But if you want payment from the proposed Equifax settlement, you must file a claim by January 22, 2020. The settlement administrator will evaluate the claims, total them up, and seek final approval by the court to pay them. There’s no guarantee that you’ll get the amount you claim and it could take a long time to see any benefits.

Full Answer

What is the settlement with Equifax?

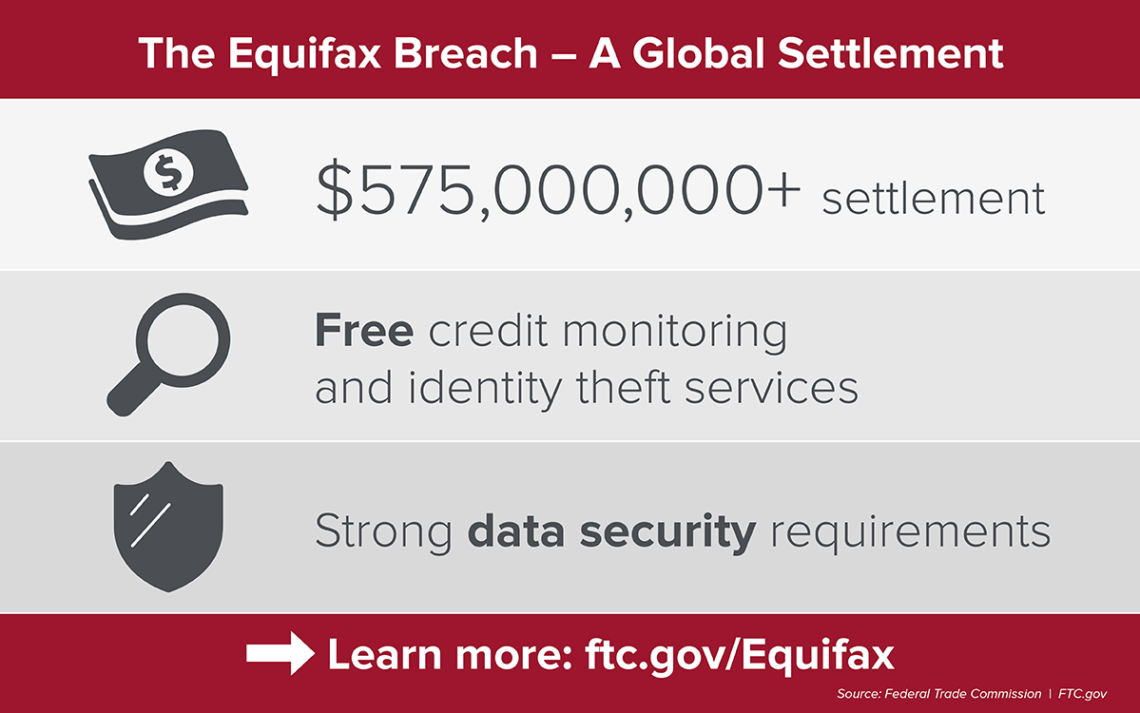

The company has agreed to a global settlement with the Federal Trade Commission, the Consumer Financial Protection Bureau, and 50 U.S. states and territories. The settlement includes up to $425 million to help people affected by the data breach. The initial deadline to file a claim in the Equifax settlement was January 22, 2020.

Are you eligible to file a claim after Equifax breach?

If you are one of the individuals impacted by the breach (hint: you probably were), you can now file a claim as part of a settlement that Equifax is finalizing to resolve claims. How Do I Find Out If I Am Eligible To File A Claim?

Is there a class action lawsuit against Equifax?

A federal court is considering a proposed class action settlement submitted on July 22, 2019, that, if approved by the Court, would resolve lawsuits brought by consumers after the data breach. Equifax denies any wrongdoing, and no judgment or finding of wrongdoing has been made.

What is the Equifax data breach?

The breach occurred at Equifax, one of the three credit reporting bureaus entrusted with some of the most sensitive personal data, including Social Security Numbers. If you are one of the individuals impacted by the breach (hint: you probably were), you can now file a claim as part of a settlement that Equifax is finalizing to resolve claims.

