How Legal Fees are Taxed in Lawsuit Settlements In most cases, if you are the plaintiff and you hire a contingent fee lawyer, you'll be taxed as receiving 100% of the money recovered by you and your attorney, even if the defendant pays your lawyer directly his contingent fee cut.

Are lawsuit settlements considered taxable?

There can be a possibility that there is more than one type of damage claim that may arise from an injury. Some may be taxable while others are not. Lawsuit settlements are generally considered taxable income by the IRS. However, not all settlement payments are taxed the same way.

Will I have to pay tax on my settlement?

You will have to pay your attorney’s fees and any court costs in most cases, on top of using the settlement to pay for your medical bills, lost wages, and other damages. Finding out you also have to pay taxes on your settlement could really make the glow of victory dim. Luckily, personal injury settlements are largely tax-free.

Are court awards and settlement proceeds taxable?

Under this doctrine, if a settlement or award payment represents damages for lost profits, it is generally taxable as ordinary income. Similarly, a settlement or award payment received from an employer for lost wages and damages would likewise generally be ordinary income.

Do you pay taxes on legal settlements?

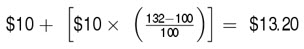

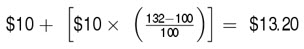

Unfortunately, you'll get taxed on the full amount of the settlement — not just the 60% you got to keep. Of course, that only applies if your settlement is taxable in the first place. To see how lawyers’ fees actually impact settlement taxation, let’s take a look at some examples. For tax-free settlements

What is a declaration from a plaintiff?

Is a wage a part of a 1099?

Is emotional distress taxable?

Do IRS see settlement income?

Was the settlement agreement in Parkinson's case specific?

Is a lawsuit settlement taxable?

Does a settlement agreement bind the IRS?

See 4 more

About this website

Is money from a legal settlement taxable?

Settlement money and damages collected from a lawsuit are considered income, which means the IRS will generally tax that money. However, personal injury settlements are an exception (most notably: car accident settlements and slip and fall settlements are nontaxable).

What part of a settlement is taxable?

Punitive damages and interest are always taxable. You might receive a tax-free settlement or judgment, but pre-judgment or post-judgment interest is always taxable (and can produce attorney fee problems).

How is money from a settlement taxed?

Settlements for automobile and property damages are not taxable, but there are exceptions. Like medical expenses, the IRS and the State of California consider these damages as reimbursement for a car or home previously paid.

Do you get a 1099 for a legal settlement?

If your legal settlement represents tax-free proceeds, like for physical injury, then you won't get a 1099: that money isn't taxable. There is one exception for taxable settlements too. If all or part of your settlement was for back wages from a W-2 job, then you wouldn't get a 1099-MISC for that portion.

Can the IRS take my settlement money?

If you have back taxes, yes—the IRS MIGHT take a portion of your personal injury settlement. If the IRS already has a lien on your personal property, it could potentially take your settlement as payment for your unpaid taxes behind that federal tax lien if you deposit the compensation into your bank account.

Is a lump sum payment in a divorce settlement taxable?

Generally, lump-sum divorce settlements are not taxable for the recipient. If the lump-sum payment is an alimony payment, it is not deductible for the person who makes the payment and is not considered income for the recipient.

How can you avoid paying taxes on a large sum of money?

6 ways to cut your income taxes after a windfallCreate a pension. Don't be discouraged by the paltry IRA or 401(k) contribution limits. ... Create a captive insurance company. ... Use a charitable limited liability company. ... Use a charitable lead annuity trust. ... Take advantage of tax benefits to farmers. ... Buy commercial property.

Do I have to report personal injury settlement to IRS?

The compensation you receive for your physical pain and suffering arising from your physical injuries is not considered to be taxable and does not need to be reported to the IRS or the State of California.

Are all legal fees 1099 reportable?

Attorneys' fees of $600 or more paid in the course of your trade or business are reportable in box 1 of Form 1099-NEC, under section 6041A(a)(1).

Do employers have to pay legal fees for settlement agreements?

Often your employer pays your legal costs in full The proposed settlement agreement probably contains a clause confirming that your employer will make a contribution towards your legal costs. This contribution may cover your fee in full, in which case there's no charge to you personally.

Why is a W 9 required for settlement?

