What is the difference between settlement date and closing date?

The settlement date and the closing date are both terms used in the real estate world to refer to the final date when you sign the final papers in the property purchase process. Both terms can be used interchangeably. At this final closing date you will sign the finalized documents for the purchase.

When does the settlement date of a real estate transaction occur?

June 23, 2011. The culmination of a real estate transaction is the settlement or closing, the date on which ownership of the property officially changes hands. At this time, the home seller receives the proceeds resulting from the sale and the buyer pays any associated costs required to complete the transaction.

What is the closing date on a house sale?

Closing Date The culmination of a real estate transaction is the settlement or closing, the date on which ownership of the property officially changes hands. At this time, the home seller receives the proceeds resulting from the sale and the buyer pays any associated costs required to complete the transaction.

What is the settlement period?

In the securities industry, the settlement period is the amount of time between the trade date—when an order for a security is executed, and the settlement date— when the trade is final. In common trading terms, a fail occurs if a seller does not deliver securities or a buyer does not pay owed funds by the settlement date.

What is considered a settlement date?

The settlement date is the date on which a trade is final, when the buyer pays the seller and the seller delivers cleared assets to the buyer. The settlement arose to deal with the complex process of clearing a transaction but has since been reduced to as little as two business days (T+2) through the use of technology.

Is the settlement date the date of sale?

There are two related and important dates when you buy or sell stock. The trade date is the date when you place an order to buy or sell. The settlement date is the date that the cash or shares are transferred to or from your account.

What does settlement date mean real estate?

Your real estate settlement date is the date that you will sign all the official documents to complete the purchase. Traditionally this is also the day that you will get the keys for the home and be able to move in. This discussion will take you through: Agreeing on a date.

Is settlement date beginning or end of day?

When does settlement occur? For most stock trades, settlement occurs two business days after the day the order executes, or T+2 (trade date plus two days). For example, if you were to execute an order on Monday, it would typically settle on Wednesday.

Is closing and settlement the same thing?

A closing is often called "settlement" because you, as buyer, along with your lender and the seller are "settling up" among yourselves and all of the other parties who have provided services or documents to the transaction.

What does settlement day mean?

What is 'settlement day'? Settlement day is the contractually agreed date on which the sale of the property is finally settled. It's the day the buyer pays the balance of the sale price to the seller and ownership changes hands.

What happens on settlement date?

What happens on settlement day? On settlement day, at an agreed time and place, your settlement agent (solicitor or conveyancer) meets with your lender and the seller's representatives to exchange documents. They organise for the balance of the purchase price to be paid to the seller.

What can go wrong on settlement day?

What could possibly go wrong?Funds not transferred in time.Documents not received in time.Other parties bank not having all documentation finalised.Bank cheques drawn for settlement are incorrect.Documents have been signed or witnessed incorrectly.Documents have been prepared incorrectly.More items...

What is the settlement period when buying a house?

Settlement is the process of paying the remaining sale price and becoming the legal owner of a home. At settlement, your lender will disburse funds for your home loan and you'll receive the keys to your home. Generally, settlement takes place around 6 weeks after contracts are exchanged.

What time of day is settlement date?

9:00 AM ET on the settlement date.

Is Record Date Same as settlement date?

When you purchase a stock, it takes three business days for ownership to be transferred. This transfer of ownership is referred to as settlement. Therefore, you have to purchase the stock at least three business days before the record date to receive a dividend.

Is value date same as settlement date?

The settlement date is the date when the transaction is completed. The value date is the same as the settlement date. While the settlement date can only fall on a business day, the value date (in the case of calculating accrued interest) can fall on any date of the month.

Is value date same as settlement date?

The settlement date is the date when the transaction is completed. The value date is the same as the settlement date. While the settlement date can only fall on a business day, the value date (in the case of calculating accrued interest) can fall on any date of the month.

What is the difference between trade date and settlement date?

