/willow-processing-2342/Visio-Lending-Logo_385x290-g052e.jpg)

Impounds are expenses that the buyer pays at closing before they’re due, such as:

- Homeowner’s insurance

- Mortgage insurance

- City or town taxes

- County taxes

- School taxes

What does impound mean in real estate?

By Investopedia Staff. Impound is an account maintained by mortgage companies to collect amounts such as hazard insurance, property taxes, private mortgage insurance and other required payments from the mortgage holders.

What can be deducted on a settlement statement?

Also, a primary residence homebuyer can deduct the amount of loan discount or interest-rate buydown points displayed on the settlement statement. Prepaid mortgage interest and mortgage insurance premiums are tax deductible, as are upfront real estate tax payments made from mortgage escrow funds.

What is the difference between impound and closing costs?

Impound is an account maintained by mortgage companies to collect payments for property taxes, private mortgage insurance, and other obligations. Closing costs are the expenses, beyond the property cost, that buyers and sellers incur to finalize a real estate transaction.

What is a settlement statement?

What is a settlement statement? A settlement statement is an itemized list of fees and credits summarizing the finances of an entire real estate transaction. It serves as a record showing how all the money has changed hands line by line.

/willow-processing-2342/Visio-Lending-Logo_385x290-q11b7.jpg)

What does impound mean in accounting?

What Does Impound Mean? Impound is an account maintained by mortgage companies to collect amounts such as hazard insurance, property taxes, private mortgage insurance, and other required payments from the mortgage holders. These payments are necessary to keep the home but are not technically part of the mortgage.

What are the four components of an impound mortgage payment?

A mortgage payment is typically made up of four components: principal, interest, taxes and insurance.

How do you read a settlement statement for taxes?

0:367:31How To Read A Settlement Statement From Your Real Estate ClosingYouTubeStart of suggested clipEnd of suggested clipSo on page one of the closing disclosure you're going to see the parties identified at the top soMoreSo on page one of the closing disclosure you're going to see the parties identified at the top so seller and buyer the property. Address and the loan. Amount.

What are estimated Prepaids and escrows?

Prepaid Items or Escrows Prepaids are expenses that you will pay at closing before they technically come due. You might be required by your lender to pay monthly or annually in advance for taxes, hazard insurance, private mortgage insurance, or special assessments.

What is the meaning of impounds?

Definition of impound transitive verb. 1a : to shut up in or as if in a pound : confine. b : to seize and hold in the custody of the law. c : to take possession of she was dismissed and her manuscript impounded— Jonathan Weiner. 2 : to collect and confine (water) in or as if in a reservoir.

What are the 5 basic parts of a mortgage payment?

The 7 Parts of a Mortgage PaymentPrincipal. Principal is the amount of money you borrowed to buy your house, or the amount of the loan that you have not yet repaid. ... Interest. ... Escrow. ... Taxes. ... Homeowners Insurance. ... Mortgage Insurance. ... Homeowner's Association Fees or Condominium Fees.

What items on a settlement statement are tax deductible?

The seller of a business or investment property may deduct condo fees, fees paid out of escrow (for utility bills, insurance, etc.), fire/casualty insurance premiums, interest, and real estate taxes. They can also include the same selling expense items as the seller of a principal residence.

What expenses can be deducted from the sale of a home?

Types of Selling Expenses That Can Be Deducted From Your Home Sale Profitadvertising.appraisal fees.attorney fees.closing fees.document preparation fees.escrow fees.mortgage satisfaction fees.notary fees.More items...

What is deductible on a settlement sheet?

Deductible Expenses Interest on your loan paid at closing is tax deductible. Any prorated property taxes allocated as your expenses are also deductible. You can deduct loan origination fees or points, which are the fees a bank charges you for making the loan.

What is the difference between Prepaids and escrow?

Prepaid items are one-time charges, paid at the time a real estate transaction is closed, or finalized. Escrow accounts are a continuing expense, typically billed monthly by the lender. The monthly statement should list the amount of principal, interest and amount for escrow.

What is escrow example?

