A Consumer's Guide to Mortgage Settlement Costs

- Application fee. Imposed by your lender or broker, this charge covers the initial costs of processing your loan request...

- Loan origination fee. The origination fee (also called underwriting fee, administrative fee, or processing fee) is...

- Points. Points are a one-time charge imposed by the lender, usually to reduce the...

What are settlement costs when buying a house?

What are settlement costs? Settlement costs (also known as closing costs) are the fees that the buyer and/or seller have to pay to complete the sale of the property. Depending on the lender, these may include origination fees, credit report fees, and appraisal fees, as well as property taxes and recording fees.

What are the different types of settlement fees?

Also called closing costs, some of the most common settlement fees are application and loan origination fees. Often, a lender or mortgage broker will include charges that cover the processing of a loan application as well as the credit check that goes along with it. A loan origination fee, on the other hand, covers the cost of preparing a mortgage.

How much are settlement costs on a car loan?

Closing costs, also known as settlement costs, are the fees you pay when obtaining your loan. Closing costs are typically about 3-5% of your loan amount and are usually paid at closing. What is included in closing costs?

What are settlement fees for appraisers?

Appraisers and home inspectors charge fees, which are often included in settlement fee totals. In most cases, the settlement fees a seller pays are negotiable. In order to make his home more attractive or easier to buy, a seller may agree to pay one or more of the settlement fees usually paid by the buyer.

What is a loan settlement fee?

Also known as early-exit fees, settlement fees are charged when borrowers pay out their home loan in full within a specified time period. This covers the losses your lender might incur due to the early termination of the home loan.

What does mortgage settlement mean?

Commonly used for loan agreements, a settlement statement details the terms and conditions of the loan and all costs owed by or credits due to the buyer or seller. It also details any fees that a borrower must pay in addition to a loan's interest.

Is settlement the same as closing?

A closing is often called "settlement" because you, as buyer, along with your lender and the seller are "settling up" among yourselves and all of the other parties who have provided services or documents to the transaction.

Is a settlement statement the same as a closing disclosure?

When you are in the process of closing, you will receive a settlement statement. They arrive three days before closing from your lender. This document is commonly known as the “closing disclosure.” Essentially, this is for buyers to review in advance before closing.

What happens at settlement when buying a house?

Settlement is the process of paying the remaining sale price and becoming the legal owner of a home. At settlement, your lender will disburse funds for your home loan and you'll receive the keys to your home. Generally, settlement takes place around 6 weeks after contracts are exchanged.

How long does it take to get money after house settlement?

The timeframe in which it takes for mortgage funds to be released does vary between lenders, however, it is common for funds to be released within between 3 and 7 days.

What not to do after closing on a house?

What Not To Do While Closing On a HouseAvoid Big Charges on a Credit Card. Do not rack up credit card debt. ... Be Careful with Trends. ... Do Not Neglect Your Neighbors. ... Don't Miss Tax Breaks. ... Keep Your Real Estate Agent Close. ... Save That Mail. ... Celebrate!

What is cost settlement?

Settlement costs (also known as closing costs) are the fees that the buyer and/or seller have to pay to complete the sale of the property. Depending on the lender, these may include origination fees, credit report fees, and appraisal fees, as well as property taxes and recording fees.

Can a mortgage fall through after closing?

The Bottom Line: You Can Overcome Many Reasons Mortgages Fall Through On Closing Day. In some cases, a mortgage falling through is out of your hands. In other situations, however, you may need to start from scratch by exploring different lenders or mortgage types.

What is the primary purpose of the settlement statement?

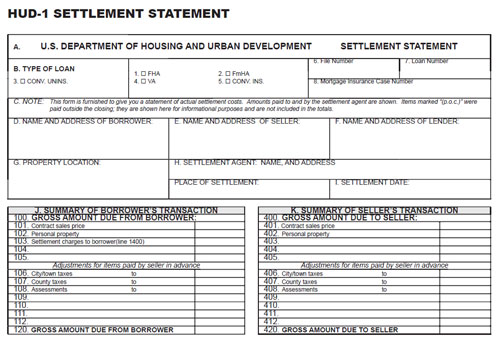

A settlement statement provides a breakdown of all the closing costs and credits involved in a real estate transaction or refinance.

Which two items will appear on a closing disclosure?

