Q: Do we have to do a HUD-1 form on a cash sale? The home is paid off and I am selling for cash. There is no lender involved. A: The answer is no. For my readers, a HUD-1 is the settlement statement that is used for most residential closings.

Full Answer

What is a HUD settlement statement?

The HUD-1 Settlement Statement is a standard government real estate form that was once used by settlement agents, also called "closing agents," to itemize all charges imposed upon a borrower and seller for a real estate transaction.

Do we have to do A HUD-1 form on a cash sale?

DEAR BENNY: Do we have to do a HUD-1 form on a cash sale? The home is paid off and I am selling for cash. There is no lender involved. –Keith DEAR KEITH: The answer is no. For my readers, a HUD-1 is the settlement statement that is used for most residential closings (called settlements or escrows in different parts of the country).

Is the HUD-1 Settlement Statement still used in 2020?

The HUD-1 settlement statement is still used in 2020 for reverse mortgages. These types of mortgages are very popular with sellers over the age of 62 who want to pull equity out of their homes. 4

Is a HUD-1 Settlement Statement required for a reverse mortgage?

Some home equity products are now exempt from using the HUD-1 settlement form, such as open-ended lines of credit. Your lender will let you know whether a HUD-1 settlement statement is involved, or if you’ll receive a Truth-in-Lending disclosure instead. A reverse mortgage is a specialized type of mortgage for homeowners that are 62 or older.

What is a HUD settlement agreement?

The HUD-1 Settlement Statement is a document that lists all charges and credits to the buyer and to the seller in a real estate settlement, or all the charges in a mortgage refinance. If you applied for a mortgage on or before October 3, 2015, or if you are applying for a reverse mortgage, you receive a HUD-1.

Is a HUD statement the same as a closing disclosure?

The Closing Disclosure combines and replaces the HUD-1 Settlement Statement and the final Truth-in-Lending (TIL) statement. The form mirrors the information provided on the Loan Estimate.

What is a HUD closing disclosure?

The Closing Disclosure (CD - formerly the HUD-1 Uniform Settlement Statement) is a three-page, government-mandated form that details the costs associated with a real estate transaction. The borrower should receive a copy of the CD at least one day prior to the closing.

What does HUD mean in real estate?

U.S. Department of Housing and Urban DevelopmentHUD Homes | HUD.gov / U.S. Department of Housing and Urban Development (HUD)

What is the HUD document in a mortgage closing?

The HUD-1 provides a picture of the monetary side of the property closing. It shows the all of the money transfers between you, as the buyer, and the home seller, and all of your closing costs, including the escrow and title fees, and the costs of your loan.

Is settlement the same as closing?

A closing is often called "settlement" because you, as buyer, along with your lender and the seller are "settling up" among yourselves and all of the other parties who have provided services or documents to the transaction.

Who prepares the HUD settlement statement?

A HUD-1 or HUD-1A Settlement Statement is prepared by a creditor or, more typically, by the settlement agent who conducts the closing on the creditor's behalf.

What is the difference between a closing statement and a closing disclosure?

A closing statement or credit agreement is provided with any type of loan, often with the application itself. A seller's Closing Disclosure is prepared by a settlement agent and lists all commissions and costs in addition to the net total to be paid to the seller.

How do I get a payoff letter from HUD?

Requests for payoff statements, subordinations, releases, and other documentation specific to these programs can be submitted to:Payoff Requests: [email protected] Requests: [email protected] Requests: [email protected] Partial Claim document submittal: [email protected] items...

Can I buy a HUD home with cash?

You can use FHA or conventional financing to purchase a HUD home. You may also purchase a property with cash.

What are the disadvantages of buying a HUD home?

List of the Cons of Buying HUD HomesSome HUD homes do not qualify for a typical mortgage. ... Money for any repairs must go into an escrow account. ... You must commit to living in a HUD home for at least one year. ... A HUD realtor is necessary to complete the purchasing process.More items...•

Is buying a HUD home a good idea?

What are "HUD homes," and are they a good deal? Answer: HUD homes can be a very good deal. When someone with a HUD insured mortgage can't meet the payments, the lender forecloses on the home; HUD pays the lender what is owed; and HUD takes ownership of the home. Then we sell it at market value as quickly as possible.

