Generally, money that is transferred between (ex)spouses as part of a divorce settlement—such as to equalize assets—is not taxable to the recipient and not deductible by the payer. This is different than alimony, also called spousal maintenance, which is taxable (and deductible) unless the settlement specifies that it is not.

Do you have to pay taxes on divorce settlement?

Tax on divorce settlement Generally, money that is transferred between (ex)spouses as part of a divorce settlement—such as to equalize assets—is not taxable to the recipient and not deductible by the payer.

What are the divorce laws in New York State?

Divorce Laws in New York 1 Divorce Laws in New York: What You Need to Know. In New York, a marriage can end through an annulment, legal separation or a divorce. ... 2 Property Issues. New York is an equitable division state. ... 3 Spousal Maintenance and Child Support. ... 4 Custody and Visitation. ... 5 Process. ... 6 Other Issues. ...

What is equitable property division in a New York divorce?

When a couple divorces in New York, judges divide property equitably, which can result in an equal property division, but not doesn't always. Instead, the basis for an equitable property division is what a judge determines is fair, considering what each spouse contributed to the marriage and what each spouse will need to move forward.

Is alimony taxable in New York State?

Is alimony taxable in New York state? As of January 1, 2019, on the federal level, alimony is no longer deductible by the payor spouse, nor is it considered income to the payee spouse. For your federal returns, if you’re paying spousal support, you do not get to deduct it. If you’re receiving spousal support, you do not declare it.

Is money from a divorce settlement taxable income?

Under the current federal income tax laws, alimony or spousal maintenance is non-taxable and the party paying the alimony or spousal maintenance does not receive a tax deduction. Spousal support or alimony is paid with after-tax dollars like child support is paid with after-tax dollars.

Is a lump sum payment in a divorce settlement taxable?

Generally, lump-sum divorce settlements are not taxable for the recipient. If the lump-sum payment is an alimony payment, it is not deductible for the person who makes the payment and is not considered income for the recipient.

Are divorce buyouts taxable?

Buyouts. After a buyout, the selling spouse doesn't need to worry about capital gains tax because the sale was part of the divorce. But if you buy out your spouse, stay in the house, and later sell the house to a third party, capital gains tax will apply to that sale.

How does a divorce settlement affect taxes?

Under the Tax Cuts and Jobs Act of 2017, all alimony being paid upon a divorce that is finalized after January 1, 2019 is no longer considered taxable income to the receiving spouse and likewise the paying spouse is no longer able to deduct these payments and receive a tax savings.

How do I avoid Capital Gains Tax in a divorce?

If the home is sold not too long after the divorce, each spouse can exclude up to $250,000 of their respective share of the capital gain, provided: (1) each owned their part of the home for at least two years during the five-year period ending on the sale date; and (2) each used the home as a principal residence for at ...

Who pays capital gains in divorce?

Property Settlements When this occurs and the property has increased in value since the time of the divorce, the seller may owe capital gains taxes based on the value of the property at the time of acquisition.

Is spousal buyout taxable?

Spousal support buyouts are technically property transfers instead of spousal support payments. This means that the transfer is not a taxable event, i.e., the person transferring the buyout does not get to write off the transfer on their taxes and the person receiving it does not pay taxes on the transfer.

Do you have to pay taxes on a buyout?

Buyouts are included as an item of gross income and are considered as fully taxable income under IRS tax laws. Section 451(a) of the Internal Revenue Code provides that the amount of any item of gross income must be included in the gross income for the taxable year in which it is received by the taxpayer.

Is money received in family settlement taxable?

Therefore, the family arrangement is not taxable - Tri. Income Tax - Taxation on amount received on family settlement - accrual of income - entire property was in existence at the time of partition in which concerned family members were having their interest/shares, therefore, it was clearly a family settlement.

How are QDRO distributions taxed?

A QDRO distribution that is paid to a child or other dependent is taxed to the plan participant. An individual may be able to roll over tax-free all or part of a distribution from a qualified retirement plan that he or she received under a QDRO.

Is a lump sum alimony payment tax deductible?

Alimony or separation payments are deductible if the taxpayer is the payer spouse. Receiving spouses must include the alimony or separation payments in their income.

Are distributions from a QDRO taxable?

A QDRO distribution that is paid to a child or other dependent is taxed to the plan participant. An individual may be able to roll over tax-free all or part of a distribution from a qualified retirement plan that he or she received under a QDRO.

Is a settlement taxable income?

Settlement money and damages collected from a lawsuit are considered income, which means the IRS will generally tax that money. However, personal injury settlements are an exception (most notably: car accident settlements and slip and fall settlements are nontaxable).