The first is the trade date, which marks the day an investor places the buy order in the market or on an exchange. The second is the settlement date, which marks the date and time the legal transfer of shares is actually executed between the buyer and seller.

Can I sell a stock before the settlement date?

Can you sell a stock before the settlement date? The key is knowing if you bought the stock using settled or unsettled cash. If you bought the stock (or other type of security) using settled cash, you can sell it at any time.

What does settlement period mean?

Property settlement is the final stage of a property sale wherein the buyer completes payment of the contract price to the vendor and takes legal possession of the property. The 'settlement period' is the amount of time between the exchange of contracts and the property settlement.

What to do after closing and settlement?

After the Closing and Settlement. After closing and settlement, make sure to get copies of every single document. When you leave, be sure to take all of your closing documents and immediately place them in your safe deposit box.

How long does it take to settle a sale?

Usually, the settlement process takes as little as a few hours. If it is a complicated transaction or there is a disagreement over the final paperwork, it could take several days.

What to look for at closing?

At closing, you will look at the final calculations and divvy up any unresolved expenses. Unresolved expenses are common where the previous owner had already paid property taxes for the year and you are responsible for reimbursing the seller for taxes paid from the date of closing until year-end. Likewise, if the seller has not paid property taxes ...

What is the last step in the home purchase process?

The very last step in the process is the closing or settlement date. Although different people use different terms, the "closing" or the "settlement" refers to the same finalization of your home purchase. At the closing or settlement date, the seller receives the sale proceeds, and the buyer pays any required expenses to close the transaction, ...

What is the most realistic expectation you can have of closing and settlement?

The most realistic expectation you can have of closing and settlement is paperwork, lots and lots of paperwork. The attorney you used for your purchase will have already reviewed the documents, but ask for explanations of any fees or documents that you don’t understand. Your attorney is there to answer your questions and guide you through the process. Closing and settlement is the last time to ask these questions before you legally own the home.

What is preliminary escrow closing?

What Is a Preliminary Escrow Closing? Purchasing a house can be a long, wild ride, and by the end, you just want to get into your new place and start arranging your furniture. But buying a house is a multi-step process that takes time. The very last step in the process is the closing or settlement date.

Do two closings have to be the same?

Since no two closings are exactly the same, make sure to ask your attorney or mortgage broker for a checklist of items to bring. Usually, your attorney or mortgage broker will already have a list prepared in advance that they will give you well ahead of time.

What Is a Settlement Date?

The settlement date is the date when a trade is final, and the buyer must make payment to the seller while the seller delivers the assets to the buyer. The settlement date for stocks and bonds is usually two business days after the execution date (T+2). For government securities and options, it's the next business day (T+1). In spot foreign exchange (FX), the date is two business days after the transaction date. Options contracts and other derivatives also have settlement dates for trades in addition to a contract's expiration dates .

What causes the time between transaction and settlement dates to increase substantially?

Weekends and holidays can cause the time between transaction and settlement dates to increase substantially, especially during holiday seasons (e.g., Christmas, Easter, etc.). Foreign exchange market practice requires that the settlement date be a valid business day in both countries.

How long does it take for a stock to settle?

Most stocks and bonds settle within two business days after the transaction date . This two-day window is called the T+2. Government bills, bonds, and options settle the next business day. Spot foreign exchange transactions usually settle two business days after the execution date.

How long does it take to settle a stock trade?

Historically, a stock trade could take as many as five business days (T+5) to settle a trade. With the advent of technology, this has been reduced first to T=3 and now to just T+2.

How far back can a forward exchange settle?

Forward foreign exchange transactions settle on any business day that is beyond the spot value date. There is no absolute limit in the market to restrict how far in the future a forward exchange transaction can settle, but credit lines are often limited to one year.

When Does Settlement Date Occur?

When investors purchase bonds, stocks, or any other financial instruments, the transactions are broken down into two key dates – transaction and settlement dates. Transaction date refers to the date when the trade actually got initiated. However, the trade is not settled on the transaction date as there is some time gap for making the payment and transferring the asset ownership. Therefore, the transaction date and the settlement date doesn’t fall on the same day.

