Is the settlement statement the same as a closing statement?

Yes, a settlement statement is the same as a closing statement, though “settlement” is the formal term most likely to be used by the real estate industry. What’s the difference between a Closing Disclosure and settlement statement?

Is settlement statement same as Closing Disclosure?

You may also see the settlement statement come into play in along with the “Closing Disclosure” form. This is among the fairly common closing documents for seller. If you find at a later time you need a copy of your closing statement, contact the settlement agent for the home purchase.

Who fills out the closing settlement statement?

The settlement statement is prepared by an impartial third party to the transaction, usually an officer with the title or escrow company that performs the closing. In California, both the buyer and the seller sign the HUD-1 settlement statement at closing.

What are some examples of closing statement?

Letter Closing Examples

- Sincerely, Sincerely yours, Regards, Yours truly, and Yours sincerely. These are the simplest and most useful letter closings to use in a formal business setting. ...

- Best regards, Cordially, and Yours respectfully. These letter closings fill the need for something slightly more personal. ...

- Warm regards, Best wishes, and With appreciation. ...

WHAT IS AN closing statement?

A closing statement is a form used in a real estate transaction that includes an itemized list of all the buying or selling costs associated with that transaction. It's a standard element of home sales, especially those that involve mortgages, and refinancings.

Is HUD settlement statement the same as closing disclosure?

While closing disclosures provide information about a borrower's loan, settlement statements do not include loan information. Settlement statements are used for commercial transactions and cash closings.

What is the final closing statement called?

A closing statement, sometimes called a settlement statement or closing disclosure, ensures the seller and buyer both know exactly what they are agreeing to pay and for how long.

Are a closing disclosure and closing statement the same thing?

A closing statement or credit agreement is provided with any type of loan, often with the application itself. A seller's Closing Disclosure is prepared by a settlement agent and lists all commissions and costs in addition to the net total to be paid to the seller.

When should I receive the HUD-1 Settlement Statement?

In such case, the completed HUD-1 or HUD-1A shall be mailed or delivered to the borrower, seller, and lender (if the lender is not the settlement agent) as soon as practicable after settlement.

What is a final HUD statement?

The HUD-1 Settlement Statement is a standard government real estate form that was once used by settlement agents, also called "closing agents," to itemize all charges imposed upon a borrower and seller for a real estate transaction.

Where do I find closing statements?

If you find at a later time you need a copy of your closing statement, contact the settlement agent for the home purchase. Other parties that may have copies of the settlement documents include your real estate agent, or the financial institution that holds the loan for the property.

What is the primary purpose of the settlement statement?

A settlement statement provides a breakdown of all the closing costs and credits involved in a real estate transaction or refinance.

What comes after the closing disclosure?

What happens after the closing disclosure? Three business days after you receive your closing disclosure, you will use a cashier's check or wire transfer to send the settlement company any money you're required to bring to the closing table, such as your down payment and closing costs.

Who prepares the HUD settlement statement?

A HUD-1 or HUD-1A Settlement Statement is prepared by a creditor or, more typically, by the settlement agent who conducts the closing on the creditor's behalf.

How do I get my HUD payoff statement?

Requests for payoff statements, subordinations, releases, and other documentation specific to these programs can be submitted to:Payoff Requests: [email protected] Requests: [email protected] Requests: [email protected] Partial Claim document submittal: [email protected] items...

What is the primary purpose of the settlement statement?

A settlement statement provides a breakdown of all the closing costs and credits involved in a real estate transaction or refinance.

What is a closing disclosure in Florida?

The Closing Disclosure is a five-page form that details all the important aspects of the subject mortgage loan, including purchase price, interest rate, taxes, loan fees, title fees and other closing costs and expenses.

What is a settlement statement?

A settlement statement is an itemized list of fees and credits summarizing the finances of an entire real estate transaction. It serves as a record showing how all the money has changed hands line by line.

Who is responsible for preparing the settlement statement?

Whoever is facilitating the closing — whether it be a title company, escrow firm, or real estate attorney — will be responsible for preparing the settlement statement.

