If you receive a settlement offer and decided you’re interested, there are a couple of ways you can respond. You can accept the settlement offer and pay the settlement account in full. This is the easiest and fastest way to deal with the debt, assuming you’ve received a legitimate settlement offer.

Full Answer

Should I write a debt settlement offer letter?

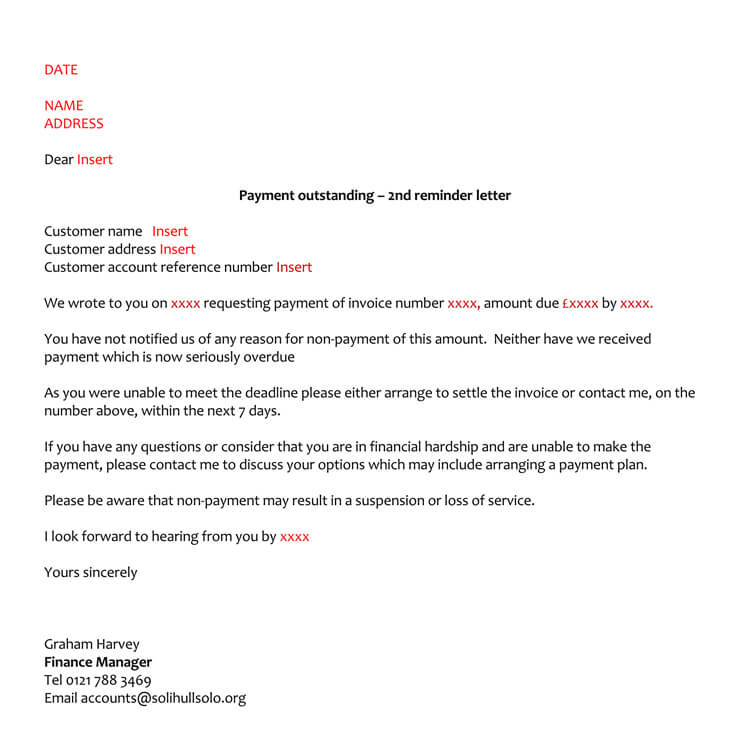

What Your Settlement Letter Should Include

- The letter should be on company letterhead, regardless of whether you’re dealing with a collection agency or the original creditor. ...

- The letter should include a date so you know when the settlement offer was made.

- Make sure the correct account number is listed on the debt settlement letter. ...

How to write a simple disagreement letter?

How to Write a Disagreement Letter. by WriteExpress Staff Writers. Consider diffusing the situation by using love and humor. Clearly describe the disagreement and explain what you want done to resolve it. Avoid accusations and threats, particularly in a first letter. (Generally, the intent is to strive to resolve the problem, not simply disagree.)

How to write a good credit dispute letter?

When writing your letter to a credit bureau, please remember these simple guidelines:

- In most cases, it’s unnecessary to mention laws, procedures, court rulings, or threaten lawsuits, etc. ...

- Similarly, remember to be kind. ...

- Include copies of information that supports your claims, but remember, anything you send them can also be used against you. ...

- Make and send copies, but always keep the originals for your records.

How to settle debt on your own?

To settle debt on your own you will need to:

- Learn the steps to settle debt on your own – What to say when negotiating, what to send to creditors in writing, and the overall order of operations.

- Obtain debt settlement letter templates, negotiating letters, counteroffers, settlement acceptance letters and much more. ...

- Understand the pros and cons when settling debt on your own. ...

Is it good to accept a settlement offer?

Never accept a settlement offer until your doctor understands the full impact of your injuries. Maximum medical improvement is the milestone in your recovery where the doctor acknowledges that there is nothing more they can do for you.

How do you respond to a settlement?

Steps to Respond to a Low Settlement OfferRemain Calm and Analyze Your Offer. Just like anything in life, it's never a good idea to respond emotionally after receiving a low offer. ... Ask Questions. ... Present the Facts. ... Develop a Counteroffer. ... Respond in Writing.

How do you respond to a low settlement offer?

If you're wondering how to respond to a low settlement offer, you and your injury attorney can follow these steps:Remain Calm and Polite. ... Table Your Questions. ... Give All the Facts. ... Develop a Counter Offer. ... Respond in Writing. ... Only Settle When Fully Healed.

