Any settlements or rewards that you receive that do not cover actual damages are taxable. That is why they need the W9. The income is considered other income and you can expense any attorney's fees or stuff like that up to the amount you received from the court or settlement.

Do I need to file a W9 for a settlement?

Part of the settlement may be taxable and the employer will have to report the payment to the IRS on a 1099. They need to request the W-9 to be able to fill in the 1099. Information provided in this forum is for generalized discussion proposes and should not be...

Why do I need a W-9 form?

Use Form W-9 to provide your correct Taxpayer Identification Number (TIN) to the person who is required to file an information return with the IRS to report, for example: Income paid to you.

Do I need to file a W-2 for a settlement check?

When the settlement is being paid by a liability insurance company, which is typical, no Form W-2 will be issued because the plaintiff doesn’t work for the insurance company – only a Form 1099 will be issued. If a Form 1099 (Box 7) is chosen, the defendant will issue the settlement check to the plaintiff for the full amount allocated to lost wages.

What happens if a payee refuses to give a W-9?

A payee who provides false or inaccurate information, or refusing to hand over a Form W-9 when requested, is subject to backup withholding on the payments. Thus, when a payer requires a Form W-9, it is usually not worth fighting about providing it, especially if there is already an understanding about which Forms 1099 will be issued.

Is a w9 required for a settlement payment?

W-9 Form Not Required to Enforce Settlement Agreement — New York Business Litigation Lawyer Blog — June 17, 2021.

Do you need a 1099 for settlement payments?

If your legal settlement represents tax-free proceeds, like for physical injury, then you won't get a 1099: that money isn't taxable. There is one exception for taxable settlements too. If all or part of your settlement was for back wages from a W-2 job, then you wouldn't get a 1099-MISC for that portion.

Are legal settlements subject to 1099 reporting?

No, the plaintiff law firm merely pays tax on its fee—40% in this example. The confusion often centers on IRS Form 1099. Generally, amounts paid to a plaintiff's attorney as legal fees are includable in the income of the plaintiff, even if paid directly to the plaintiff's attorney by the defendant.

Is a W-9 required by law?

By law, you are only obligated to provide a W-9 to parties that intend to pay you interest, dividends, non-employee compensation, or any other type of reportable income. If someone unexpected asks for a W-9, ask them why they need it.

How do I report a legal settlement on my taxes?

If you receive a settlement, the IRS requires the paying party to send you a Form 1099-MISC settlement payment. Box 3 of Form 1099-MISC will show “other income” – in this case, money received from a legal settlement. Generally, all taxable damages are required to be reported in Box 3.

How can I avoid paying taxes on a settlement?

How to Avoid Paying Taxes on a Lawsuit SettlementPhysical injury or sickness. ... Emotional distress may be taxable. ... Medical expenses. ... Punitive damages are taxable. ... Contingency fees may be taxable. ... Negotiate the amount of the 1099 income before you finalize the settlement. ... Allocate damages to reduce taxes.More items...•

What type of legal settlements are not taxable?

Settlement money and damages collected from a lawsuit are considered income, which means the IRS will generally tax that money. However, personal injury settlements are an exception (most notably: car accident settlements and slip and fall settlements are nontaxable).

Do you pay tax on a settlement agreement?

Usually a settlement agreement will say that you will be paid as normal up to the termination date. These wages are due to you as part of your earnings and so they will be taxed in the normal way.

Are Settlements tax deductible?

Generally, if a claim arises from acts performed by a taxpayer in the ordinary course of its business operations, settlement payments and payments made pursuant to court judgments related to the claim are deductible under section 162.

Who is exempt from providing a W9?

To qualify as exempt for W-9 purposes, the payee must be one of the following: Any IRA, an organization exempt from tax per section 501(a), or a custodial account per section 403(b)(7) if said account meets the criteria of section 401(f)(2) Corporation. Financial institution.

What if someone won't give you a W9?

Failure to Provide W-9 – If a vendor or contractor refuses to provide a W-9 when its requested the Payee is subject to a penalty of $50 for each such failure.

Can I refuse to fill out a W9?

