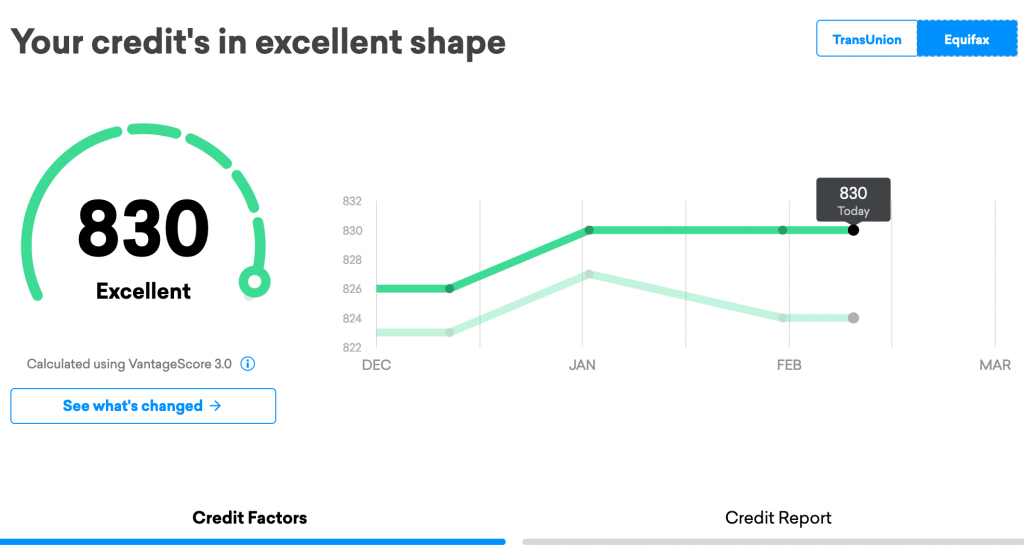

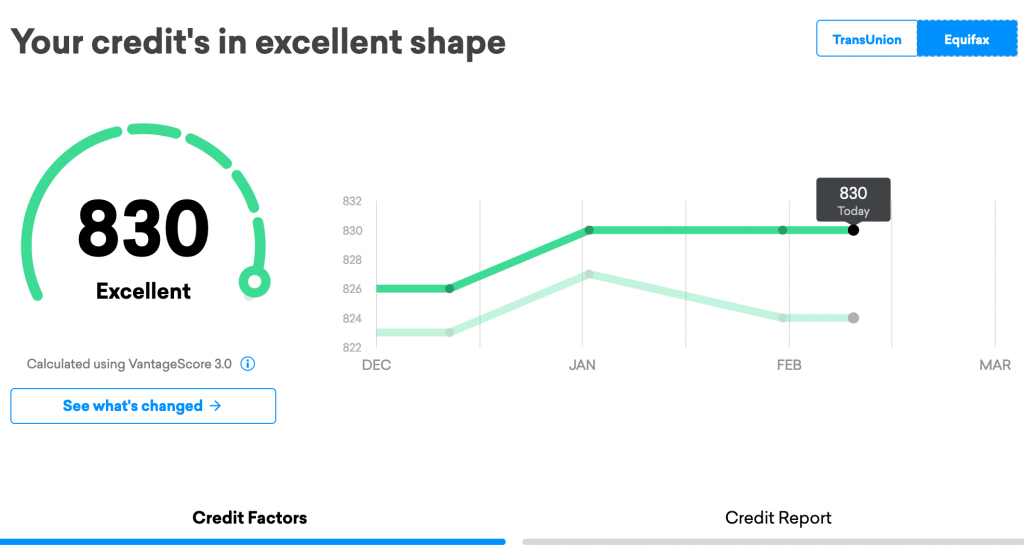

However, Credit Karma only monitors two of the three credit reporting agencies, TransUnion and Equifax, whereas the Equifax settlement offers four years of credit monitoring with all three major agencies, including Experian

Experian

Experian plc is a multinational consumer credit reporting company. Experian collects and aggregates information on over one billion people and businesses including 235 million individual U.S. consumers and more than 25 million U.S. businesses. Based in Dublin, Ireland, the compan…

Full Answer

What is the settlement with Equifax?

The company has agreed to a global settlement with the Federal Trade Commission, the Consumer Financial Protection Bureau, and 50 U.S. states and territories. The settlement includes up to $425 million to help people affected by the data breach. The initial deadline to file a claim in the Equifax settlement was January 22, 2020.