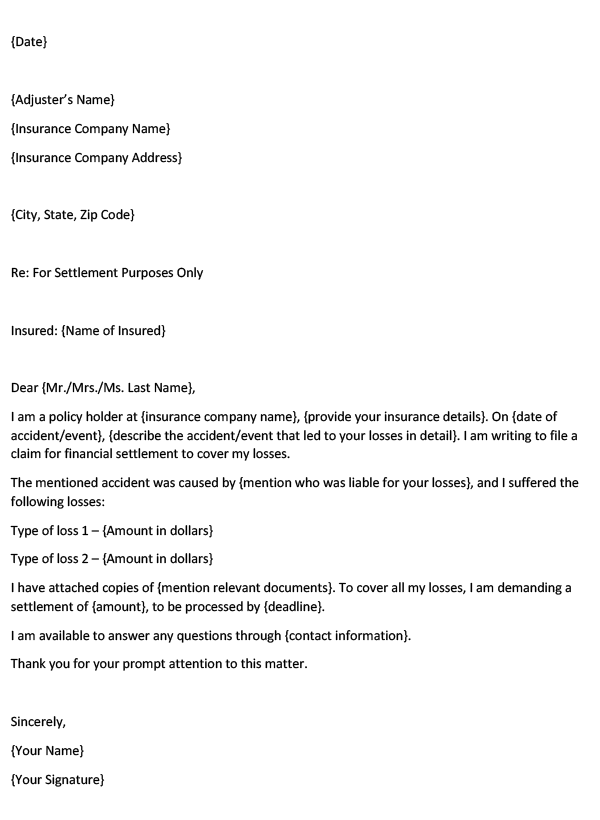

How do you counter offer a settlement letter?

Countering a Low Insurance Settlement OfferState that the offer you received is unacceptable.Refute any statements in the adjustor's letter that are inaccurate and damaging to your claim.Re-state an acceptable figure.Explain why your counteroffer is appropriate, including the reasons behind your general damages demands.More items...•

How do you accept a settlement offer in writing?

I appreciate that your company is willing to work with me in settling the debts I owe. This letter is to confirm my acceptance of the verbal offer. The amount that your representative and I have mutually agreed upon to settle the debt in full is $ .

Should I accept first offer of compensation?

Unless you have taken independent legal advice on the whole value of your claim, you should not accept a first offer from an insurance company.

What is a reasonable settlement agreement?

By Ben Power 8 April 2022. A settlement agreement is a contract between two parties, usually (but not always) an employer and an employee, which settles the employee's claims against their employer.

How do you reject a settlement?

Always reject a settlement offer in writing. Type a letter to your contact at the insurance company listing the reasons you think that their offer is too low. Back up these reasons with concrete evidence attached to the letter. Finally, provide a counteroffer of a sum you think is more reasonable.

How do you ask for more money in a settlement?

Send a Detailed Demand Letter to the Insurance Company Because the insurance company will likely reply with an offer for an amount lower than what you've asked for in the demand letter, you should ask for between 25 and 100 percent more than what you would be willing to settle for.

How do insurance companies negotiate settlements?

Let's look at how to best position your claim for success.Have a Settlement Amount in Mind. ... Do Not Jump at a First Offer. ... Get the Adjuster to Justify a Low Offer. ... Emphasize Emotional Points. ... Put the Settlement in Writing. ... More Information About Negotiating Your Personal Injury Claim.

What does it mean when an insurance company wants to settle?

When an insurance company offers you a settlement, they are essentially acknowledging their client's fault in the accident. They want you to settle to avoid litigation or going to court. Insurance companies usually do not want to get legal help involved.

How long does an insurance company have to respond to a counter offer?

In the best-case scenario, the insurance company will respond to your demand letter within 30 days. However, you generally have to wait anywhere from a few weeks to a couple of months because no law sets a deadline.

What percentage should I offer to settle debt?

When you're negotiating with a creditor, try to settle your debt for 50% or less, which is a realistic goal based on creditors' history with debt settlement. If you owe $3,000, shoot for a settlement of up to $1,500.

What happens if you pay a settlement offer?