Example of Escrow In return, the seller takes the property off the market and finalizes repairs, etc. All goes well and at the time of the purchase the escrow money is transferred to the seller and the purchase price is reduced by $5,000.

What qualifies as a prepaid expense?

Prepaid expenses are future expenses that are paid in advance, such as rent or insurance. On the balance sheet, prepaid expenses are first recorded as an asset. As the benefits of the assets are realized over time, the amount is then recorded as an expense.

What does impounded mean in mortgage?

An impound account (also called an escrow account, depending on where you live) is simply an account maintained by the mortgage company to collect insurance and tax payments that are necessary for you to keep your home but are not technically part of the mortgage.

What is held in an impound account quizlet?

An impound account (a reserve account for tax and insurance payments) is generally required for any of these types of loans. In many loans, money that will be paid toward recurring costs (such as insurance and property taxes) will be held by the lender in an impound account.

What is an escrow payment?

In essence, an escrow is a type of legal holding account for funds or assets, which won't be released until certain conditions are met. The escrow is held by a neutral third party, which releases it either when those predetermined contractual obligations are fulfilled or an appropriate instruction is received.

What is an escrow account for mortgage?

An escrow account, sometimes called an impound account depending on where you live, is set up by your mortgage lender to pay certain property-related expenses. The money that goes into the account comes from a portion of your monthly mortgage payment.

What does an impound account do at closing?

At closing the buyer sets up an impound account that allows them to bundle the cost of their mortgage principal, taxes, mortgage insurance, and other monthly costs into one payment. The lender likes this because they can make sure the new owner will keep up to date with all the payments associated with the home.

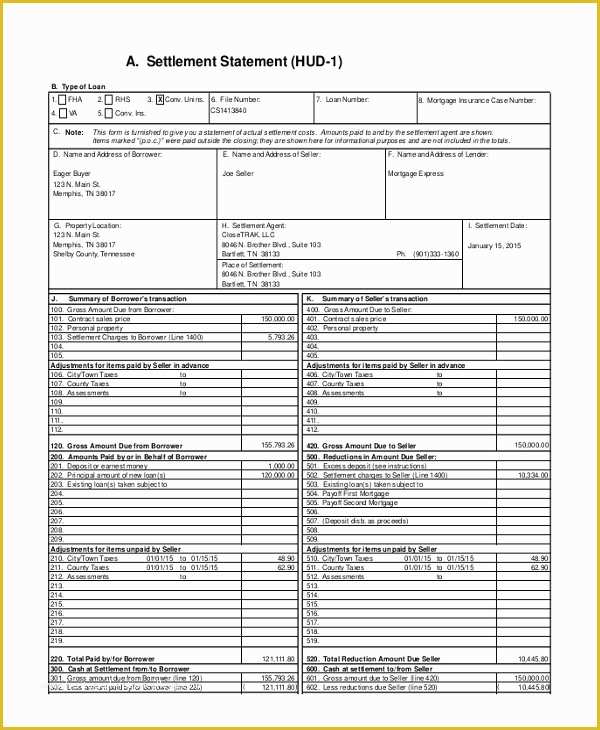

What is a settlement statement?

A settlement statement is an itemized list of fees and credits summarizing the finances of an entire real estate transaction. It serves as a record showing how all the money has changed hands line by line.

Is a settlement statement the same as a closing statement?

Yes, a settlement statement is the same as a closing statement, though “settlement” is the formal term most likely to be used by the real estate industry.

What is an ‘excess deposit’ at closing?

A particular line item that causes confusion on the seller’s settlement statement is the “Excess Deposit.” What is an excess deposit, and who will receive the funds listed on that line?

What information is needed to complete a closing document?

At the top of the document (before you get to the portion that looks like a spreadsheet) you’ll see a few boxes for inputting information that records basic details about the transaction, such as the names of the buyer and seller, the property address, and the closing date.

When are property taxes prorated?

For instance, say you get billed for property taxes in February to cover the previous year. If you’re closing on a sale on April 30, the yearly property tax is “prorated” or calculated for the first four months of the year, and it’s reflected in this section.

