Are personal injury settlements protected from creditors?

Money awarded in personal injury settlements in California is exempt under the law from garnishment under the law protecting it from creditors seizing it. That means creditors can’t legally take settlement money from your bank account and use it to pay off your old debts. However, that’s not the whole story.

What happens if you deposit a personal injury settlement check?

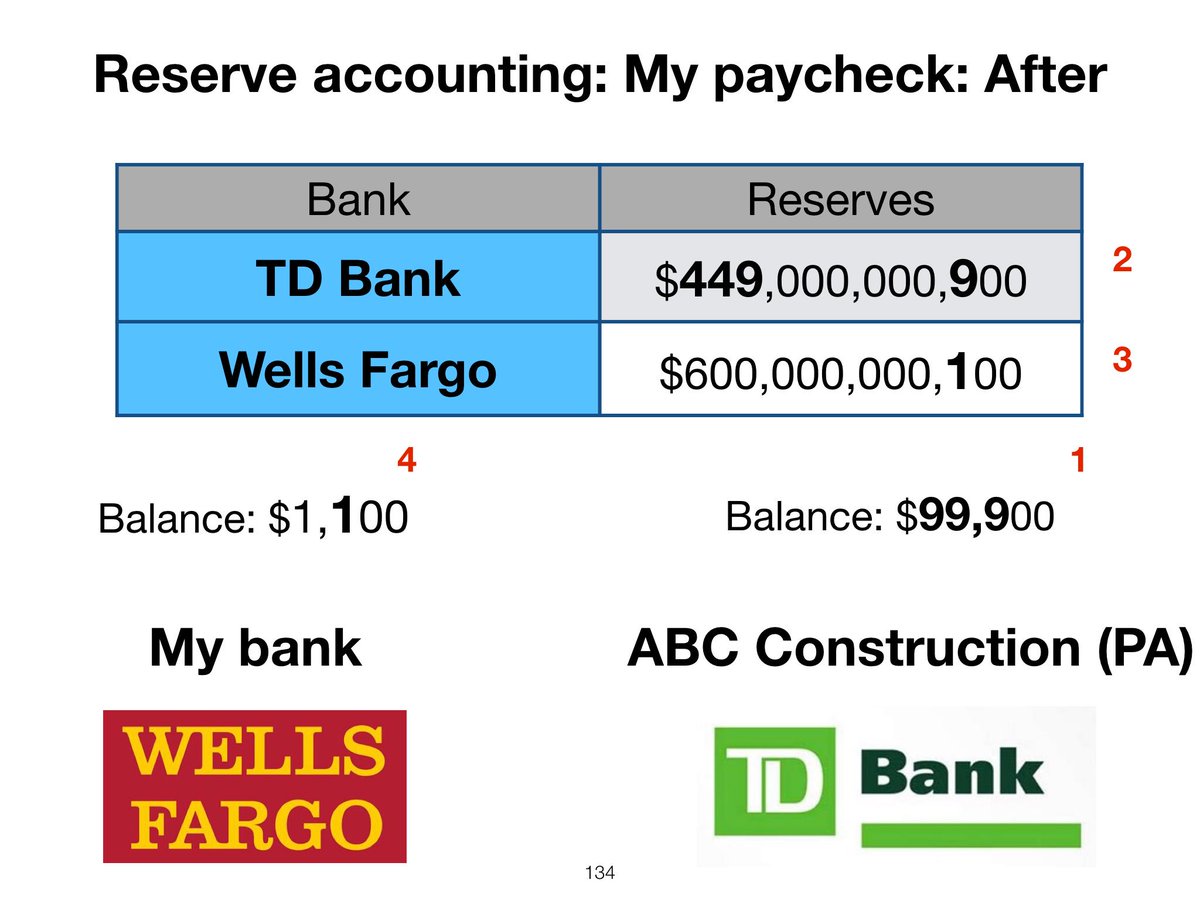

So if you deposit your personal injury settlement check like it’s your paycheck, it’s all mixed together and available for creditors to drain it out of your bank account. If a creditor files suit against you, a court may order you to pay the creditor out of your bank account where your settlement funds are stashed.

