Who is the largest buyer of structured settlement payments?

The truth is there is no one person or company that buys the majority of annuities, structured settlement payments, and lottery winnings. It is a very diverse field of investors, insurance companies, banks, and investment houses that purchase these type of reliable periodic payment streams.

What is a HUD-1 Settlement Statement?

The HUD-1 Settlement Statement is a standardized mortgage lending form in use in the United States of America on which creditors or their closing agents itemize all charges imposed on buyers and sellers in consumer credit mortgage transactions.

What are settlement charges to a seller?

Closing costs for sellers of real estate vary according to where you live, but as the seller you can expect to pay anywhere from 6% to 10% of the home’s sales price in closing costs at settlement.

What is a Mortgage Settlement Statement?

The HUD-1 Settlement Statement is a document that lists all charges and credits to the buyer and to the seller in a real estate settlement, or all the charges in a mortgage refinance. If you applied for a mortgage on or before October 3, 2015, or if you are applying for a reverse mortgage, you receive a HUD-1.

Is the settlement statement the same as the closing?

A settlement statement is a document listing the terms and conditions of a settlement agreement and details all related costs or credits due to each party. A mortgage loan settlement statement is commonly known as a closing statement.

What is a settlement statement for a mortgage?

The HUD-1 Settlement Statement is a document that lists all charges and credits to the buyer and to the seller in a real estate settlement, or all the charges in a mortgage refinance.

What is the purpose of a settlement statement in real estate?

A settlement statement is a document that outlines who paid what to whom in a real estate transaction. This statement is supposed to document all monies involved in the transaction so that both seller and buyer have this information.

When should I receive the HUD-1 Settlement Statement?

In such case, the completed HUD-1 or HUD-1A shall be mailed or delivered to the borrower, seller, and lender (if the lender is not the settlement agent) as soon as practicable after settlement.

Is a closing statement the same as a closing disclosure?

The closing statement or closing disclosure is intended to share the details of a loan right before closing so both the buyer and lender are on the same page. You can receive a closing statement for various types of loans issued, but a mortgage closing statement is the most recognizable and commonly discussed.

Who prepares the closing statement?

In real estate transactions, a closing agent prepares the closing statement which reflects the cost of the property for both the buyer and the seller. It is important that closing statements reflect the agreement of both buyers and sellers of properties, as well as a mortgage loan that backed up the home purchase.

Where do I find closing statements?

If you find at a later time you need a copy of your closing statement, contact the settlement agent for the home purchase. Other parties that may have copies of the settlement documents include your real estate agent, or the financial institution that holds the loan for the property.

Which two items will appear on a closing disclosure?

Closing disclosure form sectionsLoan information. This section should match your loan estimate regarding the loan term, loan purpose and loan program (conventional, FHA, VA or USDA).Loan terms. ... Projected payments. ... Costs at closing. ... Late payment fee. ... Escrow account.

Where does the purchase price appear on a settlement statement?

Where does the purchase price appear on the settlement statement? debit for the buyer credit for the seller. Where does the buyers new loan appear on the settlement statement? Credit buyer- The buyers debit column lists all the charges to the buyer; the credit column shows how the buyer is going to pay the charges.

Who provides HUD-1 Settlement Statement?

A HUD-1 or HUD-1A Settlement Statement is prepared by a creditor or, more typically, by the settlement agent who conducts the closing on the creditor's behalf.

What replaced the HUD-1 Settlement?

The Closing Disclosure combines and replaces the HUD-1 Settlement Statement and the final Truth-in-Lending (TIL) statement. The form mirrors the information provided on the Loan Estimate.

What happened to the HUD-1 Settlement Statement?

The HUD-1 Settlement Statement is a standard government real estate form that was once used by settlement agents, also called "closing agents," to itemize all charges imposed upon a borrower and seller for a real estate transaction. The statement is no longer used, with one exception: reverse mortgages.

Is HUD settlement statement the same as closing disclosure?

While closing disclosures provide information about a borrower's loan, settlement statements do not include loan information. Settlement statements are used for commercial transactions and cash closings.

When can a settlement agreement be used?

A settlement agreement is usually used in connection with ending the employment, but it doesn't have to be. A settlement agreement could also be used where the employment is ongoing, but both parties want to settle a dispute that has arisen between them.

What is estimated settlement statement?

The Estimated Settlement Statement lists all of the costs and credits associated with the purchase of a home showing the buyer their total costs to close the transaction and showing sellers their net profit (or loss). Think of it as your detailed receipt that details information from various places on one page.

Who should review the settlement statement before closing quizlet?

