Impounds are expenses that the buyer pays at closing before they’re due, such as:

- Homeowner’s insurance

- Mortgage insurance

- City or town taxes

- County taxes

- School taxes

What can be deducted on a settlement statement?

Also, a primary residence homebuyer can deduct the amount of loan discount or interest-rate buydown points displayed on the settlement statement. Prepaid mortgage interest and mortgage insurance premiums are tax deductible, as are upfront real estate tax payments made from mortgage escrow funds.

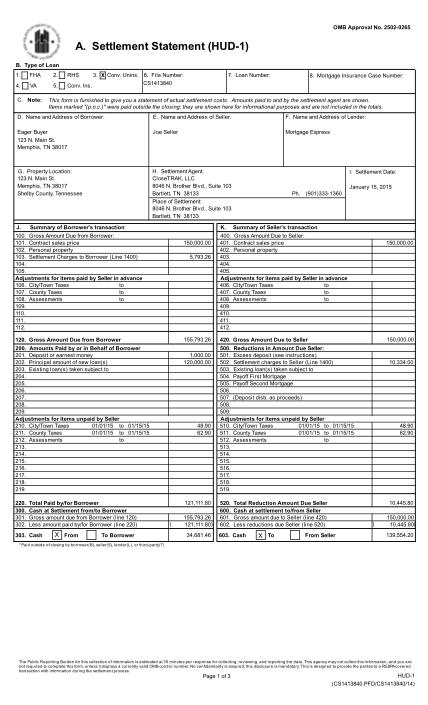

What is a settlement statement?

What is a settlement statement? A settlement statement is an itemized list of fees and credits summarizing the finances of an entire real estate transaction. It serves as a record showing how all the money has changed hands line by line.

What happens at A HUD-1 Settlement Statement closing?

A home sale transaction is typically completed at a formal closing. No less than three days before the closing the seller and the buyer each receive a HUD-1 Settlement Statement. The HUD-1 Settlement Statement is a breakdown of the expenses home sellers and homebuyers incur in a real estate sale.

Who prepares the settlement statement when closing?

Depending on what state you’re in, the settlement statement, a separate document, will be prepared by either an attorney, a title company, or an escrow firm, and the actual closing will be held at the offices of one of these three locations.

What does impound mean in accounting?

What Does Impound Mean? Impound is an account maintained by mortgage companies to collect amounts such as hazard insurance, property taxes, private mortgage insurance, and other required payments from the mortgage holders. These payments are necessary to keep the home but are not technically part of the mortgage.

Who benefits from an impound or reserve account?

An impound account greatly benefits the lender because they know your property taxes will be paid on time, and that your homeowners insurance won't lapse. After all, if you have to pay it all in one lump sum, there's a chance you won't have the necessary cash on hand.

What is the meaning of impounds?

Definition of impound transitive verb. 1a : to shut up in or as if in a pound : confine. b : to seize and hold in the custody of the law. c : to take possession of she was dismissed and her manuscript impounded— Jonathan Weiner. 2 : to collect and confine (water) in or as if in a reservoir.

Is it better to pay homeowners insurance through escrow?

If you have a down payment that's less than 20%, your lender will likely require you to pay your homeowners insurance through an escrow account. This ensures your insurance premium will be paid on time every month with no lapse in coverage. It also helps protect the lender's investment in your home.

How much does a 30 day impound cost?

With fees and administrative costs, a 30-day impound can rack up roughly $2,000 in fees. “These tows are often not tied to a public safety rationale,” said Rachel Stein, an attorney for Public Counsel, a Los Angeles law firm that worked on one of the federal lawsuits.

How do I get my impound fee waived in Colorado?

If you can show the ticket was issued in error or you had a valid excuse for violating the law, the court may decide to waive your impound fees. Another way to waive your impound fees is by filing a complaint with the city.

How much are impound fees in AZ?

Storage fees are limited to a maximum of $15.00 per day. These charges are due to the towing company that removed and is storing your vehicle. In addition, pursuant to ARS 28-3514, the owner is liable for an administrative fee of $150.00 paid with cash, cashier's check, or money order payable to the City of Phoenix.

How much does it cost to get your car out of impound in Texas?

Towing FeesVehicle WeightTow Fee10,000 lbs or less$25510,001 – 24,999 lbs$35725,000 lbs or more$459 per unit or a maximum of $918

What is a settlement statement?

A settlement statement is an itemized list of fees and credits summarizing the finances of an entire real estate transaction. It serves as a record showing how all the money has changed hands line by line.

Who is responsible for preparing the settlement statement?

Whoever is facilitating the closing — whether it be a title company, escrow firm, or real estate attorney — will be responsible for preparing the settlement statement.

Is a settlement statement the same as a closing statement?

Yes, a settlement statement is the same as a closing statement, though “settlement” is the formal term most likely to be used by the real estate industry.

What is an ‘excess deposit’ at closing?

A particular line item that causes confusion on the seller’s settlement statement is the “Excess Deposit.” What is an excess deposit, and who will receive the funds listed on that line?

What does an impound account do at closing?