The Form W-9 is a means to ensure that the payee of the settlement is reporting its full income. Attorneys are frequently asked to supply their own Taxpayer Identification Numbers and other information to the liability carrier paying a settlement.

Do I have to report personal injury settlement to IRS?

The compensation you receive for your physical pain and suffering arising from your physical injuries is not considered to be taxable and does not need to be reported to the IRS or the State of California.

Are compensatory and punitive damages taxable?

In California & New York, punitive damages can be subject to taxation by both the state and the IRS. Because punitive damages are taxable and compensatory damages are not, it's critical to be meticulous in distinguishing each classification of damages that you're awarded in a personal injury claim.

Why is a W 9 required for settlement?

The Form W-9 is a means to ensure that the payee of the settlement is reporting its full income. Attorneys are frequently asked to supply their own Taxpayer Identification Numbers and other information to the liability carrier paying a settlement.

New Tax On Lawsuit Settlements -- Legal Fees Can't Be Deducted - Forbes

New tax laws make many legal settlements 100% taxable--even the portion paid to contingent fee lawyers that now can no longer be deducted.

IRS Form 1099 Rules for Settlements and Legal Fees

IRS Forms 1099 match income and Social Security numbers. Lawyers receive and send more Forms 1099 than most people, in part due to tax laws that single them out. The tax code requires companies making payments to attorneys to report the payments to the IRS on a Form 1099.

Taxing Settlements and Judgments – Are Attorneys’ fees paid ...

Are attorneys’ fees paid from a settlement included in the gross income to the plaintiff – are they “above-the-line deduction”, merely listed as itemized deductions, “below-the-line deduction” where they may be disregarded in an alternative minimum tax analysis, or not deductible at all?

12 Ways to Deduct Legal Fees Under New Tax Laws - 10/17/19 - Wood LLP

TAX NOTES FEDERAL, OCTOBER 7, 2019 111 tax notes federal WOODCRAFT 12 Ways to Deduct Legal Fees Under New Tax Laws by Robert W. Wood You are a plaintiff in a lawsuit and just settled

Tax Implications of Settlements and Judgments

IRC Section 104 provides an exclusion from taxable income with respect to lawsuits, settlements and awards. However, the facts and circumstances surrounding each settlement payment must be considered.

Why should settlement agreements be taxed?

Because different types of settlements are taxed differently, your settlement agreement should designate how the proceeds should be taxed—whether as amounts paid as wages, other damages, or attorney fees.

How much is a 1099 settlement?

What You Need to Know. Are Legal Settlements 1099 Reportable? What You Need to Know. In 2019, the average legal settlement was $27.4 million, according to the National Law Review, with 57% of all lawsuits settling for between $5 million and $25 million.

How much money did the IRS settle in 2019?

In 2019, the average legal settlement was $27.4 million, according to the National Law Review, with 57% of all lawsuits settling for between $5 million and $25 million. However, many plaintiffs are surprised after they win or settle a case that their proceeds may be reportable for taxes. The Internal Revenue Service (IRS) simply won't let you collect a large amount of money without sharing that information (and proceeds to a degree) with the agency.

What is compensatory damages?

For example, in a car accident case where you sustained physical injuries, you may receive a settlement for your physical injuries, often called compensatory damages, and you may receive punitive damages if the other party's behavior and actions warrant such an award. Although the compensatory damages are tax-free, ...

What happens if you get paid with contingent fee?

If your attorney or law firm was paid with a contingent fee in pursuing your legal settlement check or performing legal services, you will be treated as receiving the total amount of the proceeds, even if a portion of the settlement is paid to your attorney.

Do you have to pay taxes on a 1099 settlement?

Where many plaintiff's 1099 attorneys now take up to 40% of the settlement in legal fees, the full amount of the settlement may need to be reported to the IRS on your income tax. And in some cases, you'll need to pay taxes on those proceeds as well. Let's look at the reporting and taxability rules regarding legal settlements in more detail as ...

Is money from a lawsuit taxed?

Taxation on settlements primarily depends upon the origin of the claim. The IRS states that the money received in a lawsuit should be taxed as if paid initially to you. For example, if you sue for back wages or lost profits, that money will typically be taxed as ordinary income. If you receive a settlement allocations for bodily personal physical ...

What is the tax rule for settlements?

