When will Equifax pay settlement?

Settlement benefits for eligible time spent and out-of-pocket losses are likely to begin issuing in fall 2022. The Equifax Data Breach Settlement website will provide updates. If you still have your claim number, you can enter it on the website and check the status of your claim.

How to dispute items with Equifax?

- Enter your identifying information on the page that reads “Step 1: Authentication”, then hit “Continue”.

- Answer the four questions about your credit file to verify your identity.

- Select the red box that reads “Dispute item” that appears beneath the item in question.

- Upload any supporting documentation to substantiate your claim, then hit “Continue”.

What you should know about the Equifax breach settlement?

The Federal Trade Commission (FTC) has issued a consumer alert regarding the Equifax Data Breach. In September 2017, Equifax announced a data breach, which affected the personal information of 147 million people. Under a recent settlement filed, Equifax agreed to spend up to $425 million to help people affected by the data breach.

Does a lawsuit settlement get taxed?

The general rule of taxability for amounts received from settlement of lawsuits and other legal remedies is Internal Revenue Code (IRC) Section 61 that states all income is taxable from whatever source derived, unless exempted by another section of the code.

See more

What happened with the Equifax settlement?

Court Approves Equifax Breach Settlement: Money for Some, Free Credit Monitoring for All. Equifax will pay up to $425 million in restitution to those directly impacted by the massive data breach of the credit bureau in 2017. A federal court gave final approval to the class-action lawsuit settlement in mid-January.

What is Equifax settlement?

Equifax data breach settlement. In 2017, Equifax announced a breach that exposed the personal data of approximately 147 million people. The legal settlement is now final. Here's how you can use the services provided through the settlement to protect and monitor your credit.

How much did Equifax settle for?

$425 millionThe company has agreed to a global settlement with the Federal Trade Commission, the Consumer Financial Protection Bureau, and 50 U.S. states and territories. The settlement includes up to $425 million to help people affected by the data breach.”

Is Equifax a legitimate company?

Equifax is one of three national credit bureaus. These companies collect information about your credit history, such as how many credit cards you have, how much money you owe, and how you pay your bills.

Who qualifies for Equifax settlement?

You are a Settlement Class Member if you are among the approximately 147 million U.S. consumers identified by Equifax whose personal information was impacted by the Equifax Data Breach.

How much can you get from a data breach settlement?

Under the settlement terms, Equifax agreed to set up a fund to provide free credit monitoring and identity theft protection to consumers, as well as provide cash payments to people affected by the breach—up to $20,000 per person. The company also has to pay government fines and legal fees.

Has anyone been paid from the Equifax settlement?

After a data breach in 2017 exposed personal data of more than 147 million consumers, including in some cases Social Security and driver's license numbers, credit bureau Equifax agreed to pay hundreds of millions in compensation to help affected consumers.

What happened to Equifax after the data breach?

In the wake of Equifax's 2017 data breach, which compromised the personal information of roughly 147 million consumers — including names, birthdates and Social Security numbers — the company ended up as the target of multiple lawsuits and reached a settlement in 2019 with the FTC, the Consumer Financial Protection ...

Is Equifax being sued?

In 2017, hackers broke into Equifax in a breach that exposed the financial information of 147 million Americans. A federal court in 2020 approved a $380 million settlement of class actions lawsuits, with no finding or judgment of wrongdoing made.

How secure is Equifax?

How secure is the information I provide to Equifax.com? Social Security number and credit card number(s) are encrypted before being transmitted to/from our servers. For your security, this site requires the use of a 128-bit SSL compatible browser.

What banks use Equifax?

Banks that typically use Equifax dataDiscover it Cash Bank.Discover it Balance Transfer.Discover it Miles.Chase Freedom Flex.Chase Unlimited Freedom.Chase Slate Edge.Citi Double Cash Card.Citi Premier Card.

Was there an Equifax data breach?