How can we help you get the most out of your settlement?

We care about helping you get the most out of your money. Our law office will help keep your settlement money in your pocket where it belongs! After a personal injury, contact the attorneys at Sally Morin Personal Injury Lawyers. We handle many areas of the law, including personal injury settlements.

How can I protect my personal injury settlement?

We’ll also share some steps you can take to protect your settlement. Money awarded in personal injury settlements in California is exempt under the law from garnishment under the law protecting it from creditors seizing it. That means creditors can’t legally take settlement money from your bank account and use it to pay off your old debts.

How long do banks hold settlement checks?

Cashing in Your Settlement Check With Your Bank Generally, a bank can hold funds: For up to two business days for checks against an account at the same institution. For up to five additional days for other banks (totaling seven days)

Can I deposit a large settlement check?

You will be free to deposit that settlement check anywhere that you choose. If the check is a large sum of money, you can speak to a personal financial planner to decide how you want to disburse the check to yourself.

Can I cash a settlement check at the issuing bank?

If the issuing bank operates a local branch, you can cash the settlement check at the issuing bank. You must present two forms of identification that can include a driver's license or a state-issued identification card.

How can I cash a settlement check without a bank account?

Cash a Check without a Bank AccountCash it at the issuing bank (this is the bank name that is pre-printed on the check)Cash a check at a retailer that cashes checks (discount department store, grocery stores, etc.)Cash the check at a check-cashing store.More items...

How long does it take for a $30000 check to clear?

Most checks take two business days to clear. Checks may take longer to clear based on the amount of the check, your relationship with the bank, or if it's not a regular deposit. A receipt from the teller or ATM tells you when the funds become available.

What to do with a $100000 settlement?

What to Do with a $100,000 Settlement?Sort Out Tax Implications.Find a Financial Advisor.Pay Off the Debts.Invest in a Retirement Home.Start a Business or Help Friends and Family.Donate the Money to the Needy.Final Words.

Will a bank cash a 25000 check?

Banks don't place restrictions on how large of a check you can cash. However, it's helpful to call ahead to ensure the bank will have enough cash on hand to endorse it. In addition, banks are required to report transactions over $10,000 to the Internal Revenue Service.

What is the best way to cash a settlement check?

How to Cash a Settlement Check With No Bank AccountThe Issuing Bank. If the bank that issued the check has a local branch near you, stop in and let the teller know you want to cash the check. ... Retail and Convenience Stores. Several retail and convenience stores offer check cashing services. ... Check Cashing Stores.

What do I do if I have a large settlement?

Here is a list of steps to take once you receive a settlement.Take a Deep Breath and Wait. ... Understand and Address the Tax Implications. ... Create a Plan. ... Take Care of Your Financial Musts. ... Consider Income-Producing Assets. ... Pay Off Debts. ... Life Insurance. ... Education.More items...

Can my lawyer cash my settlement check?

While your lawyer cannot release your settlement check until they resolve liens and bills associated with your case, it's usually best to be patient so you don't end up paying more than necessary.

What happens when you cash a check over $10 000?

Depositing a big amount of cash that is $10,000 or more means your bank or credit union will report it to the federal government. The $10,000 threshold was created as part of the Bank Secrecy Act, passed by Congress in 1970, and adjusted with the Patriot Act in 2002.

How are personal injury settlements paid?

Most of the time, the compensation will be paid directly to you or a trust in your name. In some cases, the money will be paid into a special account at Court instead. This will happen if you're unable to manage your own financial affairs, for example because a brain injury has left you with reduced mental capacity.

What do I do if I have a large settlement?

