Settlement costs or fees represent a complete account of all the expenses you incur to purchase a property. Examples include loan application fees, points, title fees, appraisal fee, home inspection fees, credit reports, prepaid mortgage interest, property tax apportionment and escrow reserves.

How much are closing costs to sell my home?

Closing costs for sellers of real estate vary according to where you live, but as the seller you can expect to pay anywhere from 6% to 10% of the home’s sales price in closing costs at settlement.

How much does selling a structured settlement cost?

The bulk of the cost of selling your settlement will be the discount rate, which will vary greatly by company. Quotes can range from 7% to as high as 29%. Expect many companies to offer a high discount rate in their initial quotes. Do not accept the initial quote from any company. It is standard practice to negotiate with the company’s representative to get a lower rate.

How to negotiate closing costs on a home?

Negotiating Closing Costs

- Compare Lenders. First, before you make any offer, you should always shop around for rates from multiple lenders. ...

- Credit Score. Your credit score is possibly the best tool for negotiation when you are buying a house. ...

- Don’t Rush. Good negotiation takes a lot of time so you never want to hurry through the process. ...

- Junk Fees. ...

How to save on home closing costs?

Reduce Closing Costs on Your Home Loan

- Determine which services can be shopped, then shop around. Most people know to shop around when it comes to mortgage rates. ...

- Know which fees can change. Many would-be and current homeowners don't know that certain fees listed on your Loan Estimate are locked in and others can change.

- Save on discount points when mortgage rates are low. ...

What fees can increase at settlement?

Others may change, but only by 10% or less. Some other closing costs can increase without limit....These include:Prepaid interest.Prepaid property taxes.Prepaid homeowners insurance premiums.Initial escrow account deposits.Real estate-related fees.

Are settlement charges tax deductible?

Can you deduct these closing costs on your federal income taxes? In most cases, the answer is “no.” The only mortgage closing costs you can claim on your tax return for the tax year in which you buy a home are any points you pay to reduce your interest rate and the real estate taxes you might pay upfront.