Tax Implications of Settlements and Judgments. The general rule of taxability for amounts received from settlement of lawsuits and other legal remedies is Internal Revenue Code (IRC) Section 61 that states all income is taxable from whatever source derived, unless exempted by another section of the code. IRC Section 104 provides an exclusion ...

What is the exception to gross income?

For damages, the two most common exceptions are amounts paid for certain discrimination claims and amounts paid on account of physical injury.

What is employment related lawsuit?

Employment-related lawsuits may arise from wrongful discharge or failure to honor contract obligations. Damages received to compensate for economic loss, for example lost wages, business income and benefits, are not excludable form gross income unless a personal physical injury caused such loss.

Is emotional distress excludable from gross income?

96-65 - Under current Section 104 (a) (2) of the Code, back pay and damages for emotional distress received to satisfy a claim for disparate treatment employment discrimination under Title VII of the 1964 Civil Rights Act are not excludable from gross income . Under former Section 104 (a) (2), back pay received to satisfy such a claim was not excludable from gross income, but damages received for emotional distress are excludable. Rev. Rul. 72-342, 84-92, and 93-88 obsoleted. Notice 95-45 superseded. Rev. Proc. 96-3 modified.

Is a settlement agreement taxable?

In some cases, a tax provision in the settlement agreement characterizing the payment can result in their exclusion from taxable income. The IRS is reluctant to override the intent of the parties. If the settlement agreement is silent as to whether the damages are taxable, the IRS will look to the intent of the payor to characterize the payments and determine the Form 1099 reporting requirements.

Is emotional distress taxable?

Damages received for non-physical injury such as emotional distress, defamation and humiliation, although generally includable in gross income, are not subject to Federal employment taxes. Emotional distress recovery must be on account of (attributed to) personal physical injuries or sickness unless the amount is for reimbursement ...

Does gross income include damages?

IRC Section 104 explains that gross income does not include damages received on account of personal physical injuries and physical injuries.

Are Legal Settlements Taxable? Tax Implications of Settlements and Judgments

Ryan McInnis founded Picnic Tax after working for more than a decade at some of the financial services industry's leading firms. Picnic's goal is to make tax filing simpler and painless for everyday Americans.

Do you Have to Pay Taxes on a Lawsuit Settlement?

If you read our blog regularly, you probably already know the answer to this question: It depends. The intricacies of the tax law mean it is a rare occasion that we can answer a question with a simple yes or no, and lawsuit settlements are no different.

Physical Injuries and Sickness vs Emotional Distress

The tax treatment of settlements received for sickness or injury depends on how you handled your medical expenses. If you did not deduct any medical expenses related to your physical injury on previous tax returns, the settlement money you receive is not taxable. The IRS won’t allow you to double-dip, however.

Punitive Damages and Interest

The compensation you receive for punitive damages is always taxable income. So what are punitive damages exactly? Punitive damages are monies the judge awards you in order to punish the party who caused you injury. Again, an example is helpful. Let’s return to our previous car accident example.

Lost Wages or Lost Profits

Lost wages and lost profit essentially refer to the same thing. Lost wages are meant to compensate you for any wages you lost due to another’s negligence. This money is lost wages when you work for a traditional employer and lost profits if you work for yourself.

Loss-in-Value of Property

This one gets a little tricky. Whether or not you pay tax on a settlement resulting from a loss of property value depends on the amount of the settlement as compared to your basis in the property. If the settlement is worth less than the property, the settlement isn’t taxable but it reduces your cost basis.

Getting Taxed on Attorney Fees

When dealing with legal settlement taxation, it’s imperative to understand that you do not get a break on your legal fees. In the 2005 case of Commissioner v. Banks, the United States Supreme Court ruled (perhaps unfairly) that the IRS can tax all of a legal settlement even if you don’t receive it all due to legal fees.

What are some examples of settlements facing 100% tax?

Examples of settlements facing tax on 100% include recoveries: From a website for invasion of privacy or defamation; From a stock broker or financial adviser for bad investment advice, unless you can capitalize your legal fees; From your ex-spouse for claims related to your divorce or children; From a neighbor for trespassing, encroachment, etc;

What is the new tax law?

The new tax law wiped away miscella neous itemized deductions and deductions for investment expenses. But part of the tax problem is historical. In 2005, the U.S. Supreme Court held that plaintiffs must generally recognize gross income equal to 100% of their recoveries. even if their lawyers take a share.

Do you pay taxes on a lawsuit settlement?