Here is a list of steps to take once you receive a settlement.Take a Deep Breath and Wait. ... Understand and Address the Tax Implications. ... Create a Plan. ... Take Care of Your Financial Musts. ... Consider Income-Producing Assets. ... Pay Off Debts. ... Life Insurance. ... Education.More items...

Can my lawyer cash my settlement check?

While your lawyer cannot release your settlement check until they resolve liens and bills associated with your case, it's usually best to be patient so you don't end up paying more than necessary.

How can I protect my settlement money?

Keep Your Settlement Separate Rather than depositing the settlement check directly into your standard bank account, keep the settlement money in its own separate account. This can help you keep it safe from creditors that may try to garnish your wages by taking the money you owe directly out of your bank account.

How do I cash a 20000 check?

Go to your local bank or credit union. Take your check to a friend or family member's bank or credit union. Go to the bank or credit union that issued the check to cash it. Go to any bank or credit union to cash a check.

Why do banks contact winners of personal injury settlements?

It is common for banks to contact winners of personal injury settlements in an effort to convince them to spend their new funds on pricey financial services. To make sure your finances aren’t taken advantage of, contact a lawyer, financial adviser, or accountant before making important decisions.

What happens when you get news of your personal injury settlement?

Once news of your new financial gain gets out, you will be undoubtedly contacted by banks and private agencies. Banks and financial institutions are drawn to those who find themselves with more money than usual. It is common for banks to contact winners of personal injury settlements in an effort to convince them to spend their new funds on pricey financial services.

How does a settlement check work?

Compensation from your settlement check will be awarded to you in the form of either a structured settlement , where monetary payments are provided in regular intervals over time, or as a lump sum, in which case you receive all your settlement money at once. Either way, your settlement funds will be sent directly to your attorney’s office before you can sign it.

Why do you get a settlement check?

A large settlement check provides you with the opportunity to pay off debt. Plan to pay what you may owe from credit cards, high interest loans, or other bills. Using your funds in this way can help you earn financial freedom by reducing ongoing interest payments.

What is the term for the release of a settlement?

This paperwork includes an outline of all the terms and conditions of your settlement, called the release . Your lawyer will review the release to ensure the terms are in your best interest before you agree to receive it.

What does it mean to pay off a mortgage?

Paying off your mortgage will not only mean a reduced financial burden, but will also secure your home as an asset. Depending on your situation, your settlement money could be the opportunity for a sizable down payment on a new home, or an improvement on your current one.

How to reach a settlement?

Reaching a settlement can feel like an achievement and you may feel tempted to talk about it with others. Carefully consider who you keep informed. Keep information on a need-to-know basis, telling only your immediate family and the professionals you choose to consult with.

What happens if you don't protect your settlement money?

If you don’t protect your settlement money, its exempt status could be in jeopardy and you risk losing it to a creditor. Here’s why. California law allows creditors to garnish either 25% of your disposable income or the amount by which that exceeds 40 times the state’s hourly minimum wage, whichever is lesser.

What happens if you deposit a personal injury settlement check?

So if you deposit your personal injury settlement check like it’s your paycheck, it’s all mixed together and available for creditors to drain it out of your bank account. If a creditor files suit against you, a court may order you to pay the creditor out of your bank account where your settlement funds are stashed.

What happens if you fail to pay a lien?

Liens are legally binding documents that essentially force you to pay the creditor at some point in the future. If you fail to pay, you may face a court battle. Liens sometimes go along with personal injury awards and guarantee a company – like a doctor’s office – payment after your settlement is final.

How long does it take for a debt collector to provide information?

If they don’t immediately furnish you with this information when asked, they are legally required to do so in writing within five business days of your request.

How to reduce the amount you owe?

Arrange to decrease the total amount you owe if you pay it all off by a certain date. Create a less aggressive payment plan that gives you more breathing room each month. Offer the IRS a partial payment that stops them from seizing your personal injury settlement.

How to protect yourself from a personal injury settlement?