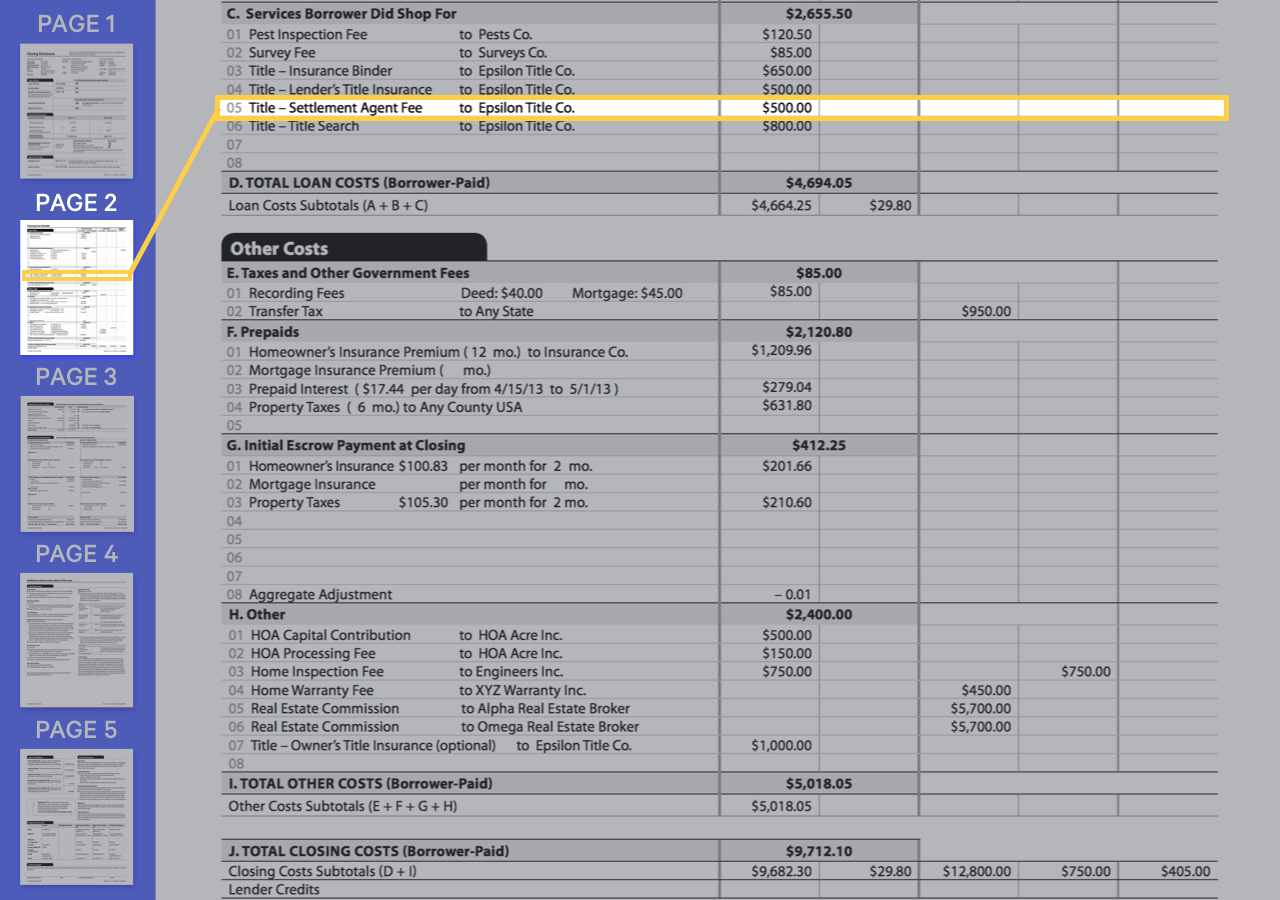

What is the primary purpose of the settlement statement?

A settlement statement provides a breakdown of all the closing costs and credits involved in a real estate transaction or refinance.

What can I write off when buying a house?

Unfortunately, most of the expenses you paid when buying your home are not deductible in the year of purchase. The only tax deductions on a home purchase you may qualify for is the prepaid mortgage interest (points)....These fees include:Title insurance.Appraisals.Abstract fees.Recording fees.Surveys.

Do closing costs reduce capital gains?

Capital Gains Tax The price you paid for the home is also called the tax basis. The closing costs associated with selling the rental property that are tax deductible, discussed above, can be used to lower overall basis (or price you paid for the home), thus potentially lowering the capital gains tax.

What is the difference between closing and settlement?

A closing is often called "settlement" because you, as buyer, along with your lender and the seller are "settling up" among yourselves and all of the other parties who have provided services or documents to the transaction.

What is the difference between a settlement statement and a closing disclosure?

While closing disclosures provide information about a borrower's loan, settlement statements do not include loan information. Settlement statements are used for commercial transactions and cash closings.

Is settlement statement the same as closing statement?

A settlement statement is a document listing the terms and conditions of a settlement agreement and details all related costs or credits due to each party. A mortgage loan settlement statement is commonly known as a closing statement.

Are settlement agreements taxable?

Settlement agreements (or compromise agreements as they used to be called), usually involve a payment from the employer to the employee. Such payments can attract income tax or national insurance contributions – but they can also sometimes rightly be paid tax free.

What legal fees are not tax deductible?

Other examples of non-allowable legal and professional expenses include: legal costs incurred in acquiring, or adding to, a property, costs in connection with negotiations under the Town and Country Planning Acts, fees pursuing debts of a capital nature, for example the proceeds due on the sale of the property.

Are settlement payments tax deductible ATO?

Yes, the legal fees and settlement payment expenses are deductible under section 8-1 of the Income Tax Assessment Act 1997 (ITAA 1997).

Will I get a 1099 for a lawsuit settlement?

If your legal settlement represents tax-free proceeds, like for physical injury, then you won't get a 1099: that money isn't taxable. There is one exception for taxable settlements too. If all or part of your settlement was for back wages from a W-2 job, then you wouldn't get a 1099-MISC for that portion.

What is settlement on HUD?

The settlement is the finalization of your purchase of real estate property. The fees associated with this sale are referred to as your settlement costs. Your settlement cost will be detailed on your HUD-1 statement, often referred to as your Settlement Statement.

