There are two standard types of settlement instructions: Securities in the Equity, Corporate Fixed Income, Government Fixed Income, Money Market, and Unspecified security type group Within this category, settlement instructions differ slightly for:

- CASH.

- CEDEL.

- EURO CLEAR.

- PHYSICAL.

- UNIVERSAL.

- Countries That Have Market-Specific Methods.

What are the standard settlement instructions documents?

Standard Settlement Instructions documents Ensure easy and efficient transactions with HSBC Bank plc (HSBC) by carefully following these Standard Settlement Instructions in the products denoted, unless otherwise specified, at transaction level.

What are standing settlement instructions (SSI)?

Worldwide standing settlement instructions for both retail and wholesale payments As a financial institution or global corporate you may need to process thousands of cross-border retail and/or FX and money market-related wholesale payments each day. Access to accurate and up-to-date Standing Settlement Instructions (SSI) is critical.

When should the customer send the settlement instruction?

The Customer should send separate settlement instruction two business day s prior to the settlement date if the Transaction needs to be settled through accounts other than that specified in the Standard Settlement Instruction.

What are HSBC's Standard Settlement Instructions?

HSBC's Standard Settlement Instructions documents allow you to have correct payment/delivery whenever you transact with HSBC. Commercial Bank About HSBCnet Online security Customer support Getting started Troubleshooting 从中国登录 Select your country HSBC Global Business websites Americas Argentina Bermuda Canada

What are standard settlement instructions?

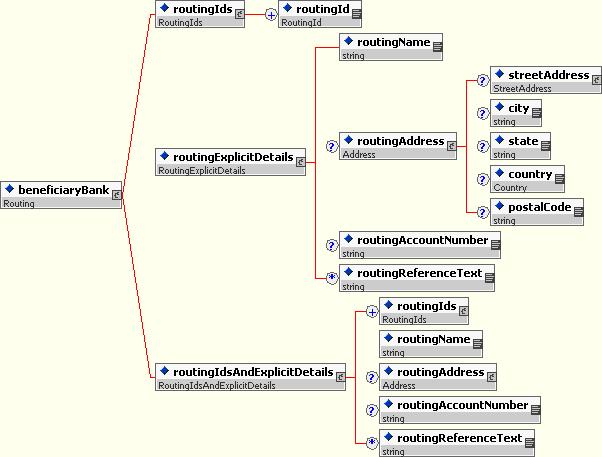

Overview. Standard Settlement Instructions (SSI's) are defined as a Legal Entities Settlement Instruction for which key information remains the same from one settlement to another (i.e., bank, account number and account name), with only the amount and value date modified.

What is SSI in trade life cycle?

Standing Settlement Instructions (SSIs) play a crucial role in the trade-processing life cycle since it includes all the details a trade needs before it can settle, including account numbers, identification codes and place of settlement.

What is an SSI in finance?

SSI stands for Supplemental Security Income.

What is settlement STO?

A security token is a unique token issued on a permissioned or permissionless blockchain, representing a stake in an external asset or enterprise.

What is SSI enrichment?

With standard ALERT enrichment the user manually provides the appropriate ALERT keys (Country, Method, Security) in CTM. When a trade is submitted to the CTM service for matching, both broker/dealers and investment managers can provide a set of fields, or keys, that activate the enrichment process.

What is alert application used for?

Alerting makes it possible for people to keep up with the information that matters most to them. Alerts are typically delivered through a notification system and the most common application of the service is machine-to-person communication. Very basic services provide notification services via email or SMS.

What are 4 types of financial institutions?

The most common types of financial institutions are commercial banks, investment banks, insurance companies, and brokerage firms.

What is the difference between SSI and SSA?

But, the programs are different. SSA is an entitlement program and SSI is needs-based.

What is a swift 103 message?

An MT103 is an international standard message format that banks and financial institutions use in the SWIFT network in order to instruct a transfer of funds from one customer to another customer.

What is STO in a company?

STO. Stock Transfer Order (inter-company movement of stock)

What is the difference between ICO and STO?

Basically, an STO is an ICO that's backed by real-world value, not as determined by supply of the token or the price determined by its creators. Get it? Security token offerings distribute securities or tokens that are fungible, negotiable financial instruments with attached monetary value.

What is STO in blockchain?

Security Token Offerings (STOs) combine the technology of blockchain with the requirements of regulated securities markets to support liquidity of assets and wider availability of finance. STOs are typically the issuance of digital tokens in a blockchain environment in the form of regulated securities.

What are the stages of trade life cycle?

Trade life cycle has different stages, by which a trade flows through. These detail steps are from the point of order, receipt, execution through to settlement of the trade in a systematic manner.

What is trade validation and enrichment?

In this Trade validation and enrichment in Capital Market, the process inspects if the received trade information in the back-office systems coincides with the front office records. The tasks that are considered are - Issuing a trade confirmation. Reporting the trade to the regulatory authorities.

How many types of trade life cycles are there?

The classification of Trade settlement can be done into 3 types: Normal/ Rolling Settlement. Trade-to-Trade Settlement. Auction.

Which of the right order of steps of a trade life cycle?

The Trade Life Cycle ExplainedStage one: the order. ... Stage two: front office action. ... Stage three: risk management. ... Stage four: off to the exchange. ... Stage five: match making. ... Stage six: trade made. ... Stage seven: confirmation. ... Stage eight: clearing begins.More items...

SSI Retail

Our SSI Retail directory provides everything you need to address your SSI needs for retail payments – helping you improve straight-through processing rates, enhance customer satisfaction and reduce correspondent fees.

SSI Wholesale

Meeting your SSI needs for wholesale payments, our SSI Wholesale directory helps you ensure a fast cross-border payments process, reduce settlement risk and avoid possible loss of interest.

SSI Plus

Suitable for financial institutions or global corporates, SSI Plus addresses your SSI needs for both retail and wholesale payments.