Is a settlement statement the same as a closing statement?

Yes, a settlement statement is the same as a closing statement, though “settlement” is the formal term most likely to be used by the real estate industry.

What is an ‘excess deposit’ at closing?

A particular line item that causes confusion on the seller’s settlement statement is the “Excess Deposit.” What is an excess deposit, and who will receive the funds listed on that line?

What does an impound account do at closing?

At closing the buyer sets up an impound account that allows them to bundle the cost of their mortgage principal, taxes, mortgage insurance, and other monthly costs into one payment. The lender likes this because they can make sure the new owner will keep up to date with all the payments associated with the home.

What information is needed to complete a closing document?

At the top of the document (before you get to the portion that looks like a spreadsheet) you’ll see a few boxes for inputting information that records basic details about the transaction, such as the names of the buyer and seller, the property address, and the closing date.

What is a seller's net sheet?

The seller’s net sheet is not an official document but an organizational worksheet that your agent will fill out to estimate how much you’ll pocket from your home sale after factoring in expenses like taxes , your real estate agent’s commission, your remaining mortgage, and escrow fees.

What Is a Settlement Statement?

A settlement statement is a document that summarizes the terms and conditions of a settlement, most commonly a loan agreement. A loan settlement statement provides full disclosure of a loan’s terms, but most importantly it details all of the fees and charges that a borrower must pay extraneously from a loan’s interest. Different types of loans can have varying requirements for settlement statement documentation. Generally, loan settlement statements can also be referred to as closing statements .

When are settlement statements created?

Beyond just loans, settlement statements can also be created whenever a large settlement has taken place, such as with a large business transaction or potentially in the legal, insurance, banking, and trading industries.

What is debt settlement?

Debt settlement: A debt settlement statement can provide a summary of debts written off, reduced, or otherwise amended after a debt settlement has completed. Lawyers and debt settlement companies work on behalf of borrowers with overwhelming amounts of debt, in order to help them reduce some or all of their obligations.

What is a settlement statement in stock trading?

Trading: In financial market trading, settlement statements provide proof of a security’s ownership transfer. Typically, stocks are transferred with a T+2 settlement date meaning ownership is achieved two days after the transaction is made.

What is insurance settlement?

Insurance settlement: An insurance settlement is most commonly documentation of the amount an insurer agrees to pay after reviewing an insurance claim. Banking: In the banking industry, settlement statements are produced on a regular basis for internal banking operations.

Does a reverse mortgage require a HUD-1 settlement statement?

RESPA requires a HUD-1 settlement statement for borrowers involved in a reverse mortgage. For all other types of mortgage loans, RESPA requires the mortgage closing disclosure. Both the HUD-1 and mortgage closing disclosure are standardized forms.

Settlement Statements, Closing Disclosures, and HUD-1s

There are a number of different ways to finance a real estate purchase. Some buyers are able to pay cash, but many work with financial institutions to obtain the funds to buy the property. Even when working with a lender, there are multiple options available for financing.

Settlement Statements

At a high level, the settlement statement is a document reflecting all the ways that money will change hands between parties at closing.

Closing Disclosures

A closing disclosure (CD) is a document given specifically to buyers who are working with a lender to finance a transaction. The CD provides all the relevant information regarding the buyer’s loan. It is provided by the lender and typically includes, but is not limited to:

Why do buyers and sellers get different versions of closing disclosure forms?

This is partly because the Closing Disclosure contains personal information like your social security number you may not want others to know.

What Information Does the ALTA Settlement Statement Contain?

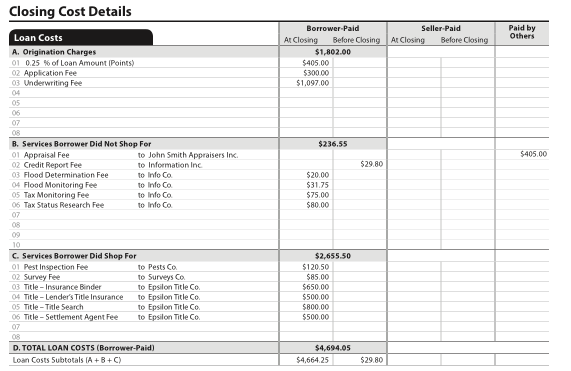

The charges listed in the ALTA Settlement Statement are broken down into ten different categories, including:

What is the ALTA Settlement Statement?

