What did Suze Orman say about structured settlement annuities?

The bottom line is that with structured settlements Suze Orman recommends against selling your payments when that is simply a short term solution to a long term problem. However, at Strategic Capital we know that when done as part of a well thought out, viable plan, selling your structured settlement payments can be a logical decision.

Do you pay taxes on a structured settlement?

The general rule is if a structured settlement is not taxable, then selling the payments also is not taxable, as long as the contract provisions don’t change and the sale follows the law. The law imposes several requirements on such sales, including oversight and approval by a judge.

What is a structured settlement and should you choose one?

The plaintiff can decide to get a lump sum payment or opt for a structured settlement. What is a structured settlement, and should you choose one? Here’s everything that you need to know about structured settlements. What is a Structured Settlement? With that said, a structured settlement is a payment made by the defendant in an annuity. Structured settlements are typical in civil cases including:

How long does it take to sell a structured settlement?

On average, it takes 30 – 45 days to sell structured settlement payments. Selling your structured settlement payments requires court approval which is usually the main cause for any unexpected delays in the transfer. Each state has an individual statue that may determine some of the waiting periods required throughout the process and can be a factor in the amount of time it takes to sell structured settlement payments.

Are Structured Settlements annuities?

A structured settlement annuity (“structured settlement”) allows a claimant to receive all or a portion of a personal injury, wrongful death, or workers' compensation settlement in a series of income tax-free periodic payments.

Who owns the annuity in a structured settlement?

A settlement agreement establishing the structured settlement will typically expressly state that the assignment company has all rights of ownership of the annuity. The structured settlement payee only owns the right to receive payments. The payee does not own the structured settlement annuity.

What are the settlement options for an annuity?

Annuity payout options include: Single Life/Life Only. Life Annuity with Period Certain (Fixed Period/Guaranteed Term) Joint and Survivor Annuity. Lump-Sum Payment.

How does a structured annuity work?

A structured annuity provides exposure to equity markets, giving you the growth potential you need to achieve your goals. For each indexed account you select, the performance of an underlying index will determine how much you can earn (either up to a cap or subject to a fee).

Do structured settlements count as income?

Structured settlement payments do not count as income for tax purposes, even when the structured settlement earns interest over time.

Are structured settlement annuities taxable?

Structured settlement annuities are not taxable — they're completely tax-exempt. It's a common question that we are asked by personal injury attorneys, and in certain situations, the tax-exempt nature of structured settlement annuities results in significant tax savings to the client.

What are the four most common settlement options?

The four most common alternative settlement approaches are: the interest option, under which the insurer holds the proceeds and pays interest to the beneficiary until such time as the beneficiary withdraws the principal; the fixed period option, under which the future value of the proceeds is calculated and paid in ...

Should I take a lump sum or structured settlement?

You should take a lump sum settlement for all small settlements and most medium-sized settlements (less than $150,000 or so). But if you are settling a larger case, there are two good reasons for doing a structured settlement. First, the structure guarantees that you won't spend the money too fast.

How much does a $500000 annuity pay per month?

approximately $2,188 each monthHow much does a $500,000 annuity pay per month? A $500,000 annuity would pay you approximately $2,188 each month for the rest of your life if you purchased the annuity at age 60 and began taking payments immediately.

How does a structured settlement payment work?

With a structured settlement, you receive your personal injury settlement or lawsuit award over time instead of in a lump sum. Personal injury plaintiffs who win or settle their cases can often choose to take their winnings as a one-time lump sum or as a series of payments over a period of time.

Can you cash out a structured settlement?

If you have a structured settlement in which you receive your personal injury lawsuit award or settlement over time, you might be able to "cash-out" the settlement. To do this, you sell some or all of your future payments in exchange for getting cash now.

What percentage do structured settlement companies take?

“Some structured settlement companies charge 25 percent to 50 percent of the payment amount to be received,” said Sullivan.

How do I get my money from a structured settlement?

Put simply, a structured settlement is not a loan or a bank account, and the only way to receive money from your settlement is to stick to your payment schedule or sell part or all of your payments to a reputable company for a lump sum of cash.

How does a structured settlement payment work?

With a structured settlement, you receive your personal injury settlement or lawsuit award over time instead of in a lump sum. Personal injury plaintiffs who win or settle their cases can often choose to take their winnings as a one-time lump sum or as a series of payments over a period of time.

What percentage do structured settlement companies take?

“Some structured settlement companies charge 25 percent to 50 percent of the payment amount to be received,” said Sullivan.

How do structured settlement companies make money?

Structured settlement purchasing companies, also known as factoring companies, serve those selling their structured settlement payments. These companies offer settlement owners lump sums of cash in exchange for the rights to future payments or portions of future payments.

How Do Structured Settlement Annuities Work?

Structured settlement annuities start with a plaintiff who has a high-dollar personal injury, workers compensation, medical malpractice, wrongful death or similar liability claim or judgment.

What happens to an annuity in a settlement agreement?

Under the terms of a settlement agreement, the defendant buys an annuity from a life insurance company (or similar institution), which in turn makes annuity payments to the plaintiff over an extended time.

