is not considered income for the recipient.

Is a lump sum payment in a divorce settlement taxable?

Generally, lump-sum divorce settlements are not taxable for the recipient. If the lump-sum payment is an alimony payment, it is not deductible for the person who makes the payment and is not considered income for the recipient.

Do I have to report personal injury settlement to IRS?

The compensation you receive for your physical pain and suffering arising from your physical injuries is not considered to be taxable and does not need to be reported to the IRS or the State of California.

Are class action settlements taxable?

Oftentimes, the nature of a class action suit determines if the lawsuit settlement can be taxable. Lawsuit settlement proceeds are taxable in situations where the lawsuit is not involved with physical harm, discrimination of any kind, loss of income, or devaluation of an investment.

Are settlement payments tax deductible?

This means that, generally, monies paid pursuant to a court order or settlement agreement with a government entity are not deductible. However, the 2017 Tax Cuts and Jobs Act (TCJA) amended § 162(f) to allow deductions for payments for restitution, remediation, or those paid to come into compliance with a law.

Does the IRS tax compensation from a lawsuit?

Let’s start by examining what instances you can expect that the IRS does not tax your compensation from a lawsuit. The primary example where you are free from tax obligations is if your settlement agreement pertained to personal injury and was awarded for observable bodily harm. So, any lawsuit that resulted in conjunction with an instance that left you physically harmed is free from a tax burden.

Do you have to report a settlement as income?

Outside of the observable bodily harm area, most other types of settlement agreements from lawsuits will require you to report the associated funds as taxable income. Settlements stemming from purely emotional distress, improperly lost wages, punitive damages, breach of contract, and other standard lawsuits outside of ones related to physical injury must have their payments all reported as taxable income and appropriately taxed.

Why should settlement agreements be taxed?

Because different types of settlements are taxed differently, your settlement agreement should designate how the proceeds should be taxed—whether as amounts paid as wages, other damages, or attorney fees.

How much is a 1099 settlement?

What You Need to Know. Are Legal Settlements 1099 Reportable? What You Need to Know. In 2019, the average legal settlement was $27.4 million, according to the National Law Review, with 57% of all lawsuits settling for between $5 million and $25 million.

How much money did the IRS settle in 2019?

In 2019, the average legal settlement was $27.4 million, according to the National Law Review, with 57% of all lawsuits settling for between $5 million and $25 million. However, many plaintiffs are surprised after they win or settle a case that their proceeds may be reportable for taxes. The Internal Revenue Service (IRS) simply won't let you collect a large amount of money without sharing that information (and proceeds to a degree) with the agency.

What is compensatory damages?

For example, in a car accident case where you sustained physical injuries, you may receive a settlement for your physical injuries, often called compensatory damages, and you may receive punitive damages if the other party's behavior and actions warrant such an award. Although the compensatory damages are tax-free, ...

What happens if you get paid with contingent fee?

If your attorney or law firm was paid with a contingent fee in pursuing your legal settlement check or performing legal services, you will be treated as receiving the total amount of the proceeds, even if a portion of the settlement is paid to your attorney.

Do you have to pay taxes on a 1099 settlement?

Where many plaintiff's 1099 attorneys now take up to 40% of the settlement in legal fees, the full amount of the settlement may need to be reported to the IRS on your income tax. And in some cases, you'll need to pay taxes on those proceeds as well. Let's look at the reporting and taxability rules regarding legal settlements in more detail as ...

Is money from a lawsuit taxed?

Taxation on settlements primarily depends upon the origin of the claim. The IRS states that the money received in a lawsuit should be taxed as if paid initially to you. For example, if you sue for back wages or lost profits, that money will typically be taxed as ordinary income. If you receive a settlement allocations for bodily personal physical ...