As long as your creditors accept your offer – i.e. agree to sum of money in the settlement offer – they will accept partial settlement of your debt in exchange for writing off the remaining amount you owe. If the settlement offer is big enough, the money will be shared equally among all of your creditors.

What does it mean when a debt collector offers a settlement?

Debt settlement is a practice that allows you to pay a lump sum that's typically less than the amount you owe to resolve, or “settle,” your debt. It's a service that's typically offered by third-party companies that claim to reduce your debt by negotiating a settlement with your creditor.

What percentage should I ask a creditor to settle for after a Judgement?

If you decide to try to settle your unsecured debts, aim to pay 50% or less. It might take some time to get to this point, but most unsecured creditors will agree to take around 30% to 50% of the debt. So, start with a lower offer—about 15%—and negotiate from there.

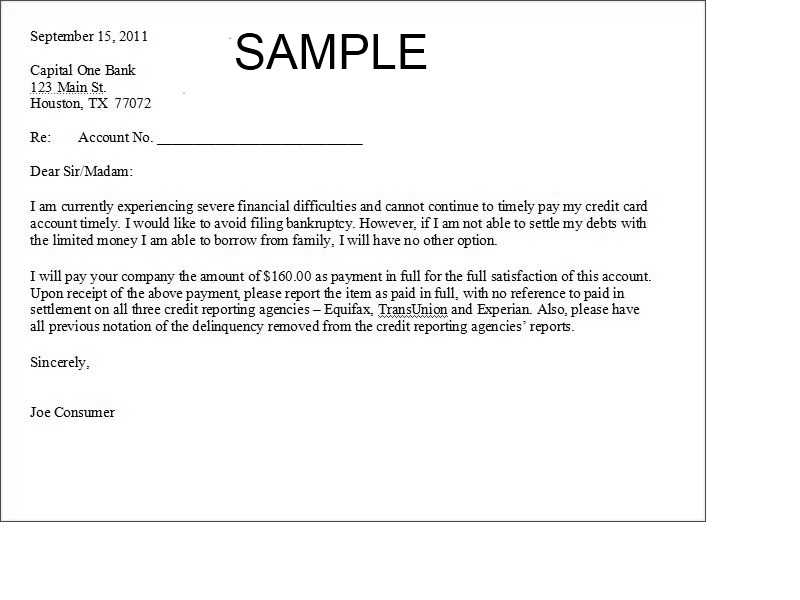

What is the goal of a settlement letter?

The goal of sending a settlement offer letter is to pay less than what you owe and put that account in your rearview mirror. Some of us may approach this effort with a specific credit reporting outcome, such as getting the negative account deleted from your credit bureau reports as a condition of paying the settlement.

What does it mean to send a settlement offer letter?

By sending in your settlement offer letter, you exhibit willingness.

How long does it take to get a settlement offer from a bank?

This can mean the best time to mail an offer is at 150 days. That leaves you with only one month to hear back from them. Now, because some banks simply ignore written settlement offers, and there is only a month left to negotiate a settlement you can agree to and pay, you will lose the opportunity to prevent charge off and get a better settlement deal now than you may be able to get later – and prevent your account from being placed with a collection law firm by creditors that do that right away.

How long does it take to mail a debt?

Mail takes time. Perhaps even weeks. What if you are dealing with a contingency debt collector, the most common type of debt collection agency? This type of collector only gets paid if they get you to pay.

What do you want in a settlement agreement?

What you do want in writing: The settlement agreement. Getting your settlement agreement in writing is critical. You absolutely want a letter that outlines the creditor, collection agency or law firm is taking less than what you owe. You want it to clearly identify you, and the outline of the deal being made.

When to ask a creditor to validate a debt?

And asking a creditor to validate a debt before you agree to pay is something you do when you are trying not to pay, or need clarity on whether to pay.

Can a credit card be placed with a collection agency?

The bank you have your credit card with may only have placed your account with the collection agency for a limited time.

What Is a Debt Settlement Letter?

If you’re unable or unsure about negotiating a debt settlement over the telephone, negotiating by letter is a reasonable option. It’s not much different negotiating with your creditor by telephone, but it might take longer. There are several ways to prepare a settlement letter, including hiring an attorney to write it for you or going online to download a template to use as a starting point. There are also several sample letters you can look at to get an idea of what your completed letter should look like.

