A roofing company can provide your insurance company with an estimate and negotiate the settlement. You don’t have to be involved at all. Deciding Whether to File an Insurance Claim When a homeowner calls the insurance company after the damage is sustained, the company will send the adjuster out to inspect.

Full Answer

Do you need to show a roofing contractor your insurance claim?

You definitely need to show a roofing contractor your insurance claim. But why? Sharing your insurance paperwork lets them know the scope of work, saves you from committing fraud, and more. The rest of this article digs deeper into the 4 reasons why it’s important to show your insurance estimate to a roofing contractor. 1.

Do I need homeowners insurance to replace my roof?

But as long as you have homeowners insurance, you shouldn’t have a problem. Once you go through the claim process and it’s approved, you’re ready to get a replacement from the roofing contractor of your choosing. When talking to a potential contractor, I can guarantee the first thing they’re going to ask is to see your insurance estimate.

What happens if my roofing invoice doesn’t match my insurance claim?

If a homeowner or roofing contractor submits an invoice that doesn’t exactly match the claim line by line, the insurance company will ask for verification as to why the amount is different. This often leads to weeks and sometimes months of repetitive calls and long delays in getting the full claim amount paid out to the homeowner.

Can a roofing contractor use an initial estimate against you?

In fact, second and third opinions are allowed from other roofing contractors. There really is no reason why a roofing contractor would use an initial estimate against you, particularly when you accept the estimate for work from the original estimate. There may be reasons behind an initial estimate being used against you.

Can I keep extra money from insurance claim?

Homeowners can keep the leftover money if there is nothing in writing saying that they must return the unused claim money. Make sure to be truthful when explaining your situation to the insurance company for the claim payout, as lying is considered insurance fraud for which the consequences are harsh.

Why do roofers ask about insurance?

1. They need to know the scope of work approved by the insurance company. Without seeing the insurance company's paperwork, your local roofing contractor won't know that you even have an insurance claim.

Does the contractor get the recoverable depreciation?

Does the contractor get the recoverable depreciation? In a roundabout way, yes. If you have submitted paperwork that the repair company, like a roofer, has finished the job, they are entitled to that recoverable depreciation.

Should I make an insurance claim on my roof?

If you've filed more than two claims on your homeowners in the last five years it could drive up the cost of your premiums. However, It's almost always worth filing a roof claim if the type of damage or the extent of the damage is extensive. The cost of replacing a roof often outweighs the cost of higher premiums.

Why you should call a roofer before your insurance company?

Calling a roofing company out to assess damage will guarantee a thorough and accurate inspection. Roofing experts don't look for surface damage, but instead dive deeper to find water and other underlying problems. Insurance adjusters often miss deeper issues and the roof's situation only deteriorates.

Should I call my insurance company if my roof is leaking?

If your roof or ceiling leaks due to a covered peril, the associated damage should be covered under your homeowners insurance policy. Most home insurance policies have an open perils claims basis, which means unless coverage is specifically excluded, then it is included.

How do I get my recoverable depreciation back?

Recoverable Depreciation is the gap between replacement cost and Actual Cash Value (ACV). You can recover this gap by providing proof that shows the repair or replacement is complete or contracted.

How long do I have to claim recoverable depreciation?

You may need to notify the insurance company that you'll be attempting to recover depreciation within six months or 180 days.

Who gets the depreciation check?

Home insurance companies usually pay replacement cost claims in two parts — actual cash value, then recoverable depreciation — to dissuade fraud and to limit excessive payouts. After you've repaired or replaced the damaged property, your insurer will write you a check for the recoverable depreciation amount.