Many plaintiffs will face higher taxes on lawsuit settlements under the recently passed tax reform law. Some will be taxed on their gross recoveries, with no deduction for attorney fees even if their lawyer takes 40% off the top. In a $100,000 case, that means paying tax on $100,000, even if $40,000 goes to the lawyer. The new law should generally not impact qualified personal physical injury cases, where the entire recovery is tax free. It also should generally not impact plaintiffs who bring claims against their employers. They are still allowed an above the line deduction for legal fees (although there are new wrinkles in sexual harassment cases).

Can you deduct legal fees on taxes?

For many, no tax deduction for legal fees will come as a bizarre and unpleasant surprise after the fact. Plaintiffs who have some advance warning and advice may go to new lengths to try to avoid the lawyer's share being income to them, or to somehow deduct it.

Can you deduct legal fees after Harvey Weinstein?

But even plaintiffs may have to worry about tax write-offs in sexual harassment cases after Harvey Weinstein. Up until now, even if you did not qualify to deduct your legal fees above the line, you could deduct them below the line.

Do you have to file a 1099 for a lawsuit?

IRS Form 1099 regulations generally require defendants to issue a Form 1099 to the plaintiff for the full settlement, even if part of the money is paid to the plaintiff’s lawyer. One possible way of deducting legal fees could be a business expense if the plaintiff is in business, and the lawsuit relates to it.

Do you pay taxes on a whistleblower claim?

Fortunately, Congress enacted an above the line deduction for employment claims and certain whistleblower claims. For employment and some whistleblower claims, this deduction remains in the law, so those claimants will pay tax only on their net recoveries.

How does Larry Lawyer earn a contingent fee?

Example 1: Larry Lawyer earns a contingent fee by helping Cathy Client sue her bank. The settlement check is payable jointly to Larry and Cathy. If the bank doesn’t know the Larry/Cathy split, it must issue two Forms 1099 to both Larry and Cathy, each for the full amount. When Larry cuts Cathy a check for her share, he need not issue a form.

What if the lawyer is beyond merely receiving the money and dividing the lawyer’s and client’s shares?

What if the lawyer is beyond merely receiving the money and dividing the lawyer’s and client’s shares? Under IRS regulations, if lawyers take on too big a role and exercise management and oversight of client monies, they become “payors” and as such are required to issue Forms 1099 when they disburse funds.

Why do lawyers send 1099s?

Copies go to state tax authorities, which are useful in collecting state tax revenues. Lawyers receive and send more Forms 1099 than most people, in part due to tax laws that single them out. Lawyers make good audit subjects because they often handle client funds. They also tend to have significant income.

What is the exception to the IRS 1099 rule?

Payments made to a corporation for services are generally exempt; however, an exception applies to payments for legal services. Put another way, the rule that payments to lawyers must be the subject of a Form 1099 trumps the rule that payments to corporation need not be. Thus, any payment for services of $600 or more to a lawyer or law firm must be the subject of a Form 1099, and it does not matter if the law firm is a corporation, LLC, LLP, or general partnership, nor does it matter how large or small the law firm may be. A lawyer or law firm paying fees to co-counsel or a referral fee to a lawyer must issue a Form 1099 regardless of how the lawyer or law firm is organized. Plus, any client paying a law firm more than $600 in a year as part of the client’s business must issue a Form 1099. Forms 1099 are generally issued in January of the year after payment. In general, they must be dispatched to the taxpayer and IRS by the last day of January.

When do you get a 1099 from a law firm?

Forms 1099 are generally issued in January of the year after payment. In general, they must be dispatched to the taxpayer and IRS by the last day of January.

How much is the penalty for not filing 1099?

Most penalties for nonintentional failures to file are modest—as small as $270 per form . This penalty for failure to file Forms 1099 is aimed primarily at large-scale failures, such as where a bank fails to issue thousands of the forms to account holders; however, law firms should be careful about these rules, too.

Is a 1099 required for Joe's fees?

No Form 1099 is required because this was Joe’s money. Big Law also agrees to refund $60,000 of the monies Joe paid for fees over the last three years. Big Law is required to issue a Form 1099 for the $60,000 payment.

What are above the line deductions in a settlement?

Attorneys – wherever possible in settlements identify settlement proceeds in categories that are “above-the-line” deductions from gross income, discrimination, civil rights and/or whistle-blower claims. Where a compromise is reached, compromise punitive damages and interest first.

