IRAs may play a bigger role in divorce settlements, with the pretax funds being used to make up for the lost alimony deduction. There is no question that IRAs have become a major asset and more of a bargaining chip in divorce. But now we’re seeing inherited IRAs being split in divorce.

How should we transfer an IRA in a divorce?

Transferring IRA Assets During Divorce

- Strategy. Include language in your divorce or separation instrument that states the following: the transfer of Individual Retirement Account funds is intended to be tax-free under section 408 (d) (6) ...

- Taxable IRA Distribution. ...

- Tax-Free IRA Transfer. ...

How do you write a divorce settlement?

You’ll then need to all relevant information about your marriage, including:

- the date on which you got married,

- the date of your separation,

- names and ages of any minor children of the marriage,

- the grounds for your divorce (irreconcilable differences, which can be proved by living “separate and apart” for a specific length of time)

- Your current living arrangements and address (es). ...

What is money paid out on settlement of a divorce?

Alimony is paid usually on the basis of the length of the marriage, the usual formula for alimony is that it is paid for half the years of the length of the marriage. For example, if the marriage lasted twenty-two years, what to expect in a divorce settlement would be alimony for eleven years.

What am I entitled to in a divorce settlement?

What you are entitled to in your divorce settlement is dependent on your individual circumstances. Normally it is the matrimonial assets that are up for debate in divorce settlements. Matrimonial assets are assets that were acquired by either party while married or with income earned while married.

How is an IRA split in a divorce?

The correct way to divide IRA funds in compliance with a divorce decree is to do a trustee-to-trustee transfer (a direct transfer) of the IRA funds, moving them directly from one spouse's IRA to the other spouse's account. If done correctly, the IRA will be split and there will be no tax liability for either spouse.

How do you value an IRA in a divorce?

The most efficient way to divide an IRA is to do a trustee-to-trustee transfer, which moves assets from one spouse's IRA to the other spouse's account. This can be beneficial because you will avoid the 10% early distribution penalty (if younger than 59½) and taxes.

Is an ex spouse entitled to an IRA after divorce?

The quick answer is no. Divorce does not usually change a beneficiary designation unless the divorce decree includes a stipulation to change it. Individual retirement accounts (IRAs) work the same way.

Do I get half of my husband's 401k in a divorce?

How Are 401(k)s Typically Split During a Divorce? Any funds contributed to the 401(k) account during the marriage are marital property and subject to division during the divorce, unless there is a valid prenuptial agreement in place.

Is an IRA considered a marital asset?

If an IRA was started during the marriage, it is considered marital property even though, by law, the account is only held in one person's name. If an IRA was started prior to marriage, but contributions were made during the marriage with joint funds, a portion of the account may be considered marital property.

How much of my retirement is my ex wife entitled to?

If you're getting Social Security retirement benefits, some members of your family may also qualify to receive benefits on your record. If they qualify, your ex-spouse, spouse, or child may receive a monthly payment of up to one-half of your retirement benefit amount.

What states require spousal consent for IRA?

If you are married and your spouse is not named as your sole primary beneficiary, spousal consent is required in the following states of residence, which are community property states: Alaska, Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas and Washington.

How long do you have to be married to get half of retirement?

To receive a spouse benefit, you generally must have been married for at least one continuous year to the retired or disabled worker on whose earnings record you are claiming benefits. There are narrow exceptions to the one-year rule.

How are investment accounts divided in divorce?

In California, financial investments are divided according to California's laws governing community property. Any assets acquired during the course of a marriage in California are considered community or marital property and are divided equally upon divorce.

Do I have to support my wife after divorce?

As long as the couple remains married, the court does not set a time limit on spousal support. Maintenance on the other hand, is support the higher-earning spouse pays after the divorce is finalized.

Is an IRA considered community property?

Assets held in an IRA will be community property to the extent that contributions were made to the account and earnings accrue during the marriage. It's important to keep in mind that community property is like ice cream.

How is 401k calculated in divorce?

How do we divide 401(k)s in a divorce? Often, the marital portion of a 401(k)—any funds contributed during the marriage—is split equitably. This frequently means a 50/50 split, but it could be divided 60/40, for example, depending on your other assets and what the court determines is fair.

Do I need a QDRO to split an IRA?

A “qualified domestic relations order”, or QDRO is not required to divide an IRA in a divorce action. All that is required is a simple order within the decree, or other order. However, there are a variety of special tax rules that affect how an IRA is distributed.

