Prepaid items on a settlement statement are costs not related to the process of getting a mortgage. This is what distinguishes them from closing costs on a settlement statement. By contrast, closing costs are fees assigned by lenders, title companies and governments.

What is a prepaid item?

What does prepaid mean? Prepaid items are exactly what the name implies - payments made in advance of the monies due to obtain your new loan. These amounts are often necessary to fund what's known as an "escrow" or "impound" account for property taxes and insurance.

What are pre-paid closing costs?

Prepaids are related to the actual home itself, not the real estate transaction. The three most common prepaids are property taxes, homeowner’s insurance, and mortgage interest. What are closing costs? Closing costs are fees related to the real estate transaction itself.

What is a pre-paid mortgage?

Prepaids got their name because they are paid at closing, which is technically before they’re due. Prepaids are related to the actual home itself, not the real estate transaction. The three most common prepaids are property taxes, homeowner’s insurance, and mortgage interest.

What are pre-prepaid expenses in real estate?

Prepaids are expenses or items that the homebuyer pays at closing before they are technically due. They are necessary to create—or "pre-fund"—an escrow account or to adjust the seller's existing escrow account.

What are considered Prepaids?

What Are Prepaid Expenses? Prepaid expenses are future expenses that are paid in advance, such as rent or insurance. On the balance sheet, prepaid expenses are first recorded as an asset.

What are prepaid expenses at closing?

Prepaid costs are payments made at closing for upcoming line items of your new home loan. They're called "prepaid" costs because you're paying for them before they are technically due. The most common kinds of prepaid costs are homeowners insurance, property taxes, and mortgage interest.

What is the difference between Prepaids and closing costs?

Prepaid Costs Vs. As a result, closing costs are paid to the lender as a fee for processing the loan. Closing costs are also listed on a Closing Disclosure. Finally, another difference between prepaid costs and closing costs is that the seller may cover the closing costs but the buyer will always pay the prepaids.

What is prepaid interest on a settlement statement?

Prepaid interest charges are charges due at closing for any daily interest that accrues on your loan between the date you close on your mortgage loan and the period covered by your first monthly mortgage payment.

What is the difference between Prepaids and escrow?

Prepaid items are one-time charges, paid at the time a real estate transaction is closed, or finalized. Escrow accounts are a continuing expense, typically billed monthly by the lender. The monthly statement should list the amount of principal, interest and amount for escrow.

Why is homeowners insurance prepaid at closing?

Most of your monthly escrow payment goes toward your mortgage, but a portion of it gets set aside for your home insurance and taxes. That way, when your annual insurance premium is due, you've built up an amount of money to pay it. This is also how prepaid homeowners insurance at closing works.

What is the difference between Prepaids and initial escrow payment at closing?

Prepaids are the Homeowner's Insurance Premium and the Prepaid Interest. Initial Escrow Payment at Closing includes Homeowner's Insurance and Property Taxes.

Can Prepaids be rolled into loan?

Costs known as prepaids must be paid upfront and may not be rolled in. Often, this is because prepaid costs must go into an escrow account.

What are prepaid fees?

A prepaid finance charge is an upfront cost associated with a loan agreement or credit extension. Prepaid costs are in addition to monthly loan payments, so they affect the total cost of the loan. Types of prepaid finance charges include origination fees, underwriting fees, and document fees.

How can prepaid interest be avoided?

The most direct way to minimize the cost of prepaid interest is to delay your closing date until the end of the month, but this also means you'll need to make your first monthly mortgage payment not long after you've paid your closing costs.

Who pays prepaid interest?

borrowerPrepaid interest, the interest a borrower pays on a loan before the first scheduled debt repayment, is commonly associated with mortgages. For mortgages, prepaid interest refers to the daily interest that accrues on the mortgage from the closing date until the first monthly mortgage payment is due.

Can prepaid interest be deducted?

Points are prepaid interest and may be deductible as home mortgage interest, if you itemize deductions on Schedule A (Form 1040), Itemized Deductions. If you can deduct all of the interest on your mortgage, you may be able to deduct all of the points paid on the mortgage.

What is the difference between Prepaids and initial escrow payment at closing?

Prepaids are the Homeowner's Insurance Premium and the Prepaid Interest. Initial Escrow Payment at Closing includes Homeowner's Insurance and Property Taxes.

What are escrow Prepaids?

Prepaids are expenses or items that the homebuyer pays at closing before they are technically due. They are necessary to create—or "pre-fund"—an escrow account or to adjust the seller's existing escrow account. Prepaids can include taxes, hazard insurance, private mortgage insurance, and special assessments.