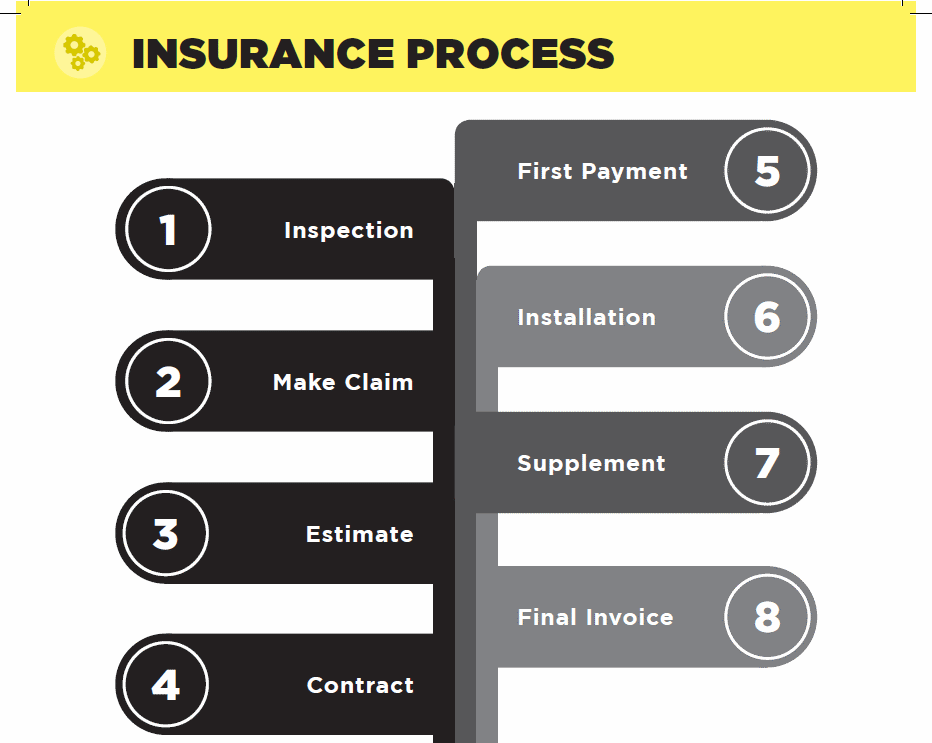

How do I make a successful roof leak insurance claim?

8 Steps to Filing an Insurance Claim for Your RoofAssess your roof damage. ... Find out what your insurance covers. ... Document your roof damage. ... Get in touch with your insurer. ... Find a local roofing company. ... File your claim. ... Meet with an insurance adjuster. ... Replace your roof.

What do insurance adjusters look for on roofs?

An adjuster will look for signs of a leak, such as peeling under roof eaves, curling or buckling roofing, damaged or rusted flashing, and rot. You may also notice leaks on the interior ceiling presenting as dark spots that could be accompanied by peeling interior paint.

Can I claim for leaking roof on insurance?

Most home insurance providers will cover the cost of repairs if roof leaks are due to a sudden, unexpected event, like storm damage or a falling tree. But you won't be covered for roof leaks that are due to wear and tear.

How do insurance companies determine roof damage?

Insurance adjusters will evaluate your roof to determine whether it needs replacement if an area has enough blows caused by storm damage. Matching Issues for Your Roof – Your insurance company may have to replace your entire roof if they can't find enough materials to repair it.

What do insurance adjusters look for on roofs?

An adjuster will look for signs of a leak, such as peeling under roof eaves, curling or buckling roofing, damaged or rusted flashing, and rot. You may also notice leaks on the interior ceiling presenting as dark spots that could be accompanied by peeling interior paint.

How do you read a roof insurance claim?

How to Read Your Insurance ClaimClaim Summary.Line Item 1: This is your line item total for materials and labor. ... Line Item 2: Line number two is the material sales tax. ... Line Item 3: Number three is the important number that we want you to pay close attention to.More items...•

When should I call my homeowners insurance?

Most homeowners policies require that the insurance company be notified promptly after any damage, theft, or injury that's likely to result in a claim. While that doesn't necessarily mean you have to call immediately, the sooner you do, the sooner the recovery process can begin.

Roofing Companies That Work With Insurance Companies

Maybe Rooftop Solutions is the norm or the exception, but I like to think we work with versus against insurance companies. You’ll probably need to be the judge of our methods. When a storm occurs with wind or hail, it prompts the phone to ring with requests to repair and inspect roofs.

Roofing Companies That Work Against Insurance Companies

The alternative relationship between insurance companies and roofing companies is oil and water. Roofing companies traveling large distances for a hail claim often say, “Yes, we will work with your insurance company” to get the job.

Why do roofers ask for a claim document?

There are plenty of reasons why the roofer will ask for the claim document. These include: When the roofer wants to review and understand your claim, looking at that document will help him know what will and will not be covered by the insurance. If items are missing from the claim, or items on the claim are incorrect, ...