Did the Supreme Court decide the impact of the fee shifting statutes?

Additionally, in the Banks case, the Supreme Court did not decide the impact of the fee shifting statutes, because the legal fees were paid based upon the contingency fee without regard to the fee shifting provisions of the civil rights statute and the amendments to the tax laws for future cases prevent a perverse result. The court stated,

Can attorney fees exceed monetary recovery?

Sometimes, as when the plaintiff seeks only injunctive relief, or when the statute caps plaintiffs’ recoveries, or when for other reasons damages are substantially less than attorney’s fees, court-awarded attorney’s fees can exceed a plaintiff’s monetary recovery. See, e. g., Riverside v.

Is a contingent fee income?

In 2005, the U.S. Supreme Court held that the portion of a money judgment or settlement paid to a plaintiff’s attorney under a contingent-fee agreement is income to the plaintiff under the Internal Revenue Code, 26 U.S.C. § 1 et seq. (2000 ed. and Supp. I [26 USCS §§ 1 et seq.]. Commissioner v. Banks, 543 U.S. 426, 429, 125 S. Ct. 826, 828 (2005).

Is attorney fees deductible as capital expense?

C. §§ 702, 704, and 761, Brief for Respondent in No. 03-907, pp. 5-21; (2) litigation recoveries are proceeds from disposition of property, so the attorney’s fee should be subtracted as a capital expense pursuant to §§ 1001, 1012, and 1016, Brief for Association of Trial Lawyers of America as Amicus Curiae 23-28, Brief for Charles Davenport as Amicus Curiae 3-13; and (3) the fees are deductible reimbursed employee business expenses under § 62 (a) (2) (A) (2000 ed. and Supp. I), Brief for Stephen B. Cohen as Amicus Curiae. These arguments, it appears, are being presented for the first time to this Court. We are especially reluctant to entertain novel propositions of law with broad implications for the tax system that were not advanced in earlier stages of the litigation and not examined by the Courts of Appeals. We decline comment on these supplementary theories. In addition, we do not reach the instance where a relator pursues a claim on behalf of the United States. Brief for Taxpayers Against Fraud Education Fund as Amicus Curiae 10-20.

What is damages intended to compensate the taxpayer for a loss?

Damages intended to compensate the taxpayer for a loss, i.e., payment to compensate the injured party for the injury sustained, and nothing more. This loss may be purely economic, for example, arising out of a contract, or personal, for example, sustained by virtue of a physical injury.

What is a lawsuit against insurance companies?

Lawsuits against insurance companies, finance companies, etc., for negligence, fraud, breach of contract, etc., can include a variety of claims, and therefore can produce a variety of types of awards/settlements.

Why is AMT considered a tax preference item?

AMT must be considered because of the allowance of the miscellaneous itemized deduction. AMT usually becomes due when there is a large amount of miscellaneous itemized deductions. Miscellaneous itemized deductions subject to the 2-percent AGI limitation are a tax preference item for alternative minimum tax purposes.

What is employment related lawsuit?

Employment-related lawsuits may arise from wrongful discharge or failure to honor contract obligations. Damages received to compensate for economic loss, for example, lost wages, business income, and benefits, are not excludable from gross income unless a personal physical injury caused such loss

When was the IRC 104(a)(2) amended?

Prior to the 1996 amendment, § 104(a)(2) did not include the word “physical” with regard to “personal injuries or sickness.” As a result, many taxpayers were allowed to exclude income received prior to the amendment‟s August 21, 1996 effective date on account of non-physical injuries and sickness. When reviewing litigation on this issue, examiners should consider the date in which the settlement was received before relying on specific case law for their position.

Can you find a settlement on a 1099?

You may have discovered a lawsuit award or settlement while performing a bank deposit analysis, in your Accurint report, through the 1099 MISC, as a related return pick up from the examination of an attorney or in the interview. Based on the facts and circumstances as well as how the award/settlement was reflected on the return, you may have an issue.

Can you deduct attorneys fees?