What happens if an IRA division agreement is not approved?

If the division agreement is not approved by the courts, the IRS will require you to file an amended tax return that reports the entire amount you sent to your ex as ordinary income.

How are IRAs divided?

IRAs are divided using a process known as "transfer incident to divorce," while 403 (b) and qualified plans, such as a 401 (k), are split under the " Qualified Domestic Relations Order " (QDRO). 1 2 . Many courts confuse this distinction by labeling both types of divisions as QDROs. Nevertheless, you and your spouse need to delineate clearly ...

What is QDRO in divorce?

Dividing a Qualified Plan: QDRO. Divorce constitutes one of the few exceptions to the protections from seizure or attachment by creditors or lawsuits that federal law accords to qualified retirement plans. Divorce and separation decrees allow the attachment of qualified-plan assets by the ex-spouse of the plan owner if the spouse uses ...

Do you have to delineate retirement assets?

You and your spouse need to clearly delineate the category into which each of your retirement assets falls when you submit your information to the judge or mediator so they are listed correctly in the divorce or separation agreement. Not doing this can produce unnecessary complications.

Do you have to divide your retirement?

If you are going through a divorce or legal separation, you will most likely be required to divide the assets you have in your retirement plans. In some cases, the assets may be awarded to one party. Whether you are giving up funds or receiving them, you need to understand the rules that govern asset division in a divorce.

Do you owe taxes on assets sent to you?

You will not owe tax on the assets that were sent to them because you followed the IRS rules for transfer incidents. It can be incredibly beneficial—and well worth the money—to hire a financial professional to assist in the splitting of retirement or any other type of financial account.

Do you have to share your retirement if you are divorced?

Updated Oct 10, 2020. If you are going through a divorce or legal separation, you will most likely be required to share the assets you have in your retirement plans. In some cases, the assets may be awarded to one party.

When did the husband and wife get their IRA?

In April of 1994, the husband and wife. drafted a marital settlement agreement requiring the husband to transfer. his IRA to his wife as part of the property settlement. In May of 1994 , the husband cashed out his IRA (he received a check for $68,000) and. endorsed the check he received to his wife.

What is direct transfer in IRA?

(b) “Direct transfer” — simply direct the trustee of your. traditional IRA to transfer specific assets to the trustee of a new or. existing IRA set up in the name of your spouse or former spouse.

What is IRC Section 408 D?

It is important to note that IRC Section 408 (d) (6) deals with the. “transfer” of an individual’s interest in an IRA and does not deal with. “distributions” from an IRA. If, as part of the divorce or legal separation, you are (or your client is) required to transfer some or all of the assets in a traditional IRA to.

Can you transfer an IRA interest tax free?

transferring an interest in an IRA tax-free as follows: (a) “Change the name on the IRA” — if you are transferring all of the. assets of the IRA, you can simply make the transfer by changing the name. on the IRA from your name to the name of your spouse or former spouse.

When did husband and wife divorce in California?

The husband and wife, both residents of. California, a community property state, were divorced in 1992. Per their. divorce settlement, the husband’s IRA, which was funded with. contributions that were community property, was to be divided equally. between the husband and wife.

Can you transfer an IRA to your spouse?

If you're transferring your interest in an IRA to your (former) spouse, you could get hit with extra tax and penalties if the transfer is not made correctly. Here's the right way -- and a couple examples of the wrong way -- to transfer these funds. IRAs, it is “form over substance”.

Is an IRA a form over substance?

IRAs, it is “form over substance”. The IRS is very clear that an early. distribution from an IRA is subject to a 10% penalty as provided in. Section 72 (t) of the Internal Revenue Code (“IRC”). The IRC also. provides that any amount distributed from an IRA “…shall be included. in gross income by the payee or distributee, as the case may be, in the.

How to divide IRA funds in divorce?

The correct way to divide IRA funds in compliance with a divorce decree is to do a trustee-to-trustee transfer (a direct transfer) of the IRA funds, moving them directly from one spouse’s IRA to the other spouse’s account. If done correctly, the IRA will be split and there will be no tax liability for either spouse.

What is required to divide an IRA without triggering a tax on the transfer?

