A Consumer's Guide to Mortgage Settlement Costs

- Application fee. Imposed by your lender or broker, this charge covers the initial costs of processing your loan request...

- Loan origination fee. The origination fee (also called underwriting fee, administrative fee, or processing fee) is...

- Points. Points are a one-time charge imposed by the lender, usually to reduce the...

Is there a fee if I settle my loan early?

You should be able to pay off a loan early if you want to - doing so will save you paying interest for the full term. But there may be penalty fees to do so. To find out exactly how much you will need to pay to repay your loan in full, you’ll have to ask your lender for an early settlement amount. This will show you:

Do legitimate loan companies charge a fee for a loan?

No legitimate lender will ask you to provide money at any point before it processes your application. Some lenders charge an origination fee for their loans, but this will be deducted from your loan amount before you receive your loan funds. An origination fee should never be paid out of pocket.

What is a settlement or closing fee?

The title settlement fee, or closing fee, is a charge from the title company to cover the administrative costs of closing. Title companies may or may not list out the individual costs of the fee.

What is settlement fee mortgage?

What are Mortgage Settlement Fees?

- Notary fees. Notary fees are the costs of getting a notary to meet at a specific location for the closing and sending a scanned copy of the closing and mailing ...

- Survey fees. Survey fees are paid to third-party vendors to survey a property and verify its boundaries.

- Fees to prep deeds. ...

- Search abstract fees. ...

- Endorsement fees. ...

- Recording fees. ...

What is settlement fee?

What is a point fee?

What is a point in a mortgage?

Do appraisers charge fees?

Is it legal to have a seller assist with a settlement fee?

Is an appraisal included in settlement fees?

See 1 more

What is settlement services in a loan?

Settlement Services means the provision of title, closing, escrow or search-related services for residential real estate transactions and all other mortgage-related transactions (including, without limitation, first mortgage loans, second mortgage loans, home equity lines of credit, other home equity loans and ...

What does mortgage settlement mean?

Commonly used for loan agreements, a settlement statement details the terms and conditions of the loan and all costs owed by or credits due to the buyer or seller. It also details any fees that a borrower must pay in addition to a loan's interest.

What's the term for a charge that either party has to pay at closing?

Closing costs are fees due at the closing of a real estate transaction in addition to the property's purchase price. Both buyers and sellers may be subject to closing costs.

Whats the difference between settlement and closing?

A closing is often called "settlement" because you, as buyer, along with your lender and the seller are "settling up" among yourselves and all of the other parties who have provided services or documents to the transaction.

How long does it take to get money after house settlement?

The timeframe in which it takes for mortgage funds to be released does vary between lenders, however, it is common for funds to be released within between 3 and 7 days.

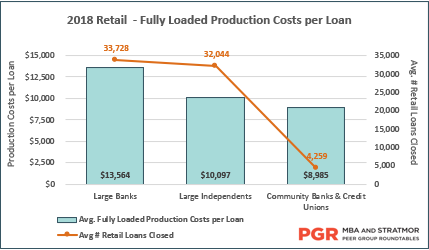

Why are closing costs so high?

Nationwide, home closing costs are now over $1,000 more expensive than before the pandemic. It's largely a consequence of lenders increasing their fees to offset soaring loan production expenses, including commissions and compensation, in addition to making up for the decline in business due to lower sales volume.

How do you figure closing costs?

To calculate your closing costs, most lenders recommend estimating your closing fees to be between one percent and five percent of the home purchase price. If you're purchasing your house for $300,000, you can estimate your total closing costs to be between $3,000 and $15,000.

Who pays expenses and receives income for the day of closing?

If the buyer assumes the seller's existing mortgage or deed of trust, the seller usually owes the buyer an allowance for accrued interest through the date of closing. Unpaid& expenses that are owed by the seller, but not due at the closing are called accrued expenses. These expenses will later be paid by the buyer.

Is a settlement statement and closing disclosure the same thing?