Save All the Paperwork: Maintain accurate records of where your settlement money came from and exactly where it goes. Keep all receipts, invoices, and bills that you paid with your settlement money. This creates a paper trail for your personal injury settlement. If it’s ever in dispute, even months or years later, you can easily provide proof to protect yourself.

How to protect your settlement?

To protect those assets, here are some things you can do. Separate Your Settlement: Keep all settlement money separate from other funds. This means you must deposit it in a completely different account from your savings, paycheck, an inheritance, or any other money you have.

What to expect when getting a personal injury settlement in California?

If you are expecting to receive a personal injury settlement, we hope that you have already retained assistance from a California personal injury lawyer. A personal injury attorney in Orange County will be able to help you navigate any of the roadblocks that you may run into if you owe money to creditors or are going through the bankruptcy process. Your attorney will have dealt with this before and will be able to help you establish the best path towards receiving your full settlement amount.

What happens if someone is injured due to negligence?

Anytime a person is injured due to the careless or negligent actions of another individual or entity, they may be entitled to various types of compensation for their losses. In some cases, this comes in the form of an insurance settlement or a personal injury jury verdict.

Can a creditor garnish a personal injury settlement?

This means that a creditor cannot reach into a person’s bank account and garnish the amount. Additionally, if a person files for bankruptcy, they will get to keep all of the money paid to them through the personal injury settlement, even if it was a substantial amount.

How long does it take to settle a personal injury case?

The court will then issue an order of settlement, which will require the parties to complete all of the settlement papers within 30 or 60 days, depending on the jurisdiction. The most important settlement paperwork is the Release.

What is a personal injury lien?

A lien is a legal right to someone else's assets. The two kinds of liens that usually exist in personal injury lawsuits are medical liens and governmental liens.

What are the two types of liens in personal injury cases?

A lien is a legal right to someone else's assets. The two kinds of liens that usually exist in personal injury lawsuits are medical liens and governmental liens. Medical liens are held by health care providers and health insurers who paid for medical treatment in connection with the underlying accident. Governmental liens are usually from Medicare, Medicaid, or from a child support agency.

Can a personal injury lawyer sue someone with no insurance?

Personal injury lawyers rarely take cases against defendants who have no insurance coverage in place for the underlying accident. This is because people who carry no insurance usually have limited assets . There is usually no good reason for suing someone with no money.

Tip One: Settlement Taxability

The first question you may have in mind is “is the money taxable?” This really depends on your situation. If it’s a settlement from a personal or physical injury, it’s usually non-taxable. Emotional distress settlement awards are typically non-taxable if the distress is attributable to a physical injury or physical sickness.

Tip Three: Giving Money to Family

Another common question that comes up is, “Should I give money to my family?” Your family members or relatives may not necessarily be in the best financial situation, so I totally understand if you feel the urge to help them out. There is nothing wrong with that. Or maybe they’re financially ok,, but they’ll still come knocking at your door.

Tip Five: Overall, what should you do with the settlement money?

The fifth and final question that I’d like to help answer is, “What should I do with the settlement money?” I would like to urge you to find some quiet time and reflect on your life goals. What is important to you? What brings you joy? And then think about how you can use the settlement money as a tool to help you live your best life.

Additional settlement money questions that you may have

Your financial goals and situation will dictate how you use a large settlement check. Working with a certified financial advisor will help you come up with a settlement check plan tailored to your unique needs. The money will then be less likely to be used on impulse. We share our top 5 tips on what to do with your settlement money in the blog.

Need help with your settlement money?

You probably have a lot more questions to ask on what to do with your settlement money. Feel free to schedule a free discovery call with one of our financial advisors to go through your personal situation.

What are the steps involved in receiving a personal injury settlement check?

