What is an Alta/Closing Disclosure/HUD-1 statement?

ALTA Settlement Statements are used in conjunction with the HUD-1 settlement statement. Under the new CFPB regulations, most real estate transactions require the use of the new Closing Disclosure Form. However, the HUD-1 settlement statement is still used in certain cases such as: Home equity revolving lines of credit.

What is an affidavit of title and Alta statement?

c. American Land Title Association (ALTA) Statement. Not unlike the Affidavit of Title, the ALTA statement contains representations regarding the status of the property’s title (e.g., the lack of easements and other encumbrances, the lack of any other claims to possession or lien on the property).

What is a HUD-1 Settlement Statement?

The HUD-1 Settlement Statement is a standardized mortgage lending form in use in the United States of America on which creditors or their closing agents itemize all charges imposed on buyers and sellers in consumer credit mortgage transactions.

What is an ALTA mortgage?

- Documentation: The most common characteristic of an Alt-A loan is a lack of documentation verifying a borrower’s income, assets, or employment.

- Credit score: Alt-A mortgage loan borrowers have clean, but not perfect, credit histories. ...

- Debt-to-income ratio: Lenders allow for higher debt-to-income ratios in Alt-A mortgage loans.

Is an Alta the same as a closing statement?

Unlike the Closing Disclosure that is meant to show the closing costs exclusively to the borrower (buyer), the ALTA statement is like a receipt given to agents and brokers on both sides of the transaction.

What is the difference between a closing disclosure and a settlement statement?

While closing disclosures provide information about a borrower's loan, settlement statements do not include loan information. Settlement statements are used for commercial transactions and cash closings.

Are HUD statements still used?

The HUD-1 Settlement Statement is a standard government real estate form that was once used by settlement agents, also called "closing agents," to itemize all charges imposed upon a borrower and seller for a real estate transaction. The statement is no longer used, with one exception: reverse mortgages.

Which disclosures are required by respa for Trid loans?

What Disclosures Does TRID Require? When you're looking for a mortgage, TRID guidelines dictate that your mortgage lender must provide you with two unique disclosures: the Loan Estimate and the Closing Disclosure.

What is the primary purpose of the settlement statement?

A settlement statement provides a breakdown of all the closing costs and credits involved in a real estate transaction or refinance.

What is final settlement statement?

A settlement statement is an itemized list of fees and credits summarizing the finances of an entire real estate transaction.

What is HUD statement called now?

If you applied for a mortgage after October 3, 2015, for most kinds of mortgage loans you receive a form called the Closing Disclosure instead of a HUD-1.

Who provides the HUD settlement statement?

A HUD-1 or HUD-1A Settlement Statement is prepared by a creditor or, more typically, by the settlement agent who conducts the closing on the creditor's behalf.

What replaced the HUD-1 Settlement?

The Closing Disclosure combines and replaces the HUD-1 Settlement Statement and the final Truth-in-Lending (TIL) statement. The form mirrors the information provided on the Loan Estimate.

What are the 6 RESPA triggers?

An application is defined as the submission of six pieces of information: (1) the consumer's name, (2) the consumer's income, (3) the consumer's Social Security number to obtain a credit report (or other unique identifier if the consumer has no Social Security number), (4) the property address, (5) an estimate of the ...

What is the 3 7 3 rule in mortgage?

Timing Requirements – The “3/7/3 Rule” The initial Truth in Lending Statement must be delivered to the consumer within 3 business days of the receipt of the loan application by the lender. The TILA statement is presumed to be delivered to the consumer 3 business days after it is mailed.

Which of the following disclosures are no longer required as per Trid?

No. The TRID Rule does not require disclosure of a closing cost and a related lender credit on the Loan Estimate if the creditor incurs a cost, but will not charge the consumer for that cost (i.e., the creditor will “absorb” the cost).

Is settlement date the same as closing date?

"Settlement date" and "closing date" are synonymous terms referring to the date when a property's seller and buyer meet to finalize the deal. At this time, the deed to the property is transferred from the seller to the buyer and all pertinent paperwork is completed.

Is a closing disclosure the same as clear to close?

A Closing Disclosure is not technically the same as being declared clear to close, but the disclosure typically comes after you have been cleared. After reviewing your Closing Disclosure, you can look forward to a final walkthrough of the home and closing day itself.

Who provides the HUD settlement statement?

A settlement agent, or closing agent, will prepare a HUD-1 settlement statement at the closing of a real estate loan. The final version will explicitly state all costs involved with the real estate loan and to whom the individual charges and fees will be paid to.

When should I receive the HUD-1 Settlement Statement?

In such case, the completed HUD-1 or HUD-1A shall be mailed or delivered to the borrower, seller, and lender (if the lender is not the settlement agent) as soon as practicable after settlement.

Where Can I Download a Sample ALTA Settlement Statement?

You can download a sample ALTA statement by clicking the text link below.

What is an ALTA Statement?