What are closing costs?

Your closing costs include a number of different fees that are all associated with your financing of the purchase of the property. These typically include your origination fee, recording fees, points, the cost of the title insurance, title insurance endorsements, attorney fees, and the payment of private mortgage insurance on the home.

Why do we review closing statements before closing?

Then before closing we will review the closing statement to make sure the closing company didn't make any mistakes that will cost you money . You could end up paying more in closing cost through mathematical error or improper reading of the contract by the closing company. You would be amazed at the credits and other monies that were supposed to be given to the buyer at closing that were not on the closing statement upon on first review.

What does a realtor estimate?

In addition, your Realtor will provide you with an estimate of your expenses at the time of writing your purchase offer. This estimate will include best guesses for the charges the lender will be charging you for. The lender's cost include document preparation, processing fees and credit report.

Who pays for title insurance in Florida?

Northeast Florida is a little different then the rest of the country in that Sellers typically pay for the title insurance cost on a purchase transaction. For this reason the Seller typically picks the closing agent or closing attorney and is responsible for those associated cost. However, if you are refinancing your home then you will be responsible for the title insurance.

Why are the amount you pay not identical?

The amount that you must pay are not identical due to the fact that you each have certain expenses that are specific to your particular position as buyer or seller. Sometimes, it is prearranged prior to the closing for the seller to pay some of your costs as Buyer.

How much does a closing cost for a home?

Typical closing costs for a buyer of a $250,000 home might range between $5,000 and $12,500.

What are the typical real estate closing costs for buyers?

Buyers are responsible for paying certain fees associated with receiving a mortgage, along with recurring fees after close (like homeowners insurance).

What are the closing costs for cash buyers?

Cash buyers are still required to pay for things like notary fees, property taxes, recording fees, and other local, county and state fees. Unlike a buyer who is using financing, cash buyers won’t have to pay any mortgage-related fees. But most cash buyers still opt to pay for things like appraisals, inspections, and owner’s title insurance.

What is the average mortgage origination fee?

The average loan origination fee is 1% of the total loan amount . For example, on a loan of $300,000, the loan origination fee would be $3,000.

How to lower closing costs?

How to reduce closing costs 1 Shop various lenders for the lowest origination fees. 2 Utilize military benefits for VA financing, if eligible. 3 Ask the seller to pay your closing costs as part of the negotiations.

How much does a HOA transfer cost?

During the negotiation, you can detail which party will pay the transfer fee. HOA transfer fees generally cost about $200. In addition to the transfer fee, your monthly HOA fee will likely be mortgaged. The first payment is often prorated, depending on your closing date.

What percentage of sellers make trade offs with buyers?

According to the Zillow Group Consumer Housing Trends Report 2019, 81% of sellers make some kind of trade-off with the buyer to facilitate the sale of a home. This can be a beneficial strategy if you don’t have enough cash available after paying your down payment to pay for your closing costs, too.

What Are the Costs of Buying a Home?

There are also ongoing costs for taxes, insurance, and maintenance.

What is closing cost on a home?

Not including the down payment, closing costs usually range between 2% and 5% of the purchase price on a home, according to data from Zillow. 18

What is escrow fee?

Escrow Fees. During the closing process, an escrow account will usually hold the money while the buyer and seller finalize the agreement. In addition, you’ll probably have a portion of your monthly mortgage payment go into escrow to pay for property taxes and insurance. Essentially, you prepay some of the homeowner's insurance ...

What is title insurance?

Title insurance is designed to protect the lender in case an issue arises with the title to the home you're buying. You're usually required to buy lender's title insurance. This cost is rolled into your closing costs or financed into the loan.

What is origination fee?

An origination fee is paid to the bank or lender for their services in creating the loan. You also may owe an underwriting fee, an application fee, and a fee for your credit report. 3

How much does an appraisal cost?

7 This appraisal is one fee you'll pay to the lender up front before the appraisal can take place. It typically costs between $300 and $400. 8

How much do discount points cost?

In some cases, you may opt to pay discount points—which cost 1% of the loan—to lower your interest rate and monthly payment. 4 These points are paid to the lender at closing as well.

How much does a realtor charge for a home sale?