Can I refuse to fill out the W-9? Yes, you can refuse a request to fill out the W-9 but only if you are suspicious as to why a business has made the request. Be wary of filling out the W-9 if the business does not have a legitimate reason to ask you to fill it out.

Is a settlement payment taxable?

Settlement money and damages collected from a lawsuit are considered income, which means the IRS will generally tax that money. However, personal injury settlements are an exception (most notably: car accident settlements and slip and fall settlements are nontaxable).

Is a class action settlement taxable income?

Oftentimes, the nature of a class action suit determines if the lawsuit settlement can be taxable. Lawsuit settlement proceeds are taxable in situations where the lawsuit is not involved with physical harm, discrimination of any kind, loss of income, or devaluation of an investment.

Are property damage settlements 1099 reportable?

Although tax provisions are not controlling, the IRS is generally reluctant to override the intent of the parties. Accordingly, any settlement payments made expressly for nontaxable damages are excluded from the 1099 reporting requirements.

Is a lump sum payment in a divorce settlement taxable?

Generally, lump-sum divorce settlements are not taxable for the recipient. If the lump-sum payment is an alimony payment, it is not deductible for the person who makes the payment and is not considered income for the recipient.

What is a W-9?

A W-9 is used by an employer to track payroll payments. It would not affect the amount you receive or the manner in which you report the settlement on your taxes. Feel free to confirm that with an accountant.

Do you have to file a 1099 for a settlement?

No, that's normal. Part of the settlement may be taxable and the employer will have to report the payment to the IRS on a 1099. They need to request the W-9 to be able to fill in the 1099.

What happens if you don't agree to a W-9?

Usually, if they don’t agree the money simply will not be paid, or the payor will withhold 24% and send it to the IRS. Still, the Form W-9 may make you uneasy.

What is a W-9?

A Form W-9 verifies your taxpayer ID number, typically your Social Security Number, or if you are a company, your employer identification number. If you want to be paid, refusing to hand over a W-9 may not make sense. The IRS says that anytime a payor thinks they may have to report a payment on an IRS Form 1099, they should ask for a Form W-9.

What is a 1099 on a tax return?

Forms 1099 allow computer matching of Social Security numbers and dollar amounts paid and received, so IRS collection efforts are streamlined. Failing to report a Form 1099 on your tax return (or at least explain it) triggers an IRS notice asking you to explain or pay up . Thus, if you receive a Form 1099, report it, ...

What to report if you receive a 1099?

Thus, if you receive a Form 1099, report it, even if you are claiming that the money should be tax free. Form W-9, Request for Taxpayer Identification Number and Certification. Say that a lawyer settles a case for $1 million, with payment to the lawyer’s trust account. Assume that 60 percent is for the client, and 40 percent is for the lawyer.

Does a lawyer receive a 1099?

The lawyer is sure to receive a Form 1099 reporting the full $1 million as gross proceed s. The lawyer can report as income the $400,000 fee without worrying about computer matching, since gross proceeds do not count as income. The client isn’t so lucky.

Can you file a lawsuit for 1099?

Recipients may not like this, and lawsuits for issuing Forms 1099 are filed on occasion. Most such suits don’t seem to go very far, perhaps precisely because it is often possible to justify whatever was issued. So, while you probably will have to provide an IRS Form W-9 to get paid if that form is requested, try to head off Form 1099 issues ...

Is a W-9 worth fighting about?

Thus, when a payer requires a Form W-9, it is usually not worth fighting about providing it , especially if there is already an understanding about which Forms 1099 will be issued. Disputes about Forms 1099 are common. The Form 1099 regulations are complex, which causes many businesses to err on the side of issuing the forms.

Why Am I Being Asked to Complete a Form W-9?

If you do consulting or gig work for a business without being on its payroll, you will likely be asked to complete a W-9.

What Information is on Form W-9?

The first line is your name as shown on your tax return. If you are an individual and report your income from the contract work on Schedule C, Profit or Loss from Business, this line is straightforward. If you are a sole proprietor or single-member limited liability company (LLC), you should enter your own name on line 1 as well. Partnerships, multiple-member LLCs, C corporations, and S corporations should enter the entity's name as shown on the entity's tax return.