See more

Will I get money from Equifax settlement?

Status of financial reimbursement If you were affected by the Equifax data breach, you can still claim financial reimbursement for costs you incurred, or time you spent dealing with fraud or identity theft, after January 22, 2022. Claims are due by January 22, 2024. For more details, visit EquifaxBreachSettlement.com .

How much will each person get from Equifax settlement?

Under the settlement terms, Equifax agreed to set up a fund to provide free credit monitoring and identity theft protection to consumers, as well as provide cash payments to people affected by the breach—up to $20,000 per person.

How much is Equifax settlement?

Back in 2017, Equifax infamously suffered a data breach that exposed devastating levels of personal and financial information of about 147 million Americans. Its punishment was a $575 million settlement with the Federal Trade Commission and a pinkie promise to go forth and sin no more.

Who qualifies for Equifax settlement?

You are a Settlement Class Member if you are among the approximately 147 million U.S. consumers identified by Equifax whose personal information was impacted by the Equifax Data Breach.

Has anyone received money from Equifax?

After a data breach in 2017 exposed personal data of more than 147 million consumers, including in some cases Social Security and driver's license numbers, credit bureau Equifax agreed to pay hundreds of millions in compensation to help affected consumers.

What happened to the Equifax lawsuit?

In 2017, hackers broke into Equifax in a breach that exposed the financial information of 147 million Americans. A federal court in 2020 approved a $380 million settlement of class actions lawsuits, with no finding or judgment of wrongdoing made.

How much can you get from a data breach settlement?

The settlement includes up to $425 million to help people affected by the data breach. The initial deadline to file a claim in the Equifax settlement was January 22, 2020.

How much did Equifax pay for data breach?

In fact, the credit reporting agency disclosed this week that it expects to pay out an additional $100 million for its role in the breach. Last year, the company set aside then agreed to pay out nearly $700 million to settle numerous federal and state investigations.

Can I trust Equifax?

Trusted: Equifax is one of the major credit bureaus and has a highly regarded reputation.

How much can you expect from a class-action lawsuit?

A class action usually ends in a settlement as opposed to going to trial. Settlements in recent years have averaged $56.5 million.

How are class action settlements divided?

Class action lawsuit settlements are not divided evenly. Some plaintiffs will be awarded a larger percent while others receive smaller settlements. There are legitimate reasons for class members receiving smaller payouts.

What is a class action settlement notice?

The class action notice outlines the original plaintiff's claims against the defendant and the terms of the proposed settlement. California's federal courts have suggested language that attorneys should use when sending out these notices.

Is there a class-action lawsuit against Desjardins?

Quebec court approves $200.9M settlement against Desjardins over data breach. The Superior Court of Quebec has approved a nearly $200.9-million settlement of a class-action lawsuit against Desjardins over a data breach — the largest to date in the Canadian financial services sector.

Should I file a lawsuit against Equifax?

Team Clark is adamant that we will never write content influenced by or paid for by an advertiser. To support our work, we do make money from some links to companies and deals on our site. Learn more about our guarantee here .

How many lawsuits have been filed against Equifax?

More than 100, if not more by now, lawsuits have been filed against Equifax over the massive data breach that exposed the personal information of at least 143 million Americans.

What happens if you are impacted by Equifax?

If you were impacted by the Equifax data breach, you may seek reimbursement for valid Out of Pocket losses or Time Spent (excluding losses of money and time associated with freezing or unfreezing credit reports or purchasing credit monitoring or identity theft protection) incurred during the Extended Claims Period if you have not received reimbursement for the claimed loss through other means.

When is the deadline to file a claim against Equifax?

The deadline to file a claim for Out-of-Pocket Losses or Time Spent that occurred through January 22, 2020 has passed.

How much time can you spend on a data breach?

You may be eligible for the following reimbursement cash payments for: Time Spent during the Extended Claims Period recovering from fraud, identity theft, or other misuse of your personal information caused by the data breach up to 20 total hours at $25 per hour.

When is the deadline for Equifax?

