Yes, the Equifax Data Breach Settlement email and website are real. WHAT WE FOUND Although the Federal Trade Commission (FTC) has previously warned of people attempting to scam Equifax cyberattack victims, EquifaxBreachSettlement.com is a real website and the email Dan received is legitimate, an FTC spokesperson confirmed to VERIFY.

Full Answer

What you should know about the Equifax breach settlement?

The Federal Trade Commission (FTC) has issued a consumer alert regarding the Equifax Data Breach. In September 2017, Equifax announced a data breach, which affected the personal information of 147 million people. Under a recent settlement filed, Equifax agreed to spend up to $425 million to help people affected by the data breach.

What to do after the Equifax breach?

- Work to help consumers (you can offer credit monitoring or other services)

- Increase your cybersecurity measures to prevent future attacks

- Show your customers how you are improving security through open communication and a commitment to transparency

Should you freeze your credit after the Equifax data breach?

Whether you could benefit from a credit freeze after a data breach depends on what information was compromised. If only your credit card information was stolen, getting a replacement card should reduce your exposure to fraud. But when identifying information is accessed, like your Social Security number, a credit freeze could be a smart move.

How to take advantage of the Equifax data breach settlement?

- Get a free credit report at www.annualcreditreport.com or by calling 877-322-8228.

- Call the Equifax Settlement Administrator at 1-833-759-2982.

- Take advantage of any free services being offered as a result of the breach.

- Use two-factor authentication on your online accounts whenever available.

- Consider a credit freeze.

See more

Did anyone get money from Equifax?

Court Approves Equifax Breach Settlement: Money for Some, Free Credit Monitoring for All. Equifax will pay up to $425 million in restitution to those directly impacted by the massive data breach of the credit bureau in 2017. A federal court gave final approval to the class-action lawsuit settlement in mid-January.

Is Equifax website safe?

How secure is the information I provide to Equifax.com? Social Security number and credit card number(s) are encrypted before being transmitted to/from our servers. For your security, this site requires the use of a 128-bit SSL compatible browser.

How do I know if I have been affected by Equifax breach?

Equifax has created a website where you can find out if you have been affected by the breach. The website will ask you for the last six digits of your social security number and your last name, and then will tell you if you have been affected. You can also call 1-833-759-2982.

What is the real Equifax website?

“Consumers should be aware of fake websites purporting to be operated by Equifax. Our dedicated website for consumers to learn more about the incident and sign up for free credit monitoring is https://www.equifaxsecurity2017.com, and our company homepage is equifax.com.

What is Equifax settlement?

Equifax data breach settlement. In 2017, Equifax announced a breach that exposed the personal data of approximately 147 million people. The legal settlement is now final. Here's how you can use the services provided through the settlement to protect and monitor your credit.

Should I give my SSN to Equifax?

Is it okay to give it to them? Yes. The credit reporting agencies ask for your Social Security Number (or Taxpayer ID Number) and other personal information to identify you and avoid sending your credit report to the wrong person. It is okay to give this information to the credit reporting agency that you call.

How much is the Equifax settlement per person?

Individual consumers who were wronged were supposed to be able to claim $125 each from the settlement—until, that is, the FTC and Equifax remembered the wronged were still 144 million strong and the settlement fund didn't have enough cash.

Has there been a recent Equifax data breach?