What is the Difference Between a W-9 and a W-4?

Independent contractors fill out a Form W-9. However, if you are an employee of the business, you should fill out Form W-4, Employee's Withholding Certificate, instead. Businesses withhold federal and state income taxes, Social Security taxes, and Medicare taxes for their employees and pay the taxes on their behalf.

What is the purpose of a W-9?

The taxpayer information on a W-9 is used by a business to report to the IRS on payments made to independent contractors and other vendors. Should you be filling out a W-9 or W-4? It depends on whether you're an independent contractor or an employee.

What is a W-9?

Businesses use Form W-9, Request for Taxpayer Identification Number and Certification, to gather information about independent contractors and other vendors. The independent contractor or vendor must fill out the W-9 and submit it to the business that pays them.

What form do you get when you are an independent contractor?

If you are an independent contractor, you will receive Form 1099-NEC from the business that pays you.

What is line 5 on a 1099?

Line 5 is for your address. Enter your number, street, and apartment or suite number. Line 6 is your city, state, and zip code. This is where your 1099-NEC or 1099-MISC will be mailed. You will need to add this information to your tax return when you file your taxes.

How are settlements taxed?

Settlements and judgments are taxed according to the origin of the claim – the nature of the damages for which the plaintiff was suing. If the lawsuit is against competing businesses for lost profits, a settlement will constitute lost profits, taxed as ordinary income. If a person is laid off at work and sues for discrimination seeking wages, the recovery will be taxed as wages. A lawsuit by a condo owner against a negligent building contractor, however, typically won’t be taxed as income. Instead, the recovery will be treated as a reduction in the owner’s purchase price of the condo. These rules are full of exceptions and nuances that are beyond the pay grade of a humble subrogation attorney. In general, however:

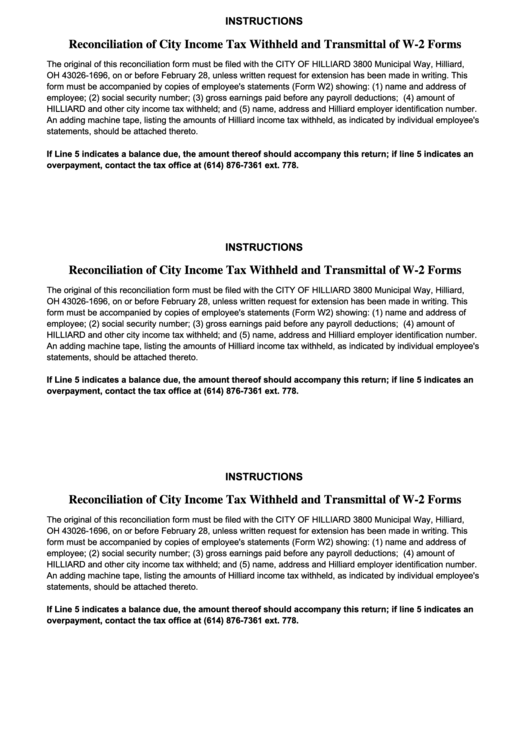

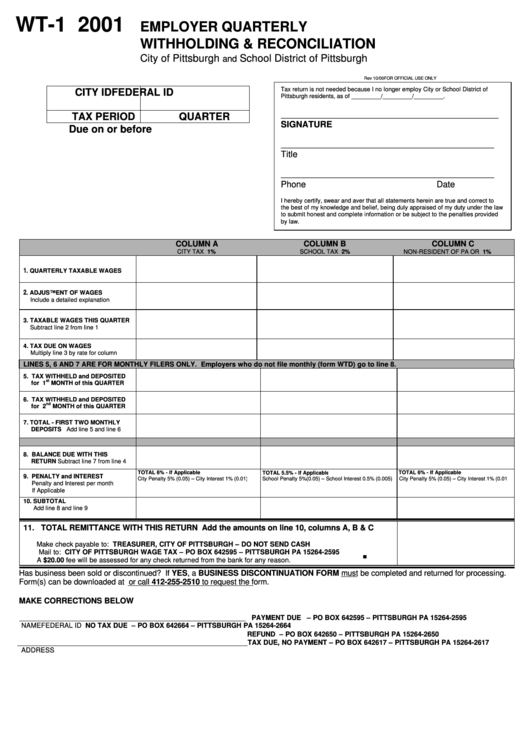

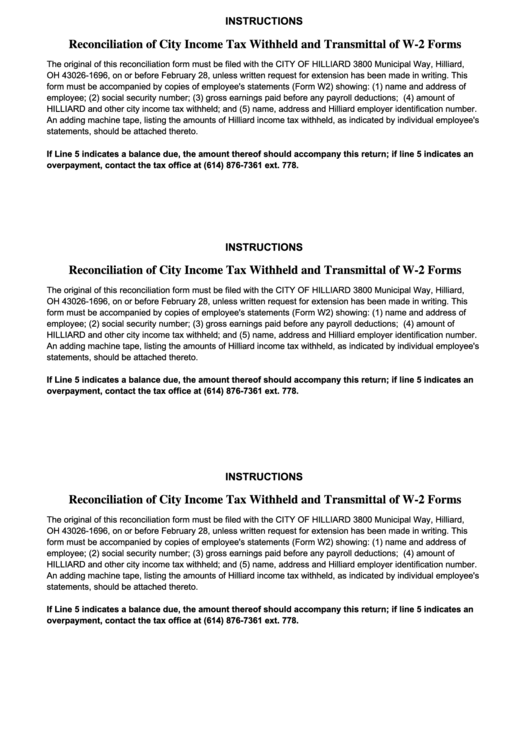

What forms do you need to file a settlement?

There are two ways for a party settling a lawsuit to report the settlement to the I.R.S. – Form W-2 and Form 1099-MISC. The Form W-2 is issued by a defendant employer in an employment claim for any portion of the settlement which is paid as compensation for wages. The employer treats it like a payroll check, withholding applicable taxes, Social Security, and Medicare (Federal Insurance Contributions Act (“FICA”) taxes). I.R.C. § 6051. The defendant employer will also have to remit the matching taxes, representing 7.65%. The plaintiff will, therefore, receive a payment less than the portion of settlement allocated to the withholdings on the lost wages. Any other non-wage damages paid as part of the settlement are reported by the employer on a Form 1099-MISC.

What is a subrogation settlement?

A typical subrogation settlement could involve a lawyer hired by a subrogation vendor to collect an auto collision subrogation claim along with the deductible paid by the insured of the vendor’s client, a national auto insurance company . The lawyer eventually settles the subrogation suit with the liability carrier for the negligent tortfeasor. The vendor requests that the settlement check be issued in its name. Defense counsel sends the subrogation lawyer a proposed release along with instructions to provide a Form W-9 for the vendor. The vendor refuses to forward a Form W-9, arguing that out of the settlement funds the deductible will be reimbursed to the insured, attorneys’ fees will be paid to the lawyer, a small portion will be retained by the vendor as a fee, and the balance will be paid to the subrogated insurer. The settlement stalls and everybody admits they are confused over what should happen – and why.

When are 1099s due?

A Form 1099is generally issued in January of the year after payment. They must be sent to the taxpayer by the end of January. The I.R.S. copies of the forms are not due at the I.R.S. until the end of February. However, beginning in 2017, the due date for Forms 1099-MISC, which report non-employee compensation in Box 7, has been changed to January 31. Because the I.R.S. will not criticize anyone for issuing more Form 1099s than necessary, it is becoming common for parties to issue Form 1099s even where they are not strictly necessary. However, failure to file a Form 1099 can be used by the I.R.S. as evidence that the party being paid was, in fact, an employee of the payor, leading to all sorts of other problems that should be avoided at all costs.

When is a 1099 required?

The liability carrier is required to issue a Form 1099 only if the underlying claim is taxable to the payee. If the underlying claim is taxable, the carrier must issue a Form 1099.

Where is subrogation payment reported on 1099?

If a subrogated insurance company receives a settlement from another insurance company, reimbursing them for a claim previously paid to an insured, this subrogation payment would be reportable to the other insurance company in Box 3 of the 1099 form, provided the other company is not a corporation.

What is a W-2?

