Bank of America was asked whether it would require the use of the ALTA model forms, and it stated in a June 9 memo that it prefers the ALTA model if a closing attorney chooses to use a settlement statement to supplement the CD, but specified that the settlement statement figures must reconcile to the CD and a copy of the settlement statement must be provided to the bank.

Full Answer

Is the Alta settlement statement the same as a HUD form?

The Alta Settlement Statement has both the buyer and seller information on it with all credits and charges listed, more like the HUD-1 form.

What is an Alta statement and why do I need one?

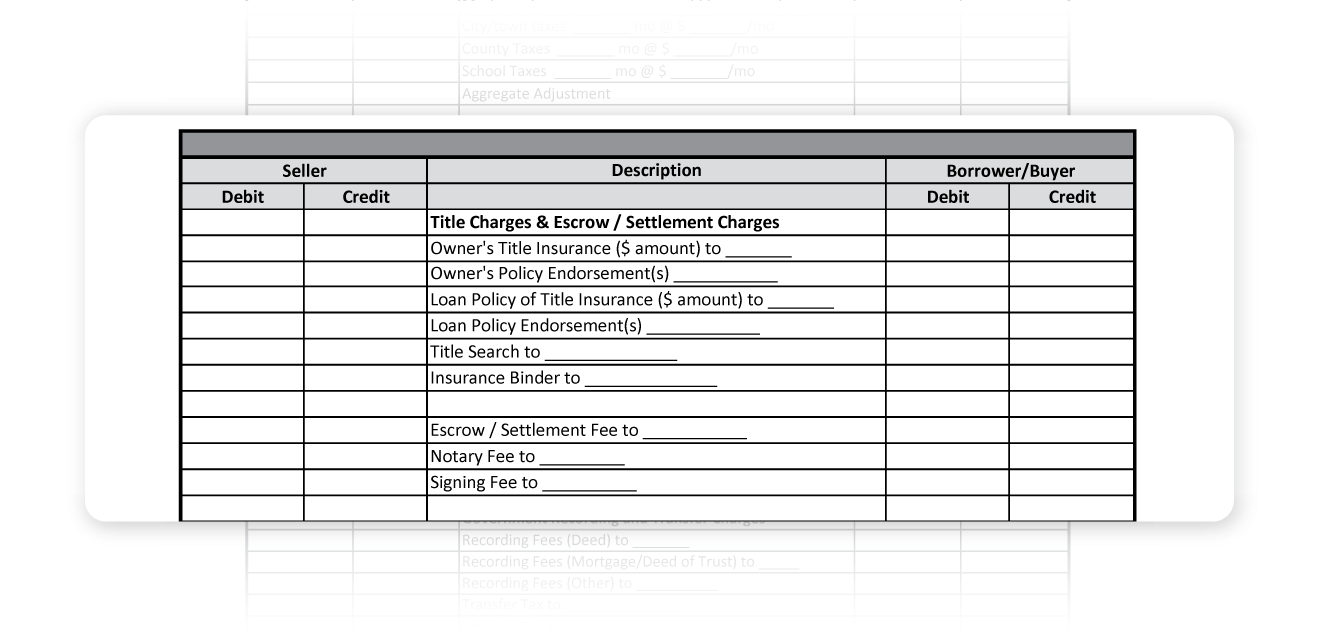

What is an ALTA Statement? The ALTA settlement statement is an itemized list of all of the fees or charges that the buyer and seller will pay during the settlement portion of a real estate transaction. Everything from the sale price, loan amounts, school taxes and other pertinent information is contained in this document.

What is an Alta Closing Disclosure?

The Closing Disclosure was introduced in 2015 as a document that instead contains this information strictly for the buyer. ALTA statements were put into use to provide thorough breakdowns for agents and brokers to receive at the end of the transaction. Are ALTA Settlement Statements the Same as Net Sheets?

Does the Alta Settlement Statement include NPI?