How to interview contractors for insurance?

Here are three very important points to consider when you’re in the interviewing stage with contractors: 1 This stage should be the interviewing stage, not the estimate-collecting stage. If your project is part of an insurance claim, the cost to you doesn’t change regardless of the cost of the project. Your out of pocket expense is, and remains, your deductible. Therefore, it really doesn’t matter what the estimates are from the contractors. <3 estimates video or blog link> 2 Since this stage should be more focused on interviewing roofers and not collecting estimates, focus on finding a contractor who you trust – one who can educate you about the insurance process and your roofing needs. 3 If you give all the roofers the claim document and ask them to build their estimates based on the scope of work in the claim, if the claim doesn’t include the proper work to meet code and manufacturer’s installation specs, then you won’t have any product or workmanship warranty if the job is done per the claim document.

When meeting with a contractor who has created an estimate for you, it’s going to be necessary to answer?

When you’re meeting with a contractor who has created an estimate for you, it’s going to be necessary to compare his estimate with your insurance claim. A professional contractor will be able to explain to you what your claim document means and why there are discrepancies between it and his estimate.

Should a contractor receive confidential information?

No contractor who hasn’t been hired to do a job should receive confidential information about your finances , your claim, or your property. Here are three very important points to consider when you’re in the interviewing stage with contractors: This stage should be the interviewing stage, not the estimate-collecting stage.

Why do insurance companies offer cash settlements?

Most insurance companies offer cash settlements of smaller claims to save time and get the case off the books, rather than have to follow it thorugh the process and risk cost increases coming out of their pocket. If the insurance company chooses (and you agree) to make a cash settlement of the claim based on their assessment of the cost (the ACV as noted by insurance guy, also called Adjusted Cash Value or Adjusted Amount), with or without prior estimates (but no firm contract) from contractors or vendors, and you accept that as total coverage of the claim before the repair or replacement work is actually done, then that is the insurance company's assessment of fair value and if you end up paying less than that for the work that is your gain, if it ends up costing more that is out of your pocket unless you can convince the insurance adjuster that there was concealed damage realted to the original claim that you did not know about until the work commnced. This, along with contractors trying to bump up their price during the course of the work, is the major risk in accepting a cash settlement rather than actual cost after the fact.

What should an insurance adjuster see?

Answered by LCD: At a minimum, he should see the technical part of the report - everything but the cost estimate by the insurance adjuster, so he knows that the adjuster noticed all the problems to be fixed.

What is scope in construction?

Scope includes a complete description of WHAT is to be done, including quality, quantity etc. The Price is self explanatory and can be different from contractor to contractor even based on exactly the same scope, that is why they call it a BID.

Is it fraud to take more from an insurance company?

If the insurance company is paying the bill directly to the contractor, or to you based on a contractor billing or signed firm bid or contract, it is fraud to take more from the insurance company then the work actually cost, after taking into account all credits or rebates you may receive.

Is it illegal to let someone see the cost of an insurance quote?

Letting him see the cost is illegal on federal jobs and in some states as it i considered insurance pricing collusion. I would let him bid first, then if he is over the insurance companies estimate have the insurance company talk to him about why they should allow more. Letting him see the estimate just almost guarantees his bid will magically come in at or a bit above that.

Can you call insurance after you didn't send all the money?

Most will use it inappropriately and find out in the end they hired the cheapest contractor they could and still ended up paying their deductible. They can call the insurance after the fact crying that they didn't send all the money they said they would in their insurance estimate.

What happens when you allow a roofing contractor to access your claim?

When you allow a trustworthy roofing contractor access to your claim, you’re giving them permission to submit an invoice that’s comparable to the original estimate and is one that helps you receive money for repairs more quickly. You also want anything else included for code upgrades or other items not included on the original estimate. You want payment for your claim, and obviously the roofing contractor wants his fair share for work done. With a roofing company on your side, you should be fully paid for what you are owed for roofing repairs.

What should a roofer know about insurance?

Your roofer should know and understand what your policy covers under your policy. Most policies have time limitations for completing roofing projects and rarely include code upgrades. In addition, anything that is considered cosmetic probably won’t be covered. Some policies (Actual Cash Value ACV) pay for only part of any repairs. A good roofer will be able to discuss all of these issues with you and include anything unforeseen in the final price. Thoroughly reviewing your claim stops additional costs from being inserted in your project.