How is prepaid interest shown on a closing statement quizlet?

D Prepaid interest (also known as interim interest) is listed as a debit for the buyer on the settlement statement.

Can Prepaids be rolled into loan?

Costs known as prepaids must be paid upfront and may not be rolled in. Often, this is because prepaid costs must go into an escrow account.

What are prepaids in real estate?

What are prepaids? Prepaids are related to the actual home itself, not the real estate transaction. The three most common prepaids are property taxes, homeowner’s insurance, and mortgage interest.

Why are prepaids called prepaids?

Prepaids got their name because they are paid at closing, which is technically before they’re due. Prepaids are related to the actual home itself, not the real estate transaction. The three most common prepaids are property taxes, homeowner’s insurance, and mortgage interest.

What is the amount collected at closing?

Mortgage interest is a little different than the other two. The amount collected at closing is the amount that will accrue between closing ...

Who is responsible for paying prepaid closing costs?

Buyers are responsible for paying both prepaids and closing costs. The only exception to this rule is when the purchase contract states the seller will help cover some of the closing costs. Even then, the buyer must pay the prepaids and often some of the closing costs.

Is prepaid closing cost the same as prepaid closing cost?

If you’ve ever bought a home or have been doing research for an upcoming purchase you have probably run across the terms ‘prepaids’ and ‘closing costs.’ Both of these are paid at the closing, so it is easy to think of them as the same thing, or at least similar. Aside from referring to amounts of money owed and being paid at the same time, the two don’t have much in common.

Why Prepaid Expenses Aren’t Initially on the Income Statement?

Accrual accounting requires that revenue and expenses be reported in the same period as incurred no matter when cash or money exchanges hands. That is, expenses should be recorded when incurred. Thus, prepaid expenses aren’t recognized on the income statement when paid, because they have yet to be incurred. 2

What is prepaid insurance?

One of the more common forms of prepaid expenses is insurance, which is usually paid in advance. 1 For example, Company ABC pays a $12,000 premium for directors and officers liability insurance for the upcoming year. The company pays for the policy upfront and then each month makes an adjusting entry to account for the insurance expense incurred. The initial entry, where we debit the prepaid expense account and credit the account used to pay for the expense, would like this:

What should be recorded in a prepaid asset account?

Regardless of whether it’s insurance, rent, utilities, or any other expense that’s paid in advance , it should be recorded in the appropriate prepaid asset account. Then, at the end of each period, or when the expense is actually incurred, an adjusting entry should be made to reduce the prepaid asset account and recognize (credit) the appropriate income expense, which will then appear on the income statement.

What expenses do companies prepay?

Additional expenses that a company might prepay for include interest and taxes. Interest paid in advance may arise as a company makes a payment ahead of the due date. Meanwhile, some companies pay taxes before they are due, such as an estimated tax payment based on what might come due in the future.

When a company prepays for an expense, is it recognized as a prepaid asset?

When a company prepays for an expense, it is recognized as a prepaid asset on the balance sheet, with a simultaneous entry being recorded that reduces the company's cash (or payment account) by the same amount.

Is prepaid expense recorded on income statement?

Prepaid expenses are not recorded on an income statement initially. Instead, prepaid expenses are initially recorded on the balance sheet, and then, as the benefit of the prepaid expense is realized, or as the expense is incurred, it is recognized on the income statement. 1 . When a company prepays for an expense, ...

How is prepaid mortgage interest calculated?

Your mortgage payment consists of principal and interest. Principal is applied towards your loan amount and interest is paid to the lender for giving you the loan. Here’s where it gets a little tricky – interest is paid in arrears. When you make your mortgage payment, the interest is for the previous month. When you make June’s mortgage payment, you’re paying May’s interest. However, when you close, there may be a short period of time that needs to be covered and you’ll pay that as prepaid interest. For example, if you close on April 15 and your first payment is due on June 1, your June payment will cover all of May’s interest. But, what about the interest from April 15 – May 1? You’ll pay that at closing as a pre-paid. In order to reduce the amount of prepaid interest, you’ll probably be like most people and try to get a closing as near to the end of a month as possible. Your lender can help you estimate the amount you’ll need in prepaids so that you can make sure to have the funds available.

What are you prepaying when you get your mortgage?