Because of this, the American Land Title Association (ALTA) created the ALTA Settlement Statement, which is a standard settlement statement form that doesn’t include NPI and can be used with the new TRID Closing Disclosure form (not in place of).

Is Alta the same as CD?

The ALTA will be provided to Real Estate agents for review, and signed by both buyers and sellers at the closing table. This is the document that every party to the transaction gets a copy of for their records. The CD only goes to the buyer, lender and title company because it contains personal, non public information.

Is CD and settlement statement the same?

The Closing Disclosure (CD - formerly the HUD-1 Uniform Settlement Statement) is a three-page, government-mandated form that details the costs associated with a real estate transaction. The borrower should receive a copy of the CD at least one day prior to the closing.

Is an Alta statement the same as a closing disclosure?

Unlike the Closing Disclosure that is meant to show the closing costs exclusively to the borrower (buyer), the ALTA statement is like a receipt given to agents and brokers on both sides of the transaction.

What does CD mean in real estate transaction?

A Closing Disclosure is a five-page form that provides final details about the mortgage loan you have selected. It includes the loan terms, your projected monthly payments, and how much you will pay in fees and other costs to get your mortgage (closing costs).

What forms does the CD replace?

The Closing Disclosure, or CD, replaced the HUD-1 beginning Oct. 3, 2015.

Is there another name for a closing disclosure?

Prior to these rules, home buyers received two documents: the HUD-1 Settlement Statement and the Truth in Lending Disclosure Statement (instead of the Closing Disclosure).

What is the difference between a closing statement and a closing disclosure?

A closing statement or credit agreement is provided with any type of loan, often with the application itself. A seller's Closing Disclosure is prepared by a settlement agent and lists all commissions and costs in addition to the net total to be paid to the seller.

What is the difference between a loan estimate and closing disclosure?

The Loan Estimate and Closing Disclosure are two forms that you'll receive during the homebuying process. The Loan Estimate comes at the beginning, after you apply, while the Closing Disclosure comes at the end, before you sign the final paperwork for your mortgage.

What is a final closing statement?

DEFINITION. A closing statement is a written record of the terms of a loan or other financial transaction, disclosing the final terms of an agreement.

What is a CD document?

A closing disclosure (CD) is a standardized document from the lender that provides final details about the mortgage loan. It includes the loan terms, projected monthly payments, fees, and other closing costs.

What does CD stand for in Title?

Commanders of the Order of Distinction are entitled to use the post-nominal letters CD in the case of Members, or CD (Hon.) in the case of Honorary Members. Officers of the Order of Distinction are entitled to use the post-nominal letters OD in the case of Members, or OD (Hon.)

Is closing Disclosure final approval?

The Closing Disclosure is the final document you'll see in the mortgage loan process just before that massive pile of paperwork you'll face at closing. Here's what the five-page document is and how to use it.

Is Settlement Statement same as HUD?

A HUD-1 form, also called a HUD-1 Settlement Statement, is a standardized mortgage lending document. Creditors or their closing agents use this form to create an itemized list of all charges and credits to the buyer and to the seller in a consumer credit mortgage transaction.

What is a settlement statement for taxes?

The HUD-1 Settlement Statement is a breakdown of the expenses home sellers and homebuyers incur in a real estate sale. The settlement statement gives both parties a full picture of the expenses attached to the transaction.

What is mortgage Settlement Statement?

The HUD-1 Settlement Statement is a document that lists all charges and credits to the buyer and to the seller in a real estate settlement, or all the charges in a mortgage refinance.

Is closing and settlement the same thing?

A closing is often called "settlement" because you, as buyer, along with your lender and the seller are "settling up" among yourselves and all of the other parties who have provided services or documents to the transaction.

Is HUD still used?

Worth mentioning, the old HUD is still used in cash transactions and reverse mortgages, with all parties permitted to receive a copy as in the past.

Do title companies charge for CDF?

