Will I have to pay tax on my settlement?

You will have to pay your attorney’s fees and any court costs in most cases, on top of using the settlement to pay for your medical bills, lost wages, and other damages. Finding out you also have to pay taxes on your settlement could really make the glow of victory dim. Luckily, personal injury settlements are largely tax-free.

What is the average settlement amount for pain and suffering?

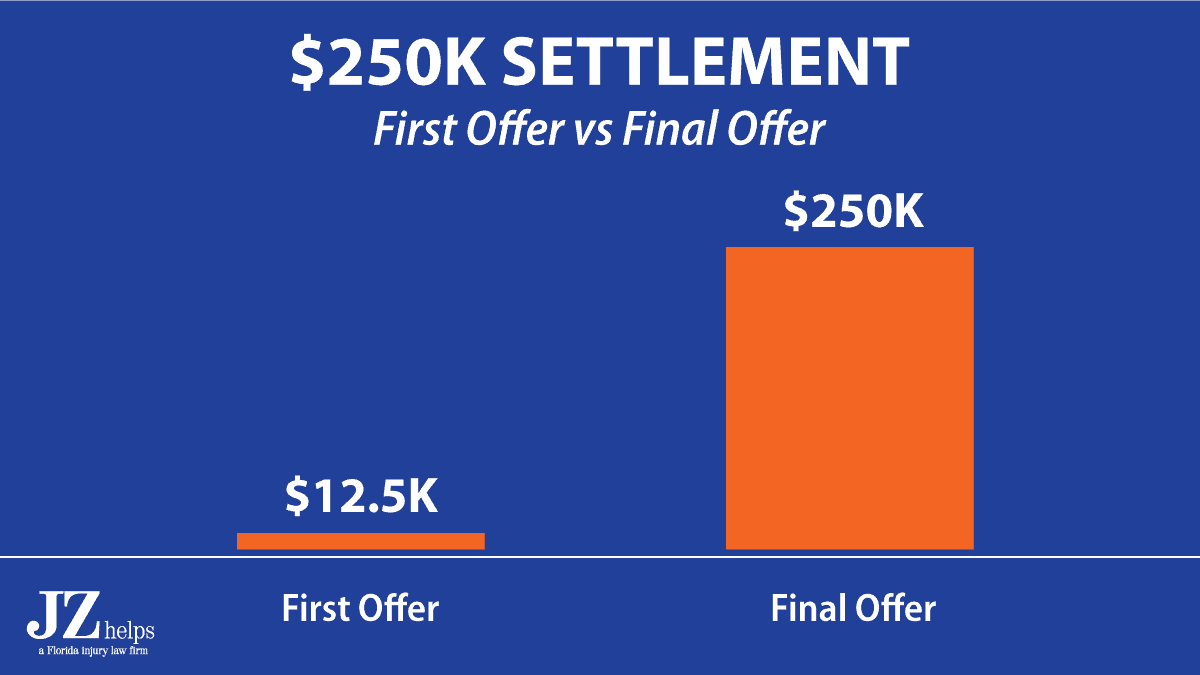

The average settlement amount for these cases is well above 6 figures. Reading these will further help you gauge just exactly how much your specific pain and suffering could potentially be worth. Figuring just exactly how much you pain and suffering is worth will depend on many factors.

What is a reasonable settlement for pain and suffering?

With few exceptions, the cap on non-economic damages in civil claims is roughly $500,000. Thus, most reasonable settlements for pain and suffering will not exceed $500,000. In specific circumstances, your non-economic damages can exceed this cap, but Colorado courts apply a strict legal standard in such instances.

Are settlements taxed like income?

Settlements themselves are not taxed because the CRA does not consider a personal injury settlement to be “income.” Your settlement is considered “compensation” for expenses incurred by another person’s negligence. Indeed, personal injury settlements rarely function as any kind of windfall.

Do I have to report settlement money to IRS?

The general rule of taxability for amounts received from settlement of lawsuits and other legal remedies is Internal Revenue Code (IRC) Section 61 that states all income is taxable from whatever source derived, unless exempted by another section of the code.

What type of settlement is not taxable?

personal injury settlementsSettlement money and damages collected from a lawsuit are considered income, which means the IRS will generally tax that money. However, personal injury settlements are an exception (most notably: car accident settlements and slip and fall settlements are nontaxable).

