In some cases, income from insurance claims and settlements is taxable.

- Life insurance claims. Life insurance payouts that people receive upon the death of a loved one are not taxed. ...

- Disability insurance claims. According to the IRS, any amount received for disability must be reported as income. ...

- Lost Income compensation. ...

- Lawsuit proceeds. ...

Is lump sum disability taxable?

While you might have to pay taxes on a small portion of your lump sum payment from Social Security, the IRS does not penalize disability beneficiaries for receiving past-due benefits all in one year. Federal law provides that individuals can apportion past-due benefits to previous years, thus lowering or eliminating the taxable amount of their lump sum per year, without having to file amended tax returns.

Are permanent disability benefits taxable?

Disability benefits may or may not be taxable. You will not pay income tax on benefits from a disability policy where you paid the premiums with after tax dollars. This includes: A employer sponsored policy you contributed to with after-tax dollars. These rules apply to both short-term and long-term disability policies.

Are EEOC settlements taxable income?

Yes, settlements for employment discrimination are considered taxable. If you receive a settlement in an employment-related lawsuit; for example, for unlawful discrimination or involuntary termination, the portion of the proceeds that is for lost wages (i.e., severance pay, back pay, front pay) is taxable wages and subject to the social security wage base and social security and Medicare tax rates in effect in the year paid.

Is my SSDI income taxable?

Social Security disability benefits (SSDI) can be subject to tax, but most disability recipients don't end up paying taxes on them because they don't have much other income. About a third of Social Security disability recipients, however, do pay some taxes, usually because of their spouse's income or other household income.

How are lump-sum disability payments taxed?

Half of Your SSDI Benefits Are Taxable Each Year Many people who rely on monthly social security disability payment as their sole source of income won't owe taxes. 2 However, reporting the lump sum as income for one tax year can result in owing taxes.

Is disability income taxable by IRS?

You must report your taxable disability payments as wages on line 1 of Form 1040 or 1040-SR until you reach minimum retirement age.

How much of disability payments are taxable?

between $25,000 and $34,000, you may have to pay income tax on up to 50 percent of your benefits. more than $34,000, up to 85 percent of your benefits may be taxable.

Are disability claims taxable?

In most cases, Disability Insurance (DI) benefits are not taxable. But, if you are receiving unemployment, but then become ill or injured and begin receiving DI benefits, the DI benefits are considered to be a substitute for unemployment benefits, which are taxable.

Can you collect disability and Social Security at the same time?

Example of concurrent benefits with Employment Supports. Many individuals are eligible for benefits under both the Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI) programs at the same time. We use the term “concurrent” when individuals are eligible for benefits under both programs.

Does disability pay more than Social Security?

In general, SSDI pays more than SSI. Based on data from 2020: The average SSDI payment is $1,258 per month. The average SSI payment is $575 per month.

Is there really a $16728 Social Security bonus?

You can receive as much as a $16,728 bonus or more every year. A particular formula will determine the money you'll receive in your retirement process. You must know the hacks for generating higher future payments.

Do you get a tax refund if you are on disability 2022?

Tax Refunds Receiving SSDI or SSI benefits doesn't prevent you from receiving a tax refund. Whether you owe taxes or not, you should file a tax return if you think you qualify for any of the above credits discussed above. If you don't file a tax return, you will miss out on many of the credits.

How do I prove my disability to the IRS?

Physician's statement. If you are under age 65, you must have your physician complete a statement certifying that you had a permanent and total disability on the date you retired. You can use the statement in the instructions for Schedule R Credit for the Elderly or the Disabled, page R-4.

Is disability income considered earned income?

The IRS emphasized that Social Security benefits and Social Security Disability Income (SSDI) do not count as earned income. Additionally, taxpayers may claim a child with a disability or a relative with a disability of any age to get the credit if the person meets all other EITC requirements.

Do you get a tax refund if you are on disability 2022?