Who is responsible for preparing the settlement statement?

Whoever is facilitating the closing — whether it be a title company, escrow firm, or real estate attorney — will be responsible for preparing the settlement statement.

How long does it take to pay insurance on an impound?

INSURANCE: The lender requires that one full year of insurance be paid in advance and through the escrow during the time the account is set up. The lender will also collect an additional 2-3 months upfront for the Impound Account, as the next premium will not become due until 12 months from the close of the escrow.

What is estimated settlement statement?

At the time of signing loan documents, the buyer is presented with an estimated settlement statement by their escrow holder. This statement includes the initial amount the lender will collect in order to establish the Impound Account. This amount often brings up questions from the buyer, as it sometimes appears that they are paying for months of taxes before they are the owner of the property. In this blog, we explain how a lender calculates the initial amount they request from the buyer through the close of escrow.

How much upfront do you have to collect from a buyer for a mortgage?

As the lender would have received at least six monthly mortgage payments, including monthly impound amounts, from the buyer at this time, then the lender would only need to collect 2 to 3 months upfront from the buyer through the escrow.

How is yearly property insurance determined in California?

The yearly insurance premium is determined by the buyer’s insurance agent and provided to the lender as a condition of the loan. TAXES: Property Taxes in California are billed once a year and are payable in two parts. The Tax bills are sent out by October each year.

How much money does a lender need to collect from the buyer?

The lender usually requires an amount equal to a two months reserves to remain in the Impound Account at all times for both property taxes and insurance. Depending on how many monthly mortgage payments the buyer would have made at the time the bill will be due, will determine how many months the lender would need to collect upfront from the buyer.

What exactly does it mean to buy a property ‘As Is’, do you still get an inspection period? EMD?

What does it mean to buy a property as-is and what are the risks to real estate investors? As you look at real estate deals you'll see the term "As-Is" on properties, so what does it mean? Here's a breakdown of exactly what "as is" offers mean and what real estate...

What is an “Escalation Clause” and how can real estate investors use them in offers, good/bad idea?

What is an escalation clause and what to real estate investors need to know about them? I got a few questions about "escalation clauses" and what they are and what Indianapolis real estate investors need to know about them. Today we'll talk about what escalation...

What real estate investors need to know about remote closings, wiring money, title company funding?

What real estate investors need to know about money transfers, remote closing and wiring money. Whether you are doing remote closings as a passive investor or not, you and your team need to know te details of how title companies handle closings and money transfers. I...

What is micro-flipping real estate? Is micro-wholesaling legal, $1,500/day from speed wholesaling?

What is micro-flipping real estate? Is micro-wholesaling legal, $1,500/day from speed wholesaling? I've gotten a lot of questions about what is micro flipping, speed wholesaling rapid house flipping, fast flipping, fast assign ments/assigning, speed flipping, etc. So...

Why do you need an impound account?

Required impound accounts also decrease the amount that money borrowers can place in an emergency fund. The lender keeps a little extra in your impound account, in order to ensure the extra cushion needed in order to keep making insurance and tax payments if you stop making your monthly mortgage payments.

What does a mortgage statement show?

Your monthly mortgage statement will probably show the balance in your impound account , making it easy for you to keep a close eye on it. Federal regulations also help borrowers out in this area by requiring lenders to review borrowers' impound accounts annually to ensure that the correct amount of money is being collected. If too little is being collected, the lender will start asking you for more; if too much money is accumulating in the account, the excess funds are legally required to be refunded to the borrower.

What happens if you have a 20% down payment on your house?

When you buy a residence with a down payment of less than 20%, your lender may require you to make a deposit on your homeowners insurance, private mortgage insurance, any required additional insurance (like flood insurance ), and your property taxes.

Do you have to pay interest on impound accounts?

Not all states require lenders to pay interest on the funds held in impound accounts, and those that do may not pay as much as individuals could earn by investing the money on their own. Not surprisingly, some consumers would rather set money aside in a high-interest savings account, or some other investment.

Do mortgage impounds work?