How many parties are involved in a structured settlement?

There are basically three parties to a structured settlement annuity – a person asserting a legal claim, the person or entity against whom the claim is asserted (or their liability insurance carrier), and a “qualified assignee.”

What happens after an annuity is funded?

After funding the annuity, the defendant is released of any further liability and can wash its hands of the matter.

Does an annuity earn interest?

And the annuity earns interest, resulting in total payments that ultimately exceed what would have been received had the settlement been tendered as a lump sum.

Is an annuity premium taxable?

As alluded to above, the qualified annuity premium received by the issuing insurance company is not included as taxable income to the company. Without the additional tax expense, the insurer can offer more attractive terms, including higher interest rates and overall payment amounts, while still realizing a profit.

Can a structured settlement annuity preserve eligibility for benefits?

And, critically for Medicaid and SSI recipients, a well-conceived structured settlement annuity, like a special needs trust, can preserve eligibility for benefits that a large lump-sum payment might jeopardize.

What is the difference between annuities and structured settlements?

Perhaps the biggest difference between structured settlements and annuities is the process of selling them.

How are structured settlements funded?

Structured settlements are funded by annuities and all structured settlement brokers are regulated by state insurance commissions. Structured settlement consultants must also comply with at least seven sections of the U.S. tax code.

What Are Annuities?

Annuities can be used in situations other than structured settlements.

Why does it take longer to sell an annuity?

Because selling structured settlement payments is a legal process, it usually takes longer than selling other annuity payments.

How to sell a structured settlement?

To sell a structured settlement, you’ll need to appear before a judge and make a valid case for why you need immediate access to your settlement money. You may be required to have a lawyer present at the hearing.

What happens when you receive a huge windfall of money?

The concept is simple: Someone who receives a huge windfall of cash may run through the money quickly, leaving them dependent on government assistance. But with a structured settlement, the payments are stretched over a longer period.

Why do lottery winners get periodic payments?

Like the plaintiff in a personal injury case, lottery and casino winners who opt for periodic payments often do so to ensure the influx of cash lasts for many years.

Why are annuities considered structured settlements?

Because annuities can be designed to offer timed payouts, guarantees on principal, as well as investment gains, and were already being offered by insurance companies, they quickly became the preferred vehicle to implement structured settlements.

Why are structured settlements linked to annuities?

Structured settlements are linked to annuities because they’re considered an effective way to deliver money to people who need it but also need the discipline of a monthly or yearly payout.

Why do people own annuities?

In addition to ensuring a continuing stream of income during one’s retirement, many annuities are guaranteed for a minimum rate of return, meaning that not only can their principal be protected against loss; their earnings can be , as well. In some cases, by annuitizing the contract, the owner of an annuity can even receive a life-long stream of income, far more than his or her original investment.

How much money did Americans invest in annuities in 2016?

Annuities today are mostly used to provide for an individual’s retirement, usually on a tax-deferred basis. Americans bought more than $117 billion in annuities in 2016, according to LIMRA Secure Retirement Institute, and the nation held nearly $2.3 trillion worth of polices.

What is an annuity policy?

Just like a life insurance policy, which guarantees a lump-sum payment to your heirs, an annuity is a contract with an insurance company that pays you, slowly in most cases, while you’re alive, and often provides a payment to a beneficiary when you die. Annuities come with large initial costs.

What is a deferred annuity?

Retirement annuities, properly called deferred annuities, come in three varieties, fixed, indexed and variable. All are tax deferred and will pay your beneficiary a specified minimum amount when you die. Periodic payments are made to you for a fixed period or a lifetime, and payments can continue after your death to your spouse.

How much was structured settlement issued in 2015?

About $5.5 billion in structured settlements were issued in 2015, according to LIMRA Secure Retirement Institute.

How Does a Structured Settlement Work?

The decision to utilize a structured settlement must be made before finalizing the settlement agreement. Once both parties have agreed to the details of the structured settlement, the claimant releases the defendant (or insurer) from liability.

How much is a structured settlement?

Structured settlements may be funded with proceeds from settlements of almost any size; in fact, many structured settlement providers will structure amounts as low as $10,000. The choice is ultimately the claimant’s, and many find that a structured settlement is much more beneficial than a lump sum cash payment.

Who pays settlement funds to?

The defendant or insurer then pays the settlement funds to a third-party assignment company , which assumes liability and purchases an annuity from a structured settlement carrier. The carrier then makes a series of periodic payments based on a previously agreed upon timeline and amount.

Does volatility affect settlements?

With a locked-in rate of return, injured claimants can rest assured that market volatility will not affect their structured settlement payments.

What You Need To Know

If an annuity and a structured settlement walked into the proverbial bar, how could you tell them apart?

How to Name a Beneficiary on a Structured Settlement Annuity

Naming a beneficiary on your structured settlement annuity is an important but simple task. This blog discusses why naming a beneficiary on your structured settlement is important and the steps to take.

Constructive Receipt is Game Over for Structured Settlements

Constructive receipt means game over in structured settlement parlance. To establish a structured settlement and enjoy all of its benefits, constructive receipt is something you must avoid.