Generally, individuals, as cash basis taxpayers, may deduct attorneys‟ fees in the year they are paid, assuming the attorneys‟ fees otherwise qualify as deductible. In the majority of such cases, the attorneys‟ fees are paid pursuant to a contingent fee arrangement once damages have been recovered. Where the ultimate recovery is excludable from gross income, either in whole or in part, the payment of contingent attorneys‟ fees allocable to exempt income are not deductible. IRC § 265(a)(1). The question of the timing and deductibility of attorneys‟ fees paid prior to resolution of the lawsuit on a noncontingent fee basis requires additional analysis that is not practical to provide in this guide. Examiners should consult with the appropriate Technical Advisor.

What is a declaration from a plaintiff?

A declaration from the plaintiff will help for the file. A declaration from a treating physician or an expert physician is appropriate, as is one from the plaintiff’s attorney. Prepare what you can at the time of settlement or, at the latest, at tax return time. Do as much as you can contemporaneously.

Is a wage a part of a 1099?

Nearly every employment case has a wage component. In most employment settlements, employer and employee agree on a wage figure subject to withholding, and the balance goes on a Form 1099. Sometimes, there can be a tax-free portion too. Exactly what is "physical" isn’t so clear, and some of it seems like semantics.

Is emotional distress taxable?

If emotional distress causes you to be physically sick, that is taxable. The order of events and how you describe them matters to the IRS. If you are physically sick or physically injured, and your sickness or injury produces emotional distress, those emotional distress damages should be tax free.

Do IRS see settlement income?

Of course, the IRS is likely to view everything as income unless you can prove otherwise. But there’s another reason to be explicit, so each client knows that to expect. That is, try to be explicit in the settlement agreement about tax forms too. If you are the plaintiff, you do not want to be surprised by IRS Forms W-2 and 1099 that arrive unexpectedly around January 31 st the year after you settle your case. That can ruin your day, and maybe even your tax return. For a summary of settlement taxes, see Settlement Awards Post-TCJA.

Was the settlement agreement in Parkinson's case specific?

Notably, the settlement agreement in Parkinson was not specific about the nature of the payment or its tax treatment. And it did not say anything about tax reporting. There was little evidence that medical testimony linked Parkinson’s condition to the actions of the employer. Still, Parkinson beat the IRS. Damages for physical symptoms of emotional distress (headaches, insomnia, and stomachaches) might be taxable.

Is a lawsuit settlement taxable?

Even worse, in some cases now, there’s a tax on lawsuit settlements, with legal fees that can't be deducted. That can mean paying tax on 100%, even if 40% off the top goes to your lawyer. Check out 12 ways to deduct legal fees under new tax law. The rule for compensatory damages for personal physical injuries, like a serious auto accident, is supposed to be easy. There, the compensatory damages should be tax free under Section 104 of the tax code. In employment cases, damages are usually taxable, and usually at least partially as wages. Nearly every employment case has a wage component. In most employment settlements, employer and employee agree on a wage figure subject to withholding, and the balance goes on a Form 1099. Sometimes, there can be a tax-free portion too. Exactly what is "physical" isn’t so clear, and some of it seems like semantics. If you make claims for emotional distress, your damages are taxable.

Does a settlement agreement bind the IRS?

As you might expect, tax language in a settlement agreement does not bind the IRS. Even so, you might be surprised at how often the IRS pays attention in an audit if you can hand them a settlement agreement that says something explicit about taxes. It can sometimes be enough to make them walk away.

IRC Section and Treas. Regulation

- IRC Section 61explains that all amounts from any source are included in gross income unless a specific exception exists. For damages, the two most common exceptions are amounts paid for certain discrimination claims and amounts paid on account of physical injury. IRC Section 104explains that gross income does not include damages received on account of personal phys…

Resources

- CC PMTA 2009-035 – October 22, 2008PDFIncome and Employment Tax Consequences and Proper Reporting of Employment-Related Judgments and Settlements Publication 4345, Settlements – TaxabilityPDFThis publication will be used to educate taxpayers of tax implications when they receive a settlement check (award) from a class action lawsuit. Rev. Rul. 85-97 - The …

Analysis

- Awards and settlements can be divided into two distinct groups to determine whether the payments are taxable or non-taxable. The first group includes claims relating to physical injuries, and the second group is for claims relating to non-physical injuries. Within these two groups, the claims usually fall into three categories: 1. Actual damages re...

Issue Indicators Or Audit Tips

- Research public sources that would indicate that the taxpayer has been party to suits or claims. Interview the taxpayer to determine whether the taxpayer provided any type of settlement payment to any of their employees (past or present).