The Closing Disclosure contains almost the exact same information as the settlement statement, but it is specific to the borrower and their fees. The Closing Disclosure is issued by the buyer’s lender, and is designed to be compared to the Loan Estimate, which is the first estimate of fees the buyer gets when they borrow money.

Is the settlement statement the same as a closing statement?

Yes, a settlement statement is the same as a closing statement, though “settlement” is the formal term most likely to be used by the real estate industry. What’s the difference between a Closing Disclosure and settlement statement?

What happens after Closing Disclosure?

What happens after signing closing disclosure? After the lender receives the signed Closing Disclosure from all borrowers, they can begin preparing loan documents. Once the loan documents are prepared, they are delivered to the escrow company. Signing. Signing typically takes place 1-2 days before closing.

Which type of loan will use A HUD-1 in place of a Closing Disclosure?

A HUD-1 form is most commonly used for reverse mortgages and mortgage refinance transactions. As of Oct. 3, 2015, the Closing Disclosure form replaced the HUD-1 form for most real estate transactions; however, if you applied for a mortgage on or before Oct. 3, 2015, you would receive a HUD-1.

What is the 3 Day Closing Disclosure rule?

Your lender is required by law to give you the standardized Closing Disclosure at least 3 days before closing. This is what is known as the Closing Disclosure 3-day rule. This requirement is thanks to the TILA-RESPA Integrated Disclosures guidelines, which went into effect on October 3, 2015.

Is there another name for a closing disclosure?

Prior to these rules, home buyers received two documents: the HUD-1 Settlement Statement and the Truth in Lending Disclosure Statement (instead of the Closing Disclosure).

What is final settlement statement?

A settlement statement is a document summarizing all costs owed by or credits due to the homebuyer and seller (or borrower if refinancing). The document also includes the purchase price of the property, loan amount and other details.

Is settlement date the same as closing date?

"Settlement date" and "closing date" are synonymous terms referring to the date when a property's seller and buyer meet to finalize the deal. At this time, the deed to the property is transferred from the seller to the buyer and all pertinent paperwork is completed.

What is the primary purpose of the settlement statement?

A The primary purpose of the settlement statement is to set forth all of the financial details of closing, showing each party's costs and credits.

Which two items will appear on a closing disclosure?

Credits and debits appear on the closing statement.

How can I get a copy of my closing documents?

You can obtain a certified copy of these documents from the closing agent or from your real estate agent if you lose the originals. The closing disclosure contains all the official charges and credits of your home purchase.

How soon after settlement can you move in?

You'll have to vacate prior to settlement day unless another arrangement has been negotiated. Buyers are generally keen to get in the day after settlement, so you'll want everything ready to go the day before.

What happens after house settlement?

After settlement, your lender will draw down on your loan. This means that they'll debit the amount they've paid at settlement from your loan account. You're then responsible for paying land transfer duty or stamp duty. It's usually paid on the settlement date.

What does settlement mean when buying a house?

Taking place at an agreed time and place, settlement day is the day you assume legal ownership of your home. The settlement day process involves your settlement agent (solicitor or conveyancer) meeting with your lender and the seller's representatives to sign and exchange the final documents of the sale.

What is the difference between a closing disclosure and a HUD?

The HUD-1 form, listing all closing costs, is given to all parties involved in reverse mortgage and mortgage refinance transactions. Since late 2015, a different form, the Closing Disclosure, is prepared for the parties involved in all other real estate transactions.

What is a HUD closing disclosure?

The Closing Disclosure (CD - formerly the HUD-1 Uniform Settlement Statement) is a three-page, government-mandated form that details the costs associated with a real estate transaction. The borrower should receive a copy of the CD at least one day prior to the closing.

What is estimated settlement statement?

The Estimated Settlement Statement lists all of the costs and credits associated with the purchase of a home showing the buyer their total costs to close the transaction and showing sellers their net profit (or loss). Think of it as your detailed receipt that details information from various places on one page.

What is FnF in salary?

What is full and final settlement? Whether an employee resigns from the job or is let go by the management, they are paid all the dues for their service till the last working day as FnF or full and final settlement. This includes any additional earnings or deductions as well.

How is FnF amount calculated?

Calculation of per day basic: (number of days of non-availed leaves * basic salary) / 26 days ( Avg paid days in a month). As per Section 7 (3) of the Payment of Gratuity Act 1972, Gratuity should be offered within 30 days of the resignation. If you fail to do so you need to pay with interest.

