Full Answer

What type of settlement is not taxable?

personal injury settlementsSettlement money and damages collected from a lawsuit are considered income, which means the IRS will generally tax that money. However, personal injury settlements are an exception (most notably: car accident settlements and slip and fall settlements are nontaxable).

Is the VW diesel settlement taxable?

In the case of property, if the settlement merely restores your original value, it's not taxable, but if it enriches you beyond where you were before, it is taxable.

What part of a settlement is taxable?

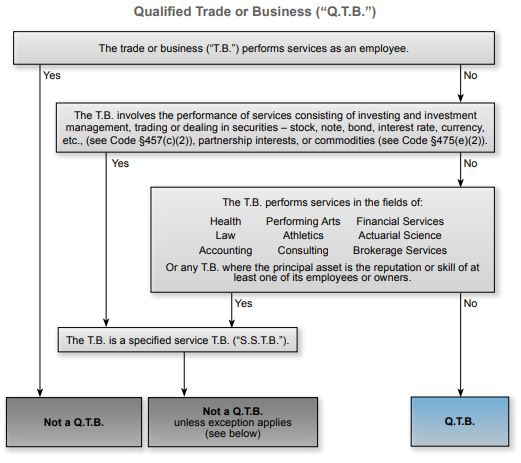

The general rule of taxability for amounts received from settlement of lawsuits and other legal remedies is Internal Revenue Code (IRC) Section 61 that states all income is taxable from whatever source derived, unless exempted by another section of the code.

Is a settlement award taxable?

In California, personal injury law allows victims to recover additional settlements known as punitive damages. These awards occur when the grievance, injury, or damage results form an egregious act of the defendant. These settlement dollars are always considered taxable.

How can I avoid paying taxes on a settlement?

How to Avoid Paying Taxes on a Lawsuit SettlementPhysical injury or sickness. ... Emotional distress may be taxable. ... Medical expenses. ... Punitive damages are taxable. ... Contingency fees may be taxable. ... Negotiate the amount of the 1099 income before you finalize the settlement. ... Allocate damages to reduce taxes.More items...•

Will I get a 1099 for a lawsuit settlement?

If your legal settlement represents tax-free proceeds, like for physical injury, then you won't get a 1099: that money isn't taxable. There is one exception for taxable settlements too. If all or part of your settlement was for back wages from a W-2 job, then you wouldn't get a 1099-MISC for that portion.

Can the IRS take my settlement money?

If you have back taxes, yes—the IRS MIGHT take a portion of your personal injury settlement. If the IRS already has a lien on your personal property, it could potentially take your settlement as payment for your unpaid taxes behind that federal tax lien if you deposit the compensation into your bank account.

Are Settlements tax deductible?

Generally, if a claim arises from acts performed by a taxpayer in the ordinary course of its business operations, settlement payments and payments made pursuant to court judgments related to the claim are deductible under section 162.

How can you avoid paying taxes on a large sum of money?

6 ways to cut your income taxes after a windfallCreate a pension. Don't be discouraged by the paltry IRA or 401(k) contribution limits. ... Create a captive insurance company. ... Use a charitable limited liability company. ... Use a charitable lead annuity trust. ... Take advantage of tax benefits to farmers. ... Buy commercial property.

Is a lump sum payment in a divorce settlement taxable?

Generally, lump-sum divorce settlements are not taxable for the recipient. If the lump-sum payment is an alimony payment, it is not deductible for the person who makes the payment and is not considered income for the recipient.

Is a lump sum payment in a divorce settlement taxable?

Generally, lump-sum divorce settlements are not taxable for the recipient. If the lump-sum payment is an alimony payment, it is not deductible for the person who makes the payment and is not considered income for the recipient.

Do I have to report personal injury settlement to IRS?

The compensation you receive for your physical pain and suffering arising from your physical injuries is not considered to be taxable and does not need to be reported to the IRS or the State of California.