Are injury settlements taxable by the IRS?

Neither the federal government (the IRS), nor your state, can tax you on the settlement or verdict proceeds in most personal injury claims. Federal tax law, for one, excludes damages received as a result of personal physical injuries or physical sickness from a taxpayer's gross income.

How can I avoid paying taxes on a settlement?

How to Avoid Paying Taxes on a Lawsuit SettlementPhysical injury or sickness. ... Emotional distress may be taxable. ... Medical expenses. ... Punitive damages are taxable. ... Contingency fees may be taxable. ... Negotiate the amount of the 1099 income before you finalize the settlement. ... Allocate damages to reduce taxes.More items...•

Will I get a 1099 for a lawsuit settlement?

If your legal settlement represents tax-free proceeds, like for physical injury, then you won't get a 1099: that money isn't taxable. There is one exception for taxable settlements too. If all or part of your settlement was for back wages from a W-2 job, then you wouldn't get a 1099-MISC for that portion.

Are 1099 required for settlement payments?

Consequently, defendants issuing a settlement payment, or insurance companies issuing a settlement payment on behalf of the defendant, are required to issue a 1099 to the plaintiff unless the settlement qualifies for one of the tax exceptions.

What is the tax rate on settlement money?

It's Usually “Ordinary Income” As of 2018, you're taxed at the rate of 24 percent on income over $82,500 if you're single. If you have taxable income of $82,499 and you receive $100,000 in lawsuit money, all that lawsuit money would be taxed at 24 percent.

Are personal injury claims taxable?

You don't need to worry about your personal injury compensation being taxed. There's legislation in place which states that you don't need to pay tax on it, no matter whether it's a lump sum or a few payments over a period of time.

Do you have to pay taxes on insurance payouts?

Answer: Generally, life insurance proceeds you receive as a beneficiary due to the death of the insured person, aren't includable in gross income and you don't have to report them. However, any interest you receive is taxable and you should report it as interest received.

What do I do if I have a large settlement?

Here is a list of steps to take once you receive a settlement.Take a Deep Breath and Wait. ... Understand and Address the Tax Implications. ... Create a Plan. ... Take Care of Your Financial Musts. ... Consider Income-Producing Assets. ... Pay Off Debts. ... Life Insurance. ... Education.More items...

How can you avoid paying taxes on a large sum of money?

6 ways to cut your income taxes after a windfallCreate a pension. Don't be discouraged by the paltry IRA or 401(k) contribution limits. ... Create a captive insurance company. ... Use a charitable limited liability company. ... Use a charitable lead annuity trust. ... Take advantage of tax benefits to farmers. ... Buy commercial property.

How are personal injury settlements paid?

Most of the time, the compensation will be paid directly to you or a trust in your name. In some cases, the money will be paid into a special account at Court instead. This will happen if you're unable to manage your own financial affairs, for example because a brain injury has left you with reduced mental capacity.

Are class action settlements taxable?

Oftentimes, the nature of a class action suit determines if the lawsuit settlement can be taxable. Lawsuit settlement proceeds are taxable in situations where the lawsuit is not involved with physical harm, discrimination of any kind, loss of income, or devaluation of an investment.

Is the roundup settlement taxable?

Do You Have to Pay Taxes on Roundup Settlement Checks? No. With a few exceptions, settlements in personal injury lawsuits are not taxable as income. So you do not pay taxes on your Roundup settlement check.

Is a lump sum payment in a divorce settlement taxable?

Generally, lump-sum divorce settlements are not taxable for the recipient. If the lump-sum payment is an alimony payment, it is not deductible for the person who makes the payment and is not considered income for the recipient.

Are legal settlements tax deductible?

Generally, if a claim arises from acts performed by a taxpayer in the ordinary course of its business operations, settlement payments and payments made pursuant to court judgments related to the claim are deductible under section 162.

What happens if you settle for punitive damages?

If a significant portion of your settlement is awarded for punitive damages, you can expect to have a high tax liability that can drastically alter the final payout.

When is compensation tax free?

When a person experiences pain, suffering, and emotional distress from physical injuries or illness caused by another party’s negligence, that compensation is tax-free.

What to do before accepting a settlement after an accident?