What is the first financial mistake to avoid regarding divorce and taxes?

The first financial mistake to avoid regarding divorce and taxes is failing to consider the tax impact of each asset. For instance, receiving IRAs is not the same as receiving cash, especially if you will need to withdraw funds from the IRA to cover your expenses. If you hope to keep the family home, or a vacation property, ...

How does tax affect pass through?

Tax-affecting the earnings of pass-through entities can have a profound effect upon valuation of the entities. As you can imagine, taxes play an important role in valuing a business for any purpose, including divorce, because taxes can reduce the value by as much as forty percent (40%).

What happens if you request innocent spouse relief?

By requesting innocent spouse relief, a joint taxpayer could be relieved of the responsibility for paying tax, interest, and penalties if their spouse has improperly reported or omitted items on their joint tax return.

Can a stay at home spouse file joint taxes?

For example, if a stay-at-home spouse filed joint tax returns during the marriage while the moneyed spouse under-reported his or her income or made fraudulent claims, both parties may be liable for all the taxes, interest, and penalties in connection with those joint returns. This is true even if a divorce decree or judgment states that one ...

Do married people file jointly?

However, when married taxpayers file jointly, both taxpayers are jointly, as well as individually, responsible for the taxes and any interest or penalty due on the joint return, even if they later divorce.

Is alimony deductible in New York?

Alimony, which is now “ maintenance” under New York law, must comply with certain rules to be tax-deductible to the payor, and avoid any subsequent recapture disallowance.

Can one spouse be held responsible for taxes?

This is true even if a divorce decree or judgment states that one of the spouses will be responsible for any amounts due on the previously filed income tax returns. Further, one spouse may be held responsible for all of the taxes, interest, and penalties, even if all of the income was earned by the other spouse.

Who pays tax on divorce settlement?

Marital property is commonly described as property acquired by the spouses during their marriage (for example, a family home or retirement plan assets).

Why is it important to provide an extra copy of a settlement proposal?

It is beneficial to provide an extra copy for your partner during negotiations so that he or she can see what basis you are working on when making settlement proposals.

What is equitable distribution?

As a result, equitable distribution refers to a fair, but not strictly equal, division of marital assets.

What to do when you are approaching the end of your divorce?

If you’re approaching the end of your divorce, it may be a good idea to consult with your partner to get formal appraisals or estimates on the more valuable items.

Is cash traded between spouses deductible?

Cash traded between (ex)spouses as a component of a separation repayment—for instance, to adjust resources—is for the most part not available to the collector and not duty deductible to the payer.

Is spousal support taxable?

This is not to be confused with alimony, also known as spousal support, which is taxable (and deductible) unless the settlement stipulates otherwise.

Do you have to accept the divorce?

Irrespective of how you feel about it, the fact remains that you agreed to the divorce and must accept the obligations that come with it.

What is divorce tax?

Divorce is about more than just distribution of assets. It is also about planning and timing. When you take certain actions can have significant tax consequences. The sale of your residence is an important example. The IRS permits a $250,000 per person or a $500,000 per couple capital gains exclusion on the profits from the sale of a residence.

What is equitable distribution in New York?

New York state uses the doctrine of equitable distribution to determine how assets will be shared in a divorce. Property is distributed in a way that is fair but not necessarily an equal split. When property is distributed in divorce, there are significant tax ramifications that must be planned for and considered.

What is included in a divorce?

Your divorce likely includes interstate and foreign assets. The layering of other states' and countries' laws makes the case even more complex. In addition to IRS rules, the property must comply with the laws of those states or countries. The U.S. maintains tax treaties with some other countries to reduce double taxation. U.S. foreign transfer tax credits can also be useful in this situation. When foreign assets are involved in a divorce, your attorney should work with experts in those countries' laws. It may also be useful for you to engage a trusts and estates attorney to manage your assets via trusts.

What happens when you get divorced?

Your divorce judgment will distribute all of the marital property and indicate how the items are divided between each spouse. As a result of this, items that were jointly owned during the marriage must be transferred to one spouse's name. Some assets may have been held in one spouse's name but were actually marital property. If the court distributes them to the other spouse, they will also need to be transferred to the other spouse's name.

Who is responsible for income from property after divorce?

Just as the recipient spouse owns and is responsible for an increase in the basis of an asset that occurs after divorce, they also are responsible for income from the property. Once the court distributes a property, the spouse who becomes the owner becomes responsible for all taxes on any income the property produces, such as a commercial building with leases.

Is a divorce a sale?