What is the difference between a closing statement and a closing disclosure?

A closing statement or credit agreement is provided with any type of loan, often with the application itself. A seller's Closing Disclosure is prepared by a settlement agent and lists all commissions and costs in addition to the net total to be paid to the seller.

Who provides the HUD statement?

settlement agentA HUD-1 or HUD-1A Settlement Statement is prepared by a creditor or, more typically, by the settlement agent who conducts the closing on the creditor's behalf.

What is a tax HUD statement?

HUD uses this information to update its records of the mortgagor's real estate taxes, the location (lot and block numbers) of the property, taxes due dates, and penalty dates. The information information can be used to verify the last taxes paid during an audit for insurance benefits.

What is a closing disclosure in Florida?

The Closing Disclosure is a five-page form that details all the important aspects of the subject mortgage loan, including purchase price, interest rate, taxes, loan fees, title fees and other closing costs and expenses.

What is a HUD-1 settlement statement?

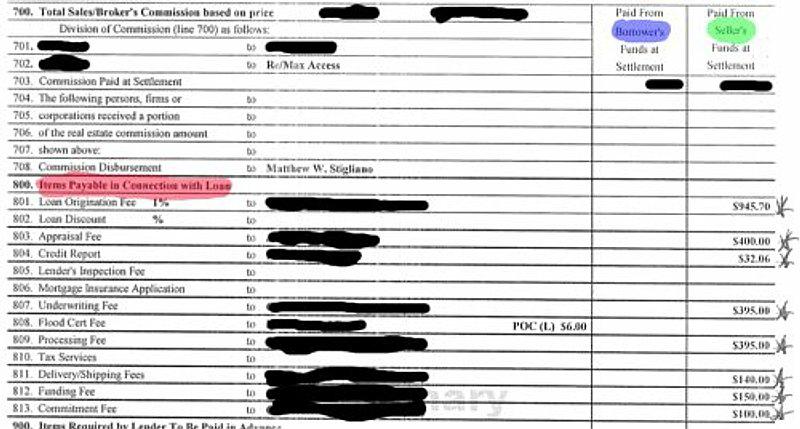

A HUD-1 settlement statement, also referred to simply as a settlement statement , details every charge associated with your new loan. It also outlines who is responsible for each of those charges — the buyer or the seller — as well as any credits you may receive for things like taxes, insurance or deposits.

What is the first page of a HUD settlement statement?

The first page of the settlement statement has a transaction overview, including the amount of cash you need to bring to closing. The sections below are highlighted so you can have an idea of what they look like on the HUD-1 settlement statement you’ll receive.

How long do you have to give a closing disclosure?

In contrast, lenders must give you a closing disclosure three days before closing. Everyone taking out a HELOC, reverse mortgage or manufactured home loan should ask their lender for the HUD-1 document at least a day before closing to allow time to review the contents, fix errors and raise questions with the lender.

How long does it take to pay down a HELOC?

You can borrow as much as you need up to your maximum loan amount, then pay it down to zero as many times as necessary during a set draw period that usually ends after 10 years.

How long does a HELOC loan last?

This revolving product has a set draw period that usually ends after 10 years. After the draw period is over, you pay the remaining balance in fixed payments until it is paid in full.

What is section 200 in mortgage?

No. 4 (Section 200): Amount paid by or on behalf of borrower. This section details any credits you receive toward costs you’ve already paid or that the seller is paying. Line 201 shows the money you’ve already paid, such as an earnest money deposit, while Line 202 reflects the principal amount of the new loan.

How many sections are there in a settlement statement?

The settlement statement lists charges in three sections. The first section shows charges that cannot change. The next section outlines charges that cannot change by more than 10%, while the final section outlines charges that may change.

What does HUD stand for?

HUD stands for the Department of Housing and Urban Development. When Congress enacted the Real Estate Settlement Procedures Act (RESPA) many years ago, it authorized HUD to prepare and implement a uniform settlement statement.

When to use HUD-1?

The HUD-1 must be used in any transaction where a federally regulated mortgage (deed of trust) is involved. In your case, because you are selling for cash, you don’t need to use that form. Inman Connect.