The Form W-2 is issued by a defendant employer in an employment claim for any portion of the settlement which is paid as compensation for wages. The employer treats it like a payroll check, withholding applicable taxes, Social Security, and Medicare (Federal Insurance Contributions Act (“FICA”) taxes). I.R.C. § 6051.

What is the tax rule for settlements?

Tax Implications of Settlements and Judgments. The general rule of taxability for amounts received from settlement of lawsuits and other legal remedies is Internal Revenue Code (IRC) Section 61 that states all income is taxable from whatever source derived, unless exempted by another section of the code. IRC Section 104 provides an exclusion ...

What is the exception to gross income?

For damages, the two most common exceptions are amounts paid for certain discrimination claims and amounts paid on account of physical injury.

What is the purpose of IRC 104?

IRC Section 104 provides an exclusion from taxable income with respect to lawsuits, settlements and awards. However, the facts and circumstances surrounding each settlement payment must be considered to determine the purpose for which the money was received because not all amounts received from a settlement are exempt from taxes.

What is employment related lawsuit?

Employment-related lawsuits may arise from wrongful discharge or failure to honor contract obligations. Damages received to compensate for economic loss, for example lost wages, business income and benefits, are not excludable form gross income unless a personal physical injury caused such loss.

What is a 1.104-1 C?

Section 1.104-1 (c) defines damages received on account of personal physical injuries or physical sickness to mean an amount received (other than workers' compensation) through prosecution of a legal suit or action, or through a settlement agreement entered into in lieu of prosecution.

Is a settlement agreement taxable?

In some cases, a tax provision in the settlement agreement characterizing the payment can result in their exclusion from taxable income. The IRS is reluctant to override the intent of the parties. If the settlement agreement is silent as to whether the damages are taxable, the IRS will look to the intent of the payor to characterize the payments and determine the Form 1099 reporting requirements.

Is mental distress a gross income?

As a result of the amendment in 1996, mental and emotional distress arising from non-physical injuries are only excludible from gross income under IRC Section104 (a) (2) only if received on account of physical injury or physical sickness. Punitive damages are not excludable from gross income, with one exception.

Why do insurance companies need to file W-9?

The technical reason is that insurance companies report claims payments to the IRS as an expense and are required to keep records of people to whom they make payments. A W-9 is a convenient and consistent way for an insurance company (or any kind of business) to keep those records. The requirement for a W-9 is legal and enforceable under IRS rules.

Is a W-9 enforceable?

The requirement for a W-9 is legal and enforceable under IRS rules. The non-technical reason is that the insurance company has no obligation to you and if you don't fill out the form you don't get the money. You don't pay tax on the money, so filling out the form shouldn't be such a big deal.

When do you have to send 1099 to IRS?

They will have to send you a 1099 at the end of the year.

Is a W9 taxable?

Any settlements or rewards that you receive that do not cover actual damages are taxable. That is why they need the W9. The income is considered other income and you can expense any attorney's fees or stuff like that up to the amount you received from the court or settlement. Link to post. Share on other sites.

Do you need a tax ID number to file taxes?

It does not matter - current IRS regulations require them to obtain a tax ID number.

Does the agreement say whether this is for actual damages or not?

the agreement does not say whether this is for actual damages or not

Is a judgment taxable?

If memory serves, judgments are not taxable, but settlements are.

Is the settlement agreement enforceable?

The terms of the settlement agreement are enforceable. There is a post in the archives regarding a defendant whom had a settlement check coming and was being withheld. He filed a seizure order of some kind and the sheriff showed up at the attorneys office with intent of confiscating properties (Laser Printers, Servers, Computers) to be auctioned off to comply with the court order to play the defendant. The check was immediately paid on the spot precluding seizure and auction. I checked on the bond for that and it was about $600.00 in Oregon. That might be collectible also?????

Is a medical settlement taxable?

If you don't send the W-9 they have all your SSAC information anyway and will just send you a 1099 Misc and report it to the IRS. Either way it will get reported so what's the difference. Medical settlements are non-taxable, so maybe you can call it an emotional stress settlement when you file your Itemized 1040 and/or if you have enough deductions probably won't be much taxes on 2000.00 anyway.