Facts about the Equifax data breach and settlement Equifax initially disclosed the data breach September 7, 2017. The company said it discovered the data breach in July 2017. The unauthorized access of personal data that was exposed by Equifax could increase the risk of identity theft for anyone affected.

How is Equifax project in TCS?

TCS helped Equifax UK build a digital core and modernize its IT infrastructure. TCS partnered with Equifax UK in its cloud journey using the power of Google Cloud and leveraged its innovative capabilities such as the Google Cloud Kubernetes engine and APIfication to modernize its Consumer and Commercial bureaus.

What is a good Equifax credit score?

670 to 739Although ranges vary depending on the credit scoring model, generally credit scores from 580 to 669 are considered fair; 670 to 739 are considered good; 740 to 799 are considered very good; and 800 and up are considered excellent.

How does Equifax work?

Credit bureaus collect and maintain a timely history of your credit activity as reported by the lenders and creditors with whom you have accounts, along with certain other information such as bankruptcies and collection items. Each creditor may report the status of your account according to your payment history.

Do you have to pay for Equifax?

Equifax CompleteTM Premier $19.95 / month Equifax Consumer Services LLC (“ECS”) is a company based in the United States.

Claim

Equifax data breach settlement emails offering a free membership for Experian IdentityWorks are legitimate.

Origin

In late January 2022, Google users looked to Reddit and elsewhere to find out if an email for the status of the Equifax data breach settlement was a “scam or legit,” as readers often do after receiving such notices.

How much did Equifax pay in penalties?

The company has also agreed to pay $175 million in civil penalties to 48 states, the District of Columbia, and Puerto Rico, as well as $100 million to the Consumer Financial Protection Bureau (CFPB). The FTC Commissioners voted unanimously, 5-0, to take this action against Equifax.

How many free credit reports will Equifax give in 2020?

In addition, beginning in January 2020, Equifax will provide all U.S. consumers with six free credit reports each year for seven years. That's in addition to the one free annual credit report that Equifax and the two other nationwide credit reporting agencies currently provide.

Who warns consumers not to rely too heavily on credit monitoring?

Brookman warns consumers to not rely too heavily on credit monitoring.

Did Equifax respond to Consumer Reports?

Equifax had not responded to Consumer Reports' request for comment at time of publication.

Do retailers earn affiliate commissions?

When you shop through retailer links on our site, we may earn affiliate commissions. 100% of the fees we collect are used to support our nonprofit mission. Learn more.

Is Equifax breach preventable?

A scathing Congressional report released in December of 2018 called the Equifax breach “entirely preventable.” The 96-page report concluded that the financial reporting company failed to properly fix a vulnerability in its database software despite being warned about the problem in early March 2017, months before the data breach.

How much did Equifax pay for data breach?

It's been mere days since credit-reporting firm Equifax agreed to pay up to $700 million to settle claims over a massive 2017 data breach and already scammers are trying to exploit the deal to fraudulently get their hands on your personal information.

How to figure out if you are a settlement claimant?