The ALTA Settlement Statement is a form that itemizes all of the credits and costs associated with a real estate transaction. There are four different versions of this form, including:

What is the financial section of a mortgage?

The financial section includes important information about the sale of the property including the final purchase price, the amount of earnest money the buyer put down, and the loan amount issued to the borrower. If the seller agreed to pay for repairs or a portion of the buyer’s closing costs, that’s also reflected in this section of the form. You may see a few other charges you’re not familiar with, including:

What is an impound at closing?

Impounds are expenses that the buyer pays at closing before they’re due , such as:

What is the middle column in a closing?

The middle column shows all the closing costs involved in the transaction. It’s divided up into sections so buyers and sellers can see the types of fees they’ll need to pay. There’s also a column on either side of the middle section—one for the buyer and one for the seller.

How much commission does a seller have to pay for a home?

This section shows how much real estate commission the seller will need to pay. Real estate commission usually costs 5% to 6% of the sale price of the home and is split between the buyer’s and seller’s agent.

What is a closing statement?

The Seller’s Closing Statement, or Settlement Statement, is an itemized list of fees and credits that shows your net profits as the seller, and sums up the finances of the entire transaction. Everything from the sale price, loan amounts, school taxes, and other important information is contained in this document. Sellers can expect to pay between 6-10% of the final sale price in commissions and closing costs. So, it’s good to see exactly where that money is going.

What is settlement statement cash?

Settlement Statement Cash – This version is used for liquid cash transactions for property sales.

What fees would a seller pay?

Another cost that buyers and sellers may both have to pay is their portion of the commission for the real estate agents. This would be listed in your seller’s disclosure statement. You might also pay your prorated portion of the property taxes, or homeowners insurance for the period you’re still living in the home.

How long does it take to get a closing disclosure?

Since the subprime lending crisis of the 2000s, the Consumer Financial Protection Bureau requires that buyers receive the Closing Disclosure no later than 3 days before closing. It outlines loan costs among other fees and information pertinent to the borrower,

What is due when closing a mortgage?

The Big Stuff. Anything you owe on the mortgage is due when you close the sale. That’s the first big thing to think about from a seller’s perspective. Another cost that buyers and sellers may both have to pay is their portion of the commission for the real estate agents.

Is there a closing statement for a seller?

There’s no single boilerplate “closing statement” form for sellers from state to state. However, the seller’s settlement form created by the American Land Title Association (ALTA) is widely used for real estate transactions, and lists the main terms you’ll see on your statement.

Can a buyer and seller statement be combined?

But it is possible to have a combined Buyer’s or Seller’s statement.

The History of Real Estate Settlement Procedures

HUD-1 Settlement Statement

- 1986-2015:Prior to October 2015, the Settlement Statement was known as the HUD-1, which is a standard government form issued by the Closing Agent that lists all credits, charges and home loan terms for both the buyer and the seller in all real estate transactions that required a mortgage. The charges for both the borrower and seller were listed on ...

The Current Closing Disclosure

- 2015-today: Now let’s get down to the nitty gritty on what is expected in the here and now. The Consumer Financial Protection Bureau (CFPB) took over administration from HUD and replaced the HUD-1 with the Closing Disclosurein October of 2015. It is similar to the HUD-1 in that it details the loan terms and costs, including the interest rates, closing costs, taxes, monthly payments, a…

A Couple Tips

- Take the time to read through these documents to look for mistakes, and ask your lender and Real Estate Agent to help you what you don't understand. Don’t assume that the Closing Disclosure is correct. Mistakes happen, so don’t be afraid to ask questions or seek clarification before you sign the paperwork at closing. If it is a major mistake, the buyer can obtain an explanation, and even …