Tax Refunds Receiving SSDI or SSI benefits doesn't prevent you from receiving a tax refund. Whether you owe taxes or not, you should file a tax return if you think you qualify for any of the above credits discussed above. If you don't file a tax return, you will miss out on many of the credits.

How much can you make on Social Security disability without being penalized?

During the 36-month extended period of eligibility, you usually can make no more than $1,350 ($2,260 if you are blind) a month in 2022 or your benefits will stop. These amounts are known as Substantial Gainful Activity (SGA).

Can I get a tax refund if my only income is Social Security disability?

Yes, if you meet the qualifying rules of the CTC. You can claim this credit from the Internal Revenue Service (IRS) based on each of your qualifying children, even if you get Social Security or SSI and don't normally file a tax return.

How do I prove my disability to the IRS?

Physician's statement. If you are under age 65, you must have your physician complete a statement certifying that you had a permanent and total disability on the date you retired. You can use the statement in the instructions for Schedule R Credit for the Elderly or the Disabled, page R-4.

The Taxes Will Depend On How the Plan Is Paid For

The leading factor that will help determine whether you must pay taxes on a long-term disability lump-sum settlement is who paid for the insurance premium. The long-term disability settlement will typically be tax-free if you paid for the premium with money that had already been taxed (such as taxable income).

We Can Help You Make a Decision

If you’ve been offered a lump-sum settlement for your long-term disability benefits, there are many things you need to consider. It’s important that you speak with a professional who knows the ins and outs of the industry so that you aren’t caught off guard with any surprises you may not be expecting.

How are disability payments taxed?

How disability payments are taxed depends on the source of the disability income. The answer will change depending on whether the payments are from a disability insurance policy, employer-sponsored disability insurance policy, a worker’s compensation plan, or Social Security disability.

What is disability insurance?

Disability insurance is a type of insurance that provides income in the event that an employee is unable to perform tasks at work due to an injury or disability. Disability insurance falls in two categories:

Is Workers’ Compensation Taxable?

Income from a workers’ compensation fund isn’t taxable if it’s compensation for an on-the-job injury or sickness.

How much is the federal income tax for married filing separately?

The base amount is: $25,000 if you’re filing single, head of household, or married filing separately (living apart all year) $32,000 if you’re married filing jointly. $0 if you’re married filing separately and lived together with your spouse at any point in the year.

How long does a short term disability last?

Short-term disability: This type of insurance pays out a portion of your income for a short period of time – and can last from a few months to up to two years. Long-term disability: This type of insurance begins after a waiting period of several weeks or months – and can last from a few years to up to retirement age.

Is disability income taxable?

Disability benefits may or may not be taxable. You will not pay income tax on benefits from a disability policy where you paid the premiums with after tax dollars. This includes: A employer sponsored policy you contributed to with after-tax dollars.

Is Social Security Disability Taxable?

Income from social security disability isn’t taxable if your provisional income isn’t more than the base amount. Provisional income is your modified adjusted gross income (AGI) plus half of the social security benefits you received. The base amount is:

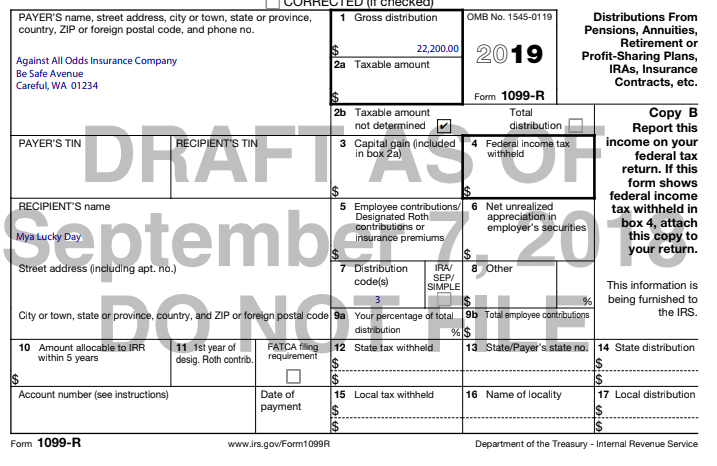

Brad Howell

If the social security number listed under "Recipient's Identification Number" is your social security number, then the attorney is not required to issue you a Form 1099-MISC, as you've already been issued one.