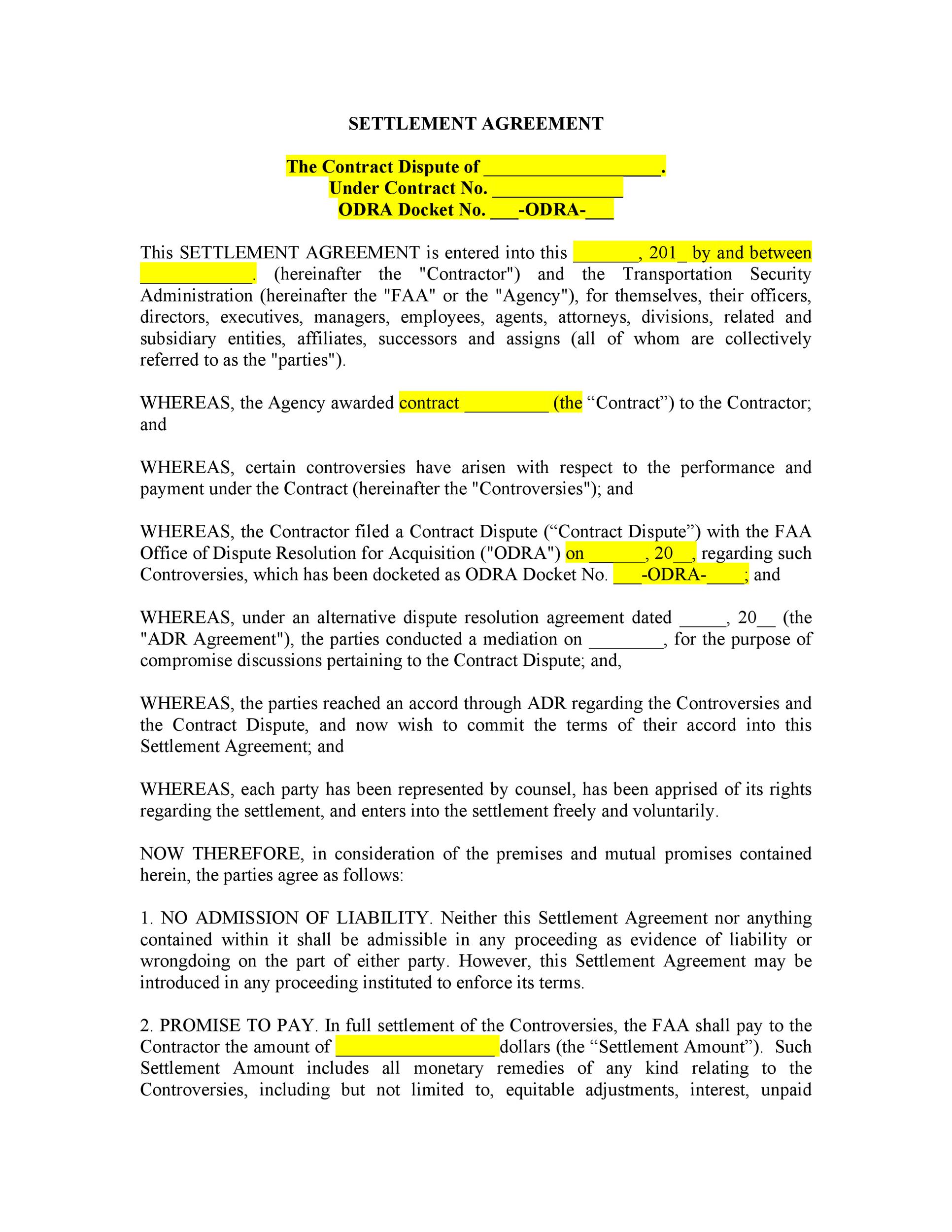

What are Settlement Agreements tax considerations?

Settlement Agreements are legally binding agreements between an employer and an employee, formerly known as a Compromise Agreement. Whether you are an employer letting staff go or an employee about to lose your job, Settlement Agreement advice from a solicitor is essential.

What is a settlement agreement?

Settlement Agreements are legally binding agreements between an employer and an employee, formerly known as a Compromise Agreement. Whether you are an employer letting staff go or an employee about to lose your job, Settlement Agreement advice from a solicitor is essential.

What deductions are made for all payments made for the period up to the point that the contract of employment ends?

All payments made for the period up to the point that the contract of employment ends are subject to deductions of tax and national insurance in the normal way.

What is the OT tax rate?

Your employer now has to deduct tax at the OT tax code rate which may mean making deductions at different rates from 20% to 45% depending on the size of the excess. The OT Code does not include any personal allowances and divides the different tax bands into twelfths.

Does notice pay have to be taxed?

Since April 2018, the Finance Act (2018) has made it clear that notice pay must always be taxed and subject to National Insurance. All Settlement Agreements require you to indemnify your employer on any excess tax which remains unpaid after termination. This means that if there is excess tax, you would have to pay.

Is a pension contribution subject to tax?

Contributions to registered pension scheme. Payments made direct into a pension scheme are treated separately and are not subject to tax. There are annual and lifetime allowances for contributions to registered pension schemes and contributions in excess of these allowances do incur tax charges.

Can a disability payment be made free of tax?

Payment on account of a Disability or Injury. A payment can be made free of tax where it is on account of a disability or injury (and also death). The payment must relate to the fact of the injury or disability and not any consequential effect on earnings.