Mortgage interest, real estate taxes, homeowner’s insurance, hazard insurance, private mortgage insurance, and any special assessments (usually related to real estate taxes) are the most common items you’ll see listed as prepaids. In order to create an escrow account, your lender needs money to place in the account. At closing, you’ll be asked to pay a portion of your taxes and insurance, including private mortgage insurance if applicable, as prepaids for this purpose. Depending on when you close, you may not have a payment due for another 30-45 days which would delay your lender being able to fully set up your account in their system. Including a portion of these items in your closing allows them to have your account ready for future deposits and disbursements before your first payment is made. Going forward, all of these items are collected as part of your regular mortgage payment . “There is a regulated amount that can be put into this account at closing. The amount collected at closing along with the monthly payments will combine to be sufficient to pay the taxes and insurance when they come due. Escrows are required on FHA and VA loans. They may be waived on a conventional loan if the LTV is 80% or below,” explains Bob Dineen, Regional VP and Branch Manager, at Atlantic Bay.

Do you have to pay in advance for cable?

As the term suggests, you are paying in advance for something. At some point in your life, you’ve probably been asked to pay in advance for a service. Most cable providers require payment in advance for the next month of usage. Your car insurance premiums are paid in advance. If you need an attorney, you may be asked to pay a retainer for their services. You get the picture – you prepaid for something you were going to be using later. Your mortgage lender asks you to prepay a few things as well.

Can the seller pay for your prepaids with the rest of your closing costs?

Maybe. If your sales contract includes language that states that your seller is paying just closing costs, then you can’t include prepaids. It’s important that you have your contract state both closing costs and prepaids are being taken care of by the seller. Be careful, though, because some loan types put restrictions on how much your seller can cover. Ask your mortgage banker what is acceptable. If you have any questions at all about your closing disclosure or any of the costs associated with your loan, please contact us today.

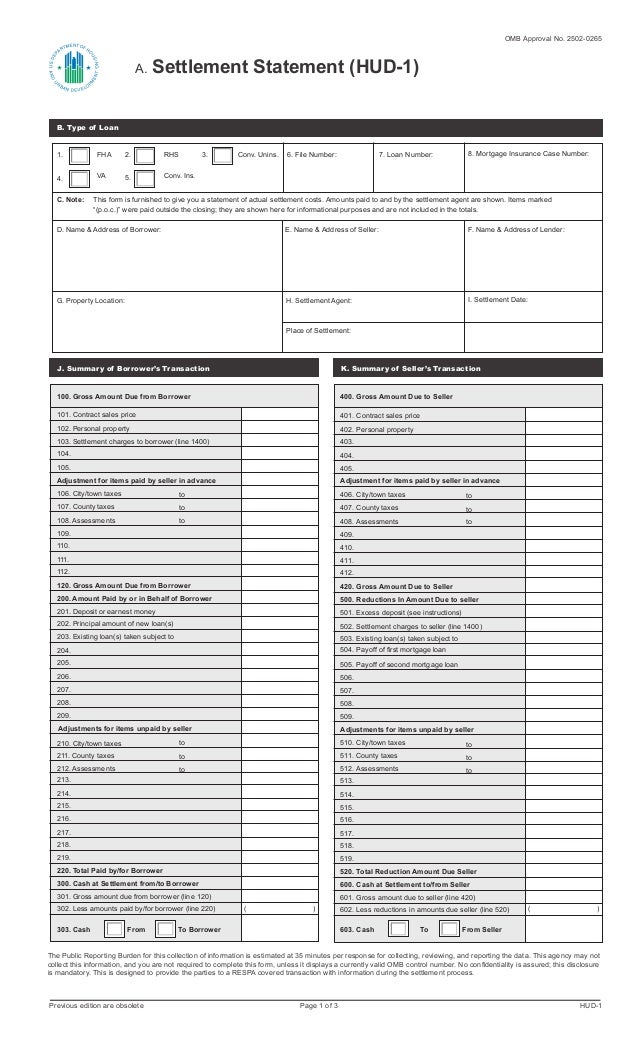

What is a settlement statement?

A settlement statement is an itemized list of fees and credits summarizing the finances of an entire real estate transaction. It serves as a record showing how all the money has changed hands line by line.

Who is responsible for preparing the settlement statement?

Whoever is facilitating the closing — whether it be a title company, escrow firm, or real estate attorney — will be responsible for preparing the settlement statement.

Is a settlement statement the same as a closing statement?

Yes, a settlement statement is the same as a closing statement, though “settlement” is the formal term most likely to be used by the real estate industry.

What is an ‘excess deposit’ at closing?