Where does Credit Karma get its free credit score from?

The free credit score you receive from Credit Karma comes straight from TransUnion and Equifax, two of the three credit bureaus. It is not your FICO score, the scoring model used by the vast majority of lenders. In the credit industry, these credit scores are referred to as “FAKOs.”

Why is Credit Karma so good at selling?

Because Credit Karma has access to so much of your personal and financial information, they are able to make extremely targeted individualized offers to each member. Be sure to use your judgment wisely before committing to any product you’re offered.

Are you eligible for free credit monitoring services from the settlement?

The settlement administrator also recently sent emails and letters to people who filed valid claims requesting free credit monitoring services from the settlement. Eligible claimants will get free membership in Experian IdentityWorks℠ for four years. This service is free for you.

See more

How much will Equifax settlement be?

$425 millionEquifax will pay up to $425 million in restitution to those directly impacted by the massive data breach of the credit bureau in 2017. A federal court gave final approval to the class-action lawsuit settlement in mid-January.

Has Equifax settlement been approved?

The Settlement received final approval from the Court on January 13, 2020. You may review the Final Approval Order and Final Order and Judgment by clicking here. Settlement appeals have been resolved and the Settlement is now effective.

Is Credit Karma Score accurate?

The credit scores and reports you see on Credit Karma should accurately reflect your credit information as reported by those bureaus. This means a couple of things: The scores we provide are actual credit scores pulled from two of the major consumer credit bureaus, not just estimates of your credit rating.

How many points is Credit Karma off?

Credit Karma touts that it will always be free to the consumers who use its website or mobile app. But how accurate is Credit Karma? In some cases, as seen in an example below, Credit Karma may be off by 20 to 25 points.

Will Equifax pay $125?

Consumers can get free credit monitoring or up to $125. You'll get at least four years of credit monitoring at the three major bureaus (through Experian), as well as $1,000,000 of identity theft insurance, plus up to six more years of free one-bureau credit monitoring from Equifax.

Who qualifies for Equifax settlement?

You are a Settlement Class Member if you are among the approximately 147 million U.S. consumers identified by Equifax whose personal information was impacted by the Equifax Data Breach.

Which is more accurate Credit Karma or Experian?

Our Verdict: Credit Karma has better credit monitoring and more features, but Experian actually gives you your “real” credit score. Plus it offers the wonderful Experian Boost tool. Since they're both free, it's worth it to get both of them.

Why is there no Equifax score on Credit Karma?

If you've had credit in the past but no longer use credit cards, or you have closed accounts on your report, there won't be recent activity to produce a score for you. And even if you have recent credit activity, you still may not have scores if your lenders don't report to the bureaus.

Why is Credit Karma score higher than Experian?

While Experian compiles your credit report and determines your credit score, Credit Karma simply shows you credit scores and report information from Equifax and TransUnion. Think of it this way — Credit Karma is like a newspaper that writes about the credit scores other companies give you.

What is an excellent credit score on Credit Karma?

800–855FICO industry-specific score rangesCredit score rangesRating580–669Fair670–739Good740–799Very good800–855Exceptional1 more row•Jun 9, 2022

Is your TransUnion or Equifax more important?

Is TransUnion more important than Equifax? The short answer is no. Both TransUnion and Equifax are reliable credit reporting agencies that compile reports and calculate your credit scores using different scoring models.

Why is Credit Karma score lower than my FICO?

Some lenders report to all three major credit bureaus, but others report to only one or two. Because of this difference in reporting, each of the three credit bureaus may have slightly different credit report information for you and you may see different scores as a result.

How do I check the status of my Equifax settlement?

Status of financial reimbursement For more details and to check your claim status, visit EquifaxBreachSettlement.com . If you were affected by the Equifax data breach, you can still claim financial reimbursement for costs you incurred, or time you spent dealing with fraud or identity theft, after January 22, 2022.

How Much Will Indiana residents get from the Equifax settlement?

approximately $79The Indiana Attorney General will start sending settlement payments on Wednesday to Hoosiers whose data was leaked in a 2017 Equifax breach. More than 236,000 past and current Indiana residents will get approximately $79 as part of a settlement that Indiana reached with the credit company.

How much will I get from Indiana Equifax settlement?

“Each person who filed an eligible claim for restitution at IndianaEquifaxClaims.com will receive approximately $79," a statement from the Attorney General's Office said. "The Office will begin distributing digital and check payments on March 31.