What is included in full and final settlement?

The full and final settlement includes the unpaid salary for the number of days for which the employee has worked for since his resignation date and his last working day.

What is F&F process?

Full and Final Settlement is the process when an employee quits an organization. It is actually the amount of money an employee receives after all the deductions after leaving the organization.

What is closing disclosure?

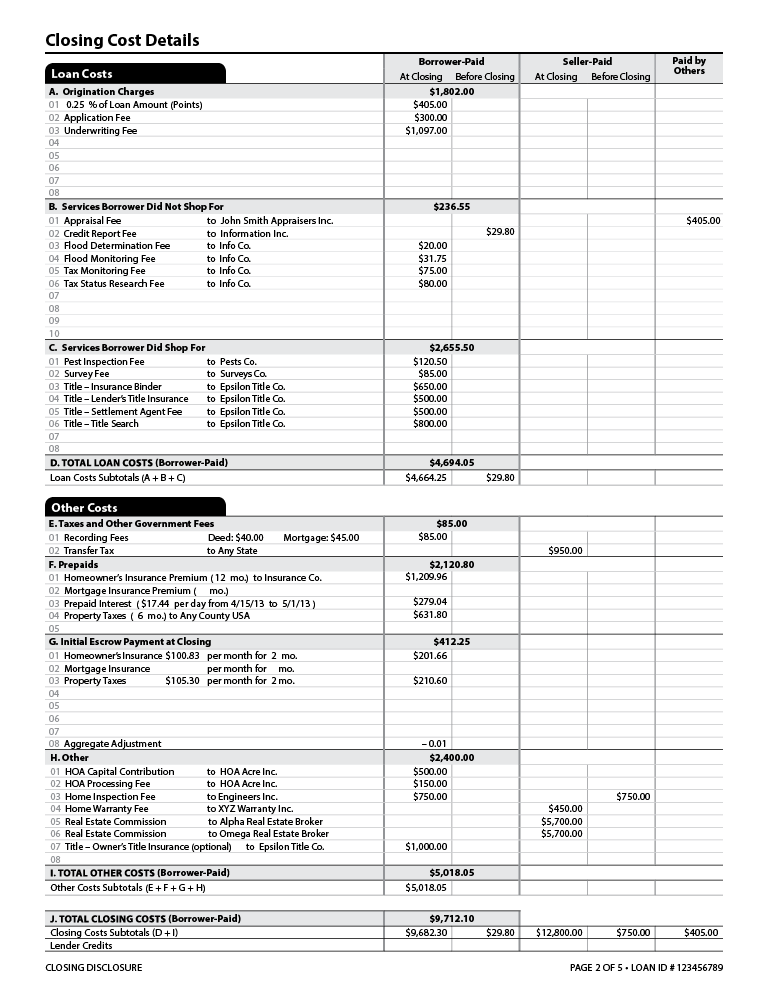

The closing disclosure is a type of settlement statement that was created and is regulated for the mortgage lending market. The closing disclosure is provided by the lender, closing attorney or title company to a borrower about three days before the closing on real estate. It outlines the final version of the loan terms and costs. Items in the closing disclosure include clauses like:

What is a HUD-1 settlement statement?

Both settlement statements, including HUD-1 settlement statements, and closing disclosures are a statements prepared by the closing attorney or title company giving a complete breakdown of costs involved in a real estate transaction. While closing disclosures provide information about a borrower’s loan, settlement statements do not include loan information.

What are disclosures regarding escrow accounts?

Disclosures regarding escrow accounts and if the lender will collect and distribute property taxes and insurance, total payments and finance charges, as well as appraisals, and lack of payment.

Who can review a reverse mortgage settlement?

Most buyers and sellers review the settlement statement or the closing disclosure form with a real estate agent, attorney, or settlement agent because it is important that the terms and costs are correct including spelling of the parties’ names, loan types, amounts to close the transaction, the loan term and amount, and estimated costs for closing, payments, and insurance. If you are obtaining either a reverse mortgage, buying or selling real estate the attorneys at Smith-Weiss Shepard & Spony, P.C. can assist you in reviewing these documents to ensure your financial interests are protected.

Settlement Statements, Closing Disclosures, and HUD-1s

There are a number of different ways to finance a real estate purchase. Some buyers are able to pay cash, but many work with financial institutions to obtain the funds to buy the property. Even when working with a lender, there are multiple options available for financing.