Kevin Matthew Sayed

Without the exact facts of what the settlement paid you for it is hard to say exactly what you might own. Disability policies that take the place of income generally are taxable, and components of settlement to replace wages typically trigger taxable components of a settlement.

David Charles Dodge

It appears only your attorney received a form 1099-Misc., with an amount only in form 1099-Misc. box 18, State Income. I assume this means the form 1099-Misc. stated your lawyer's federal identification number, not your social security number. Generally, if your litigation settlement was for "personal injury," then the net after...

How long does a disabled person have to be disabled to work?

First, the SSA says, "Your condition must significantly limit your ability to do basic work such as lifting, standing, walking, sitting, and remembering—for at least 12 months.".

How many states will have tax benefits in 2020?

As of 2020, however, a total of 13 states tax benefits to some degree. Those states are Colorado, Connecticut, Kansas, Minnesota, Missouri, Montana, Nebraska, New Mexico, North Dakota, Rhode Island, Utah, Vermont, and West Virginia. Most of these states set similar income criteria to the ones used by the IRS to determine how much, if any, ...

Why did Roosevelt include Social Security in the New Deal?

The purpose of the New Deal was to lift the country out of the Great Depression and restore its economy.

Do you have to pay taxes on Social Security?

Most states do not tax Social Security benefits, including those for disability. As of 2020, however, a total of 13 states tax benefits to some degree. Those states are Colorado, Connecticut, Kansas, Minnesota, Missouri, Montana, Nebraska, New Mexico, North Dakota, Rhode Island, Utah, Vermont, and West Virginia. Most of these states set similar income criteria to the ones used by the IRS to determine how much, if any, of your disability benefits are taxable. 3

Is SSDI income taxed?

Key Takeaways. Many Americans rely on Social Security Disability Income (SSDI) benefits for financial support. If your total income, including SSDI benefits, is higher than IRS thresholds, the amount that is over the limit is subject to federal income tax.

What is the tax rule for settlements?

Tax Implications of Settlements and Judgments. The general rule of taxability for amounts received from settlement of lawsuits and other legal remedies is Internal Revenue Code (IRC) Section 61 that states all income is taxable from whatever source derived, unless exempted by another section of the code. IRC Section 104 provides an exclusion ...

What is employment related lawsuit?

Employment-related lawsuits may arise from wrongful discharge or failure to honor contract obligations. Damages received to compensate for economic loss, for example lost wages, business income and benefits, are not excludable form gross income unless a personal physical injury caused such loss.

What is the purpose of IRC 104?

IRC Section 104 provides an exclusion from taxable income with respect to lawsuits, settlements and awards. However, the facts and circumstances surrounding each settlement payment must be considered to determine the purpose for which the money was received because not all amounts received from a settlement are exempt from taxes.

What is the exception to gross income?

For damages, the two most common exceptions are amounts paid for certain discrimination claims and amounts paid on account of physical injury.

Is emotional distress excludable from gross income?

96-65 - Under current Section 104 (a) (2) of the Code, back pay and damages for emotional distress received to satisfy a claim for disparate treatment employment discrimination under Title VII of the 1964 Civil Rights Act are not excludable from gross income . Under former Section 104 (a) (2), back pay received to satisfy such a claim was not excludable from gross income, but damages received for emotional distress are excludable. Rev. Rul. 72-342, 84-92, and 93-88 obsoleted. Notice 95-45 superseded. Rev. Proc. 96-3 modified.

Is a settlement agreement taxable?

In some cases, a tax provision in the settlement agreement characterizing the payment can result in their exclusion from taxable income. The IRS is reluctant to override the intent of the parties. If the settlement agreement is silent as to whether the damages are taxable, the IRS will look to the intent of the payor to characterize the payments and determine the Form 1099 reporting requirements.

