The short answer: Yes, debt settlement is worth it if all of your debt is with a single creditor, and you're able to offer a lump sum of money to settle your debt. If you're carrying a high credit card balance or a lot of debt, a settlement offer may be the right option for you. What happens if you pay a settlement offer?

Are debt settlement offers too good to be true?

These problems include higher taxes, a big hit to your credit score for years, and having to come up with the money to pay the debt off in a lump sum. For many people, the promises of debt settlement offers really are too good to be true. Is it a Good Idea? How Does it Affect Your Credit?

How does debt settlement work with credit card companies?

Instead of paying your credit card issuer, you pay the debt settlement company directly an agreed-upon amount each month and the company pays your creditor after reaching a settlement agreement. This strategy isn’t for everyone. It can get expensive, and your credit score could hit rock bottom.

Can I stop paying my creditors to settle my debt?

Some debt settlement companies may insist you use an intermediary, when in fact you can contact a creditor yourself to settle. Some of these companies advise people to stop paying on active accounts and to stop speaking with their creditors. Withholding payments to save up for a settlement can lead to interest and penalties.

Is a settlement better for my credit score than bankruptcy?

While a settlement is better for a credit score than having an account reported as unpaid, it’s almost as bad as having a bankruptcy. Many debt relief companies want you to stop making monthly payments while they negotiate.

Is it better to take a settlement or pay in full?

Generally speaking, having a debt listed as paid in full on your credit reports sends a more positive signal to lenders than having one or more debts listed as settled. Payment history accounts for 35% of your FICO credit score, so the fewer negative marks you have—such as late payments or settled debts—the better.

Does paying off a settlement hurt your credit?

Debt settlement can negatively impact your credit score, but it won't hurt you as much as not paying at all. You can rebuild your credit by making all payments on time going forward and limiting balances on revolving accounts.

How many points does a settlement affect credit score?

Debt settlement practices can knock down your credit score by 100 points or more, according to the National Foundation for Credit Counseling. And that black mark can linger for up to seven years.

What percentage of my debt should I offer to settle?

When you're negotiating with a creditor, try to settle your debt for 50% or less, which is a realistic goal based on creditors' history with debt settlement. If you owe $3,000, shoot for a settlement of up to $1,500.

What is a reasonable full and final settlement offer?

It depends on what you can afford, but you should offer equal amounts to each creditor as a full and final settlement. For example, if the lump sum you have is 75% of your total debt, you should offer each creditor 75% of the amount you owe them.

Can I get loan after settlement?

The bank or lender takes a look at the borrower's CIBIL score before offering him a loan and if the past record shows any settlement or non-payment, his loan is likely to get rejected.

How do I get a settled account off my credit report?

Review Your Debt Settlement OptionsDispute Any Inconsistencies to a Credit Bureau.Send a Goodwill Letter to the Lender.Wait for the Settled Account to Drop Off.

How do I raise my credit score after a settlement?

How to Improve CIBIL Score After Loan Settlement?Build a Good Credit Repayment History. ... Clear off Pending Dues. ... Manage Credit Cards Better. ... Apply for a Secured Card. ... Credit Utilisation. ... Do Not Raise Frequent Loan Queries. ... Apply for a Secured Credit.

How long does it take to rebuild credit after debt settlement?

Your credit score will usually take between 6 and 24 months to improve. It depends on how poor your credit score is after debt settlement. Some individuals have testified that their application for a mortgage was approved after three months of debt settlement.

Will debt collectors settle for 30%?

Lenders typically agree to a debt settlement of between 30% and 80%. Several factors may influence this amount, such as the debt holder's financial situation and available cash on hand.

Can I pay original creditor instead of collection agency?

Working with the original creditor, rather than dealing with debt collectors, can be beneficial. Often, the original creditor will offer a more reasonable payment option, reduce the balance on your original loan or even stop interest from accruing on the loan balance altogether.

Why do debt collectors offer discounts?

Why is that? Because the collection agency bought the original debt from your creditor, most likely for a substantial discount. That means they don't have to recover the entire amount to make a profit. By proposing a settlement, you can pay off the debt quickly, usually for less than the original amount.