At closing the buyer sets up an impound account that allows them to bundle the cost of their mortgage principal, taxes, mortgage insurance, and other monthly costs into one payment. The lender likes this because they can make sure the new owner will keep up to date with all the payments associated with the home.

What information is needed to complete a closing document?

At the top of the document (before you get to the portion that looks like a spreadsheet) you’ll see a few boxes for inputting information that records basic details about the transaction, such as the names of the buyer and seller, the property address, and the closing date.

Does the seller get a closing statement?

Buyers tend to sign the bulk of the paperwork at closing, making some sellers wonder if they will even receive a settlement statement.

What is estimated settlement statement?

At the time of signing loan documents, the buyer is presented with an estimated settlement statement by their escrow holder. This statement includes the initial amount the lender will collect in order to establish the Impound Account. This amount often brings up questions from the buyer, as it sometimes appears that they are paying for months of taxes before they are the owner of the property. In this blog, we explain how a lender calculates the initial amount they request from the buyer through the close of escrow.

How long does it take to pay insurance on an impound?

INSURANCE: The lender requires that one full year of insurance be paid in advance and through the escrow during the time the account is set up. The lender will also collect an additional 2-3 months upfront for the Impound Account, as the next premium will not become due until 12 months from the close of the escrow.

How much upfront do you have to collect from a buyer for a mortgage?

As the lender would have received at least six monthly mortgage payments, including monthly impound amounts, from the buyer at this time, then the lender would only need to collect 2 to 3 months upfront from the buyer through the escrow.

How is yearly property insurance determined in California?

The yearly insurance premium is determined by the buyer’s insurance agent and provided to the lender as a condition of the loan. TAXES: Property Taxes in California are billed once a year and are payable in two parts. The Tax bills are sent out by October each year.

Why do you need an impound account?

Required impound accounts also decrease the amount that money borrowers can place in an emergency fund. The lender keeps a little extra in your impound account, in order to ensure the extra cushion needed in order to keep making insurance and tax payments if you stop making your monthly mortgage payments.

What does a mortgage statement show?

Your monthly mortgage statement will probably show the balance in your impound account , making it easy for you to keep a close eye on it. Federal regulations also help borrowers out in this area by requiring lenders to review borrowers' impound accounts annually to ensure that the correct amount of money is being collected. If too little is being collected, the lender will start asking you for more; if too much money is accumulating in the account, the excess funds are legally required to be refunded to the borrower.

Do you have to pay interest on impound accounts?

Not all states require lenders to pay interest on the funds held in impound accounts, and those that do may not pay as much as individuals could earn by investing the money on their own. Not surprisingly, some consumers would rather set money aside in a high-interest savings account, or some other investment.

Do mortgage impounds work?

For many homeowners, mortgage impounds are a necessary evil. Without them, lenders might not be willing to give mortgages to borrowers who can afford only low down payments. The best way to deal with impound accounts is to understand how they work, monitor them carefully – and get rid of them when you can.

What is a HUD-1 settlement statement?

The HUD-1 Settlement Statement is a breakdown of the expenses home sellers and homebuyers incur in a real estate sale. The settlement statement gives both parties a full picture of the expenses attached to the transaction. Some of the expenses assigned to home sellers and buyers on the HUD-1 form might be tax-deductible, and whether they are depends on the specifics of each transaction. Some of the more common examples of deductible expenses include loan origination fees, mortgage insurance premiums, and real estate tax payments.

What Are Seller Deductions?

Any prorated real estate taxes a home seller pays at closing are tax deductible. However, many of the closing costs listed on a settlement statement are deducted from sale proceeds. Lowered net proceeds reduce the capital gains the home seller may have garnered, thus reducing associated taxes. A capital gain is the improvement between a home's past purchase price and its later sale price, minus sale expenses.

What is the real estate settlement procedure act?

The Real Estate Settlement Procedures Act (Regulation X) protects consumers when they apply for and have a mortgage loan. Section 1024.17, entitled “Escrow Accounts” limits payments to escrow accounts upon creation.

What is aggregate adjustment?

The aggregate adjustment is typically a credit provided to the buyer on the settlement statement, which means the amount collected exceeded what was allowed pursuant to the above regulation.

How to make sure you get all your deductions?

The best way to make sure you get all of your tax deductions is to talk to your tax advisor. With the Tax Reform and tax deductions changing so drastically, it’s best to get a professional opinion. As long as you make sure you tell your advisor about your home purchase, sale, or refinance and prove payment of the tax-deductible expenses, you may be able to lower your tax liability.

Is a settlement statement tax deductible?

What Settlement Statement Items are Tax Deductible? Closing on a loan can cost you several thousand dollars. Before you let that prevent you from buying a home or refinancing, learn which settlement statement items are tax deductible. This lowers the overall cost of closing on a loan, by lowering your tax liability at the end of the year.

Can you deduct refinance costs on settlement?

Even if you refinance, you may be able to deduct some of the costs on your settlement statement.

Do you include prepaid interest on closing statement?

Don’t forget to include the prepaid interest on your Loan Closing Statement in your taxes. Points paid – Again, lenders may charge origination fees or discount points. Luckily, the IRS lets you deduct these items even if you refinance. The difference, however, is how you deduct them.