Here are some commonly encountered situations and their taxability: Age Discrimination: Tax law doesn’t consider back pay or liquidated damages received under the Age Discrimination in Employment Act (ADEA

Age Discrimination in Employment Act of 1967

The Age Discrimination in Employment Act of 1967 is a US labor law that forbids employment discrimination against anyone at least 40 years of age in the United States. In 1967, the bill was signed into law by President Lyndon B. Johnson. The ADEA prevents age discrimination and provides equal employment opportunity under conditions that were not explicitly covered in Title VII of the Civil Rig…

Will I have to pay tax on my settlement?

You will have to pay your attorney’s fees and any court costs in most cases, on top of using the settlement to pay for your medical bills, lost wages, and other damages. Finding out you also have to pay taxes on your settlement could really make the glow of victory dim. Luckily, personal injury settlements are largely tax-free.

What damages are awarded in age discrimination cases?

The California woman who sued who employer for age discrimination was awarded $3 million in compensatory damages. Compensatory damages are used to help victims cope with any injuries that were caused by the employer’s discriminatory behavior.

Is the money received under a discrimination lawsuit taxable?

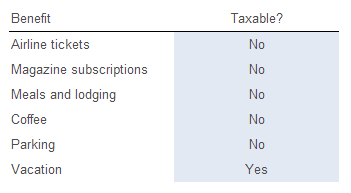

Proceeds from a settlement involving an employment-related discrimination case may be taxable to the employee under some circumstances and not taxable in others. Non-taxable settlement amounts: Medical expenses associated with medical distress; Emotional distress, pain or suffering resulting from a physical injury; Personal injury or sickness; and

Will my settlement be taxable?

Taxation on settlements primarily depends upon the origin of the claim. The IRS states that the money received in a lawsuit should be taxed as if paid initially to you. For example, if you sue for back wages or lost profits, that money will typically be taxed as ordinary income.

Are proceeds from age discrimination lawsuit taxable?

Earlier this year the United States Supreme Court gave the final word, holding that amounts received to settle an age discrimination case are taxable.

What type of settlement is not taxable?

personal injury settlementsSettlement money and damages collected from a lawsuit are considered income, which means the IRS will generally tax that money. However, personal injury settlements are an exception (most notably: car accident settlements and slip and fall settlements are nontaxable).

Are damages for discrimination taxable?

Damages received for non-physical injury such as emotional distress, defamation and humiliation, although generally includable in gross income, are not subject to Federal employment taxes.

How can I avoid paying taxes on a settlement?

Spread payments over time to avoid higher taxes: Receiving a large taxable settlement can bump your income into higher tax brackets. By spreading your settlement payments over multiple years, you can reduce the income that is subject to the highest tax rates.

Can the IRS take my settlement money?

If you have back taxes, yes—the IRS MIGHT take a portion of your personal injury settlement. If the IRS already has a lien on your personal property, it could potentially take your settlement as payment for your unpaid taxes behind that federal tax lien if you deposit the compensation into your bank account.

Will I get a 1099 for a lawsuit settlement?

If your legal settlement represents tax-free proceeds, like for physical injury, then you won't get a 1099: that money isn't taxable. There is one exception for taxable settlements too. If all or part of your settlement was for back wages from a W-2 job, then you wouldn't get a 1099-MISC for that portion.

Are settlements tax deductible?

Generally, if a claim arises from acts performed by a taxpayer in the ordinary course of its business operations, settlement payments and payments made pursuant to court judgments related to the claim are deductible under section 162.

Are retaliation settlements taxable?

In an employment discrimination, harassment or retaliation context, this means that a plaintiff's recovered damages, whether through settlement or judgment, may be non-taxable if those damages resulted from physical injury or physical sickness, or if they resulted from emotional distress that was caused by or ...

Where do you report settlement income on 1040?

Attach to your return a statement showing the entire settlement amount less related medical costs not previously deducted and medical costs deducted for which there was no tax benefit. The net taxable amount should be reported as “Other Income” on line 8z of Form 1040, Schedule 1.

What do I do if I have a large settlement?

Here is a list of steps to take once you receive a settlement.Take a Deep Breath and Wait. ... Understand and Address the Tax Implications. ... Create a Plan. ... Take Care of Your Financial Musts. ... Consider Income-Producing Assets. ... Pay Off Debts. ... Life Insurance. ... Education.More items...

What is the tax rate for lawsuit settlements?

In most cases, if you are the plaintiff and you hire a contingent fee lawyer, you'll be taxed as receiving 100% of the money recovered by you and your attorney, even if the defendant pays your lawyer directly his contingent fee cut. It shouldn't cause any tax problems if your case is fully nontaxable.

How can you avoid paying taxes on a large sum of money?

6 ways to cut your income taxes after a windfallCreate a pension. Don't be discouraged by the paltry IRA or 401(k) contribution limits. ... Create a captive insurance company. ... Use a charitable limited liability company. ... Use a charitable lead annuity trust. ... Take advantage of tax benefits to farmers. ... Buy commercial property.