When you are in the process of closing, you will receive a settlement statement. They arrive three days before closing from your lender. This document is commonly known as the “closing disclosure.” Essentially, this is for buyers to review in advance before closing.

What is mortgage settlement letter?

In this case, you inform the lender of your situation and request them to give you some time off before you begin repayments. The lender may give you a one-time settlement option where you take some time off and then, settle the loan in one go. Since you are given some time, you may readily accept this offer.

Is settlement is possible in mortgage loan?

It is usually not feasible to negotiate and settle secured loans like home loans, auto loans or gold loans because the bank can always take possession of the asset which is mortgaged against the loan.

What is the primary purpose of the settlement statement?

A settlement statement provides a breakdown of all the closing costs and credits involved in a real estate transaction or refinance.

What are settlement charges? - Answers

Settlement charges are fees assessed through the title company associated with buying a home. Title charges include fees directly related to the transfer of title, such as the title examination ...

What is typical Title Closing and Settlement Fees? - Mortgagefit

the title fees will vary between refinance and purchase as well. many title companies offer brokers discounts on refinance fees which get passed onto the client. like mentioned above a flat fee of $350 may be used for a refi but they usually go by the posted prices for a purchase... a purchase will cost you more because there is a little more involbed for the company....

What is a Title Company Settlement Fee? | Scott Title Services

Contact Scott Title Services Today. For over two decades, the Scott Title team has maintained a commitment to delivering the highest quality of service in the title insurance industry. We provide our clients with an attention to detail they won’t find anywhere else when it comes to title insurance services including property title searches, settlement services, and real estate paralegal ...

Definition of Settlement Fee | Pocketsense

Settlement costs or fees represent a complete account of all the expenses you incur to purchase a property. Examples include loan application fees, points, title fees, appraisal fee, home inspection fees, credit reports, prepaid mortgage interest, property tax apportionment and escrow reserves.

What is settlement fee?

Definition of Settlement Fee. When you're buying a home with a mortgage, it's important to understand the type of fees you might incur. Most people are familiar with the term closing costs, or the genuine third-party costs that are associated with the closing of a real estate transaction, and expect to pay these expenses when they purchase ...

How Do You Calculate Settlement Costs?

Right at the beginning of your loan application, you'll get a good faith estimate. This document outlines all the fees you should expect to pay for your mortgage such as the loan application fee, appraiser's fees, points, title insurance, mortgage insurance and accrued mortgage interest from the closing date until the end of the month. It's an estimate of the total cost of buying the property and it's provided to help you compare the cost of different mortgage providers.

What are closing costs when buying a home?

Most people are familiar with the term closing costs, or the genuine third-party costs that are associated with the closing of a real estate transaction, and expect to pay these expenses when they purchase a property.

What are closing costs?

Closing costs are the legitimate third-party expenses you incur when you buy a property. These are expenses that you would never get back even if you sold the home a day after you closed on it. Examples include the loan application fee, points, title search fees, appraisal fee, home inspection fees, escrow fees, credit reports, courier fees, ...

What happens when you close a mortgage?

When you close the mortgage loan, on top of the closing costs, you're going to pay interest on the new mortgage from the day you close until the day the first monthly mortgage payment is due. You're also going to pay your share of the property taxes and HOA fees the seller has paid upfront for the property from the closing date to the end of the month. On top of that, the lender will collect escrow reserves upfront on account of future property taxes and homeowner's insurance. And don't forget the down payment. That's required at closing, too, and it goes towards the equity in your home.

What is the HUD-1 settlement statement?

This looks a bit like the good faith estimate, only now it shows the true closing costs, including the final cost of items that could only be estimated before.

What happens when you combine closing costs?

If you combine all these various sums together and add them to the genuine closing costs, you get a complete account of everything you need to purchase the property. This total amount is what real estate professionals are referring to when they talk about "settlement costs," "settlement expenses" or "settlement fees."

What is a mortgage settlement?