Is mental distress a gross income?

As a result of the amendment in 1996, mental and emotional distress arising from non-physical injuries are only excludible from gross income under IRC Section104 (a) (2) only if received on account of physical injury or physical sickness. Punitive damages are not excludable from gross income, with one exception.

How much disability income is taxable?

But if you're filing as an individual with provisional income between $25,000 and $34,000, up to 50% of your disability benefits are considered taxable income. If you have provisional income over $34,000, 85% of your benefits are taxable. If you're married filing jointly and have combined income over $32,000, up to 50% of your disability benefits ...

What is the tax rate for disability?

Any disability income that is taxable will be taxed at your ordinary marginal rate (which, for most people, is between 10% and 28%). Of course, you could owe state taxes on your disability backpay, but most states don't tax Social Security disability benefits.

How much does a disability lawyer charge?

Most lawyers who handle Social Security disability cases charge a standard fee of 25% of your past-due benefits, with a cap of $6,000. (The fee may work somewhat differently if your case goes to the Appeals Council or requires multiple hearings.) If you win your disability claim, Social Security will pay the attorney fee directly to your lawyer, and you'll receive the remainder.

Is Social Security disability taxed in lump sum?

The IRS has implemented a fair system for taxing Social Security disability back payments that come in a lump sum.

Does Social Security withhold disability payments?

As a result, Social Security does not automatically withhold any of your disability lump sum amount, or any of your monthly check, for tax purposes.

Do you have to pay taxes on Social Security?

While you might have to pay taxes on a small portion of your lump sum payment from Social Security, the IRS does not penalize disability beneficiaries for receiving past-due benefits all in one year. Federal law provides that individuals can apportion past-due benefits to previous years, thus lowering or eliminating the taxable amount of their lump sum per year, without having to file amended tax returns.

Do I Earn Enough to Owe Federal Income Tax?

Whether you'll owe federal income tax while receiving Social Security disability depends on whether you file individually or jointly and how much "provisional income" you report. Provisional income includes your adjusted gross income (AGI), any tax-exempt interest you earned, and half of your Social Security disability benefits.

What is damages in a lawsuit?

Damages means any amounts received (other than workers’ compensation) as the result of a lawsuit or settlement agreement. To answer Ms. Beckett’s question, the U.S. Tax Court had to look at the specific nature of her disability discrimination claim and the language of the settlement agreement for the actual award.

Does gross income include punitive damages?

Section 104 (a) (2) says gross income does not include “the amount of any damages (other than punitive damages) received (whether by suit or agreement and whether as lump sums or as periodic payments) on account of personal physical injuries or physical sickness.”.

Is the $19,000 disability award taxable?

While in court to enter the settlement, Ms. Beckett asked her civil court judge whether the $19,000 disability discrimination award was taxable as income. The judge told her no, because the lawsuit was based on her seizures.

Is a settlement award excludable as personal injury?

The Court explained that whether a settlement award is excludable as personal injury damages depended on the facts and circumstances of the agreement itself, including: The Court had to be able to draw a “direct causal link” between the damages received and physical injury or sickness suffered by the plaintiff.

Is $8,000 in attorney fees taxable?

By the time the issue came to the U.S. Tax Court for a decision on the taxability of the disability discrimination award, everyone agreed that the $8,000 in attorney fees should have been reported as gross taxable income. However, it also qualified for a deduction under the U.S. tax code, so all that remained was the $19,000 award.

Was Beckett's seizure a taxable wrongful termination?

The Court recognized that, while Ms. Beckett had characterized her case as a taxable wrongful termination claim, “There was, however, a physical component to petitioner’s complaint.” Ms. Beckett’s seizures “were an actual basis for the settlement”. She testified that she suffered head injuries and other injuries because her employer refused her requests for reasonable accommodations. These factors set her disability discrimination award apart from other, taxable wrongful termination awards.