Closing disclosure form sectionsLoan information. This section should match your loan estimate regarding the loan term, loan purpose and loan program (conventional, FHA, VA or USDA).Loan terms. ... Projected payments. ... Costs at closing. ... Late payment fee. ... Escrow account.

What is settlement in real estate?

What is settlement? Property settlement is a legal process that is facilitated by your legal and financial representatives and those of the seller. It's when ownership passes from the seller to you, and you pay the balance of the sale price. The seller sets the settlement date in the contract of sale.

What is mortgage settlement letter?

In this case, you inform the lender of your situation and request them to give you some time off before you begin repayments. The lender may give you a one-time settlement option where you take some time off and then, settle the loan in one go. Since you are given some time, you may readily accept this offer.

Is settlement is possible in mortgage loan?

It is usually not feasible to negotiate and settle secured loans like home loans, auto loans or gold loans because the bank can always take possession of the asset which is mortgaged against the loan.

What is the primary purpose of the settlement statement?

A settlement statement provides a breakdown of all the closing costs and credits involved in a real estate transaction or refinance.

What is the purpose of a settlement agent?

A settlement agent (also known as a conveyancer) is a licensed, qualified agent who handles the preparation of documentation to sell or buy a property. They also handle all necessary searches to ensure all debts are removed and you are made aware of all important information about the property you're looking to buy.

What is a mortgage settlement?

Mortgage settlement--sometimes called mortgage closing--can be confusing. A settlement may involve several people and many documents and fees. This information will help you understand all that is involved. Although the focus of this guide is on settlements for home purchases, much of it will also be useful if you are refinancing a mortgage.

What are the fees for FHA mortgage insurance?

As with Private MI, insurance premium payments will stop when you acquire 22% equity in your home. FHA fees are about 1.5% of the loan amount. VA guarantee fees range from 1.25% to 2% of the loan amount, depending on the size of your down payment (the higher your down payment, the lower the fee percentage). RHS fees are 1.75% of the loan amount.

What is appraisal fee?

Appraisal fee. Lenders want to be sure that the property is worth at least as much as the loan amount. This fee pays for an appraisal of the home you want to purchase or refinance. Some lenders and brokers include the appraisal fee as part of the application fee; you can ask the lender for a copy of your appraisal.

How long does it take to get a good faith estimate of closing costs?

The Real Estate Settlement Procedures Act (RESPA) requires your mortgage lender to give you a good faith estimate of all your closing costs within 3 business days of submitting your application for a loan, whether you are purchasing or refinancing the home. This is a good faith estimate, but the actual expenses at closing may be somewhat different. If you are purchasing the home, you will also get an information booklet, Buying Your Home: Settlement Costs and Helpful Information.

What happens if you don't pay down on a mortgage?

If your down payment is less than 20% of the value of the house, the lender will usually require mortgage insurance. The insurance policy covers the lender's risk in the event that you do not make the loan payments. Typically, you will pay a monthly premium along with each month's mortgage payment. Your private MI can be canceled at your request, in writing, when your reach 20% equity in your home, based on your original purchase price, if your mortgage payments are current and you have a good payment history. By federal law your private MI payments will automatically stop when you acquire 22% equity in your home, based on the original appraised value of the house, as long as your mortgage payments are current.

What is origination fee?

The origination fee (also called underwriting fee, administrative fee, or processing fee) is charged for the lender's work in evaluating and preparing your mortgage loan. This fee can cover the lender's attorney's fees, document preparation costs, notary fees, and so forth.

When are mortgage payments due?

Your first regular mortgage payment is usually due about 6 to 8 weeks after you settle (for example, if you settle in August, your first regular payment will be due on October 1; the October payment covers the cost of borrowing the money for the month of September). Interest costs, however, start as soon as you settle.

What is settlement fee?

In real estate, a settlement fee is a charge that covers expenses in excess of the amount a person pays to purchase or sell a property. Settlement fees can encompass many types of expenses, but often include such things as application and attorney ’s fees, loan origination fees, and fees for title searches.

What is a point fee?

Points are fees that are charged a single time and can be negotiated with a lender to lower the interest rate a borrower will pay on a mortgage in exchange for paying a particular sum up front.

What is a point in a mortgage?

Points are fees that are charged a single time and can be negotiated with a lender to lower the interest rate a borrower will pay on a mortgage in exchange for paying a particular sum up front. For example, paying $1,000 US Dollars (USD) up front might lower a person’s interest paid over the life of his loan by one percent. Points paid at settlement are tax deductible in some jurisdictions as well.