Can children control how their parents dispose of their real estate?

First, I have to repeat what I have been telling clients for years: Children cannot — and should not — control how their parents will dispose of their real estate, their jewels or their money.

Is it a good idea to withhold rent?

My experience tells me that it is not a good idea to withhold the rent — regardless of the reason. Judges that handle landlord-tenant cases hear all kinds of excuses — some legitimate and some wildly fictitious. Judges sometimes believe that the tenant just does not have the money and is thus fabricating an excuse not to pay.

What is a HUD-1 settlement statement?

HUD-1 settlement statement: Required by federal law, the HUD-1 is a detailed accounting of all money involved in the deal. It includes everything you will have negotiated up to this point, and more: sales price, payoff balances, pro-rated tax and utility bills, and more. You’ll want to keep this form for your taxes.

What happens when you accept a cash offer on a house?

Luckily, when you accept a cash offer on a house, the selling process is a bit simpler , there are fewer parties involved, there is a bit less paperwork, the timeline can be expedited, and the risk of the deal falling through can be lower.

What is the job of escrow company?

The escrow company is responsible for managing all closing documents, facilitating the transfer of funds, and completing the legal paperwork that records the sale. Note that sometimes the same company can handle both the title and escrow tasks.

How to sign a deed to a house?

Make sure to bring the following items with you to your signing appointment: 1 Your government-issued ID. 2 The deed, if your home is paid off. 3 House keys, garage door remotes, and codes to keyless entry and alarm systems. 4 A certified or cashier’s check to cover any outstanding costs that won’t be covered by your proceeds, like lien payments, property taxes, or prorated utilities. Your escrow company should let you know ahead of time if you’ll need to bring additional funds.

What is a title company?

A title company is responsible for making sure the property lines are drawn correctly and that there are no property liens that need to be addressed; issuing title insurance; and, on closing day, ensuring that the actual property ownership changes hands.

How long does it take to close a cash sale?

Once you’re under contract, a cash sale can close in as few as two weeks — just enough time for the title and escrow companies to clear any liens, provide insurance, and get paperwork ready (more on that later).

What is the title deed?

Title deed: The deed is the piece of paper that actually transfers ownership to the new owner.

What Is a HUD-1?

A HUD-1 form, also called a HUD-1 Settlement Statement, is a standardized mortgage lending document. Creditors or their closing agents use this form to create an itemized list of all charges and credits to the buyer and to the seller in a consumer credit mortgage transaction. A HUD-1 form is most commonly used for reverse mortgages and mortgage refinance transactions.

When did HUD 1 replace HUD 1?

As of October 3, 2015, the Closing Disclosure form replaced the HUD-1 form for most real estate transactions. However, if you applied for a mortgage on or before October 3, 2015, you received a HUD-1. In transactions that do not include a seller, such as a refinance loan, the settlement agent may use the shortened HUD-1A form.

What is the closing disclosure form?

Now, for most kinds of mortgage loans, borrowers receive a form called the Closing Disclosure instead of a HUD-1 form. Either form must be reviewed by the borrower before the closing, in order to prevent errors or any unplanned for expenses.

What form does a settlement agent use for a refinance?

In transactions that do not include a seller, such as a refinance loan, the settlement agent may use the shortened HUD-1A form. Now, for most kinds of mortgage loans, borrowers receive a form called the Closing Disclosure instead of a HUD-1 form.

How many days before closing do you have to provide a mortgage disclosure?

Borrowers must be provided with the disclosure three days before closing. This five-page form includes finalized figures for all closing fees and costs to the borrower, as well as the loan terms, the projected monthly mortgage payments, and closing costs. Mortgage lending discrimination is illegal.

Why do you need to review both mortgages before closing?

Both must be reviewed by the borrower before the closing in order to prevent errors or surprises.

How long does it take to file a HUD loan?

One such step is to file a report to the Consumer Financial Protection Bureau or with the U.S. Department of Housing and Urban Development (HUD). The three days are meant to allow the borrower to ask the lender questions and clear up any discrepancies or misunderstandings regarding costs before closing.