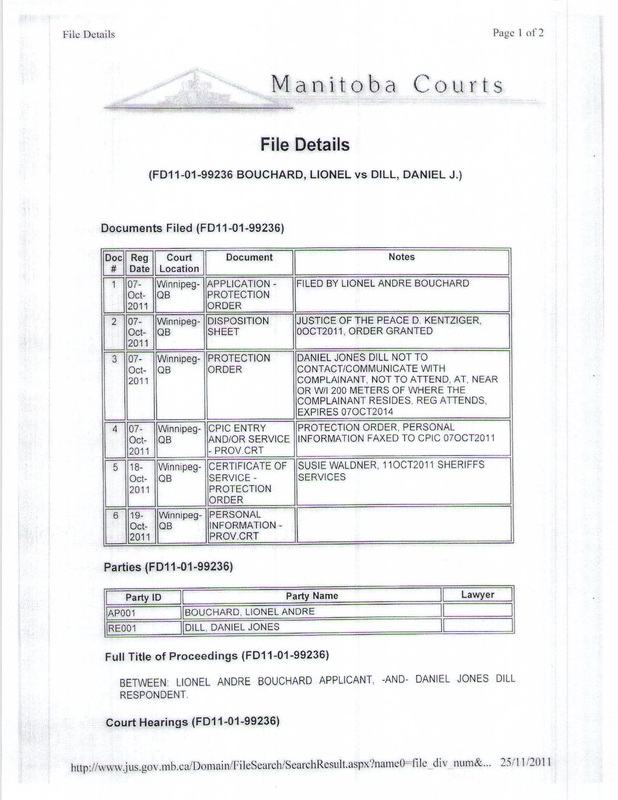

Here are 3 important facts to be aware of: 1. A divorce decree is required. For an IRA to be divided without triggering a tax on the transfer, there must be a divorce decree issued pursuant to state domestic relations law that addresses marital property rights.

Can you transfer IRA funds to Roth IRA after divorce?

Although the funds were transferred due to divorce and may even have been distributed to pay costs associated with the divorce, there is no exception to the 10% penalty here. A spouse who is awarded IRA funds due to divorce may also convert those funds to a Roth IRA.

Is an IRA a financial asset in divorce?

Jan 01, 2018. Divorce often involves the splitting of major financial assets, and an IRA plan is, in some cases, a couple’s largest single financial asset. Splitting an IRA in a divorce is not like splitting a home or other assets. IRAs contain their own specific tax rules that must be followed to avoid triggering taxes or penalties.

Can a property settlement be part of a divorce decree?

The mere fact that a property settlement is agreed to and signed by the parties will not, in and of itself, cause the agreement to be part of a divorce decree. It is possible, however, for divorcing parties to agree to terms as to how IRAs should be divided, and then submit the agreement to the court for approval.

Is a spouse's IRA distribution taxable?

However, if the spouse who receives the funds decides to take a distribution from his or her IRA, that distribution would be taxable. If the spouse who takes the distribution is under age 59½, the 10% early distribution penalty would apply.

Can an IRA be divided without a divorce decree?

Without a divorce decree, there is no authority for the IRA to be divided. A casual agreement settling the division of their property, without the involvement of a court, is not enough to divide an IRA. The mere fact that a property settlement is agreed to and signed by the parties will not, in and of itself, cause the agreement to be part ...

What happens to a retirement plan if you get divorced?

If a plan participant gets divorced, his or her ex-spouse may become entitled to a portion of the participant’s retirement account balance. Depending on the type of plan and the amount of benefits, the ex-spouse may have immediate access to his or her portion of those assets or at some point in the future ...

Do ex spouses have to file a domestic relations order?

Most plans require an ex-spouse to file a Qualified Domestic Relations Order with the plan administrator before the plan can pay any portion of a participant’s retirement plan benefits to that ex-spouse.

Can a court award a retirement plan to a spouse?

A court can award all or a portion of participant’s retirement plan assets to his or her spouse, former spouse, child or other dependent by issuing a QDRO, which must be honored by the plan. The QDRO can order the plan to pay the participant’s retirement plan benefits to an alternate payee. The court's order can be in the form of a state court judgment, decree or order, or court approval of a property settlement agreement.

Can a divorced person change the beneficiary of his or her retirement plan?

A participant who gets divorced may also want to change the beneficiary of his or her retirement plan. To do this, the participant should: contact his or her employer or plan administrator to request change of beneficiary forms; complete those forms in accordance with their instructions; and.