What is the Indiana Equifax settlement?

As part of the settlement, Equifax agreed to pay $19.5 million to the State of Indiana. That money is being directed to consumer restitution payments and costs associated with the settlement. If your personal information was impacted in the data breach, you are eligible for a consumer restitution payment.

How much did Equifax settle for?

Equifax, one of the three major consumer credit bureaus, last week reached a settlement for up to $700 million related to its major security breach in 2017. If you were affected by this breach, which exposed the personal information of 147 million people, you could be entitled to compensation. Read on to find out if you may be eligible, how ...

How long does credit monitoring last?

If you’re eligible for compensation of up to $125, you’ll need to already have credit monitoring that will continue for at least six more months. You may have credit monitoring through Credit Karma and can check your account to confirm.

Does Credit Karma pay advertisers?

Editorial Note: Credit Karma receives compensation from third-party advertisers, but that doesn’t affect our editors’ opinions. Our marketing partners don’t review, approve or endorse our editorial content. It’s accurate to the best of our knowledge when posted.

Does compensation factor into how and where products appear on our platform?

Compensation may factor into how and where products appear on our platform ( and in what order). But since we generally make money when you find an offer you like and get, we try to show you offers we think are a good match for you. That's why we provide features like your Approval Odds and savings estimates.

Does Equifax check if your data was affected by the 2017 breach?

Equifax offers a free service that lets you check if your data was affected by the 2017 breach. Here’s a link to Equifax’s secure lookup tool. Heads up — the site will ask you for the last six digits of your Social Security number. This helps Equifax determine if your information was impacted and if you’re a class member.

What is credit karma?

Credit Karma has recently rolled out a few extra features to offer members. The first is called Unclaimed Money. You can perform a free search to see if you qualify. When companies owe you money but can’t reach you, for example, they’re required to turn that money over to the state.

How does Credit Karma work?

Unlike other sites, you never have to enter your credit card information on Credit Karma, so you don’t have to worry about hidden charges, fees, or trial periods that end suddenly.

How does Credit Karma make money?

Credit Karma makes money by offering promotions and financial services to its members from partner companies.

How accurate is Credit Karma?

The free credit score you receive from Credit Karma comes straight from TransUnion and Equifax, two of the three credit bureaus. It is not your FICO score, the scoring model used by most lenders. In the credit industry, these credit scores are referred to as “FAKOs.”

Does checking your credit score on credit karma lower it?

No. Checking your credit score on Credit Karma doesn’t hurt your credit score. When you request a credit report from Credit Karma, they perform a soft inquiry on your credit report, which isn’t reflected on your report. Only applying for a loan or other new credit will result in hard pulls.

Should I use Credit Karma?

Credit Karma is an excellent option if you want to keep an eye on your credit score regularly. In addition, it’s beneficial when you want to repair or build your credit score. Your credit score is critical in your financial health, and it’s essential to know how the scores change.

What services does Credit Karma provide?

Credit Karma provides free credit scores, credit monitoring, and insights to help you take control of your credit . It alerts you to important changes to your credit reports and offers recommendations and tips to help you manage your credit wisely and for improving your credit score. Other helpful services Credit Karma provides include:

How much can you claim for time spent on Equifax?

The Equifax settlement has a provision through which victims can claim a cash payment for "time spent.". This means that you can claim a rate of $25 per hour for up to 20 hours of the time you wasted dealing with the fallout of the breach.

How much can you claim for a credit freeze?

If you spent hours researching what to do about the breach, setting up credit freezes, hopping on the phone with your bank, or doing anything else remotely relevant, you can claim up to $250 for that time without needing to show any specific evidence.

Can you still get your money from Equifax?

The Equifax settlement process has been absurd, but don't worry. You can still get your money. Photograph: David Muir/Getty Images

Does Equifax have free credit monitoring?

The free credit monitoring Equifax offered after its breach has now expired, but many states offer a list of disclosed breaches that you can check. Many of those companies have given out free credit monitoring as recompense.

What is the settlement for Equifax?

Equifax, one of the three major consumer credit bureaus, reached a settlement for up to $700 million related to its major data breach in 2017. If your information was exposed in the data breach, you can file a claim for free credit monitoring. If you already have credit monitoring, you can file a claim for a cash payment.

Does Credit Karma monitor your credit?

Credit Karma doesn’t have any insight into whether you are able to file a claim or not. However, we do provide 100% free credit monitoring of your Equifax and TransUnion credit reports.