-gives buyer the right to review the completed settlement statement one business day prior to closing. -specifically prohibits any payment or receiving of fees or kickbacks when a service has not been rendered.

What Is a Settlement Statement?

A settlement statement is a document that summarizes the terms and conditions of a settlement, most commonly a loan agreement. A loan settlement statement provides full disclosure of a loan’s terms, but most importantly it details all of the fees and charges that a borrower must pay extraneously from a loan’s interest. Different types of loans can have varying requirements for settlement statement documentation. Generally, loan settlement statements can also be referred to as closing statements .

When are settlement statements created?

Beyond just loans, settlement statements can also be created whenever a large settlement has taken place, such as with a large business transaction or potentially in the legal, insurance, banking, and trading industries.

What is included in HUD-1?

These forms also include comprehensive information about the borrower’s loan, detailing the principal and interest as well as all of the upfront costs, commission charges, service costs, and any deductions associated with the loan. Loan terms are also included, such as details on principal, interest, variable rates, prepayment penalties, and any special clauses associated with a loan such as escrow requirements.

What is debt settlement?

Debt settlement: A debt settlement statement can provide a summary of debts written off, reduced, or otherwise amended after a debt settlement has completed. Lawyers and debt settlement companies work on behalf of borrowers with overwhelming amounts of debt, in order to help them reduce some or all of their obligations.

What is a settlement statement in stock trading?

Trading: In financial market trading, settlement statements provide proof of a security’s ownership transfer. Typically, stocks are transferred with a T+2 settlement date meaning ownership is achieved two days after the transaction is made.

What is insurance settlement?

Insurance settlement: An insurance settlement is most commonly documentation of the amount an insurer agrees to pay after reviewing an insurance claim. Banking: In the banking industry, settlement statements are produced on a regular basis for internal banking operations.

Does a reverse mortgage require a HUD-1 settlement statement?

RESPA requires a HUD-1 settlement statement for borrowers involved in a reverse mortgage. For all other types of mortgage loans, RESPA requires the mortgage closing disclosure. Both the HUD-1 and mortgage closing disclosure are standardized forms.

What is a settlement statement?

A settlement statement is an itemized list of fees and credits summarizing the finances of an entire real estate transaction. It serves as a record showing how all the money has changed hands line by line.

Who is responsible for preparing the settlement statement?

Whoever is facilitating the closing — whether it be a title company, escrow firm, or real estate attorney — will be responsible for preparing the settlement statement.

Is a settlement statement the same as a closing statement?

Yes, a settlement statement is the same as a closing statement, though “settlement” is the formal term most likely to be used by the real estate industry.

What is an ‘excess deposit’ at closing?

A particular line item that causes confusion on the seller’s settlement statement is the “Excess Deposit.” What is an excess deposit, and who will receive the funds listed on that line?

What does an impound account do at closing?

At closing the buyer sets up an impound account that allows them to bundle the cost of their mortgage principal, taxes, mortgage insurance, and other monthly costs into one payment. The lender likes this because they can make sure the new owner will keep up to date with all the payments associated with the home.

What information is needed to complete a closing document?

At the top of the document (before you get to the portion that looks like a spreadsheet) you’ll see a few boxes for inputting information that records basic details about the transaction, such as the names of the buyer and seller, the property address, and the closing date.

What is a seller's net sheet?

The seller’s net sheet is not an official document but an organizational worksheet that your agent will fill out to estimate how much you’ll pocket from your home sale after factoring in expenses like taxes , your real estate agent’s commission, your remaining mortgage, and escrow fees.

What is HUD-1 Settlement Statement?

Janet Wickell. Updated January 29, 2020. The HUD-1 Settlement Statement is a standard government real estate form that was once used by settlement agents, also called closing agents, to itemize all charges imposed upon a borrower and seller for a real estate transaction.

Who studied the statement of sale?

Most buyers and sellers studied the statement on their own, with the assistance of their real estate agent and the settlement agent. The idea was that the more people who reviewed it, the more likely it became that errors would be detected.

When Is the HUD-1 Distributed?

Before October 3, 2015, RESPA stated that borrowers should be given a copy of the HUD-1 at least one day prior to settlement. 5 However, entries could easily still be coming in, right up until a few hours before closing.

What is HUD-1 form?

The statutes of the Real Estate Settlement Procedures Act (RESPA) required that the HUD-1 form be used as the standard real estate settlement form in all transactions in the United States that involved federally related mortgage loans. 2.

When did the closing disclosure change?

Borrowers began receiving a form called the Closing Disclosure instead of a HUD-1 for most kinds of mortgage loans after October 2015. The change was in response to the TILA RESPA Integrated Disclosures, or simply TRID, which overhauled the way mortgages are processed and disclosed. 3.

