Do you have to pay taxes on a divorce settlement?

You do not usually have to pay Capital Gains Tax if you give, or otherwise ‘dispose of’, assets to your husband, wife or civil partner before you finalise the divorce or civil partnership. Assets...

Do you pay taxes on divorce settlements?

This means that every individual has their own personal tax allowance and pays personal tax on their own income. Separation or divorce does not affect this. Note that there is no Income Tax to pay when you transfer assets under a divorce settlement.

Do you have to pay taxes on a settlement?

Whether you need to pay taxes on a lawsuit settlement is dependent on the circumstances of the case. You’ll have to determine the nature of the claim and whether it was paid to you. If it was a settlement of an accident, it’ll be treated as ordinary income. Its value will be taxable if the plaintiff made it whole and won’t receive tax breaks.

Will I have to pay taxes on my settlement?

While there are times that you are not required to pay tax on your settlement, there are also cases in which you will be required to fork over a percentage. As long as you know your way around the law, you can minimize how much you have to pay in the end. In Court for Personal Injury?

Is money paid in a divorce settlement taxable?

Under the current federal income tax laws, alimony or spousal maintenance is non-taxable and the party paying the alimony or spousal maintenance does not receive a tax deduction. Spousal support or alimony is paid with after-tax dollars like child support is paid with after-tax dollars.

Is a lump sum payment in a divorce settlement taxable?

Generally, lump-sum divorce settlements are not taxable for the recipient. If the lump-sum payment is an alimony payment, it is not deductible for the person who makes the payment and is not considered income for the recipient.

How can I avoid paying taxes on a divorce settlement?

Primary Residence If you sell your residence as part of the divorce, you may still be able to avoid taxes on the first $500,000 of gain, as long as you meet a two-year ownership-and-use test. To claim this full exclusion, you should make sure to close on the sale before you finalize the divorce.

Who pays capital gains in divorce?

Property Settlements When this occurs and the property has increased in value since the time of the divorce, the seller may owe capital gains taxes based on the value of the property at the time of acquisition.

Is a settlement taxable income?

Settlement money and damages collected from a lawsuit are considered income, which means the IRS will generally tax that money. However, personal injury settlements are an exception (most notably: car accident settlements and slip and fall settlements are nontaxable).

Is money received in family settlement taxable?

Therefore, the family arrangement is not taxable - Tri. Income Tax - Taxation on amount received on family settlement - accrual of income - entire property was in existence at the time of partition in which concerned family members were having their interest/shares, therefore, it was clearly a family settlement.

Is a house buyout taxable?

Generally, you don't have to pay taxes on any gain or loss you have from the buyout. That's true even if the house is just one part of the bigger plan to divvy up your assets and debts — for example, if you get the house because you agreed to give your ex-spouse cash or to pay off debt you both owe.

Can you file married if you were divorced during the year?

Filing status Couples who are splitting up but not yet divorced before the end of the year have the option of filing a joint return. The alternative is to file as married filing separately. It's the year when your divorce decree becomes final that you lose the option to file as married joint or married separate.

Are spousal support payments taxable?

Spousal support is usually taxable and deductible And they must pay income tax on the payments. The spouse who pays the support (the payor) can claim it as a deduction. (It's like deducting contributions to registered retirement plans or child care expenses).

Are alimony payments taxable?

If you receive monthly spousal support, you must pay income tax on the total support you receive each year. And, you can claim a tax deduction on legal fees spent to get monthly spousal support. But, if you receive all of your spousal support at once in a lump-sum payment, you do not pay income tax on it.

Who pays tax on divorce settlement?

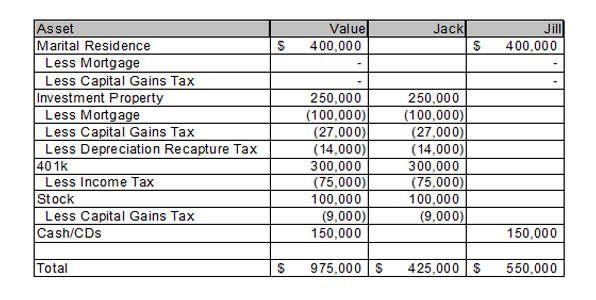

Marital property is commonly described as property acquired by the spouses during their marriage (for example, a family home or retirement plan assets).

Who is responsible for proving the presence of property in divorce?

It is the responsibility of the divorced parties to recognize and prove the presence of properties.

What is equitable distribution?

As a result, equitable distribution refers to a fair, but not strictly equal, division of marital assets.

What to do when you are approaching the end of your divorce?

If you’re approaching the end of your divorce, it may be a good idea to consult with your partner to get formal appraisals or estimates on the more valuable items.

Why is it important to provide an extra copy of a settlement proposal?

It is beneficial to provide an extra copy for your partner during negotiations so that he or she can see what basis you are working on when making settlement proposals.

Who has more say in how the property is shared whether they signed a prenuptial agreement or an agreement during?

The spouse has more say in how the property is shared whether they signed a prenuptial agreement or an agreement during the marriage. The following are some other elements of a fair distribution that should not be overlooked:

Is cash traded between spouses deductible?