The transfer of an asset as part of a divorce is not considered a sale in the eyes of the IRS. Therefore, the recipient of the asset takes on the transferor's adjusted tax basis in the asset. If you and your spouse have an adjusted basis of $6 million for a piece of real estate and that property is distributed to you in the divorce, your adjusted basis will be $6 million.

Why do you have to disclose assets in a divorce in New York?

In New York, each spouse must disclose to the other the amount and type of assets they have so that there can be an equitable division of those assets as part of the final divorce decree. Accurate and complete disclosures are essential to making sure there is a fair division of assets.

How does a marriage end in New York?

In New York, a marriage can end through an annulment, legal separation or a divorce. New York has been a no-fault state since 2010, meaning that a couple only need cite that a marriage is irretrievably broken to end a marriage.

Why is bifurcation not allowed in New York?

Part of the reason bifurcation is frowned upon is that it can result in two trials instead of one and it also removes any sense of urgency in resolving economic issues because incentives for settlements are removed. Couples must consider that they will have to pay court costs and attorneys’ fees for two trials instead of one when considering a bifurcation action.

What factors are considered when determining the distribution of assets in a divorce?

Some of these factors may include: the age and health of each spouse. how long the marriage lasted. the income and property each spouse brought into the marriage. whether alimony will be awarded.

How long does spousal maintenance last?

For marriages lasting 15 to 20 years, maintenance will last 30% to 40% of the length of the marriage. For marriages lasting more than 20 years, maintenance will last 35% to 50% of the length of the marriage. Courts can adjust spousal maintenance based on a number of factors. Some of those include:

What is the custody law in New York?

The order defines two types of custody in New York: legal custody and physical custody.

Can a spouse cite a spouse's at fault?

However, a spouse can also cite one of several at-fault reasons as well, such as cruelty , adultery, or a spouse’s incarceration. This is sometimes done to gain more favorable terms during a settlement.

How to protect yourself financially after divorce in New York?

One of the primary ways you may be able to do this is through alimony, either on a temporary or permanent basis.

What are the two types of alimony in New York?

There are two types of alimony in New York: temporary spousal maintenance and post-divorce spousal maintenance.

What is alimony payment?

Alimony refers to payments from one spouse to the other to provide for the support and maintenance of the supported spouse. The amount and duration can vary widely, depending on the facts and circumstances.

When do you calculate spousal support?

When you’re calculating spousal support, you always calculate spousal support before child support. The reason for this is when you calculate child support, the person paying the spousal support gets to deduct that off of his income before the child support is calculated.

What is a contribution made by the receiving spouse?

Contributions made by the receiving spouse, for example, if the spouse was a homemaker and did not receive a fixed income. Waste of property by either spouse, for example, if one spouse has wasted or lost marital funds as the result of gambling addiction, or also, say, an extramarital affair.

When does spousal support arise?

The right to spousal support arises on the day of your marriage.

Can you use a calculator for spousal support in New York?

No. The court provides a calculator, but other people post their own versions of it. You pick one and use it. I tend to use the one provided by the courts. You can go to New York State Court, and you can just search the New York spousal support calculator, and the court one will come up.

What happens if you sign a transfer deed when you divorce?

First, who owns the home? If you signed a transfer deed when you divorced and it is only in your ex's name, then you have no tax consequences from the sale. If your ex pays you $65,000 then it's not taxable to you no matter how your ex got it.

Do you have to pay capital gains tax if you sell your house?

If either you or your spouse has lived in the home for at least the last 2 years, then both of you qualify to use the capital gains exclusion even though you moved out. You can exclude the first $250,000 of capital gains each, then any higher gains are subject to capital gains tax.

Is a 401(k) taxable if you transfer assets?

However, if the asset transfer includes a tax-advantaged retirement fund like a pension, annuity, IRA or 401 (k), then the money will be taxed by the spouse when they withdraw it. Such plans are always taxable on withdrawal because the money was not taxed when it was contributed. If you receive IRA-type assets in a divorce, you may have several options on what to do with it, with different tax consequences.

Is alimony taxable in divorce?

Generally, money that is transferred between (ex)spouses as part of a divorce settlement—such as to equalize assets—is not taxable to the recipient and not deductible by the payer. This is different than alimony, also called spousal maintenance, which is taxable (and deductible) unless the settlement specifies that it is not. In some cases, a settlement might include an asset transfer and a lump sum of alimony instead of periodic payments—in that case the alimony will generally be taxable.