What is tabulated before being brought forward to page 1 in Section L or page 2?

Many entries are tabulated before being brought forward to page 1 in Section L or page 2. Columns contain charges that are paid from either the borrower's or the seller's funds. Your closing statement probably won't have entries in all these lines.

What is the 701 and 702 section?

This section deals with the commissions paid to real estate agencies. Lines 701 and 702 show how the commissions are split between two participating agencies. 6

What happens after settlement?

After settlement, your lender will draw down on your loan. This means that they’ll debit the amount they’ve paid at settlement from your loan account.

What is settlement?

Property settlement is a legal process that is facilitated by your legal and financial representatives and those of the seller. It’s when ownership passes from the seller to you, and you pay the balance of the sale price.

What are the things that are in the same condition as when you first saw the property?

structure, walls, light fittings, window and floor coverings are in the same condition as when you first saw the property. locks, keys and automatic garage door controls are supplied and working. If you’re buying a new home, make sure all the work is finished and that the appliances are installed and working.

When to do final inspection on a property?

Just before settlement, you’ll have the opportunity to do a final inspection of the property. Often this is done the day before or the morning of the settlement. Contact the agent to arrange this inspection. The seller must hand over the property in the same condition as when it was sold. When you view the property ...

Who must hand over the property when it was sold?

The seller must hand over the property in the same condition as when it was sold. When you view the property for the final time you should check:

Can you take possession of a house after settlement?

Once settlement is completed, you can collect the keys from the agent and take possession of the property. It’s time to move into your new home at last.

What is HUD-1 settlement statement?

The HUD-1 settlement statement outlines your exact mortgage payments, a loan’s terms (such as the interest rate and term) and additional fees you’ll pay, called closing costs (which total anywhere from 2% to 7% of your home’s price). Compare your HUD-1 to the good-faith estimate your lender gave you at the outset; make sure they’re similar and ask your lender to explain any discrepancies.

How long before closing do you get your HUD-1?

Thanks to new regulations put in effect in October 2015 known as TRID (which stands for TILA-RESPA Integrated Disclosure), you will receive your HUD-1 three days before closing so that you have plenty of time to check it over. (Before TRID, home buyers received this form only 24 hours ahead of time, which resulted in a lot more last-minute surprises and holdups.)

How long before closing can you walk through a home?

Do a final walk-through: A buyer’s contract usually allows for a walk-through of the home 24 hours before closing. First and foremost, you’re making sure the previous owner has vacated (unless you’ve allowed a rent-back arrangement where they can stick around for a period of time before moving). Second, make sure the home is in the condition agreed upon in the contract. If you’d had a home inspection done earlier and it had revealed problems that the sellers had agreed to fix, make sure those repairs were made.

What to do if you find an issue during a walk through?

If you find an issue during your walk-through, bring it up with the sellers as soon as possible. There’s no need to panic; at worst you can simply delay the closing until you resolve it.

Who is present at closing?

The cast includes the home seller, the seller’s real estate agent as well as your own, buyer and seller attorneys, a representative from a title company (more on that below), and, occasionally, a representative from the bank or lender where you got your loan.

Do you need a title clearance before you can own a home?

Title clearance: Before you can own or “take title” to a home, most lenders will require a title search of public property records to make sure there aren’t any liens or issues with transferring the property into your name (which is rare, but if something does crop up, it’s better to know that upfront).

Does realtor.com make commissions?

The realtor.com ® editorial team highlights a curated selection of product recommendations for your consideration; clicking a link to the retailer that sells the product may earn us a commission.

How long does it take to get paid for a home purchase?

That’s the day when the final papers are signed and you (and your mortgage holder if you have one) finally get paid. This typically takes four to six weeks after finalizing the purchase and sales agreement . During this time, any earnest money the buyer paid will be held in escrow. Escrow means it’s being held by a third party until everything is settled and the sale is ready to be completed.

What do you bring to closing?

What you’ll bring to closing. • The deed, if your home is paid off. • A valid, state-issued photo ID like a driver’s license or passport. • A certified check if required in the amount requested by the escrow officer. • The keys and security codes, if possession of the house is granted at closing.

What does escrow mean in real estate?

Escrow means it’s being held by a third party until everything is settled and the sale is ready to be completed. You can start packing up whatever isn’t already in storage but remember, until the deal is closed and the new buyer takes possession, you’re responsible for maintaining the home.

What is the closing agent's accounting?