Is the Affordable Care Act a Credible Way to Mitigate Damages?

The Affordable Care Act was supposed to make health insurance more affordable however, market developments as well as large rate increases at renewals since its enactment, present significant challenges to using ACA policies as a means to mitigate damages during settlement negotiations.

Inherited a Structured Settlement

Have you inherited a structured settlement? You may be wondering what you should do. If you a named beneficiary and have inherited a structured settlement, the first thing that you should do is put J.G. Wentworth on hold, breathe and take a few minutes to watch this video.

What is a Qualified Assignment?

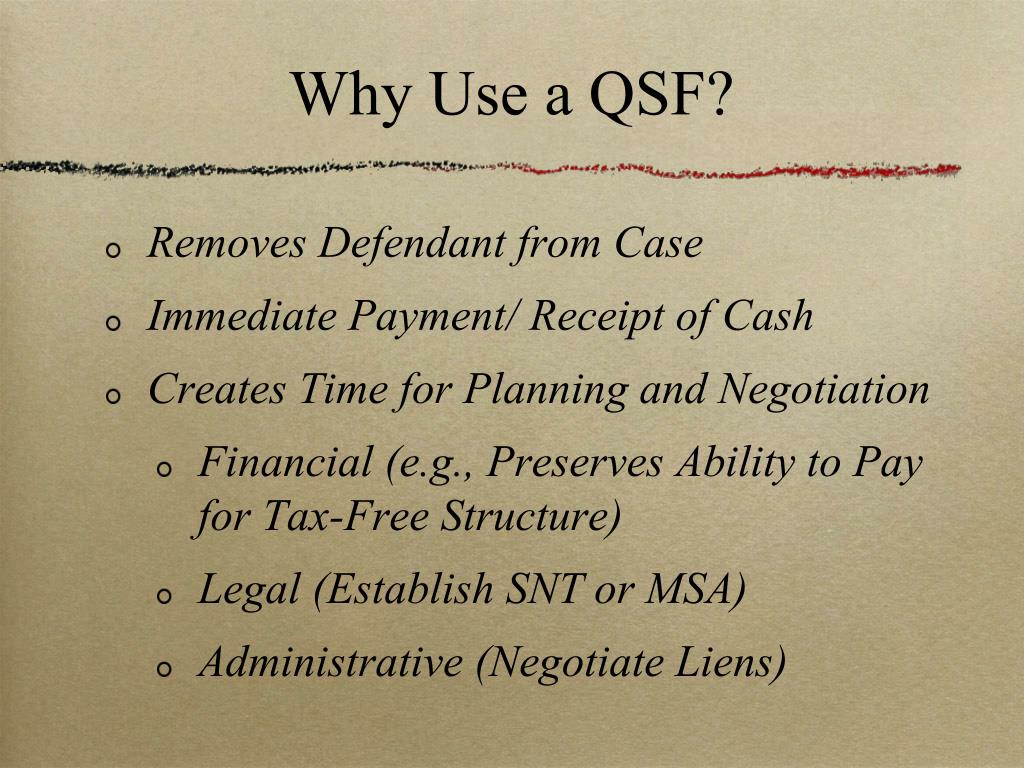

A qualified assignment is part of the process to establish a structured settlement that enables a Defendant, Insurer, or Qualified Settlement Fund, to achieve a complete novation of the future periodic payment claim established by suit or agreement, through a substitution of obligors.

New York City Structured Settlement Annuities 2022

Which life insurance companies write structured settlement annuities for settlements in Bronx, Brooklyn, Staten Island, Queens, Manhattan, Westchester in 2018 through licensed representatives?

What is structured settlement annuity?

A structured settlement annuity allows individuals to receive tax-free payments over time. Learn how structured settlements work and when they're used.

Why do we need structured payments?

Receiving structured payments can make it easier to manage recurring medical expensesor other costs associated with an injury.

What happens if you withdraw money from a settlement?

Withdrawing money from a structured settlement prematurely could result in tax penalties and you may also pay surrender fees.

Can you receive more from a structured settlement than a lump sum?

It’s possible that you may receive more from a structured settlement than you could through a lump sum payoutwhen interest is factored in. While a lump sum may be attractive, there may be a temptation to spend the money unwisely. And even if you choose to invest it, you still run the risk of losing money if those investments don’t pay off.

Can you use an annuity to pay medical bills?

Once the annuity is in place, the plaintiff will receive payments from it according to the agreed-upon schedule. Those payments are tax-free for the plaintiff who can use them to pay for medical expenses, daily living expenses or any other expenses as they see fit.

Can annuity payments be tailored?

Annuity payments can be tailored to fit the recipient’s lifestyle and needs.

Is structured settlement tax free?

Structured settlement agreements can be beneficial for individuals who are on the receiving end of these payments. Again, this is tax-free compensation so you don’t have to worry about payments affecting your tax liability. And if you’ve named a beneficiary for a structured settlement annuity, that individual could continue receiving tax-free payments after you pass away.