Are class action settlements taxable?

Oftentimes, the nature of a class action suit determines if the lawsuit settlement can be taxable. Lawsuit settlement proceeds are taxable in situations where the lawsuit is not involved with physical harm, discrimination of any kind, loss of income, or devaluation of an investment.

Is the roundup settlement taxable?

Do You Have to Pay Taxes on Roundup Settlement Checks? No. With a few exceptions, settlements in personal injury lawsuits are not taxable as income. So you do not pay taxes on your Roundup settlement check.

Is a lump sum payment in a divorce settlement taxable?

Generally, lump-sum divorce settlements are not taxable for the recipient. If the lump-sum payment is an alimony payment, it is not deductible for the person who makes the payment and is not considered income for the recipient.

Do I have to report personal injury settlement to IRS?

The compensation you receive for your physical pain and suffering arising from your physical injuries is not considered to be taxable and does not need to be reported to the IRS or the State of California.

What is the tax rule for settlements?

Tax Implications of Settlements and Judgments. The general rule of taxability for amounts received from settlement of lawsuits and other legal remedies is Internal Revenue Code (IRC) Section 61 that states all income is taxable from whatever source derived, unless exempted by another section of the code. IRC Section 104 provides an exclusion ...

What is employment related lawsuit?

Employment-related lawsuits may arise from wrongful discharge or failure to honor contract obligations. Damages received to compensate for economic loss, for example lost wages, business income and benefits, are not excludable form gross income unless a personal physical injury caused such loss.

What is the exception to gross income?

For damages, the two most common exceptions are amounts paid for certain discrimination claims and amounts paid on account of physical injury.

Is emotional distress excludable from gross income?

96-65 - Under current Section 104 (a) (2) of the Code, back pay and damages for emotional distress received to satisfy a claim for disparate treatment employment discrimination under Title VII of the 1964 Civil Rights Act are not excludable from gross income . Under former Section 104 (a) (2), back pay received to satisfy such a claim was not excludable from gross income, but damages received for emotional distress are excludable. Rev. Rul. 72-342, 84-92, and 93-88 obsoleted. Notice 95-45 superseded. Rev. Proc. 96-3 modified.

Is a settlement agreement taxable?

In some cases, a tax provision in the settlement agreement characterizing the payment can result in their exclusion from taxable income. The IRS is reluctant to override the intent of the parties. If the settlement agreement is silent as to whether the damages are taxable, the IRS will look to the intent of the payor to characterize the payments and determine the Form 1099 reporting requirements.

Is mental distress a gross income?

As a result of the amendment in 1996, mental and emotional distress arising from non-physical injuries are only excludible from gross income under IRC Section104 (a) (2) only if received on account of physical injury or physical sickness. Punitive damages are not excludable from gross income, with one exception.

Is emotional distress taxable?

Damages received for non-physical injury such as emotional distress, defamation and humiliation, although generally includable in gross income, are not subject to Federal employment taxes. Emotional distress recovery must be on account of (attributed to) personal physical injuries or sickness unless the amount is for reimbursement ...

Is a settlement for discrimination taxable?

Are Discrimination Settlements Taxable? If you have ever sued a person and received a settlement for your physical or mental pain, you may wonder: Are settlements taxable? The answer would be yes or no, depending on the nature of the settlement.

Is a settlement for lost wages taxable?

Settlements are typically divided into various portions. For example, a portion of your settlement may be for lost wages. A portion may be for mental anguish. There may be amounts allotted for other damages you suffered. The portion of your settlement that you received for lost wages would be considered taxable. Lost wages could include back pay, front pay and severance pay. These amounts would be subject to Social Security and Medicare tax rates. You would also be responsible for employment taxes and you would have to report it as income on Form 1040 on your tax return.

Is a physical injury taxable?

According to the Publication 4345 from the IRS, settlements for physical injuries would be deemed non-taxable if you did not itemize deductions for medical expenses associated with the injury. For employment-related lawsuits, such as those involving discrimination, the tax laws are a little different. Physical injuries or sickness are tax free. Damages awarded for emotional injuries are not tax free. The exception to this is if the emotional issues were triggered or caused by a physical injury or sickness.

What is non taxable settlement?

Non-taxable settlement amounts: Medical expenses associated with medical distress; Emotional distress, pain or suffering resulting from a physical injury; Personal injury or sickness; and. Legal costs associated with the case.

How much did the employee receive in the settlement?

In a settlement, the employee agreed to receive $175,000 and the settlement agreement noted that it was for emotional distress and not for wages-likely an attempt to ensure that it would not be taxable.

How long did the employee get fired for an altercation with a supervisor?