Before accepting any settlement after your accident, always seek trusted legal counsel. It’s in your best interest to ensure that you’re not overlooking critical details that could alter your final payment outcome. A knowledgeable attorney can be of immense value to help you understand the different damages you are being offered and the taxation related to each category. In a poorly structured settlement, you could stand to lose thousands of dollars. The IRS won’t accept the fact that you were unaware should you fail to include the taxable amounts in your yearly tax return.

What is financial reimbursement?

Financial reimbursement, known as compensatory damages, are intended to relieve a person for direct costs related to an injury. These damages include compensation for losses related to: Compensatory damages are not taxed by the State of California nor by the Internal Revenue Service (IRS).

What is punitive damages?

Punitive damages are awarded by a judge or jury as a punishment when the defendant’s actions were especially heinous or showed complete and utter disregard for human life. An example of a case where a judge may award punitive damages would involve a drunk driver.

How long does it take to get compensation for an accident?

If you were hurt in an accident caused by another party’s negligence, the legal process could often take months or years before a settlement or payout can be reached. When you receive financial reimbursement for all the expenses and costs you sustained since the accident, it’s exciting and comes as a relief to many.

Will a lawsuit be taxed if there are no injuries?

However, if there were no physical injuries, and the foundation of the lawsuit is related solely to the harm being mental or emotional distress—those damages will likely be taxed both by the state and the IRS.

What is the tax rule for settlements?

Tax Implications of Settlements and Judgments. The general rule of taxability for amounts received from settlement of lawsuits and other legal remedies is Internal Revenue Code (IRC) Section 61 that states all income is taxable from whatever source derived, unless exempted by another section of the code. IRC Section 104 provides an exclusion ...

What is employment related lawsuit?

Employment-related lawsuits may arise from wrongful discharge or failure to honor contract obligations. Damages received to compensate for economic loss, for example lost wages, business income and benefits, are not excludable form gross income unless a personal physical injury caused such loss.

What is the exception to gross income?

For damages, the two most common exceptions are amounts paid for certain discrimination claims and amounts paid on account of physical injury.

What is Publication 4345?

Publication 4345, Settlements – Taxability PDF This publication will be used to educate taxpayers of tax implications when they receive a settlement check (award) from a class action lawsuit.

Is emotional distress excludable from gross income?

96-65 - Under current Section 104 (a) (2) of the Code, back pay and damages for emotional distress received to satisfy a claim for disparate treatment employment discrimination under Title VII of the 1964 Civil Rights Act are not excludable from gross income . Under former Section 104 (a) (2), back pay received to satisfy such a claim was not excludable from gross income, but damages received for emotional distress are excludable. Rev. Rul. 72-342, 84-92, and 93-88 obsoleted. Notice 95-45 superseded. Rev. Proc. 96-3 modified.

Is a settlement agreement taxable?

In some cases, a tax provision in the settlement agreement characterizing the payment can result in their exclusion from taxable income. The IRS is reluctant to override the intent of the parties. If the settlement agreement is silent as to whether the damages are taxable, the IRS will look to the intent of the payor to characterize the payments and determine the Form 1099 reporting requirements.

Is mental distress a gross income?

As a result of the amendment in 1996, mental and emotional distress arising from non-physical injuries are only excludible from gross income under IRC Section104 (a) (2) only if received on account of physical injury or physical sickness. Punitive damages are not excludable from gross income, with one exception.

What is compensatory damages?

What are compensatory damages exactly? Compensatory damages are money awarded to a plaintiff in a personal injury case to compensate for damages, injury, or another loss that happened due to the negligence or unlawful conduct of another party. (This party may be one or more individuals, or an entity such as a business, community organization, or even a church or other religious institution.) In order to receive compensatory damages, the plaintiff needs to demonstrate that the loss is real and that it was caused by the defendant.

What is punitive damages?

What are punitive damages? These are meant not just to compensate the plaintiff, but to also provide a harsher punishment for the defendant in situations where the defendant is found to be wildly or grossly negligent in some way. Essentially, punitive damages are meant to be an extra punishment, on top of compensatory and lost wage damages, for recklessness, intentional misconduct, or complete disregard for the safety of others.

Do you have to think about taxes when accepting a settlement?