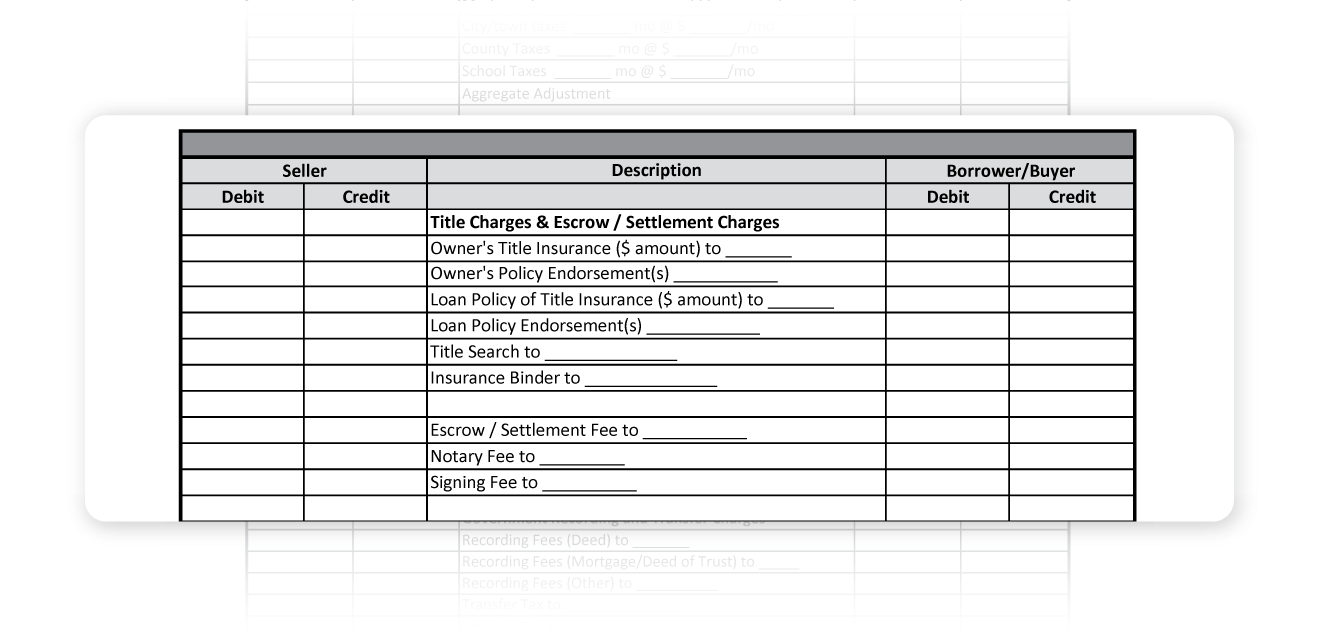

The ALTA settlement statement is an itemized list of all of the fees or charges that the buyer and seller will pay during the settlement portion of a real estate transaction. Everything from the sale price, loan amounts, school taxes and other pertinent information is contained in this document.

What is a settlement statement?

Settlement Statements – This is the version supplied solely to the buyer and contains only information pertinent to the buyers side of the transaction.

What is a HUD-1?

A Hud-1 used to be the primary statement associated with real estate and is used to document all cash transactions and how they affect both parties. It is now outdated. The Closing Disclosure was introduced in 2015 as a document that instead contains this information strictly for the buyer.

Why is a standard form required for title insurance?

Having a standard form for nearly all title insurance policy transactions maintains that all exchanges of land are done smoothly and efficiently.

Is ALTA the same as net sale?

No, an ALTA settlement statement is not the same as the net sale sheet. A net sheet is a document that can be provided throughout the sale process to give the seller an estimate on what they can expect to make. The net sale sheet is not final, and multiple sheets may be provided as offers are made and transactions process. An ALTA settlement statement is provided during the closing of a transaction and contains solid numbers rather than estimates.

Can you have a buyer's statement and seller's statement in ALTA?

But please note that it is possible to have a combined ALTA Buyer’s or Seller’s statement.

How many versions of ALTA Settlement Statement are there?

There are four versions of the ALTA Settlement Statement available:

How to contact ALTA?

Contact ALTA at 202-296-3671 or [email protected].

Why use ALTA settlement statement?

Another benefit of using the ALTA Settlement Statements is the ability to disclose the actual premiums of title insurance charged to the homebuyer or seller during the closing transaction. In the majority of states, the cost of a homebuyer’s title insurance premiums will be inaccurate on the Closing Disclosure form due to a mandatory calculation method imposed by the Bureau in situations where the lender’s and owner’s title insurance policies are simultaneously issued. Many state regulators require settlement agents to disclose the actual costs for each fee the homebuyer is responsible for paying. The ALTA Settlement Statements help settlement agents disclose the accurate costs to homebuyers.

How to contact ALTA?

Contact ALTA at 202-296-3671 or [email protected].

Does Wells Fargo use ALTA?

The ALTA Settlement Statements help settlement agents disclose the accurate costs to homebuyers. Wells Fargo and Bank of America will allow use of the ALTA Settlement Statement.

How many sections are there in an ALTA settlement statement?

There are a total of 11 sections in the ALTA settlement statement. Each of them highlights a particular type of cost associated with closing. Note that the debit and credit sections are listed against the seller and buyer on their respective sides from the second section which is where the costs are highlighted. Let’s go through all the sections.

What is the ALTA statement sheet?

One of the important documents in this pile is the ALTA statement sheet. The ALTA statement gives an itemized list of prices for the closing process. While the HUD-1 settlement statement used to serve this purpose before, it is now outdated.

How many types of ALTA statements are there?

There are 4 types of ALTA statements made according to their unique recipients. These four types of statements are:

Where are miscellaneous costs debited?

Miscellaneous costs are debited from the buyer’s account most of the time. However, a lot of time the sellers may agree to pay apart as well, and the costs are debited from the seller’s side. Here is the list of all miscellaneous costs. Pest Inspection Fee.