A particular line item that causes confusion on the seller’s settlement statement is the “Excess Deposit.” What is an excess deposit, and who will receive the funds listed on that line?

What is a seller's net sheet?

The seller’s net sheet is not an official document but an organizational worksheet that your agent will fill out to estimate how much you’ll pocket from your home sale after factoring in expenses like taxes , your real estate agent’s commission, your remaining mortgage, and escrow fees.

When are property taxes prorated?

For instance, say you get billed for property taxes in February to cover the previous year. If you’re closing on a sale on April 30, the yearly property tax is “prorated” or calculated for the first four months of the year, and it’s reflected in this section.

Does the seller get a closing statement?

Buyers tend to sign the bulk of the paperwork at closing, making some sellers wonder if they will even receive a settlement statement.

What Are Prepaid Expenses?

Prepaids are expenses or items that the homebuyer pays at closing before they are technically due. They are necessary to create—or "pre-fund"—an escrow account or to adjust the seller's existing escrow account. Prepaids can include taxes, hazard insurance, private mortgage insurance, and special assessments.

How much is needed to pre-fund a home loan?

How much is needed to pre-fund the account is determined by how many months the new owner will own the home in the current year. Most often, the amount can be added to the total value of the loan.

What does it mean when a bank underwrites a loan?

When a bank or other financial institution underwrites a loan for a big-ticket item—like a home—they want some assurance that the property they are lending money for is protected. They want to make sure the property taxes are paid each year so there are not outside claims. They also want to make sure it is insured in case the house faces a fire or other hazard.

What is a contingency account in real estate?

They are like a guarantee or contingency account that the buyer will be able to complete the transaction and their obligations. Often these funds are used to pay property taxes and insurance on the home.

Can a fixed rate mortgage payment change?

The cash amount that fixed-rate borrowers think of as their monthly payment is still subject to change–that is one of the biggest issues with impound accounts. Since homeowner's insurance and property taxes are subject to change, monthly payment amounts can fluctuate.

What does prepaid mean?

Prepaid items are exactly what the name implies - payments made in advance of the monies due to obtain your new loan.

What is the difference between prepaids and closing costs?

Difference between prepaids, closing costs. There is a difference between prepaids, closing costs and fees. Prepaid items are not closing costs. They are monies that would have been paid anyway -- new home loan or not. Prepaid items, listed above, are figures on your Closing Disclosure unrelated to the process of getting a mortgage.

What is an additional cushion for homeowners insurance?

An additional cushion for homeowners insurance, along with property taxes, are collected and placed into an escrow account. This is so your new lender can build reserves and have enough to pay those bills when they come due.

How long does it take for a mortgage to be prepaid?

This way, no matter which day of the month you close, the lender has at least 30 days to enter your data into its system, and issue your first statement.

Is an inspection part of closing costs?

Some homebuyers wonder, "Is the inspection part of closing costs.". The answer is "typically not.". Generally the homebuyer orders and pays for an inspection to gain a detailed understanding of the home's condition. Sometimes, the homebuyer is able to use the inspection report to gain price concessions from the seller or to negotiate certain ...

Do prepaid items have to be the same?

Prepaid items should be the same from one lender to the next. They are separate from your mortgage closing costs, rate and terms. As such, you can remove them from your cost comparisons. Separating closing costs and prepaids should make comparing mortgage rates easy.

What section of closing disclosure shows prepaids?

Look at Section F (Prepaids) and Section G (Escrows paid at closing). Your Closing Disclosure (formerly HUD-1) will also show prepaids and escrows in sections F and G.

How long does an insurance company have to pay you for a 600 check?

On January 1, when your insurance company expects a check for $600, your servicer will only have four months (September, October, November, December) in their escrow account, so they will ask you for eight months at closing.

How long does it take to get a good faith estimate?

Within 3 days of your submitting a loan application, your lender will issue you a Loan Estimate (which used to be called a Good Faith Estimate) of all your closing costs, including escrows and prepaids.

When do you have to pay property taxes at closing?

When you close on your loan, your servicer can only count on receiving two payments before the November 1 deadline: September 1 and October 1. Therefore, from their standpoint, they will only have two tax payments in their escrow account but they will be required to pay out twelve months to the municipality. So at closing, they will escrow (or ask you to pay) ten months worth of property taxes so that they have enough to pay a full twelve months when they are due.

What is cushion insurance?

A cushion is basically what it sounds like – extra money you have to lay aside so your servicer has something extra in case you don’t make your mortgage payments and they still have to pay property taxes and homeowner’s insurance.