Settlement Statements

At a high level, the settlement statement is a document reflecting all the ways that money will change hands between parties at closing.

Closing Disclosures

A closing disclosure (CD) is a document given specifically to buyers who are working with a lender to finance a transaction. The CD provides all the relevant information regarding the buyer’s loan. It is provided by the lender and typically includes, but is not limited to:

What is a settlement statement?

A settlement statement is an itemized list of fees and credits summarizing the finances of an entire real estate transaction. It serves as a record showing how all the money has changed hands line by line.

How long before closing do you have to give closing disclosure?

In the wake of the subprime crisis, the Consumer Financial Protection Bureau requires that buyers receive the Closing Disclosure, outlining loan costs among other fees and information pertinent to the borrower, no later than 3 days before closing for review.

Is a settlement statement the same as a closing statement?

Yes, a settlement statement is the same as a closing statement, though “settlement” is the formal term most likely to be used by the real estate industry.

What is an ‘excess deposit’ at closing?

A particular line item that causes confusion on the seller’s settlement statement is the “Excess Deposit.” What is an excess deposit, and who will receive the funds listed on that line?

What does an impound account do at closing?

At closing the buyer sets up an impound account that allows them to bundle the cost of their mortgage principal, taxes, mortgage insurance, and other monthly costs into one payment. The lender likes this because they can make sure the new owner will keep up to date with all the payments associated with the home.

What information is needed to complete a closing document?

At the top of the document (before you get to the portion that looks like a spreadsheet) you’ll see a few boxes for inputting information that records basic details about the transaction, such as the names of the buyer and seller, the property address, and the closing date.

What is a seller's net sheet?

The seller’s net sheet is not an official document but an organizational worksheet that your agent will fill out to estimate how much you’ll pocket from your home sale after factoring in expenses like taxes , your real estate agent’s commission, your remaining mortgage, and escrow fees.

What is closing disclosure form?

What is a closing disclosure form? Put simply, it’s a form outlining the terms and costs of your mortgage—and one of the most important pieces of paperwork to check before you close on a home.

When is a HUD-1 settlement statement required?

Before Aug. 1, 2015, the CD was known by another name: the HUD-1 settlement statement. Yet this document was long and confusing, and required by federal law to be distributed to home buyers only on the day of closing—which didn’t give them much time to address any issues. This is why the settlement statement was replaced by the much more streamlined five-page closing disclosure, and laws were changed so that lenders are required to provide this document at least three business days before closing.

What is LE disclosure?

The LE outlined the approximate fees you would be expected to pay if you move forward with a lender to close on a home. But your closing disclosure is the real deal, which is all the more reason to scrutinize it carefully.

How much does closing cost for a home?

But in general, home buyers can expect typical closing costs to amount to about 3% to 4% of the home’s sale price.

Do real estate agents have errors on CDs?

Think such errors aren’t common? A recent survey of real estate agents by the National Association of Realtors® found that half of agents have detected errors on CDs. In other words, it really pays to check this document carefully and ask your real estate agent for help.

Can closing disclosures be postponed?

In some cases, though, the closing may have to be postponed so that a new closing disclosure can be sent out with a new three-day review period.

Why do buyers and sellers get different versions of closing disclosure forms?

This is partly because the Closing Disclosure contains personal information like your social security number you may not want others to know.

What Information Does the ALTA Settlement Statement Contain?

The charges listed in the ALTA Settlement Statement are broken down into ten different categories, including:

What is the ALTA Settlement Statement?

The ALTA Settlement Statement is a form that itemizes all of the credits and costs associated with a real estate transaction. There are four different versions of this form, including:

What is the financial section of a mortgage?

The financial section includes important information about the sale of the property including the final purchase price, the amount of earnest money the buyer put down, and the loan amount issued to the borrower. If the seller agreed to pay for repairs or a portion of the buyer’s closing costs, that’s also reflected in this section of the form. You may see a few other charges you’re not familiar with, including:

What is an impound at closing?

Impounds are expenses that the buyer pays at closing before they’re due , such as:

What is the middle column in a closing?

The middle column shows all the closing costs involved in the transaction. It’s divided up into sections so buyers and sellers can see the types of fees they’ll need to pay. There’s also a column on either side of the middle section—one for the buyer and one for the seller.

How much commission does a seller have to pay for a home?

This section shows how much real estate commission the seller will need to pay. Real estate commission usually costs 5% to 6% of the sale price of the home and is split between the buyer’s and seller’s agent.