Personal injury settlement checks can be issued for various types of cases, including car accidents, wrongful death claims, slip and falls, product liability or defect claims, premises liability claims, medical malpractice, TBI (traumatic brain injury) or spinal cord injuries, and more . When a victim is injured in an accident and suffers expenses from medical care, lost wages or earning capacity, reduced quality of life, pain and suffering, loss of consortium, and more, financial compensation via a civil lawsuit settlement is a means of helping the injured party recovery and live a productive life following an unfortunate accident.

What is a legal settlement?

In civil lawsuits, a settlement is an alternative to pursuing trial litigation. Generally, a settlement occurs when the defendant agrees to some or all of the plaintiff’s claims rather than proceeding to fight the matter in a court of law. In almost all cases, a settlement requires the defendant to pay the plaintiff monetary compensation – whether for medical bills, pain and suffering, lost wages, psychological trauma, etc. Agreeing to a settlement is commonly referred to as settling out of court, and said settlement effectively ends the matter of litigation. Agreeing to a settlement is an advantageous option for both parties in many cases. By settling out of court, defendants can avoid exorbitant costs of litigation, which can drag on for an extended period of time depending on the nature of the case. A settlement may be reached before a trial, or during its early stages. In some cases, settlements are reached before a lawsuit is ever filed.

What is a medical lien in a personal injury settlement?

Medical liens refer to a third party’s legal right to appropriate a portion or the entirety of the settlement or proceeds from your personal injury case. Said third party may file a request for a lien during the lawsuit, and a judge will ultimately decide whether to approve or deny the request. If a judge were to approve a lien, the person or entity who owns that lien would be paid from your total settlement amount before you receive any financial compensation. Again, this is just another example of why having an experienced and dedicated DLG lawyer fighting on your behalf can give you the advantage necessary to prevail, and help ensure another party does not wrongly take a portion of your settlement. Once a lien is approved by a judge, there is virtually nothing you or your attorney can do to reverse the decision, and the debt must be legally paid in full.

What is the pain and suffering multiplier versus per diem method?

The pain and suffering multiplier method, which is most commonly used by insurance companies, involves adding all “special damages” and then multiplying that figure by a certain number (typically between 1.5 and 5 , with 3 being most common). Special damages can include any easily calculable economic losses such as medical bills, lost wages, and property damage.

What happens if my attorney won’t turn over my settlement award check?

Most attorney-client relationships are built on respect and an understanding that both individuals are working together to achieve the same goal – a successful case outcome leading to a maximum financial damages award.

How long does it take to get a settlement check?

Although the time required for a settlement negotiation process to be finalized can vary considerably from case-to-case, once a settlement is reached a victim can generally expect to receive a settlement check in approximately six weeks. There are, of course, exceptions to that rule, and delays can occur. Let’s take a look at the standard process for receiving a personal injury settlement check, the steps involved from start to finish, and also look at average settlements for personal injury cases.

Can a delay in a personal injury settlement happen?

Delays, while not a common occurrence, can happen occasionally in personal injury settlements. In such cases, it’s helpful to know what to expect. If a defendant is not represented by an insurance company, it’s possible that he or she may have their own release form that needs to be agreed upon by all parties. In such cases, your attorneys, as well as the legal representation for the defendant, will have to review the release and agree unanimously on the terms. This may add additional time to your settlement check being received, but in most cases the situation can be resolved without issue and in a relatively short period of time. Wrongful death cases and other cases involving estates are two types of claims that tend to take a bit longer and require additional preparation.

Why do banks hold money after a settlement?

If there were any medical or other liens existing at the time of the settlement and the bank has been put on notice of the liens, they may be holding the money to protect themselves from legal action if they release the funds before a legitimate lien holder was paid.

What to do if you have a hold on a personal injury case?

The best thing to do is consult with the personal injury attorney who represented you. If she hasn’t already explained the reason for the hold, she should now.

Can a bank hold a personal injury settlement check?

That is – if the personal injury settlement check was made payable to you, and you alone, the bank should only be able to hold on to the check for a reasonable amount of time.