How do I raise my credit score after a settlement?

How to Improve CIBIL Score After Loan Settlement?Build a Good Credit Repayment History. ... Clear off Pending Dues. ... Manage Credit Cards Better. ... Apply for a Secured Card. ... Credit Utilisation. ... Do Not Raise Frequent Loan Queries. ... Apply for a Secured Credit.

How long does it take to rebuild credit after debt settlement?

Your credit score will usually take between 6 and 24 months to improve. It depends on how poor your credit score is after debt settlement. Some individuals have testified that their application for a mortgage was approved after three months of debt settlement.

How long does a settled account stay on your credit report?

seven yearsA settled account remains on your credit report for seven years from its original delinquency date. If you settled the debt five years ago, there's almost certainly some time remaining before the seven-year period is reached. Your credit report represents the history of how you've managed your accounts.

Should I pay a 5 year old collection?

If you have a collection account that's less than seven years old, you should still pay it off if it's within the statute of limitations. First, a creditor can bring legal action against you, including garnishing your salary or your bank account, at least until the statute of limitations expires.

How much should a defendant offer for a settlement?

If the fault of all parties involved, including you as the plaintiff, is estimated to be around 80%, the defendant should offer you about 80% of damages for your settlement. You’ll also have to think about the fairness of your compensation based on the court jurisdiction your case is in.

What to do before accepting a settlement offer?

When it comes to severe injury cases, it’s best to get in touch with a lawyer before accepting a settlement offer from the defendant. You may want to schedule a free consultation with an experienced attorney to ask any questions you have about your case and get an accurate idea of what you can expect in your settlement.

What happens if you settle a personal injury case with multiple parties?

If your case involves several parties, your settlement offer has to account for the fault of everyone connected to your accident.

How do you determine if a settlement is good?

Some people determine a good settlement based on whether or not both parties come away from the situation satisfied. This often means that the person at fault paid more than they desired, and the settlement wasn’t as much as the plaintiff wanted. There are several factors to consider when you’re considering accepting a settlement. If you can get pretty close to the value of the case in your settlement, you can assume that your settlement is acceptable.

What happens if a plaintiff is desperate for the money to pay for medical bills and maintain household bills due to time?

If the plaintiff is desperate for the money to pay for medical bills and maintain household bills due to time off work , the defendant will offer a lower settlement, and the plaintiff is likely to take it.

What to consider when accepting a settlement?

One of the most important things you and your lawyer should consider is the possibility of prevailing when it comes to liability.

Do settlement offers take judicial interest into account?

Many settlement offers won’t take judicial interest into account. Judicial interest is given to you if you’re the plaintiff and you win your trial. If your case is older, judicial interest can be significant.