No matter where you live, your most expensive home selling cost will likely be realtor fees. Realtor commission rates are usually around 6% . On a $500,000 home sale, you could owe up to $30,000 in commission fees. That's a HUGE chunk out of your potential profits!

What are closing costs when buying a house?

When you buy or sell a house, you must pay a set of taxes and other fees called closing costs. These expenses cover the cost of finalizing the sale and transferring the property's title into the buyer's name.

How do closing costs work?

At the end of a typical home sale, both the seller and buyer pay an assortment of taxes and transaction-related fees that are collectively called "closing costs."

How much does closing cost add up to?

Seller closing costs typically add up to 1-3% of the sale price, while buyers generally owe around 3-5%. How much you'll actually pay will depend on the laws and conventions in your local area, as well as your negotiations with the buyer or seller.

What is loan cost?

Loan costs: Fees that the buyer's lender charges to process and approve the loan. Loan costs are usually paid by the buyer.

How much cash can you bring to closing?

This can limit the amount of cash you need to bring to closing. However, there's likely a limit to how much help you can receive, which could be as low as 3% depending on what kind of mortgage you're getting.

What to ask when negotiating a purchase agreement?

When you're negotiating a purchase agreement, you can ask the other party to cover fees or taxes you'd typically pay. Or you can ask them to contribute a lump sum toward your overall closing cost burden.

What is settlement fee?

Sometimes referred to the Closing Fee, the Settlement Fee covers costs associated with closing operations. Some title companies list out each cost, and some bucket them all in one place, so be sure you know exactly what you’re paying for. Costs bundled under the Settlement Fee may include the cost of escrow, survey fees, notary fees, deed prep fees, and search abstract fees.

Who is Better Settlement Services?

Better Settlement Services, an affiliate of Better Mortgage, has answers. Contact us at [email protected] and we’d be happy to provide you with any information you need.

Why are title fees called title fees?

These costs are called “title fees,” because the “title” is a legal document that proves you own a property. Title fees can cover a wide range of costs, so we’ve outlined a few of them below to help you know what to expect.

What is title fee?

These costs are called “title fees,” because the “title” is a legal document that proves you own a property. Title fees can cover a wide range of costs, ...

When is a deed prep fee required?

A Deed Prep Fee is applicable when a title is transferred, or an existing deed has to be modified as part of a transaction. When a home is purchased, for example, the deed must be transferred title from the seller to the buyer.

Who pays the premium on a refinance?

In a refinance transaction, the lender’s premium is typically paid by the borrower , but in some purchase transactions, the borrower may be responsible for the cost. The lender’s premium is dependent on the loan amount or purchase amount. So if either increase, the premium will likely follow suit.

What is lender title insurance?

Lender’s Title Insurance. Lender’s Title Insurance is required in nearly all refinance and purchase transactions. As the name suggests, this policy protects the lender against losses incurred due to title disputes.

How much does closing cost for cash?

Even if you’re buying a home with cash, the one-time closing costs, or fees you’ll have to pay during the closing process, can be as much as 3% of the purchase price, according to Lee Dworshak, a Realtor with Keller Williams LA Harbor Realty.

How much does a HOA cost?

These fees will be based on the size of your home and the amenities in your community, but for a typical single-family home, HOA fees can cost around $200 to $300 a month.

Why do people buy houses with cash?

Maybe you came into a large inheritance, or you’re just really good at saving. Either way, paying the price of the home in full means you won’t have to worry about making mortgage payments. Plus, sellers love a cash offer because it means they won’t have to wait for mortgage lenders ...

How much does a home warranty cost?

Shur recommends considering a home warranty, which costs about $450 a year and provides coverage on a wide variety of elements such as plumbing, electrical, heating/air conditioning, and appliances.

How to find out what your property tax bill is?

To get an idea of what those bills will look like, check a home’s listing on realtor.com®. Scroll down to the Payment Calculator section, and look on the line that says Property Tax.

What utilities do you need to pay for a house?

Don’t forget to factor in utilities such as electric, gas, water, sewer, and trash. To get a clear picture of what you’ll be required to pay, ask your real estate agent to ask the sellers what a year’s worth of bills costs. Utilities can fluctuate from season to season, so this is especially important if you’re moving across the country to a new climate.