What is the settlement date in a security document?

The settlement date occurs after the specified time has elapsed after the transaction date, which is mentioned in the security document. For instance, if the document says that the settlement date is T+2, then it means that the trade will be settled after two [business] days from the transaction date. The time gap between the transaction date and the settlement date is known as the settlement period. It is to be noted that the date doesn’t occur on exchange holidays as well as weekends [Saturday & Sunday], and it is shifted to the next business day.

What is the difference between a settlement date and a transaction date?

The difference between the transaction date and the settlement date is owing to the time required by the seller to deliver the assets. Nowadays, the transactions are executed electronically which were previously done manually. Once the buyers receive the delivery of the assets, they make the payment for the assets.

What is settlement risk?

Settlement Risk: It occurs when either the seller or the buyer fails to honor their part of the contract. For instance, the seller might be unable to deliver the underlying asset in exchange for the payment or the buyer might fail to make the payment in time after the transfer of the asset ownership.

Is settlement date accounting a conservative approach?

Therefore, in the case of month-end transactions, there is a likelihood that the trading month will be different in date accounting as compared to transaction date accounting. Accounting is a conservative approach and it captures the cash position of a company more accurately.

When is the settlement date for a government bond?

For mutual funds, options, government bonds, and government bills, the settlement date is one day after the trade date 2

Why did the stock market have settlement dates?

Settlement dates were originally imposed in an effort to mitigate against the fact that in earlier times, stock certificates were manually delivered, leaving windows of time where a stock's share price could fluctuate before investors received them.

What is the date of a security purchase?

Purchasing a security involves a trade date, which signifies the day an investor places the buy order, and a settlement date, which marks the date and time the legal transfer of shares is actually executed between the buyer and the seller.

How long after the trade date do you settle a mutual fund?

For mutual funds, options, government bonds, and government bills, the settlement date is one day after the trade date. For foreign exchange spot transactions, U.S. equities, and municipal bonds, the settlement date occurs two days after the trade date, commonly referred to as "T+2". In most cases, ownership is transferred without complication.

What is the first date of a buy order?

The first is the trade date , which marks the day an investor places the buy order in the market or on an exchange. The second is the settlement date, which marks the date and time the legal transfer of shares is actually executed between the buyer and seller.

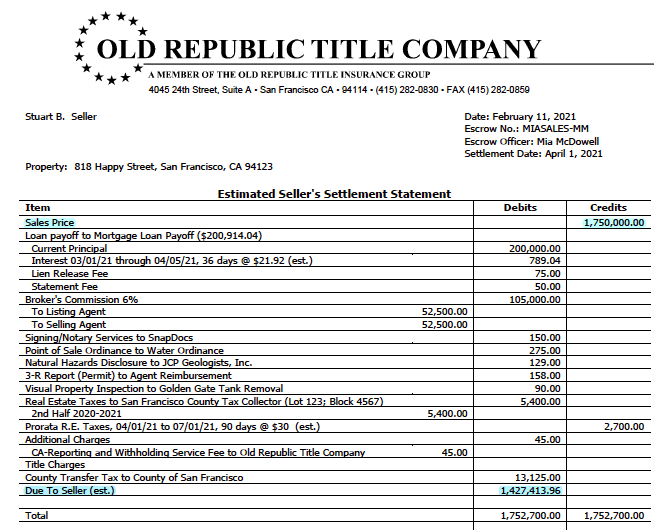

What is a settlement statement?

A settlement statement is an itemized list of fees and credits summarizing the finances of an entire real estate transaction. It serves as a record showing how all the money has changed hands line by line.