Are compensatory and punitive damages taxable?

In California & New York, punitive damages can be subject to taxation by both the state and the IRS. Because punitive damages are taxable and compensatory damages are not, it's critical to be meticulous in distinguishing each classification of damages that you're awarded in a personal injury claim.

Why is a W 9 required for settlement?

The Form W-9 is a means to ensure that the payee of the settlement is reporting its full income. Attorneys are frequently asked to supply their own Taxpayer Identification Numbers and other information to the liability carrier paying a settlement.

What happens if you sell your car at a later date?

When you sold your vehicle at a later date, you would need to take this reduced basis into account to determine if the sale of your vehicle results in a taxable gain at that time. If the total payments received do not exceed your tax basis in the vehicle, you would not have any tax consequence from the payments, now or when you sold the car in the future.

Why was Volkswagen caught?

Environmental Protection Agency for cheating on the emissions tests of its “clean diesel” vehicles.

What happens if you buy back a car?

Under the owner buyback option, there could be tax implications to you if the payments made as a result of the Class Action Settlement exceed your tax basis in the vehicle. In this instance, you would recognize a gain on your tax return resulting from the sale of the affected vehicle. If the Class Action Settlement payments are less than your tax basis in the vehicle, you would not have any tax consequences as losses realized on personal-use property are not deductible. If the affected vehicle had been used for business purposes or was held strictly for investment purposes, the loss would be deductible on your tax return.

Can you report Volkswagen restitution on your taxes?

Current lessees would not have any income to report by allowing Volkswagen to repair their leased vehicle. However, current and former lessees should report the full value of their “lessee restitution” payment as income on their tax return. At this time, we do not know if the courts will consider the damages that will be paid out to be compensatory or punitive, but it is unlikely that these payments will fall under one of the few exceptions in the Internal Revenue Code that allow damages from a settlement lawsuit to be nontaxable.

What is the tax rule for settlements?

Tax Implications of Settlements and Judgments. The general rule of taxability for amounts received from settlement of lawsuits and other legal remedies is Internal Revenue Code (IRC) Section 61 that states all income is taxable from whatever source derived, unless exempted by another section of the code. IRC Section 104 provides an exclusion ...

What is employment related lawsuit?

Employment-related lawsuits may arise from wrongful discharge or failure to honor contract obligations. Damages received to compensate for economic loss, for example lost wages, business income and benefits, are not excludable form gross income unless a personal physical injury caused such loss.

What is the exception to gross income?

For damages, the two most common exceptions are amounts paid for certain discrimination claims and amounts paid on account of physical injury.

Is emotional distress excludable from gross income?

96-65 - Under current Section 104 (a) (2) of the Code, back pay and damages for emotional distress received to satisfy a claim for disparate treatment employment discrimination under Title VII of the 1964 Civil Rights Act are not excludable from gross income . Under former Section 104 (a) (2), back pay received to satisfy such a claim was not excludable from gross income, but damages received for emotional distress are excludable. Rev. Rul. 72-342, 84-92, and 93-88 obsoleted. Notice 95-45 superseded. Rev. Proc. 96-3 modified.

Is a settlement agreement taxable?

In some cases, a tax provision in the settlement agreement characterizing the payment can result in their exclusion from taxable income. The IRS is reluctant to override the intent of the parties. If the settlement agreement is silent as to whether the damages are taxable, the IRS will look to the intent of the payor to characterize the payments and determine the Form 1099 reporting requirements.

Is mental distress a gross income?

As a result of the amendment in 1996, mental and emotional distress arising from non-physical injuries are only excludible from gross income under IRC Section104 (a) (2) only if received on account of physical injury or physical sickness. Punitive damages are not excludable from gross income, with one exception.

Is emotional distress taxable?

Damages received for non-physical injury such as emotional distress, defamation and humiliation, although generally includable in gross income, are not subject to Federal employment taxes. Emotional distress recovery must be on account of (attributed to) personal physical injuries or sickness unless the amount is for reimbursement ...