For many homeowners, mortgage impounds are a necessary evil. Without them, lenders might not be willing to give mortgages to borrowers who can afford only low down payments. The best way to deal with impound accounts is to understand how they work, monitor them carefully – and get rid of them when you can.

What is an impound?

Impounds are nothing but a consolidated bundle of charges incurred to process the mortgage.

How many sections are there in an ALTA settlement statement?

There are a total of 11 sections in the ALTA settlement statement. Each of them highlights a particular type of cost associated with closing. Note that the debit and credit sections are listed against the seller and buyer on their respective sides from the second section which is where the costs are highlighted. Let’s go through all the sections.

What are points in a mortgage?

Points. Mortgage points are given to the lender for which they reduce the interest rate for the buyers. This amount is paid upfront during closing.

What does escrow charge?

The escrow or title company charges buyers for settlement charges and escrow costs. These costs are debited from the buyer’s side.

What is the disbursement date?

Disbursement Date. The day when the seller is supposed to receive the payment in their bank account. The disbursement date is the same as the settlement date in most cases. Other Dates: Dates given for recording or anything that relates to transferring the title of the property.

What is flood determination fee?

Flood Determination Fee to. It is paid to get government approval on the property and that it is not located in an area prone to flooding.

Where are miscellaneous costs debited?

Miscellaneous costs are debited from the buyer’s account most of the time. However, a lot of time the sellers may agree to pay apart as well, and the costs are debited from the seller’s side. Here is the list of all miscellaneous costs. Pest Inspection Fee.

What is a HUD-1 settlement statement?

The HUD-1 Settlement Statement is a breakdown of the expenses home sellers and homebuyers incur in a real estate sale. The settlement statement gives both parties a full picture of the expenses attached to the transaction. Some of the expenses assigned to home sellers and buyers on the HUD-1 form might be tax-deductible, and whether they are depends on the specifics of each transaction. Some of the more common examples of deductible expenses include loan origination fees, mortgage insurance premiums, and real estate tax payments.

What Are Seller Deductions?

Any prorated real estate taxes a home seller pays at closing are tax deductible. However, many of the closing costs listed on a settlement statement are deducted from sale proceeds. Lowered net proceeds reduce the capital gains the home seller may have garnered, thus reducing associated taxes. A capital gain is the improvement between a home's past purchase price and its later sale price, minus sale expenses.

Can closing costs be deducted from a sale?

Clarifying Buyer Deductions. Many of the expenses attached to such a sale can be referred to collectively as closing costs. All homebuyers and sellers usually end up paying closing costs, some of which may even be tax deductible. Costs such as home appraisals, inspections, notary fees and others found on a settlement statement may be tax deductible ...

How to make sure you get all your deductions?

The best way to make sure you get all of your tax deductions is to talk to your tax advisor. With the Tax Reform and tax deductions changing so drastically, it’s best to get a professional opinion. As long as you make sure you tell your advisor about your home purchase, sale, or refinance and prove payment of the tax-deductible expenses, you may be able to lower your tax liability.

What is discount points?

Discount points – If you want a lower interest rate, you may have to pay discount points. This is yet another form of prepaid interest. The lender accepts an upfront payment in exchange for a lower interest rate. In other words, they make the interest now, rather than over the term of the loan.

Can you deduct refinance costs on settlement?

Even if you refinance, you may be able to deduct some of the costs on your settlement statement.

Do seller fees get deducted from taxes?

Generally, the fees sellers owe come right out from the proceeds of the sale. This in turn, reduces their capital gains, which reduces their tax liability.

Is a settlement statement tax deductible?

What Settlement Statement Items are Tax Deductible? Closing on a loan can cost you several thousand dollars. Before you let that prevent you from buying a home or refinancing, learn which settlement statement items are tax deductible. This lowers the overall cost of closing on a loan, by lowering your tax liability at the end of the year.

Do you include prepaid interest on closing statement?

Don’t forget to include the prepaid interest on your Loan Closing Statement in your taxes. Points paid – Again, lenders may charge origination fees or discount points. Luckily, the IRS lets you deduct these items even if you refinance. The difference, however, is how you deduct them.