What is the tax consequences of a settlement?

Takeaway. The receipt or payment of amounts as a result of a settlement or judgment has tax consequences. The taxability, deductibility, and character of the payments generally depend on the origin of the claim and the identity of the responsible or harmed party, as reflected in the litigation documents. Certain deduction disallowances may apply.

How is proper tax treatment determined?

In general, the proper tax treatment of a recovery or payment from a settlement or judgment is determined by the origin of the claim. In applying the origin-of-the-claimtest, some courts have asked the question "In lieu of what were the damages awarded?" to determine the proper characterization (see, e.g., Raytheon Prod. Corp., 144 F.2d 110 (1st Cir. 1944)).

What is the exception to restitution?

The restitution exception applies only if (1) a court order or settlement identifies the payment as restitution/remediation or to come into compliance with law (identification requirement) and (2) the taxpayer establishes that the payment is restitution/remediation or to come into compliance with law ( establishment requirement).

What is the burden of proof for IRS?

The burden of proof generally is on the taxpayer to establish the proper tax treatment. Types of evidence that may be considered include legal filings, the terms of the settlement agreement, correspondence between the parties, internal memos, press releases, annual reports, and news publications. However, as a general rule, the IRS views the initial complaint as most persuasive (see Rev. Rul. 85-98).

Is a claim for damages deductible?

For example, a claim for damages arising from a personal transaction may be a nondeduct ible personal expense. A payment arising from a business activity may be deductible under Sec. 162, while payments for interest, taxes, or certain losses may be deductible under specific provisions of the Code (e.g., Sec. 163, 164, or 165). Certain payments are nondeductible (as explained further below), and others must be capitalized, such as when the payer obtains an intangible asset or license as a result of asettlement.

Is a settlement taxable income?

For a recipient of a settlement amount, the origin-of-the-claimtest determines whether the payment is taxable or nontaxable and, if taxable, whether ordinary or capital gain treatment is appropriate. In general, damages received as a result of a settlement or judgment are taxable to the recipient. However, certain damages may be excludable from income if they represent, for example, gifts or inheritances, payment for personal physical injuries, certain disaster relief payments, amounts for which the taxpayer previously received no tax benefit, cost reimbursements, recovery of capital, or purchase price adjustments. Damages generally are taxable as ordinary income if the payment relates to a claim for lost profits, but they may be characterized as capital gain (to the extent the damages exceed basis) if the underlying claim is for damage to a capitalasset.

Is a settlement deductible?

For both the payer and the recipient, the terms of a settlement or judgment may affect whether a payment is deductible or nondeductible, taxable or nontax able, and its character (i.e., capital or ordinary). In general, the taxpayer has the burden of proof for the tax treatment and characterization of a litigation payment, ...

What is settlement payment?

Settlement Agreement Payments. Payments made in a Settlement Agreement are usually made up of a lump sum and any other payments related to your employment contract. The lump sum is usually known as an ex gratia or termination payment. Other payments related to your employment contract will include things like: ...

Who to get advice on a settlement agreement?

You must get specialist legal advice from an Employment Law Solicitor or independent legal advisor as part of any Settlement Agreement. We can help to make sure that the correct tax treatment is applied to your Settlement Agreement. This reduces the risk of HMRC needing to recover tax from you later and offers you peace of mind.

What is contractual pay?

Contractual payments include holiday pay or payment in lieu of your notice period. Many employers will prefer to pay your notice period rather than ask you to work it, so this would be taxed at your normal rate.

Does HMRC tax termination payments?

We should point out that ultimate decision on taxation of termination payments rests with HMRC. Our advice doesn’t serve as a guarantee that your termination payments will or won’t attract tax. Settlement Agreements will commonly contain an indemnity clause. This means that your employer can recover tax or national insurance contributions from you at a later date if there is any further tax due under your Settlement Agreement.

Can you take your employer to a tribunal?

You or your employer can request a Settlement Agreement, but you should be aware that if you agree to a Settlement Agreement, you typically waive your rights to take your employer to an Employment Tribunal. Your Employment Law Solicitor will review your Settlement Agreement and go through the terms with you.

Is a settlement agreement taxable?

If you’re offered a Settlement Agreement by your employer, it’s usually made up of different payments. Some of these payments will be treated as being taxable and others may be paid as a tax-free amount by your employer. The first £30,000 of a termination payment is generally treated as being tax-free as long as no contractual payments are included ...

Do you need to get legal advice before signing a settlement agreement?

You must get independent legal advice before signing a Settlement Agreement. It is common for employers to contribute to your legal costs to cover any advice given by your legal adviser.