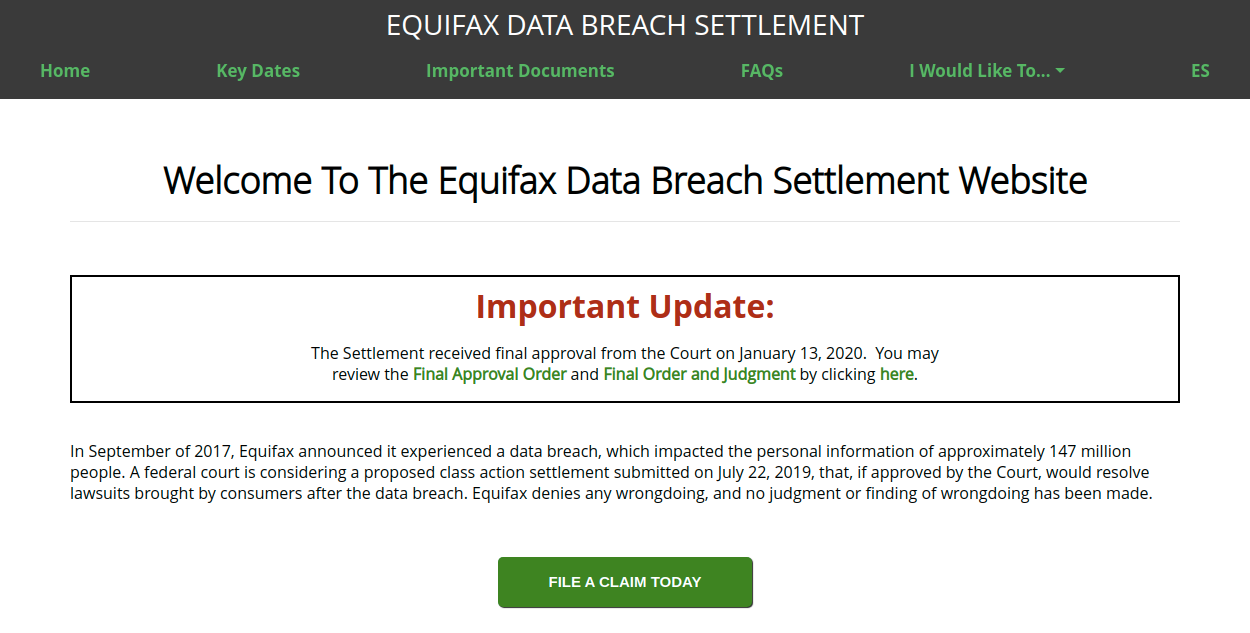

In September of 2017, Equifax announced a data breach that exposed the personal information of 147 million people. The company has agreed to a global settlement with the Federal Trade Commission, the Consumer Financial Protection Bureau, and 50 U.S. states and territories.

What happened to Equifax after the data breach?

In the wake of Equifax's 2017 data breach, which compromised the personal information of roughly 147 million consumers — including names, birthdates and Social Security numbers — the company ended up as the target of multiple lawsuits and reached a settlement in 2019 with the FTC, the Consumer Financial Protection ...

Is Equifax a legit company?

Trusted: Equifax is one of the major credit bureaus and has a highly regarded reputation.

Is Equifax and Experian the same?

Experian provides monthly data for each account including the minimum payment due, payment amounts, and balances. Equifax lists accounts in groupings of “open” or “closed,” which makes it easy to view current versus old credit data.

Which banks use Equifax?

Banks that typically use Equifax dataDiscover it Cash Bank.Discover it Balance Transfer.Discover it Miles.Chase Freedom Flex.Chase Unlimited Freedom.Chase Slate Edge.Citi Double Cash Card.Citi Premier Card.

Is Equifax a legitimate company?

Equifax is one of three national credit bureaus. These companies collect information about your credit history, such as how many credit cards you have, how much money you owe, and how you pay your bills.

Is Equifax Credit Score accurate?

Both TransUnion and Equifax are reliable credit reporting agencies that compile reports and calculate your credit scores using different scoring models.

Can Experian be trusted?

Experian is trusted by millions of consumers and businesses and is safe to use. Their free and premium services are readily available but with several layers of protection to shield your information from fraudsters.

Is Equifax or TransUnion more accurate?

Neither score is more or less accurate than the other; they're only being calculated from slightly differing sources. Your Equifax credit score is more likely to appear lower than your TransUnion one because of the reporting differences, but a “fair” score from TransUnion is typically “fair” across the board.

How much did Equifax pay for data breach?

It's been mere days since credit-reporting firm Equifax agreed to pay up to $700 million to settle claims over a massive 2017 data breach and already scammers are trying to exploit the deal to fraudulently get their hands on your personal information.

How to figure out if you are a settlement claimant?