If you are a class member, the deadline to file Initial Claims Period claim (s) for free credit monitoring or up to $125 cash payment and other cash reimbursement passed on January 22, 2020.

When is the deadline for credit monitoring in 2024?

January 22, 20 24 (For future losses and time) File a claim for Credit Monitoring Services or Alternative Reimbursement Compensation. The deadline to submit a claim to receive the Free Credit Monitoring Services offered under the Settlement, or Alternative Reimbursement Compensation has passed.

When is the extended claim period for credit monitoring?

You may seek reimbursement for valid Out-of-Pocket Losses or Time Spent (excluding losses of money and time associated with freezing or unfreezing credit reports or purchasing credit monitoring or identity theft protection) incurred during the Extended Claims Period (between January 23, 2020 and January 22, 2024) if you have not received reimbursement for the claimed loss through other means.

Can you claim out of pocket time spent?

Submit a claim to receive reimbursement for Out-of-Pocket Losses and/or Time Spent. You may claim Out-of-Pocket Losses, Time Spent, and Credit Monitoring Services under the Settlement depending on whether you file claim(s) during the Initial or Extended Claims Period.

How many class action suits have been filed against Equifax?

Since the Equifax breach—which involved the theft of names, birth dates, addresses, credit card numbers, and full Social Security numbers—more than 50 class-action suits have reportedly been filed against the credit bureau.

What is the lawsuit against Equifax?

District Court in Oregon on Sept. 7 accuses the company of negligence by failing to take appropriate measures to protect consumer data. The suit estimates billions of dollars in losses.

What is class action lawsuit?

Class-action lawsuits are usually initiated by lawyers on behalf of consumers who they say have been similarly harmed by a company because of fraud or other unlawful conduct.

How many credit files were compromised by Equifax?

If your personal information is among the 143 million credit files compromised in the Equifax cyberattack, you might be wondering if you have any recourse against the company.

What are the benefits of class action?

One of the biggest benefits of a class action is that it discourages companies from engaging in fraud or other illegal activities , says Myriam Gilles, vice dean at the Cardozo School of Law in New York City.

Why do lawyers use class actions?

Lawyers turn to class actions because the cost of suing companies on behalf of just one consumer often is impractical, especially if the financial loss to that individual is small.

Can you opt out of a class action lawsuit?

You can opt out of a class action. If you do, you’ll preserve your right to sue on your own, Sovern says. If you suffered serious harm, you should consult an attorney to discuss your options, Slover advises.

The Equifax Data Hack

The data systems of Equifax were hacked in July 2017. Incredibly, Equifax only notified the public a month later. The personal information of over 147 million Americans, like S.S. numbers, birthdates, addresses, and credit card information, was stolen in the hack. Not much is known about the hack beyond what Equifax has belatedly revealed.

Settlement Option

Equifax will pay up to $700 million in settlements in coordination with federal investigations and to compensate those who might have been affected. The problem is that the claims process is excessively bureaucratic, process intensive, and could take months or years to dole out compensation.

Fight the Power

The FTC believes that you should file a claim for the free and extended credit monitoring from Equifax. If Equifax’s $700 million settlement was divided into $125 payments, only about 248,000 could qualify. The company has yet to reveal the depth of the hack and is not making the claims process convenient.

What happened to the Social Security numbers in 2017?

In 2017, the personal information of over 145 million Americans was exposed by one of the largest data breaches in recent times. The breach occurred at Equifax, one of the three credit reporting bureaus entrusted with some of the most sensitive personal data, including Social Security Numbers. If you are one of the individuals impacted by the breach (hint: you probably were), you can now file a claim as part of a settlement that Equifax is finalizing to resolve claims.

How much can you get for a breach of contract?

If you suffered losses as a result of the breach and can provide documentation of your out-of-pocket costs, you may be eligible for cash payments up to $20,000.

Can you file a claim if your personal information was compromised by the breach?

You are eligible to file a claim if your personal information was compromised by the data breach. There is a dedicated page - https://www.equifaxbreachsettlement.com/ - with important information about the proposed settlement.