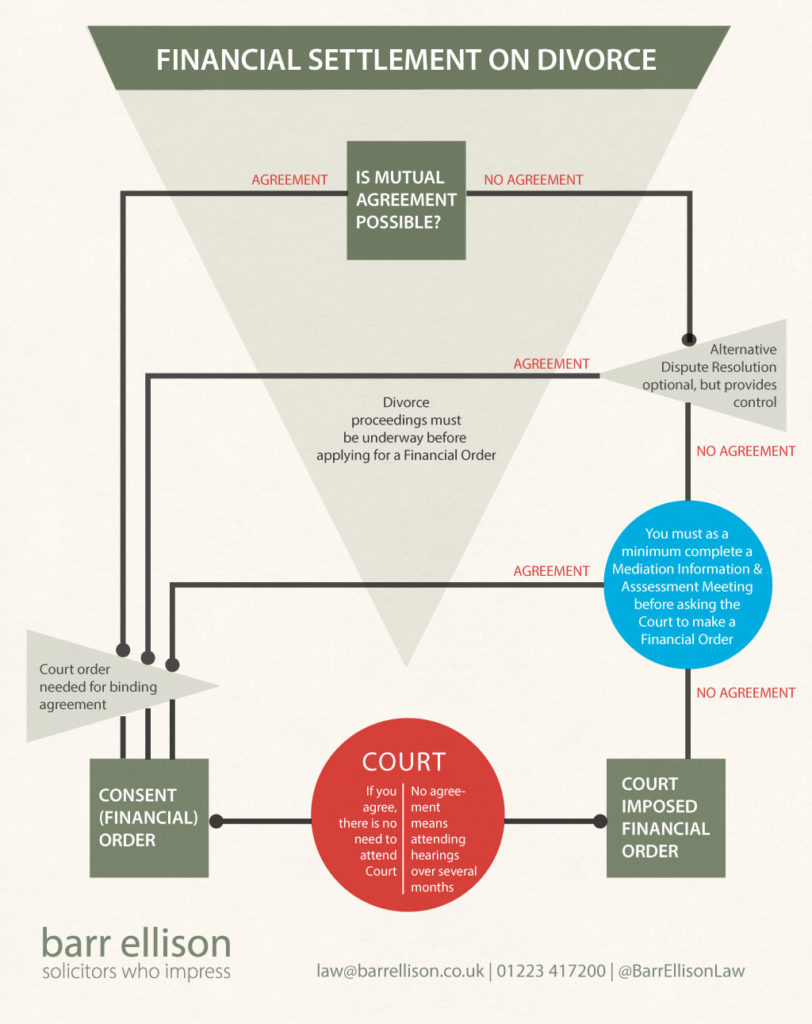

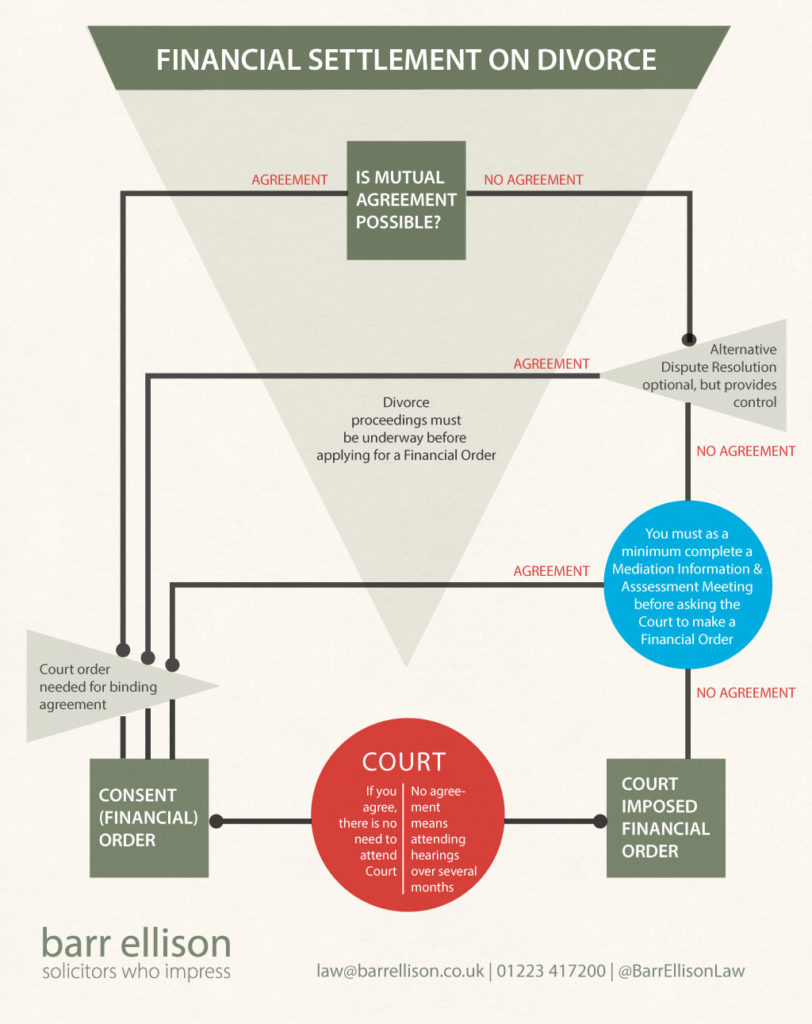

How to negotiate a property settlement with your spouse?

If you'd like to negotiate a property settlement with your spouse, you can contact a mediator or arbitrator for help before you ask the court to decide for you.

What rights do you lose in a divorce?

the need of the parent with custody to live in the family home and use or own its effects. the pension, health insurance, and inheritance rights either spouse will lose as a result of the divorce, valued as of the date of the divorce.

What Property Is Subject to Equitable Distribution?

Under New York's divorce laws, courts only divide marital property, and spouses gets to keep their separate property.

What Is Separate Property?

Instead, each spouse gets to keep their own separate property, except to the extent that the other spouse contributed to the property's increase in value. Separate property includes:

What is equitable distribution?

Equitable distribution is a method for dividing a married couple's property when they divorce. Prior to the adoption of equitable distribution in New York, New York was a "common law property" state—meaning, the court distributed the property owned by either spouse in the divorce according to who held the title.

Does a divorce in New York have to be equitably divided?

When a couple divorces in New York, judges divide property equitably, which can result in an equal property division, but not doesn't always. Instead, the basis for an equitable property division is what a judge determines is fair, considering what each spouse contributed to the marriage and what each spouse will need to move forward.

Can a divorce agreement be reached?

In most cases, divorcing couples can reach an agreement on property division that meets both spouses' needs. The courts encourage couples to work together to decide how to split assets and debts. Generally, the judge will approve a settlement agreement if it's fair to both spouses.

Divorce Laws in New York: What You Need to Know

Property Issues

- Marital Property and Division of Assets in New York

New York is an equitable division state. Unlike community property stateswhere all marital property is divided equally, in New York each spouse owns the income he or she made during a marriage. They also have the right to manage any property that is in their name alone. While this … - Debts

In New York, the courts consider any debt acquired during a marriage as the responsibility of both parties, even if it is only one party that was responsible for accruing the debt. It may be possible when settling assets for one spouse to take control of a larger part of a debt in exchange for oth…