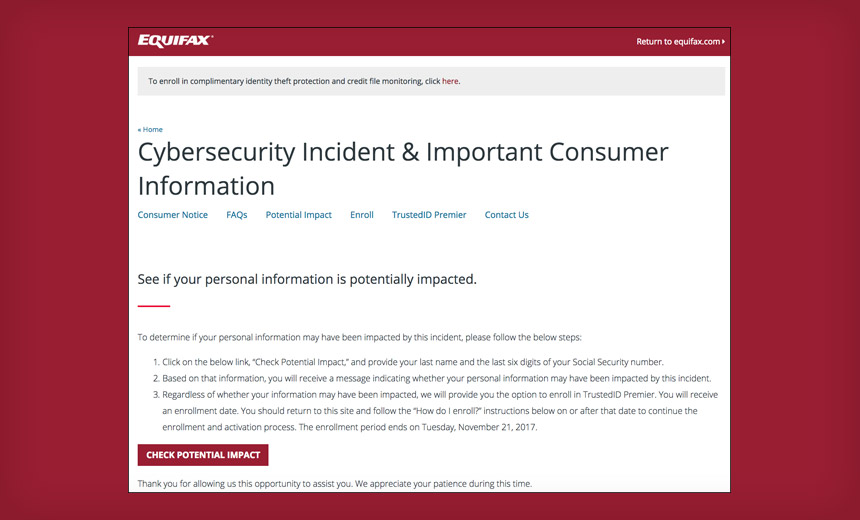

On the settlement website, you can figure out whether you're one of the eligible claimants. Enter your last name and last six digits of your Social Security number in a website operated by the settlement administrator (not Equifax). If told your personal information was affected by the data theft, then you can file a claim.

What is the deadline for filing your claim?

The deadline to file claims is Jan. 22, 2020, for most benefits, and you won't receive anything until the settlement administrator gets the go-ahead from a court — that would be Jan. 23, 2020, at the earliest.

How to make sure you're not handing over sensitive financial information to a fake website?

To make sure you're not handing over sensitive financial information to a fake website, start your claims process on the FTC's Equifax page at ftc.gov/Equifax. The federal agency noted that consumers never have to pay a fee to claim benefits from the settlement and said anyone who calls to urge you to file a claim is most certainly a con artist.

How much can you claim for cyber theft?

People who were harmed in the cybertheft can also claim as much as $20,000 in cash reimbursement for expenses related to the breach. Those include fees to freeze or unfreeze credit reports, as well as for credit-monitoring services; losses from unauthorized charges to accounts; and any payments to lawyers and or accountants.

How long can you claim for identity theft?

You can make a claim for up to 20 hours of time spent dealing with the breach. The good news here is that backing documents aren't required, and you could see compensation for time you spend trying to recover from identity theft (or avoid it in the first place) of $25 an hour (up a maximum of 10 hours -- more than that and you will need documents backing up your additional time spent). You must certify that you are being truthful.

How long does Experian monitor credit?

Consumers impacted by the data breach are entitled to up to 10 years of free monitoring of their credit reports. You can also sign up for at least four years of monitoring services provided by Experian at no cost, or if you already have credit monitoring going, you can file to be compensated for up to $125 in cash.

What happens if you are impacted by Equifax?

If you were impacted by the Equifax data breach, you may seek reimbursement for valid Out of Pocket losses or Time Spent (excluding losses of money and time associated with freezing or unfreezing credit reports or purchasing credit monitoring or identity theft protection) incurred during the Extended Claims Period if you have not received reimbursement for the claimed loss through other means.

When is the deadline to file a claim against Equifax?

The deadline to file a claim for Out-of-Pocket Losses or Time Spent that occurred through January 22, 2020 has passed.

When is the deadline for Equifax?

If you are a class member, the deadline to file Initial Claims Period claim (s) for free credit monitoring or up to $125 cash payment and other cash reimbursement passed on January 22, 2020.

When is the deadline for credit monitoring in 2024?

January 22, 20 24 (For future losses and time) File a claim for Credit Monitoring Services or Alternative Reimbursement Compensation. The deadline to submit a claim to receive the Free Credit Monitoring Services offered under the Settlement, or Alternative Reimbursement Compensation has passed.

When is the extended claim period for credit monitoring?

You may seek reimbursement for valid Out-of-Pocket Losses or Time Spent (excluding losses of money and time associated with freezing or unfreezing credit reports or purchasing credit monitoring or identity theft protection) incurred during the Extended Claims Period (between January 23, 2020 and January 22, 2024) if you have not received reimbursement for the claimed loss through other means.

Is the Equifax settlement final?

By order of the Court, the Settlement cannot become final until the appeals of the remaining objectors are resolved. In September of 2017, Equifax announced it experienced a data breach, which impacted the personal information of approximately 147 million people.

When is the extended claim period for out of pocket loss?

To be eligible, your claim for Out-of-Pocket Losses or Time Spent must occur between January 23, 2020 and January 22, 20 24(the “Extended Claims Period”).