Do appraisers charge fees?

Appraisers and home inspectors charge fees, which are often included in settlement fee totals. In most cases, the settlement fees a seller pays are negotiable. In order to make his home more attractive or easier to buy, a seller may agree to pay one or more of the settlement fees usually paid by the buyer.

Is it legal to have a seller assist with a settlement fee?

Having the seller assist with a settlement fee is usually legal, as long as the seller's contribution is detailed in the official agreement between the buyer and seller and doesn't violate any terms set by the lender.

Is an appraisal included in settlement fees?

Lenders may also require an inspection by a professional home inspector in order to analyze the structure of the property and look for evidence of issues such as termites. Appraisers and home inspectors charge fees, which are often included in settlement fee totals.

Who pays closing costs?

Typically the buyer pays closing costs, though sometimes negotiations between the buyer and the seller can lead to the seller paying some of the closing costs.

What is loan amount?

Loan amount. The amount of debt, not including interest, being assumed by taking out a mortgage. Interest rate. The cost of a loan to the borrower, expressed as a percentage of the loan amount and paid over a specific period of time. The interest rate does not include fees charged for the loan.

What is APR in mortgage?

Money collected from the borrower by the lender (typically as part of the monthly mortgage payment) in order to pay property taxes and homeowners insurance premiums. Annual percentage rate (APR) The cost of a loan to the borrower, expressed as a percentage of the loan amount and paid over a specific period of time.

How long does an adjustable rate mortgage last?

Note: Bank of America adjustable-rate mortgage (ARM) loans feature an initial fixed interest rate period (typically 5, 7 or 10 years) after which the interest rate becomes adjustable every six months for the remainder of the loan term .

What is the purpose of collecting money from a borrower?

Money collected from the borrower by the lender (typically as part of the monthly mortgage payment) in order to pay property taxes and homeowners insurance premiums.

What is mortgage insurance?

For conventional loans, insurance that protects the lender if you default on your loan. If your down payment is less than 20%, most lenders will require you to pay mortgage insurance. Also called private mortgage insurance (PMI).

How much is a point on a mortgage?

Money paid to the lender, usually at mortgage closing, in order to lower the interest rate. One point equals one percent of the loan amount. For example, 2 points on a $100,000 mortgage equals $2,000. Sometimes referred to as discount points or mortgage points.

What is a settlement statement?

A settlement statement is an itemized list of fees and credits summarizing the finances of an entire real estate transaction. It serves as a record showing how all the money has changed hands line by line.

Who is responsible for preparing the settlement statement?

Whoever is facilitating the closing — whether it be a title company, escrow firm, or real estate attorney — will be responsible for preparing the settlement statement.

Is a settlement statement the same as a closing statement?

Yes, a settlement statement is the same as a closing statement, though “settlement” is the formal term most likely to be used by the real estate industry.

What is an ‘excess deposit’ at closing?

A particular line item that causes confusion on the seller’s settlement statement is the “Excess Deposit.” What is an excess deposit, and who will receive the funds listed on that line?

What does an impound account do at closing?

At closing the buyer sets up an impound account that allows them to bundle the cost of their mortgage principal, taxes, mortgage insurance, and other monthly costs into one payment. The lender likes this because they can make sure the new owner will keep up to date with all the payments associated with the home.

What is a seller's net sheet?

The seller’s net sheet is not an official document but an organizational worksheet that your agent will fill out to estimate how much you’ll pocket from your home sale after factoring in expenses like taxes , your real estate agent’s commission, your remaining mortgage, and escrow fees.

How much does it cost to sell a house in 2021?

A 2021 study we conducted found that it costs $31,000 on average to sell a home. But ideally your sale price covers the costs of all the transaction fees, your mortgage payoff, and then some, leaving you with a tidy sum to add to your bank account.

What is finance charge?

A finance charge is the total amount of interest and loan charges you would pay over the entire life of the mortgage loan. This assumes that you keep the loan through the full term until it matures (when the last payment needs to be paid) and includes all pre-paid loan charges. Loan charges include:

Where to find finance charge on closing disclosure?

You can find your finance charge on page 5 of the Closing Disclosure form in the “Loan Calculations” section.

Do you get a HUD-1 or Truth in Lending disclosure?

If you are applying for a HELOC, a manufactured housing loan that is not secured by real estate, or a loan through certain types of homebuyer assistance programs, you will not receive a HUD-1 or a Closing Disclosure, but you should receive a Truth-in-Lending disclosure. Read full answer.