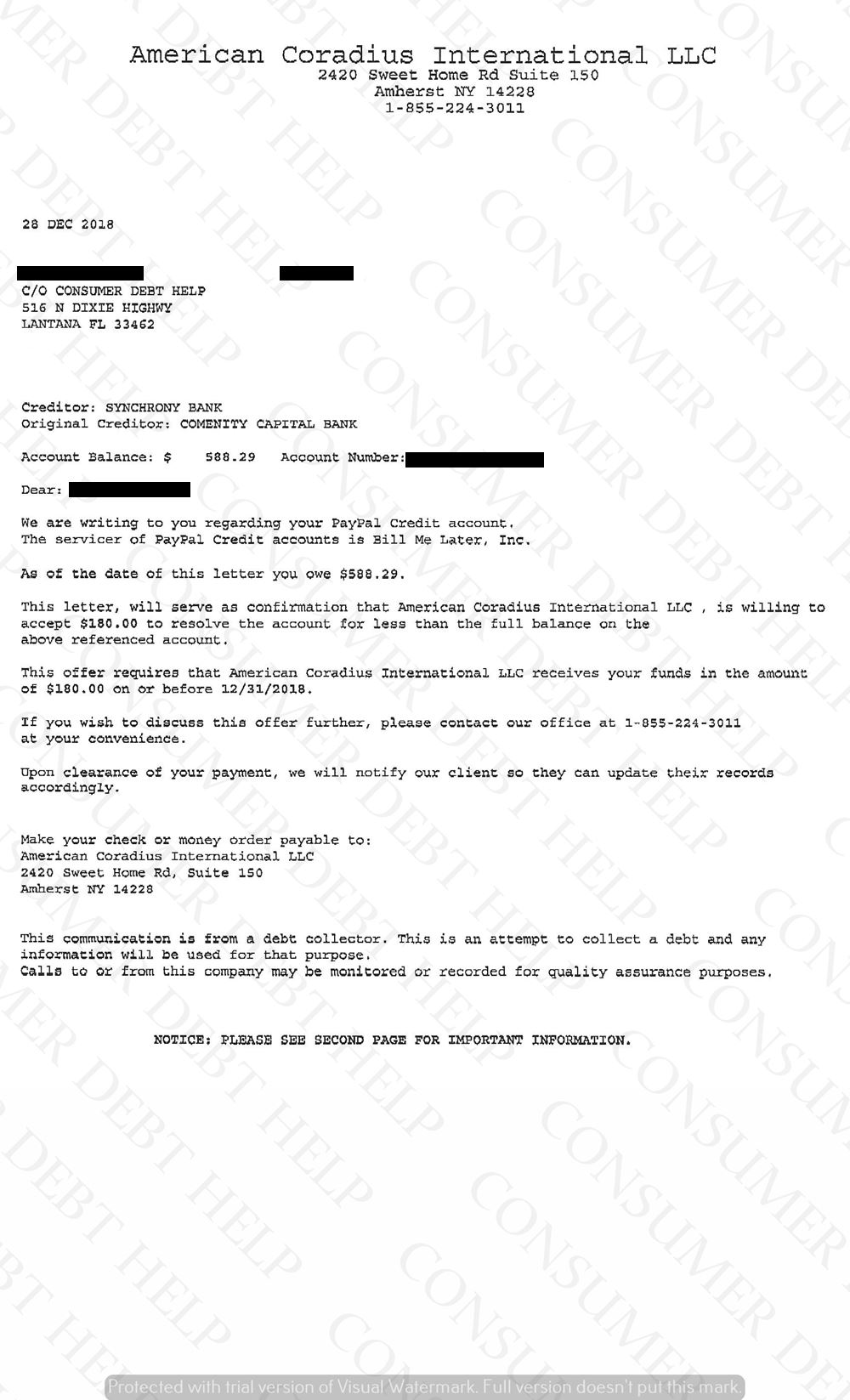

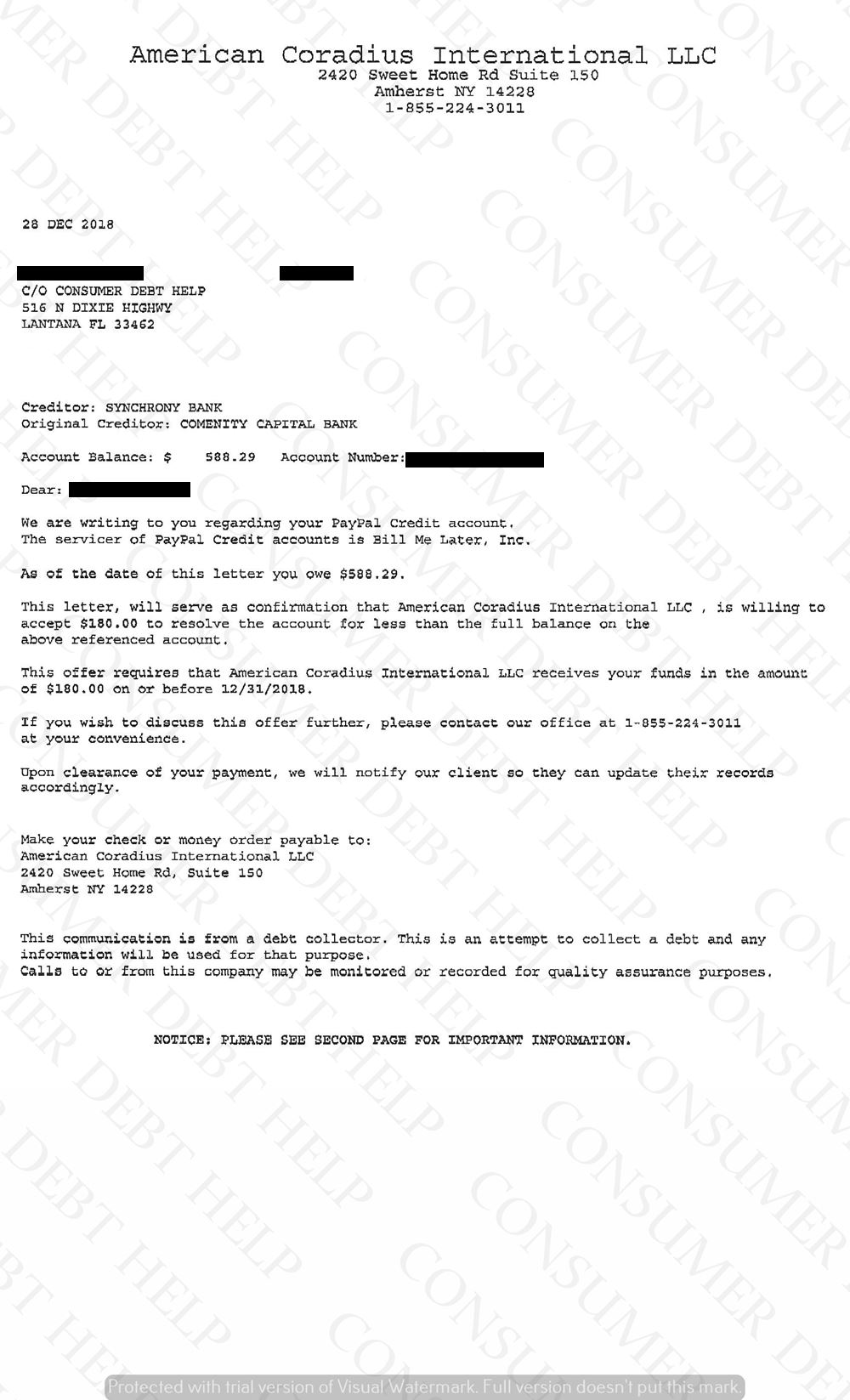

What is debt settlement?

In a nutshell, debt settlement is the process of negotiating with creditors to be able to pay a lump sum that’s less than the full amount of debt you owe. This practice is usually offered by third-party debt settlement companies who work to negotiate with creditors on your behalf. Also known as debt reduction, or debt resolution, settlement negotiations often result in creditors agreeing to forgive a large part of the debt, allowing a debtor to make a single payment for less than the full balance owed.

Can you erase debt with a debt settlement company?

If you are receiving non-stop call s from debt collectors or collection agencies, working with a debt settlement company will allow you to erase your debt for a low-cost single-time payment .

Can you pay a lump sum to a creditor?

Unlike debt consolidation, with the help of a reliable debt settlement company you can pay a lump sum to a creditor through a straightforward process that will alleviate debt.

Does settlement affect credit?

Settling an account instead of paying it in full can be considered negative and may affect short term credit history because the agreed-upon lump sum amount will cause the creditor to accept a loss compared to what was owed. How much debt settlement will affect your credit score will vary depending on your own personal situation, however being debt free may be worth damaging your credit score to achieve long-term financial health.

Is it worth it to settle debt?

Settling a debt is worth it and can help people out of debt at a cost that is less than what owe a creditor. Here are the three key reasons why debt settlement is a good idea and when to pursue this option:

Is Debt Settlement a Good Idea?

Ultimately, depending on your own personal finance situation debt settlement can be worth it, but it’s important to keep in mind that the debt settlement process can take time. Finding the right company to assist you through the process will be key to resolving your debt issues rapidly and effectively so that you can start building a path to wealth today.