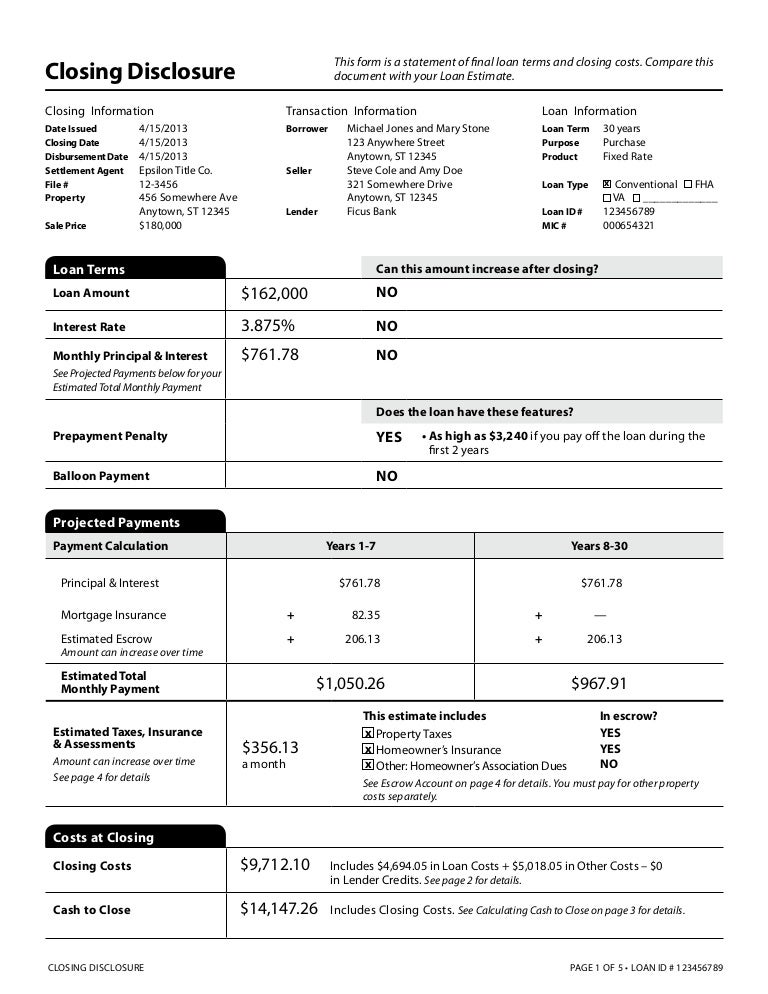

How long before closing do you have to give closing disclosure?

In the wake of the subprime crisis, the Consumer Financial Protection Bureau requires that buyers receive the Closing Disclosure, outlining loan costs among other fees and information pertinent to the borrower, no later than 3 days before closing for review.

Is a settlement statement the same as a closing statement?

Yes, a settlement statement is the same as a closing statement, though “settlement” is the formal term most likely to be used by the real estate industry.

What is an ‘excess deposit’ at closing?

A particular line item that causes confusion on the seller’s settlement statement is the “Excess Deposit.” What is an excess deposit, and who will receive the funds listed on that line?

What does an impound account do at closing?

At closing the buyer sets up an impound account that allows them to bundle the cost of their mortgage principal, taxes, mortgage insurance, and other monthly costs into one payment. The lender likes this because they can make sure the new owner will keep up to date with all the payments associated with the home.

What information is needed to complete a closing document?

At the top of the document (before you get to the portion that looks like a spreadsheet) you’ll see a few boxes for inputting information that records basic details about the transaction, such as the names of the buyer and seller, the property address, and the closing date.

How much does it cost to sell a house in 2021?

A 2021 study we conducted found that it costs $31,000 on average to sell a home. But ideally your sale price covers the costs of all the transaction fees, your mortgage payoff, and then some, leaving you with a tidy sum to add to your bank account.

Why Is There a Delay Between Trade and Settlement Dates?

Given modern technology, it seems reasonable to assume that everything should happen instantaneously.

How long does it take for a trade to settle?