Why is an initial estimate being used against you?

For example, if you’ve hired a roofer who agrees with the estimate and immediately asks for a deposit, there may be questionable concerns.

What to do if you are suspicious of a roofing contractor?

If you’re suspicious or doubtful of the roofing contractor, go ahead and get several estimates before you choose the contractor who will give you the most accurate and inclusive price.

What is the objective of a good roofing contractor?

The objective of a good roofing contractor is not to commit fraud or get more money through a claim, but to make an honest transaction that’s fair to all parties concerned.

How to contact contractor insurance?

If you’re still unsure as to whether you should show your contractor your insurance. estimate, call us at 856-264-9093. We’ll fully answer any questions or concerns you may have.

Do adjusters work on roofs?

Adjustors aren’t Roofers. During the estimate process, an adjustor decides about roofing problems through a standard template and not all roof areas are going to be the same. There are certain items on a roof that will be on one roof and not another. Codes vary for different counties and states.

How much does home insurance underpay for repairs?

Regardless of whether you do the repairs, home insurance carriers commonly underpay property damage by at least ten thousand dollars.

How to inspect damage to property?

to inspect the damage and tabulate the damaged property's value . Once you have an estimate from your insurer, get a detailed estimate from a professional before committing to repairing yourself. A professional can spot or anticipate the damage that may not be obvious to you, even if you're an experienced DIYer.

What to do if you have a mortgage on your home?

If you have a mortgage on your home, your lender may have a say in repairing your home and give you a hard time. One standard clause in mortgage contracts is to name your lender on insurance claim checks.

What to consider before repairing a home?

Before deciding to repair your home, consider financial costs, local regulations, and, above all, work safety. Even if your mortgage company gives you the go-ahead to do the repairs on your home, you should seriously consider the risks and whether it's worth it to do the work yourself before committing to self-repair.

What happens if you do not have a permit to repair a fence?

For example, imagine a falling tree damages your fence, and you repair it yourself.

Why do insurance companies demonize lawyers?

Insurance companies often spend millions of dollars demonizing lawyers because they are the most effective tool for consumers.

What is the most important issue in repairing a home?

The first and most important issue is safety. Many dangerous elements can be involved in repairing a home. If the damage to your home is something like an electrical system, and you're not experienced with it, you shouldn't take this opportunity to learn — leave it to the professionals.

What to do if you have a wind storm damaged roof?

If you have a wind or storm damaged roof, you’ll likely be anxious to get it repaired or replaced and want to ensure a payout and subsequent repairs as soon as possible. Therefore, the first person you call up (after everyone is safe and your property is secured, of course) should be your public adjuster.

Can a roof claim take forever?

A roof insurance claim can feel like it is taking forever, especially if the roof damage is impeding your ability to do business. This is partnering with a public adjuster you trust as well as an experienced and trustworthy roofing contractor is essential – not only for your property, but for your home or business.

Does every roofing contractor offer insurance?

Know that not every roofing contractor will offer insurance claim assistance – which doesn’t mean that they don’t do good work, it’s just not their area of expertise – but some may have adjusters on staff to help through every step of the roof insurance claim process.

Can insurance companies withhold depreciation?

You should also be aware that your insurance company can withhold depreciation or part of your payout in order to ensure that you actually do the work on your roof with the money, since people sometimes spend their payout on something else, especially if their property’s roof isn’t a total loss.

Can you put tarps on a roof?

Whether or not you notice any immediate damage, it will be important for your future insurance claim to mitigate any potential problems by placing tarps over the roof and checking for water damage, mold, or other issues that may cause further damage before your insurance claim can get paid out and your roof can be restored or repaired.

Can you replace a roof after a tornado?

And of course, a major event like a hurricane or tornado can require the replacement of the roof completely. Also, be sure to check your insurance policy or speak to your public adjuster, since there are some that have requirements regarding how long you can wait after a major storm or disaster and still have your roof repairs or restorations ...

Is hail a loss on my insurance?

Know that hail storms, wind storms, and other damage from natural disasters are all considered losses against your insurance policy, so be aware, follow these steps, and work with your contractors, insurance company, and most importantly your public adjuster to make the roof insurance claim process as smooth as possible.

Why do roofers ask for a copy of insurance?