Does home insurance add up?

Homeowners insurance adds up. The cost of the policy will depend on the size and value of your home, your location, your deductible, and your coverage. Talk to your current insurer about the home and area you’ll be moving to to get an accurate picture of your new insurance costs.

What is title settlement fee?

The title settlement fee, or closing fee, is a charge from the title company to cover the administrative costs of closing. Title companies may or may not list out the individual costs of the fee.

How much does a home buyer pay for closing costs?

Home buyers can typically expect to pay 2% – 5% of the loan amount in closing costs. One of the main costs is a title fee. Here we’ll cover what title fees are, who pays them and how much they cost.

What Are Title Fees?

Title is the right to own and use the property. Title fees are a group of fees associated with closing costs. These fees pay a title company to review, adjust and insure the title of the property.

How to find closing costs?

You can find title fees and overall closing costs on a couple documents: 1 Closing disclosure: Your closing disclosure will break down total closing costs, including title fees, in an itemized list. 2 Loan estimate: The loan estimate will list your total closing costs, along with title service fees, and tell you the cash you need to bring to close.

How much does title fee vary?

Title fees change from company to company and from location to location. They can also change depending on what’s included. In general, closing costs, which title fees are a large part of, cost from 2% – 5% of the total loan amount.

How much does it cost to record a deed?

The national average for this charge is around $125.

What does a title company do?

The title company will perform a title search to find any potential issues with the title, such as encumbrances or liens. The company can then make any changes and ensure that their findings are correct.

Who pays closing costs?

Typically the buyer pays closing costs, though sometimes negotiations between the buyer and the seller can lead to the seller paying some of the closing costs.

What is origination fee?

Usually a percentage of the amount loaned (often 1%). The origination fee is stated in the form of points.

How long does an adjustable rate mortgage last?

Note: Bank of America adjustable-rate mortgage (ARM) loans feature an initial fixed interest rate period (typically 5, 7 or 10 years) after which the interest rate becomes adjustable every six months for the remainder of the loan term .

What is the purpose of collecting money from a borrower?

Money collected from the borrower by the lender (typically as part of the monthly mortgage payment) in order to pay property taxes and homeowners insurance premiums.

What is mortgage insurance?

For conventional loans, insurance that protects the lender if you default on your loan. If your down payment is less than 20%, most lenders will require you to pay mortgage insurance. Also called private mortgage insurance (PMI).

How much is a point on a mortgage?

Money paid to the lender, usually at mortgage closing, in order to lower the interest rate. One point equals one percent of the loan amount. For example, 2 points on a $100,000 mortgage equals $2,000. Sometimes referred to as discount points or mortgage points.

What is the down payment on a home?

Down payment. Money paid toward the purchase of a home, typically ranging between 5% and 20% of the purchase price. A down payment of less than 20% often requires the borrower to have private mortgage insurance.

Where are closing costs listed?

Here are all the closing costs when paying cash for a home. The costs are listed under the Debit column.

How much does a title notary cost?

Title Notary: $15. The notary takes your signatures and thumbprints and makes sure all the documents are official.

What happens when you get a title examination?

The title examination will reveal that there are several outstanding mortgage liens on the property and the property will not be able to be conveyed to a buyer until this title defect is cleared. Owner’s title insurance will not only protect the seller from this kind of loss but the title insurance company will also defend the seller and pay for the cost in clearing the title.

Why do sellers pick escrow companies?

The escrow company is usually picked by the seller because the seller initially pays a fee to analyze the title of the property before selling. For the buyer to insist on a different escrow company would be a waste of money since analyzing the initial title costs money (~$500). Title Notary: $15.

What is a costlier title issue to clear?

A costlier title issue to clear would be one involving a discrepancy with land ownership.

How much does selling costs eat up?

Selling costs can easily eat up about 6% of the returns from your home due to the 5% real estate selling commission plus transfer taxes and other settlement fees that can amount to 1%.

When was Financial Samurai founded?

Financial Samurai was started in 2009 and is one of the most trusted personal finance sites on the web with over 1.5 million pageviews a month.