Because the sellers will also need a settlement statement (CDF) – and because this is not provided by the buyer’s lender like the buyer CDF is – it is the responsibility of the Title Company to now create and provide this additional document. As this is a new, additional form not required in the past, it has become the norm in the industry now for the title company to charge a fee for this form, payable by the sellers.

Where Can I Download a Sample ALTA Settlement Statement?

You can download a sample ALTA statement by clicking the text link below.

What is an ALTA Statement?

The ALTA settlement statement is an itemized list of all of the fees or charges that the buyer and seller will pay during the settlement portion of a real estate transaction. Everything from the sale price, loan amounts, school taxes and other pertinent information is contained in this document.

What is the difference between seller disclosure and closing disclosure?

The difference between a seller disclosure and closing disclosure is simple – the seller will receive a seller’s disclosure, which provides a breakdown of costs and fees that factor into the cash they will receive at the transaction’s end. Due to TRID regulations, agents will have nothing to do with the closing disclosure.

What is closing disclosure?

The closing disclosure is provided to the buyer and pertains a list of fees and costs and how they work into the buyer’s total expense. It is important to note that only the lender can provide the Closing Disclosure to the buyer 3 days prior to closing? And only the buyer should be able to see it unless they allow the release of it by signing a release disclosure. You should also know that the lender is obligated under the TRID regulations, and the lender can be penalized for failing to disclose 3 days after they’re loan application is approved and again 3 days prior to closing.

What is a settlement statement?

Settlement Statements – This is the version supplied solely to the buyer and contains only information pertinent to the buyers side of the transaction.

What is a HUD-1?

A Hud-1 used to be the primary statement associated with real estate and is used to document all cash transactions and how they affect both parties. It is now outdated. The Closing Disclosure was introduced in 2015 as a document that instead contains this information strictly for the buyer.

Why is a standard form required for title insurance?

Having a standard form for nearly all title insurance policy transactions maintains that all exchanges of land are done smoothly and efficiently.

How many versions of ALTA Settlement Statement are there?

There are four versions of the ALTA Settlement Statement available:

How to contact ALTA?

Contact ALTA at 202-296-3671 or [email protected].

How many sections are there in an ALTA settlement statement?

There are a total of 11 sections in the ALTA settlement statement. Each of them highlights a particular type of cost associated with closing. Note that the debit and credit sections are listed against the seller and buyer on their respective sides from the second section which is where the costs are highlighted. Let’s go through all the sections.

What is the ALTA statement sheet?

One of the important documents in this pile is the ALTA statement sheet. The ALTA statement gives an itemized list of prices for the closing process. While the HUD-1 settlement statement used to serve this purpose before, it is now outdated.

How many types of ALTA statements are there?

There are 4 types of ALTA statements made according to their unique recipients. These four types of statements are:

Where are miscellaneous costs debited?

Miscellaneous costs are debited from the buyer’s account most of the time. However, a lot of time the sellers may agree to pay apart as well, and the costs are debited from the seller’s side. Here is the list of all miscellaneous costs. Pest Inspection Fee.

Who levies title and mortgage costs?

These costs are levied by the county for recording the new title and mortgage for the new owner.

What is appraisal fee?

Appraisal Fee to. Paid to the lender or an appraisal company to determine the current value of the property.

What is ALTA settlement statement?

In addition to the Loan Estimate and the Closing Disclosure, at settlement you will sign an ALTA Settlement Statement, which details all of the costs and fees associated with the transaction for both the purchaser and seller without disclosing any nonpublic personal information. The form was designed by the American Land Title Association (ALTA) to be a standardized industry form to be used with transactions involving a lender. The ALTA Settlement Statement will be signed and acknowledged by the purchaser and seller, and is a document that is able to be shared with all parties to the transaction.

What is ALTA form?

The form was designed by the American Land Title Association (ALTA) to be a standardized industry form to be used with transactions involving a lender. The ALTA Settlement Statement will be signed and acknowledged by the purchaser and seller, and is a document that is able to be shared with all parties to the transaction.