The T+2 rule refers to the fact that it takes two days beyond a trade date for a trade to settle. For example, if a trade is executed on Tuesday, the settlement date will be Thursday, which is the trade date plus two business days. Note that weekends and holidays are excluded from the T+2 rule.

How long after a trade is a T+2?

For many securities in financial markets, the T+2 rule applies, meaning the settlement date is usually two days after the trade date. An investor therefore will not legally own the security until the settlement date.

What is a trade date?

The trade date is the day an investor or trader books an order to buy or sell a security. But it’s important for market participants to also be aware of the settlement date, which is when the trade actually gets executed.

What time does the stock market open?

Note that weekends and holidays are excluded from the T+2 rule. That’s because in the U.S., the stock market is open from 9:30 a.m. to 4:00 p.m. Eastern time Monday through Friday.

What are the dates of an investment?

There are two important dates to know when making an investment: the trade date and the settlement date.

Can Treasury bills settle on the same day?

This delay in settling applies to trading of almost all securities. An exception is Treasury bills, which can settle on the same day they are transacted.

What Is A Settlement Date?

- The settlement date is the date when a trade is final, and the buyer must make payment to the seller while the seller delivers the assets to the buyer. The settlement date for stocks and bonds is usually two business days after the execution date (T+2). For government securities and options, it's the next business day (T+1). In spot foreign exchang...

Understanding Settlement Dates

- The financial market specifies the number of business days after a transaction that a security or financial instrument must be paid and delivered. This lag between transaction and settlement datesfollows how settlements were previously confirmed, by physical delivery. In the past, security transactions were done manually rather than electronically. Investors would have to wai…

Settlement Date Risks

- The elapsed time between the transaction and settlement dates exposes transacting parties to credit risk. Credit risk is especially significant in forward foreign exchange transactions, due to the length of time that can pass and the volatility in the market. There is also settlement riskbecause the currencies are not paid and received simultaneously. Furthermore, time zone differences inc…

Life Insurance Settlement Date

- Life insurance is paid following the death of the insured unless the policy has already been surrendered or cashed out. If there is a single beneficiary, payment is usually within two weeks from the date the insurer receives a death certificate. Payment to multiple beneficiaries can take longer due to delays in contact and general processing. Most states require the insurer pay inter…

Explanation

When Does Settlement Date occur?

- When investors purchase bonds, stocks, or any other financial instruments, the transactions are broken down into two key dates – transaction and settlement dates. Transaction date refers to the date when the trade actually got initiated. However, the trade is not settled on the transaction date as there is some time gap for making the payment and transferring the asset ownership. T…

Risks of Settlement Date

- There are two main risks associated with – credit risk and settlement risk. 1. Credit Risk: It refers to the risk of loss emanating from the buyer’s inability to meet the contractual trade obligations. Some of the reasons for the credit risk include liquidity issues or unanticipated volatility in the market during the time period between the transaction and settlement dates. 2. Settlement Risk…

Breaking Down Settlement Date

- The financial markets clearly specify the number of business days at the end of which the transaction has to be completed, i.e.the assets/ securities have to be delivered in exchange for the payment. The difference between the transaction date and the settlement date is owing to the time required by the seller to deliver the assets. Nowadays, the transactions are executed electr…

Importance

- The importance can be ascertained on the basis of the following: 1. Regulation:According to regulatory bodies, the prospective buyer can’t resell the particular securities until the trade settlement, while the seller can’t use the funds to be received in exchange for the particular securities for buying any another security until the trade settlement. Hence, the date is equally i…

Conclusion

- So, it can be seen that the settlement date is a very important aspect of any transaction as it signifies when the trade has been actually settled, which is usually after certain days from the trading date. Further, accounting based on date is also a better indicator of the actual cash position of a company.

Recommended Articles

- This is a guide to Settlement Date. Here we also discuss the introduction and when does the settlement date occur? along with the importance and example. you may also have a look at the following articles to learn more – 1. Date of Record of Dividends 2. Dividends EX-Date vs Record Date 3. Future vs Option 4. Spot Market