Spousal Maintenance and Child Support

- Spousal Maintenance in New York

Laws changed in 2015 that created a presumptive formula to determine how much spousal maintenance one spouse should pay another. These amounts and time periods are presumed to be correct unless evidence can be presented to show why those variables should be changed. T… - Child Support in New York

There are several factors that impact how child support is determined in New York. Specific child support guidelines in state statutes are used to determine exact amounts, unless there are reasons to support that the amount would be unjust or inappropriate. Those reasons may includ…

Custody and Visitation

- Child Custody in New York

Most states, including New York, follow guidelines laid out in the Uniform Child Custody Jurisdiction and Enforcement Act. As part of the divorce process, a Custody Order will be issued that will dictate the responsibility for a child’s care. The order defines two types of custody in Ne… - Substance Abuse

New York is a no-fault state and you only need to state that a marriage is irretrievably broken to file for divorce. However, you can also file for divorce stating reasons for the divorce. Although substance abuse is not explicating one of the reasons that can be cited, if it can be proved that …

Process

- Bifurcation of marital status

Bifurcation means that both parties in a divorce can legally declared as a single person while the other issues in their divorce are still being worked out. It does not affect things such as child custody, visitation, child support, alimony or other contentious issues that may have stalled or b… - Disclosing Assets

In New York, each spouse must disclose to the other the amount and type of assets they have so that there can be an equitable division of those assets as part of the final divorce decree. Accurate and complete disclosures are essential to making sure there is a fair division of assets…

Other Issues

- Domestic Violence

In divorces where domestic violence is present, any divorce actions are secondary to the immediate safety of a spouse or children who may be in immediate danger. Domestic violence can include any kind of physical abuse, emotional abuse, stalking, or any other kind of harassme… - Health Insurance

When a person files for divorce in New York, an automatic order is put in place that prevents either spouse from changing insurance coverage unless they get permission from the court. After a divorce is granted, a spouse may no longer remain on the other’s health insurance plan and they …