Mortgage settlement--sometimes called mortgage closing--can be confusing. A settlement may involve several people and many documents and fees. This information will help you understand all that is involved. Although the focus of this guide is on settlements for home purchases, much of it will also be useful if you are refinancing a mortgage.

What are the fees for FHA mortgage insurance?

As with Private MI, insurance premium payments will stop when you acquire 22% equity in your home. FHA fees are about 1.5% of the loan amount. VA guarantee fees range from 1.25% to 2% of the loan amount, depending on the size of your down payment (the higher your down payment, the lower the fee percentage). RHS fees are 1.75% of the loan amount.

What is appraisal fee?

Appraisal fee. Lenders want to be sure that the property is worth at least as much as the loan amount. This fee pays for an appraisal of the home you want to purchase or refinance. Some lenders and brokers include the appraisal fee as part of the application fee; you can ask the lender for a copy of your appraisal.

How long does it take to get a good faith estimate of closing costs?

The Real Estate Settlement Procedures Act (RESPA) requires your mortgage lender to give you a good faith estimate of all your closing costs within 3 business days of submitting your application for a loan, whether you are purchasing or refinancing the home. This is a good faith estimate, but the actual expenses at closing may be somewhat different. If you are purchasing the home, you will also get an information booklet, Buying Your Home: Settlement Costs and Helpful Information.

What happens if you don't pay down on a mortgage?

If your down payment is less than 20% of the value of the house, the lender will usually require mortgage insurance. The insurance policy covers the lender's risk in the event that you do not make the loan payments. Typically, you will pay a monthly premium along with each month's mortgage payment. Your private MI can be canceled at your request, in writing, when your reach 20% equity in your home, based on your original purchase price, if your mortgage payments are current and you have a good payment history. By federal law your private MI payments will automatically stop when you acquire 22% equity in your home, based on the original appraised value of the house, as long as your mortgage payments are current.

What is origination fee?

The origination fee (also called underwriting fee, administrative fee, or processing fee) is charged for the lender's work in evaluating and preparing your mortgage loan. This fee can cover the lender's attorney's fees, document preparation costs, notary fees, and so forth.

When are mortgage payments due?

Your first regular mortgage payment is usually due about 6 to 8 weeks after you settle (for example, if you settle in August, your first regular payment will be due on October 1; the October payment covers the cost of borrowing the money for the month of September). Interest costs, however, start as soon as you settle.

Is a courier charge a finance charge?

This presumption applies even if the lender did not require the specific service for which the fee is charged. For example, if the closer uses a cour ier service and charges the fee to the customer, it is a finance charge even if the lender did not require the use of a courier.

Is a fee charged by a third party a finance charge?

The other rule of thumb is that a fee charged by a third party is exempt from the finance charge if it would be exempt if charged by the lender. Any of the charges listed in 226.4 (c) (7) are exempt whether charged by the bank or by a third party. They don't become finance charges just because of how they were billed.

How much does a debt settlement company charge?

Debt settlement companies charge a fee, generally 15-25% of the debt the company is settling. The American Fair Credit Council found that consumers enrolled in debt settlement ended up paying about 50% of what they initially owed on their debt, but they also paid fees that cut into their savings. The report gives an example of a debt settlement client whose $4,262 account balance was reduced to $2,115 with the settlement. So, at first it would seem she saved $2,147, the different between what she owed and what the settlement amount was. But she also paid $829 in fees to the debt settlement company, so she ended up saving $1,318.

What is debt settlement?

Debt settlement is an agreement made between a creditor and a consumer in which the total debt balance owed is reduced and/or fees are waived, and the reduced debt amount is paid in a lump sum instead of revolving monthly. Get Debt Help.

Why Work with a Debt Settlement Company?

Often there’s a good reason – a layoff or reduction in pay, big medical bills, an unexpected emergency expense. No matter what the reason, it can be difficult to get out from under overwhelming debt on your own. This is particularly true for credit card debt or other revolving debt, that never seems to decrease, even if you’re paying monthly.