What is settlement document 7436?

For most cases solely involving deficiencies or liabilities for taxes or penalties, including employment taxes in section 7436 cases, the form of the settlement document will be a combination stipulation and decision. This is one document executed by or on behalf of the parties. It is submitted to the court, and, upon execution by the judge, ...

Who must execute a settlement document?

If documents to be filed with the Tax Court on behalf of both the petitioner and the respondent are not executed by the petitioner, they must be executed by an attorney or other representative admitted to practice before the court who has duly entered an appearance on behalf of the petitioner in the case. This fact must be checked by the attorney prior to forwarding the documents for execution on behalf of the petitioner. Settlement documents are not executed on behalf of the Chief Counsel until after execution on behalf of the petitioner and when they are ready for filing with the court.

Why is a separate stipulation never served?

A separate stipulation document, however, is never served on the parties because the court merely files this document. When settlement documents are filed at trial sessions, Field Counsel will date stamp the initialed copy of the combined settlement and decision document, or the separate decision document "lodged" with the court.

When is a decision document required to include a provision that states that the petitioner is not entitled to costs under?

When the litigation or administrative costs issue has been raised in settled or litigated cases and the parties agree on the disposition of this issue, the decision document must include either a provision which states that the petitioner is not entitled to costs under section 7430 or a provision stating that petitioner is entitled to $ [amount] in costs under section 7430. For a discussion of settlement procedures and settlement authority, please refer to CCDM 35.10.1.1.2. See also requirements of T.C. Rule 232 (e).

How does a stipulation document work?

A separate stipulation document is filed with the court. It will be stamped "filed" by the court. The combined stipulation and decision document or the separate decision document, however, is not "filed" . Instead, it is executed by the judge, and it becomes "entered" as the court’s decision. In effect, the combined or separate decision documents are "lodged" with the court until the decision is entered on the court’s records. The date of the decision is the date it is entered, not the date on which a judge executes the decision document. See section 7459. One copy of the entered decision is served on the respondent. A separate stipulation document, however, is never served on the parties because the court merely files this document.

When the parties cannot agree on the award of litigation or administrative costs in settled cases, the parties will submit a answer?

When the parties cannot agree on the award of litigation or administrative costs in settled cases, the parties will submit a stipulation of settlement which shall include the elements described in T.C. Rule 231 (c). The rule provides that the stipulation of settlement is to accompany a motion for costs. This stipulation of settlement is binding upon the parties.

Who approves Section 7436 cases?

As a general rule, decisions in section 7436 cases are reviewed and approved by Division Counsel/Associate Chief Counsel (TEGE), EOEG:ET1.

IRC Section and Treas. Regulation

- IRC Section 61explains that all amounts from any source are included in gross income unless a specific exception exists. For damages, the two most common exceptions are amounts paid for certain discrimination claims and amounts paid on account of physical injury. IRC Section 104explains that gross income does not include damages received on account of personal phys…

Resources

- CC PMTA 2009-035 – October 22, 2008PDFIncome and Employment Tax Consequences and Proper Reporting of Employment-Related Judgments and Settlements Publication 4345, Settlements – TaxabilityPDFThis publication will be used to educate taxpayers of tax implications when they receive a settlement check (award) from a class action lawsuit. Rev. Rul. 85-97 - The …

Analysis

- Awards and settlements can be divided into two distinct groups to determine whether the payments are taxable or non-taxable. The first group includes claims relating to physical injuries, and the second group is for claims relating to non-physical injuries. Within these two groups, the claims usually fall into three categories: 1. Actual damages re...

Issue Indicators Or Audit Tips

- Research public sources that would indicate that the taxpayer has been party to suits or claims. Interview the taxpayer to determine whether the taxpayer provided any type of settlement payment to any of their employees (past or present).