The closing agent prepares this accounting of all the money involved in the transaction. This statement is required by federal law. There is a buyer’s column and a seller’s column on this form. (You should have received a copy for review prior to the closing meeting.) Double-check all figures and look for clerical errors before signing the HUD-1 form. Check everything from the sales price to the payoff balances on your loan and the pro-rated tax and utility bills you’re being charged. You’ll need this form for your federal income taxes.

What to ask the closing officer before closing?

Ask the closing officer to give you a copy of the documents you’ll be signing a few days before the closing meeting so you have time to carefully review and correct them.

When to ask closing officer for a copy of documents?

Ask the closing officer to give you a copy of the documents you’ll be signing a few days before the closing meeting so you have time to carefully review and correct them.

Who will prepare the paperwork for title change?

In other areas, you may pass each other in the hallway or maybe sign your paperwork days earlier than the buyer. Either way, a closing or escrow officer will prepare the paperwork and record the title changes at the county. They will help walk you through the process.

What is settlement statement?

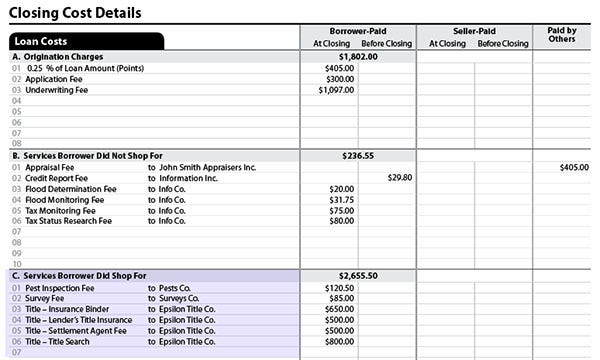

A settlement statement is the statement that summarizes all the fees and charges that both the home-buyer and seller face during the settlement process of a housing transaction. The table below gives further explanation as to what these fees and charges are for both buyer and seller.

When are sellers charged for taxes?

Seller is charged their portion of the current year taxes from January 1st to the closing date. Based on either prior year taxes or most recent mill levy and assessed value. This determines pursuant to the contact.

What is a mortgage payoff?

Mortgage Payoff. The payoff amount is sent to the existing mortgage company and includes additional interest a few days beyond closing. Title Insurance (Owner’s Policy) Typically paid for by the seller, however the contract gives the option for either buyer or seller to pay.

When are prior year taxes due?

Prior year taxes are not due and payable until the next calendar year. Amounts due for any prior year taxes will be collected from the seller. Typically, any closings after June 15th should already have their taxes for the prior year paid.

What is closing statement?

The closing statement is the final estimate of all charges and credits for buying the home. This document includes the sale price, your cash to close escrow, your loan amount, and all the other costs paid through escrow to settle the sale, including credits and prorations. This document is also known as the HUD 1 Settlement Statement. The Consumer Financial Protection Bureau replaced it with the closing disclosure in 2015. 7

What is a purchase agreement?

The purchase agreement is your contract to buy the home, setting forth all the terms and conditions required for closing. It's the document you and the seller signed when you agreed to buy the property, and both parties are legally obligated to abide by its terms.

What is seller disclosure?

Seller disclosures include material facts about things like lead-based paint. They might include a transfer disclosure statement, and other written warranties, guarantees, or disclosures that the seller provides. These documents are often the basis for future lawsuits against sellers when they fail to disclose an issue that becomes apparent later. 4

What is a repair addendum?

A repair addendum specifies the particular type of work to be completed.

What is included in closing disclosure?

Other inspections and work-related documents could include contractor invoices and permits. The closing disclosure includes all the final costs for your mortgage, laid out in a manner that you might not understand even though the government tries to make it simple for you.

How long do you keep a pest inspection certificate?

Not every state requires a pest inspection, but others, such as California, require that they be kept on file for two years. 5 .

What is a document on the way to closing?

Documents on the Way to Closing. Addendums, amendments, or riders include anything that alters or amends the terms of your original purchase contract. These types of document might clarify the names on title or the spelling of the seller's or buyer's name. They might correct a street address.

What to do if you can't get settlement papers?

If you are unable to obtain the settlement papers from any of those parties, you will need to reconstruct the transaction and estimate the amounts from whatever evidence you can gather from bank records, emails/correspondence, old property tax bills, or any other documentation involving the purchase or value of your Home.

How to get a copy of closing statement for 2006?

To get a copy of your closing statement of your home purchase in 2006, you should start by contacting the settlement agent for the purchase of the home. Depending on how long they retain their records, they should be able to supply you with a copy of your Settlement Documents . Other parties that may have copies of the Settlement Documents include your real estate agent, the seller's real estate agent, the mortgage broker, the financial institution that held the loan for the property, or the seller himself.