Here the reasons why your roofer will request a copy of your insurance claim before giving you a price: It is important for your roofer to review and understand your insurance claim and policy. Your roofer needs to understand what will and will not be covered ...

How does reviewing a roofer's claim help?

Reviewing your claim allows your roofer to help you get your money from insurance. Your roofer wants to get paid and so do you. Allowing your roofer access to your insurance claim gives them the ability to submit a final invoice that matches the claim and get your money to you more quickly. It also allows them to assist you with getting more money from your insurance company if needed to cover missing items or larger code upgrade items (such as decking replacement). All of this helps both you and the roofing company get paid what you are owed in a timely manner.

What happens if an insurance company doesn't match a claim?

After years of working with insurance companies, this fact stands out like a sore thumb. If a homeowner or roofing contractor submits an invoice that doesn’t exactly match the claim line by line, the insurance company will ask for verification as to why the amount is different. This often leads to weeks and sometimes months of repetitive calls and long delays in getting the full claim amount paid out to the homeowner.

How to avoid scams from contractors?

Find out how long your contractor has been in business. Use referrals from trusted friends and neighbors, and check the contractor’s online reputation.

Can you have items on one roof on another?

Sometimes, items on one roof don’t exist on another or vice versa. Code requirements vary from county to county and state to state. Not every adjustor who gets on your roof is familiar with these items. During a large storm recovery time, most insurance adjustors come in from other states to work.

Is storm chasing roofing a scam?

You may have read news articles about non-reputable roofing companies or even storm-chasing roofing scammers. Therefore, you may be hesitant to hand your insurance claim to your roofer, but be assured that this is not a way for us to scam you. Rather, it is a way to be sure we are giving you the most accurate price possible.

Is the Better Business Bureau a good place to research contractors and businesses in your area?

The Better Business Bureau is a great place to research contractors and businesses in your area. If you do your research thoroughly, trusting your roofer with your insurance claim should be an easy choice. Tags: colorado roofing, colorado springs hail damage, hail claim, homeowner's insurance claim, roofer, Roofing, roofing claim.

What happens when you get a roof repair check?

Once the claim is reviewed and processed, the insurance company will finalize the total amount of damages. At this point, the insurance company will send a check for that amount to the homeowner. This check is intended to cover the costs, either of repairing the roof to its original condition, or of replacing the roof completely, according to the terms of the policy.

What happens after a homeowner reports damage to their insurance company?

After the homeowner reports the damage to their insurance company, the insurance company will send an adjuster to get their own look at the damage. This insurance adjuster will inspect the roof, taking special note of any areas of damage that your business identified in your initial inspection.

What is AccuLynx roofing software?

AccuLynx roofing software makes it easy for insurance restoration contractors to store and access information for each one of their jobs. Our cloud-based platform allows you to create digital job files that can be accessed from anywhere. You can store documents, photos, notes, and more in these job files—then see and update them from the field, the office, or wherever you happen to be. Instead of having to look through paper files to answer an insurance question, you can simply log into AccuLynx and bring up the information you need with just a few clicks. Using cloud-based roofing software like AccuLynx puts the information you need to pass along to the insurance company within easy reach, keeping the claims process from being delayed.

Why is it important to learn the language of insurance companies?

Learning to speak the language of insurance companies will also help you complete any paperwork correctly and reduce the possibility of errors when you fill out insurance restoration forms. When contractors understand the terms that insurance companies use, it helps facilitate clearer communication and eliminates error-related delays.

How to master insurance claims?

Good communication between your business and the insurance company is key to mastering the insurance claims process. The greater understanding you have of insurance-related terms and concepts, the easier it will be to answer any questions that arise and understand how the process is progressing.

What happens when you receive a check from insurance?

When the claim is finalized and the check is received, the insurance company’s involvement in the process comes to an end. Now, you and the homeowner can agree on a formal scope of work and draw up a contract for the repairs or replacement. In many cases, this agreement will exactly cover the damages mentioned in the assessment; in other cases, the homeowner may want you to do additional repair work besides what is covered by the insurance check.

What is damage assessment?

During this time, the insurance company will evaluate the report of the damage provided by the adjuster to determine how much should be paid to the homeowner for repairs. This process can take a significant amount of time, and is often the reason why insurance restoration projects get delayed.