Cash traded between (ex)spouses as a component of a separation repayment—for instance, to adjust resources—is for the most part not available to the collector and not duty deductible to the payer.

Is a lump sum payment in a divorce settlement taxable?

Lump-sum payments of property made in a divorce are typically taxable. Now those payments are no longer deductible.

Is a cash settlement in a divorce taxable?

Generally, money that is transferred between (ex)spouses as part of a divorce settlement—such as to equalize assets—is not taxable to the recipient and not deductible by the payer. Such plans are always taxable on withdrawal because the money was not taxed when it was contributed.

Do divorce payments get taxed?

The Tax Cuts and Jobs Act enacted new tax rules regarding spousal support payments, also known as alimony. In divorces finalised after January 1, 2019, the person paying spousal support can no longer deduct the amount from their taxes. For recipients, spousal support payments are no longer considered taxable income.

Do you pay tax on a divorce settlement UK?

In England and Wales the majority of divorce settlements will not be taxable. The main tax provisions which relate to people going through a divorce or separation cease to apply when the relationship has broken down, rather than by reference to the date of Decree Absolute or Final Dissolution Order.

Do you have to report settlement money on your taxes?

Settlement money and damages collected from a lawsuit are considered income, which means the IRS will generally tax that money, although personal injury settlements are an exception (most notably: car accident settlement and slip and fall settlements are nontaxable).

Does a divorce settlement affect benefits?

Most income replacement benefits including Universal Credit, Jobseekers Allowance, Income Support and Employment and Support Allowance would be affected by a settlement. Your divorce financial settlement may see you receive assets such as property, cars and other possessions.

Is divorce maintenance taxable?

Certain alimony or separate maintenance payments are deductible by the payer spouse, and the recipient spouse must include it in income (taxable alimony or separate maintenance). Alimony and separate maintenance payments you receive under such an agreement are not included in your gross income.

Is a cash settlement from a husband taxable?

If the cash settlement you received from your husband was for equalization of matrimonial property, then it is not considered taxable ...

Is a lump sum payment taxable?

If the money was for support, then a lump sum payment is neither taxable or tax deductible. In any case, you should always seek the advice of a qualified individual, such as a lawyer, prior to accepting anything in a settlement.

Is a T4 taxable?

One unique instance of this occurs when a paying spouse gives money to his ex-spouse out of a corporation and the accountant then produces a T4—making it fully taxable. The CRA will want you to pay taxes on this revenue and leave it up to you to fight with your spouse.

Can you rollover from one spouse to another without penalty?

They key takeaway? The only time a rollover from one spouse to another can be done without any tax consequences is when there’s a fully executed and signed separation agreement. You only get one kick at the can, so you have to make sure you get it right the first time.

What happens if you sign a transfer deed when you divorce?

First, who owns the home? If you signed a transfer deed when you divorced and it is only in your ex's name, then you have no tax consequences from the sale. If your ex pays you $65,000 then it's not taxable to you no matter how your ex got it.

Do you have to pay capital gains tax if you sell your house?

If either you or your spouse has lived in the home for at least the last 2 years, then both of you qualify to use the capital gains exclusion even though you moved out. You can exclude the first $250,000 of capital gains each, then any higher gains are subject to capital gains tax.

Is a 401(k) taxable if you transfer assets?

However, if the asset transfer includes a tax-advantaged retirement fund like a pension, annuity, IRA or 401 (k), then the money will be taxed by the spouse when they withdraw it. Such plans are always taxable on withdrawal because the money was not taxed when it was contributed. If you receive IRA-type assets in a divorce, you may have several options on what to do with it, with different tax consequences.

Is alimony taxable in divorce?

Generally, money that is transferred between (ex)spouses as part of a divorce settlement—such as to equalize assets—is not taxable to the recipient and not deductible by the payer. This is different than alimony, also called spousal maintenance, which is taxable (and deductible) unless the settlement specifies that it is not. In some cases, a settlement might include an asset transfer and a lump sum of alimony instead of periodic payments—in that case the alimony will generally be taxable.

What happens if my spouse withdraws from my 401(k)?

Similarly, if a spouse who receives a percentage of a 401k makes a withdrawal from the account, that person must pay income taxes on the amount withdrawn. And if the withdrawal is made before age 59 1/2, that person must also pay a 10% penalty on top of the taxes. In short, 401k and other retirement transfers pursuant to a divorce are generally ...

Is retirement transfer taxable?

There are a couple of things you can do to lower the risk of a tax issue. First, although this seems obvious, to ensure the event is not taxable, the transfer must be included in the divorce agreement and/or court judgment. Retirement transfers are generally included in every agreement.

Is retirement money taxable after divorce?

Finally, although transfers of retirement money pursuant to a divorce are non-taxable events , regular tax and penalty rules do still apply to any withdrawals or payments from the plan after the transfer is complete.

Is retirement money transferred to a divorce taxable?

Finally, although transfers of retirement money pursuant to a divorce are non-taxable events, regular tax ...

Is a 401(k) transfer taxable in divorce?

In short, 401k and other retirement transfers pursuant to a divorce are generally non-taxable. However, once the money is transferred, regular tax rules apply to payouts or withdrawals from the account. If you have any questions about 401k transfers in divorce or any other divorce questions, feel free to contact us.