She took leave from work while being treated by a therapist to emotionally recover from stress allegedly caused by this altercation. Ten months after the altercation (eight months of which were spent on leave) she was terminated by her employer. In a settlement, the employee agreed to receive $175,000 and the settlement agreement noted that it was for emotional distress and not for wages-likely an attempt to ensure that it would not be taxable.

What is tax attorney?

A tax attorney can assist the parties in crafting a demand, complaint or settlement that may make the difference between an award non-taxable rather than taxable. Although the tax attorney would always prefer to be part of the case from the beginning, if you have already received your settlement or judgment you want to consult with ...

Can you characterize a settlement for tax purposes?

Unfortunately, not everyone involved with an employment discrimination case is familiar with the most desirable settlement characterization for tax purposes, and even if they are, they may not be able to properly characterize the settlement to pass IRS scrutiny.

Is emotional distress a tax deductible injury?

However, the Tax Court held that damages for emotional distress ( even physical symptoms of emotional distress) are not excludable from ordinary income if they were caused by a non-physical injury such as discrimination.

What is age discrimination tax?

Taxation of Age Discrimination Awards. The law permits individuals to exclude from gross income only those damages which are received on account of a personal physical injury or a physical sickness. Thus, when a law suit is based on a physical injury or sickness, then all damages (other than punitive damages) flowing from ...

Is attorney fees deductible on taxes?

To a limited extent, attorney fees (whether contingent or non-contingent) or court costs paid by, or on behalf of, the taxpayer in connection with an action involving a claim under ADEA, are deductible from gross income to determine adjusted gross income (AGI). Specifically, the amount of this above-the-line deduction is limited to the amount includible in your gross income for the tax year on account of a judgment or settlement resulting from the ADEA claim, whether by suit or agreement, and whether as lump sum or periodic payments. Attorneys fees in excess of the amount includible in your gross income for the tax year may be deductible as a below-the-line, or “miscella neous itemized” deduction. Thus, these excess fees are deductible only to the extent that they, together with your other miscellaneous itemized deductions, exceed 2% of your adjusted gross income.

How old do you have to be to file a lawsuit for age discrimination?

The existing Federal law protects employees above 40 years of age from age discrimination settlements.

What is settlement in employment?

A settlement is one way of compensation the employee. But more than that, it saves the company time, trouble and costs. Above all, a settlement helps a company save face and this is especially true of they have been at fault. In most cases, the penalties for violating the ADEA can be very severe. If the victim is successful in his/her claim, they may receive the following: 1 Back pay- The damages will be based on the plaintiff’s earnings & the duration of time that they have been out of work 2 Hiring 3 Reinstatement 4 Promotion 5 Front pay

How to contact the EEOC for mediation?

The EEOC always encourages the concerned parties to engage in some alternative dispute resolution via mediation. Call NOW toll free at (800) 738-3353 for a FREE CONSULTATION with NO RECOVERY – NO FEE (No Up-front Costs, Fees or Charges) if you feel like your rights may have been violated. Contact via email.

What is settlement in compensation?

A settlement is one way of compensation the employee. But more than that, it saves the company time, trouble and costs. Above all, a settlement helps a company save face and this is especially true of they have been at fault. In most cases, the penalties for violating the ADEA can be very severe.

What are the forms of age discrimination?

This discrimination can take a number forms such as: Job advertisements. Promotion. Interviewing. Hiring. Compensation. Job evaluations, Job discipline.

Does age discriminate in hiring?

The law prohibits the employer from effectively discriminating based on age in hiring, promotion, firing, benefit, layoff, training, and compensation & job assignment decisions. All of this holds true unless age is actually a genuine qualification for that particular position.

Is it illegal to discriminate against employees?

The Regulation. Via this law, it is illegal to discriminate against these employees in various matters of employment. It is illegal for the concerned employer to also retaliate against the individual who is pursuing any claims of age discrimination Settlements against the employer.

IRC Section and Treas. Regulation

- IRC Section 61explains that all amounts from any source are included in gross income unless a specific exception exists. For damages, the two most common exceptions are amounts paid for certain discrimination claims and amounts paid on account of physical injury. IRC Section 104explains that gross income does not include damages received on account of personal phys…

Resources

- CC PMTA 2009-035 – October 22, 2008PDFIncome and Employment Tax Consequences and Proper Reporting of Employment-Related Judgments and Settlements Publication 4345, Settlements – TaxabilityPDFThis publication will be used to educate taxpayers of tax implications when they receive a settlement check (award) from a class action lawsuit. Rev. Rul. 85-97 - The …

Analysis

- Awards and settlements can be divided into two distinct groups to determine whether the payments are taxable or non-taxable. The first group includes claims relating to physical injuries, and the second group is for claims relating to non-physical injuries. Within these two groups, the claims usually fall into three categories: 1. Actual damages re...

Issue Indicators Or Audit Tips

- Research public sources that would indicate that the taxpayer has been party to suits or claims. Interview the taxpayer to determine whether the taxpayer provided any type of settlement payment to any of their employees (past or present).