On the settlement website, you can figure out whether you're one of the eligible claimants. Enter your last name and last six digits of your Social Security number in a website operated by the settlement administrator (not Equifax). If told your personal information was affected by the data theft, then you can file a claim.

What is the deadline for filing your claim?

The deadline to file claims is Jan. 22, 2020, for most benefits, and you won't receive anything until the settlement administrator gets the go-ahead from a court — that would be Jan. 23, 2020, at the earliest.

How to make sure you're not handing over sensitive financial information to a fake website?

To make sure you're not handing over sensitive financial information to a fake website, start your claims process on the FTC's Equifax page at ftc.gov/Equifax. The federal agency noted that consumers never have to pay a fee to claim benefits from the settlement and said anyone who calls to urge you to file a claim is most certainly a con artist.

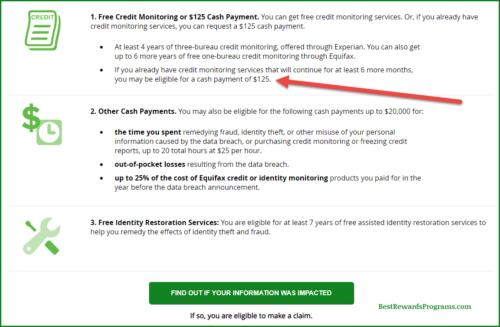

How much can you claim for cyber theft?

People who were harmed in the cybertheft can also claim as much as $20,000 in cash reimbursement for expenses related to the breach. Those include fees to freeze or unfreeze credit reports, as well as for credit-monitoring services; losses from unauthorized charges to accounts; and any payments to lawyers and or accountants.

How long can you claim for identity theft?

You can make a claim for up to 20 hours of time spent dealing with the breach. The good news here is that backing documents aren't required, and you could see compensation for time you spend trying to recover from identity theft (or avoid it in the first place) of $25 an hour (up a maximum of 10 hours -- more than that and you will need documents backing up your additional time spent). You must certify that you are being truthful.

How long does Experian monitor credit?

Consumers impacted by the data breach are entitled to up to 10 years of free monitoring of their credit reports. You can also sign up for at least four years of monitoring services provided by Experian at no cost, or if you already have credit monitoring going, you can file to be compensated for up to $125 in cash.

What happens if you are impacted by Equifax?

If you were impacted by the Equifax data breach, you may seek reimbursement for valid Out of Pocket losses or Time Spent (excluding losses of money and time associated with freezing or unfreezing credit reports or purchasing credit monitoring or identity theft protection) incurred during the Extended Claims Period if you have not received reimbursement for the claimed loss through other means.

When is the deadline to file a claim against Equifax?

The deadline to file a claim for Out-of-Pocket Losses or Time Spent that occurred through January 22, 2020 has passed.

How much time can you spend on a data breach?

You may be eligible for the following reimbursement cash payments for: Time Spent during the Extended Claims Period recovering from fraud, identity theft, or other misuse of your personal information caused by the data breach up to 20 total hours at $25 per hour.

When is the deadline for Equifax?

If you are a class member, the deadline to file Initial Claims Period claim (s) for free credit monitoring or up to $125 cash payment and other cash reimbursement passed on January 22, 2020.

When is the deadline for credit monitoring in 2024?

January 22, 20 24 (For future losses and time) File a claim for Credit Monitoring Services or Alternative Reimbursement Compensation. The deadline to submit a claim to receive the Free Credit Monitoring Services offered under the Settlement, or Alternative Reimbursement Compensation has passed.

When is the extended claim period for credit monitoring?

You may seek reimbursement for valid Out-of-Pocket Losses or Time Spent (excluding losses of money and time associated with freezing or unfreezing credit reports or purchasing credit monitoring or identity theft protection) incurred during the Extended Claims Period (between January 23, 2020 and January 22, 2024) if you have not received reimbursement for the claimed loss through other means.

Is the Equifax settlement final?

By order of the Court, the Settlement cannot become final until the appeals of the remaining objectors are resolved. In September of 2017, Equifax announced it experienced a data breach, which impacted the personal information of approximately 147 million people.