Who pays settlement fee?

Settlement: This fee is paid to the settlement agent or escrow holder. Responsibility for payment of this fee can be negotiated between the seller and the buyer.

Who pays the surveyor fee?

Survey: The lender may require that a surveyor conduct a property survey. This is a protection to the buyer as well. Usually the buyer pays the surveyor’s fee, but sometimes this may be paid by the seller.

What is origination fee?

Origination: The fee the lender and any mortgage broker charges the borrower for making the mortgage loan. Origination services include taking and processing your loan application, underwriting and funding the loan, and other administrative services.

What is home insurance premium?

Homeowner’s insurance premium: This insurance protects you and the lender against loss due to fire, windstorm, and natural hazards. Lenders often require the borrower to bring to the settlement a paid-up first year’s policy or to pay for the first year’s premium at settlement.

What is appraisal charge?

Appraisal: This charge pays for an appraisal report made by an appraiser.

What are points on a loan?

Points: Points are a percentage of a loan amount. For example, when a loan officer talks about one point on a $100,000 loan, this is 1 percent of the loan, which equals $1,000. Lenders offer different interest rates on loans with different points. You can make three main choices about points. You can decide you don’t want to pay or receive points at all. This is a zero-point loan. You can pay points at closing to receive a lower interest rate. Alternatively, you can choose to have points paid to you (also called lender credits) and use them to cover some of your closing costs.

What is document preparation fee?

Document Preparation: This fee covers the cost of preparation of final legal papers, such as a mortgage, deed of trust, note or deed.

What happens when a creditor provides a loan estimate that is not required?

When a creditor provides a Loan Estimate that is not required, this creates a number of challenges. First, unnecessary revised Loan Estimates can confuse applicants who are already overwhelmed by the disclosures they are receiving. Secondly, unnecessary revised Loan Estimates create additional work and expenses for the creditor as the LEs must be prepared and appropriately delivered.

Why is it bad to provide unnecessary loan estimates?

That said, the biggest problem I tend to see when a financial institution provides unnecessary Loan Estimates is that this practice creates significant confusion regarding the “good faith” rules (i.e. the tolerance calculations). For example, if a Loan Estimate is provided, out of courtesy, the fees on the new LE cannot be used for calculating good faith (tolerances) under Regulation Z. This makes it very difficult for creditors, auditors, and examiners, to know which numbers are supposed to be used for good faith purposes.

What happens if the circumstances change in the consumer's eligibility for specific loan terms and revised disclosures are provided?

If changed circumstances cause a change in the consumer's eligibility for specific loan terms and revised disclosures are provided because the change in eligibility resulted in increased cost for a settlement service beyond the applicable tolerance threshold, the charge paid by or imposed on the consumer for the settlement service for which cost increased due to the change in eligibility is compared to the revised estimated cost for the settlement service to determine if the actual fee has increased above the estimated fee .

When can a creditor use a revised estimate?

The final reason a creditor can use a revised estimate for calculating good faith is when there is a delayed settlement date on a construction loan. The rule states that in transactions involving new construction, where the creditor reasonably expects that settlement will occur more than 60 days after the Loan Estimate is provided, the creditor may provide revised disclosures to the consumer if the original disclosures state clearly and conspicuously that at any time prior to 60 days before consummation, the creditor may issue revised disclosures. If no such statement is provided, the creditor may not issue revised disclosures, unless one of the other reasons for revised fees applies.

When is a revised loan estimate required?

Again, this regulatory requirement where a bank must provide a revised Loan Estimate relates to instances when a rate is locked for the first time after an initial LE was already provided, but before a Closing Disclosure was provided . If a Closing Disclosure was provided before an initially floating rate is finally locked, a revised CD is only needed if the information on the CD becomes inaccurate.

What is good faith in lending?

Good faith is the term referred to in Regulation Z which requires creditors to reimburse customer for certain fee increases on the Closing Disclosure (final costs) which are more than what was disclosed on the initial Loan Estimate. In other words, creditors are required by law to quote fees in “good faith.”.

Do creditors have to quote fees in good faith?

In other words, creditors are required by law to quote fees in “good faith.”. Otherwise, the law requires them to refund those fees. This is extremely important to understand because financial institutions have some protection if they self identify and reimburse customers for violations of the good faith rules.