Questions about taxes and personal injury settlements are very common. This is understandable. You have to think about how much money you’ll actually get if you accept a settlement, and that includes figuring out the tax situation. You may know someone who received a personal injury settlement, then unexpectedly received a large tax bill because of it. However, it’s important to know that this isn’t always the case.

Is compensatory damages taxable?

So are compensatory damages taxable? In most cases, no. Usually settlements for losses involved with physical injuries or illnesses, like broken bones, head injuries, brain damage, traumatic brain injury (TBI), paralysis or spinal cord injuries, loss of vision or hearing, loss of limbs, etc., are tax-exempt.

Can you deduct medical bills on taxes?

In some cases, plaintiffs who have extensive medical bills will have taken these as deductions on their taxes , because in most cases you are allowed to deduct medicare expenses. If you then receive this money back in the form of compensation for your injuries, then you will need to pay the taxes you didn’t pay when taking this money as a deduction. Essentially, the IRS doesn’t permit anyone to get a tax deduction twice—if you already deducted the sum of your medical bills from your taxes last year, you’ll need to pay income tax when you receive that sum back as a settlement.

Can you file a lawsuit for emotional injuries?

Physical or emotional injuries are not the only situations where one can file a lawsuit and receive damages. You may receive damages in a lawsuit over wrongful termination, a breach of contract, or other business disputes, for example. In some situations, plaintiffs may point out that the stress of being fired may have caused a chronic condition to flare up or triggered a migraine. However, if your lawsuit is not about your physical ailment, than you will have to pay taxes on the award.

Do you have to pay taxes on a settlement?

You also shouldn’t have to pay taxes on portions of a settlement that are supposed to pay for things like medical care, repairs to your car or other property, legal fees, loss of quality of life, emotional distress, loss of consortium, or wrongful death. So, for example, if you are awarded an amount of money for loss of consortium and wrongful death after your spouse died in an accident caused by someone else’s negligence, you would not have to pay taxes on that award.

Is a settlement for physical injury taxable?

If you receive a settlement for personal physical injuries or physical sickness and did not take an itemized deduction for medical expenses related to the injury or sickness in prior years, the full amount is non-taxable. Do not include the settlement proceeds in your income.

Is severance pay taxable?

If you receive a settlement in an employment-related lawsuit; for example, for unlawful discrimination or involuntary termination, the portion of the proceeds that is for lost wages (i.e., severance pay, back pay, front pay) is taxable wages and subject to the social security wage base and social security and Medicare tax rates in effect in the year paid. These proceeds are subject to employment tax withholding by the payor and should be reported by you as ‘Wages, salaries, tips, etc.” on line 1 of Form 1040.

Do you have to report a settlement on your taxes?

Property settlements for loss in value of property that are less than the adjusted basis of your property are nottaxable and generally do not need to be reported on your tax return. However, you must reduce your basis in theproperty by the amount of the settlement.

How much of a settlement do you have to pay in taxes?

Even though your lawyer (working on contingency) will take roughly one-third of your settlement, you will be responsible for taxes on the entire settlement amount in addition to paying the Social Security and Medicare taxes.

How much tax is paid on a structured settlement?

You'd receive a Form 1099 from the insurance company each year. Typically, a structured settlement can save you between 25% and 35% of taxes on interest income that would otherwise be subject to tax.

Why are punitive damages taxable?

Punitive damages are taxable because they are not compensating you for out-of-pocket losses. In essence, they are income, so you will have to pay taxes on any punitive damages. ×. Compare your quotes from these popular Auto Insurance Companies in Edit.

What is the tax bracket for lost wages?

However, if you receive three years of lost wages in your settlement -- you're now paying taxes on $111,000, which puts you in the 28% bracket. You'll also have to pay Social Security and Medicare taxes on the insurance settlement money.

What is the tax rate for Medicare?

The tax rate for Medicare and Social Security will run about 15.3%. Large settlement: If you receive a large settlement that represents several years of income all at once, you will most likely end up being taxed at a higher rate than you usually pay. For example, at $37,000 a year, you'd be taxed at a 15% rate.

What happens if you receive a large settlement?

Large settlement: If you receive a large settlement that represents several years of income all at once, you will most likely end up being taxed at a higher rate than you usually pay.

What is compensation for lost wages?

Compensation for lost wages is intended to replace what you would have earned had you not been injured. If you don't make a complete recovery, you may also receive compensation for future lost wages.