What is the first step in a debt settlement?

The first step in a debt settlement negotiation with a bank, credit card company, or collection agency is to confirm the debt belongs to you. Some debts pass through multiple collection agencies once they leave the original creditor. During that time, mix-ups can occur or debts can become so old they are past the statute of limitations and legally uncollectible .

How does debt settlement work?

Luckily, there are many debt relief options. Debt settlement is one of the most advertised and for good reason. It’s often used for credit card debts and allows borrowers with unmanageable debt to pay off one or more debts for less than the full amount. The creditor then forgives the remaining debt. This may sound too good to be true, but it’s not. How well it works for you will depend on your financial situation and whether you choose to hire a debt settlement company to help you or do the debt settlement process yourself. This article will explain how to handle debt settlement on your own and how to write the best debt settlement letter possible.

How long do you have to be behind on your debt to get a creditor to accept your debt?

To increase your chances of getting a creditor to accept your debt, you need to be at least 90 days behind on your payments with that creditor. And during the negotiation process, you’ll need to continue not making any payments. This will hurt your credit score and the extra fees and interest may increase your overall debt. But it’s easier to convince a creditor that you can’t fully pay off your debt when you haven’t made any payments for several months. Remember, a creditor is willing to settle a debt for less than what you owe because they fear your financial situation is so uncertain that they won’t recover any money from you in the near future.

How to reach out to your creditor?

Now it’s time to reach out to your creditor. You can do this by telephone or by letter. Either way, you’ll need to have some cash saved up beforehand. Most debts get settled after the borrower makes a one-time lump-sum payment of the outstanding debt. In other cases, you’ll need to pay two or three large payments over a short period of time instead. Creditors rarely agree to let borrowers use a payment plan with monthly payments to settle their debts.

How long does it take to settle a debt?

Another major advantage is that the DIY debt settlement process tends to be faster, perhaps six months or less. In contrast, using a debt settlement company can easily take several years. Not only does this extra time mean it takes longer to get debt relief, but that’s more time for your debt to accrue interest and penalties.

What is the second step in negotiating a debt?

The second step is deciding what terms you’ll agree to. During negotiations, the biggest item to discuss will be how much of the debt you need to pay. But don’t overlook another important term: how the debt will show up on your credit report.

What is the answer to a lawsuit?

An answer is your opportunity to respond to the complaint’s factual allegations and legal claims. It also allows you to assert "affirmative defenses," facts or legal arguments you raise to defeat plaintiff’s claim. Filing an answer prevents the plaintiff from getting a default judgment against you. It signals to the court and the other side that you intend to defend the case.

How long do you have to respond to a lawsuit?

However you decide to respond to the lawsuit, remember there are deadlines to take action. Typically, you have twenty calendar days from when you received the summons and complaint (not counting the day of service) to file a response with the court. But that time might be shorter in some cases.

What happens if you don't file a written response?

If you do not file a written response within the required time, the “plaintiff” (the party suing you) can ask the court for a default judgment against you for everything she asked for in her complaint. After the plaintiff gets a default judgment, she can try to garnish your wages, attach your bank account, or take your property.

What is a counterclaim?

Compulsory counterclaims. If your claim arises out of the same transaction that underlies the plaintiff's claim , you have a “compulsory counterclaim.”. If you do not file a counterclaim in plaintiff’s case, you will lose the right to file a separate lawsuit.

Why do you file a motion to dismiss?

File a motion to dismiss or for a more definite statement. There are a number of reasons why you might file a motion to dismiss, including: Lack of jurisdiction. In other words, the court does not have jurisdiction over you. Click to visit Deciding Where to File for more information about jurisdiction.

What does "fail to state a claim" mean?

In other words, you are arguing that plaintiff failed to state a legal claim in the complaint, and there is no relief legally available to plaintiff based on her allegations.

What does it mean when you receive a summons and complaint?

Overview. If you have received a summons and complaint, that probably means you are being sued. Being sued can be one of life’s most stressful experiences. Although it might be tempting to ignore a summons and complaint, ignoring a lawsuit does not make it go away.