How long does it take for a debt settlement to pay?

Meanwhile, the company will negotiate with your creditors to settle for a lower amount. Once you’ve paid the amount the agreement is for into the escrow account, the debt settlement company will pay your creditor. This process can take 2-3 years.

What do debt settlement companies have to explain?

Debt settlement companies must explain price and terms, including fees and any conditions on services.

What happens when you settle a debt?

In debt settlement, the company will instruct you to stop making payments to the creditors. Your accounts become delinquent, and the debt settlement company tries to negotiate a settlement on your behalf. In the meantime, you give your money to the debt settlement company, who also is not paying the creditor with it.

How much money did a debt settlement save?

The report found that debt settlement clients settled an average of about 50% of what was originally owed, but realized savings of about 30%.

How are loan fees deducted?

The loan fees are deducted from the total of the loan raised. The deducted amount is amortized over the complete life of the loan. In other words, the loan fees are allocated to different accounting periods with the help of an effective rate of interest. The amortization of the finance cost is done in line with the matching concept of accounting which states that expense should be charged in a period where economic benefit is obtained.

How is the issuance cost allocated over the life of a loan?

So, if the business deducts the complete cost of loan issuance in the first year, it can be allocated over the life of the loan by incorporating the issuance cost in the effective rate of interest.

Why is amortization important?

The concept of amortization arises because a loan is usually long-term and does not relate to a single (current) accounting period. Hence, as per the matching concept, the loan should be amortized over the life of the loan. The amortization of the fees helps to ensure that cost is allocated to the periods in which benefit is obtained from the loan. Hence, it seems to be a fair approach.

How is amortization of finance cost done?

The amortization of the finance cost is done in line with the matching concept of accounting which states that expense should be charged in a period where economic benefit is obtained. So, if the business deducts the complete cost of loan issuance in the first year, it can be allocated over the life of the loan by incorporating the issuance cost in the effective rate of interest.

What is coupon rate?

The coupon rate is the rate of paying interest, and this rate is not charged in the income statement but is used for calculating the amount of payment.

What are the expenses of raising a business?

The expenses may include the appraisal fees, registration charges, accounting fees, regulator charges, loan marketing expenses, regulator fees, and all other related expenses.

When do fees need to be recorded in the financial statement?

When the business enters into the loan agreement or opts to restructure an existing loan, fees are associated with the process. These fees need to be recorded in the financial statement. However, the question arises if related fees should be charged in a single (current) accounting period or spread over the life of the loan.

What is settlement fee?

In real estate, a settlement fee is a charge that covers expenses in excess of the amount a person pays to purchase or sell a property. Settlement fees can encompass many types of expenses, but often include such things as application and attorney ’s fees, loan origination fees, and fees for title searches.

What is a point fee?

Points are fees that are charged a single time and can be negotiated with a lender to lower the interest rate a borrower will pay on a mortgage in exchange for paying a particular sum up front.

What is a point in a mortgage?

Points are fees that are charged a single time and can be negotiated with a lender to lower the interest rate a borrower will pay on a mortgage in exchange for paying a particular sum up front. For example, paying $1,000 US Dollars (USD) up front might lower a person’s interest paid over the life of his loan by one percent. Points paid at settlement are tax deductible in some jurisdictions as well.

Do appraisers charge fees?

Appraisers and home inspectors charge fees, which are often included in settlement fee totals. In most cases, the settlement fees a seller pays are negotiable. In order to make his home more attractive or easier to buy, a seller may agree to pay one or more of the settlement fees usually paid by the buyer.

Is it legal to have a seller assist with a settlement fee?

Having the seller assist with a settlement fee is usually legal, as long as the seller's contribution is detailed in the official agreement between the buyer and seller and doesn't violate any terms set by the lender.

Is an appraisal included in settlement fees?

Lenders may also require an inspection by a professional home inspector in order to analyze the structure of the property and look for evidence of issues such as termites. Appraisers and home inspectors charge fees, which are often included in settlement fee totals.