Trusts and estates are the two main legal structures for transferring assets to your heirs and beneficiaries. Each works in critically different ways. Estates make a one-time transfer of your assets after death.

Full Answer

What is the difference between an estate and a share Trust?

Estate vs. Trust: What’s the Difference? Eric ReedJul 06, 2022 Share Trusts and estates are the two main legal structures for transferring assets to your heirs and beneficiaries. Each works in critically different ways. Estates make a one-time transfer of your assets after death.

What is a trust?

The Role of Trusts in Estate Planning A trust is an entity or an agreement that allows you, as the grantor or donor, to transfer property to someone known as the trustee for the benefit of a third party, called the beneficiary.

How to settle a revocable trust after the Trustmaker dies?

Settling a Revocable Trust After the Trustmaker Dies 1 Inventory. The first step in settling a revocable living trust is to locate all of the decedent's original estate... 2 Meet With a Trust Attorney. Once you have reviewed the decedent's legal documents and other important papers, the next... 3 Pay Taxes. More ...

What is the next step in settling a trust?

Once you've met with a trust attorney, the next step in settling a trust is to establish date-of-death values for all of the decedent's assets. All financial institutions where the decedent's assets are located must be contacted to obtain the date-of-death values.

What are settlers in a trust?

The settlor is the party that creates a trust, usually the donor. The settlor transfers legal title in some asset to the trustee. The settlor then provides in the trust instrument how that trust property is to be used for the beneficiaries. In the case of the inter vivos trust, the settlor can also be the beneficiary.

What is the definition of trust estate?

Trust estate means the determinable and beneficial interest of a beneficiary or principal in trust funds but does not include the beneficial interest of an heir or devisee in a decedent's estate.

Are trusts and estates the same?

Trusts and estates are the two main legal structures for transferring assets to your heirs and beneficiaries. Each works in critically different ways. Estates make a one-time transfer of your assets after death. Trusts, meanwhile, allow you to create an ongoing transfer of assets both before and after death.

What is a settlement of a common trust fund?

Settlement of a trust estate involves the process necessary to transfer asset ownership from the deceased person's trust to the parties entitled to receive the assets, according to the provisions of the decedent's trust.

What are the 3 types of trust?

To help you get started on understanding the options available, here's an overview the three primary classes of trusts.Revocable Trusts.Irrevocable Trusts.Testamentary Trusts.More items...•

What are the 4 types of trust?

The four main types are living, testamentary, revocable and irrevocable trusts. However, there are further subcategories with a range of terms and potential benefits.

What is the main purpose of a trust?

Trusts are established to provide legal protection for the trustor's assets, to make sure those assets are distributed according to the wishes of the trustor, and to save time, reduce paperwork and, in some cases, avoid or reduce inheritance or estate taxes.

Who owns the property in a trust?

TrusteesTrustees. The trustees are the legal owners of the assets held in a trust.

How long does it take to settle a trust after death?

Most times, an executor would take 8 to 12 months. But depending on the size and complexity of the estate, it may take up to 2 years or more to settle the estate.

What happens when you inherit money from a trust?

It must distribute income earned on trust assets to beneficiaries annually. If you receive assets from a simple trust, it is considered taxable income and you must report it as such and pay the appropriate taxes. A complex trust must contribute to a charity and can take deductions on its taxes.

How do trust funds pay out?

As stated above getting money out of your trust is done simply by making a distribution. This distribution can be made as easily as a bank transfer from the trust account to your own personal account.

Do beneficiaries pay taxes on trust distributions?

Beneficiaries of a trust typically pay taxes on the distributions they receive from the trust's income, rather than the trust itself paying the tax. However, such beneficiaries are not subject to taxes on distributions from the trust's principal.

Who owns the property in a trust?

TrusteesTrustees. The trustees are the legal owners of the assets held in a trust.

How does a trust work after someone dies?

A Trust puts your assets under the control of a board of trustees who can act in your place for your beneficiaries once you've passed away: This allows for financial security for your loved ones in the event of your death (or even absence or incapacity because of illness).

What assets Cannot be placed in a trust?

Assets That Can And Cannot Go Into Revocable TrustsReal estate. ... Financial accounts. ... Retirement accounts. ... Medical savings accounts. ... Life insurance. ... Questionable assets.

What are the disadvantages of a trust?

One of the disadvantages of a Trust are that Trusts are very difficult to understand. Historically, trusts used language that was specific to the legal field. For those that were not trust and estate lawyers, it was almost impossible to understand.

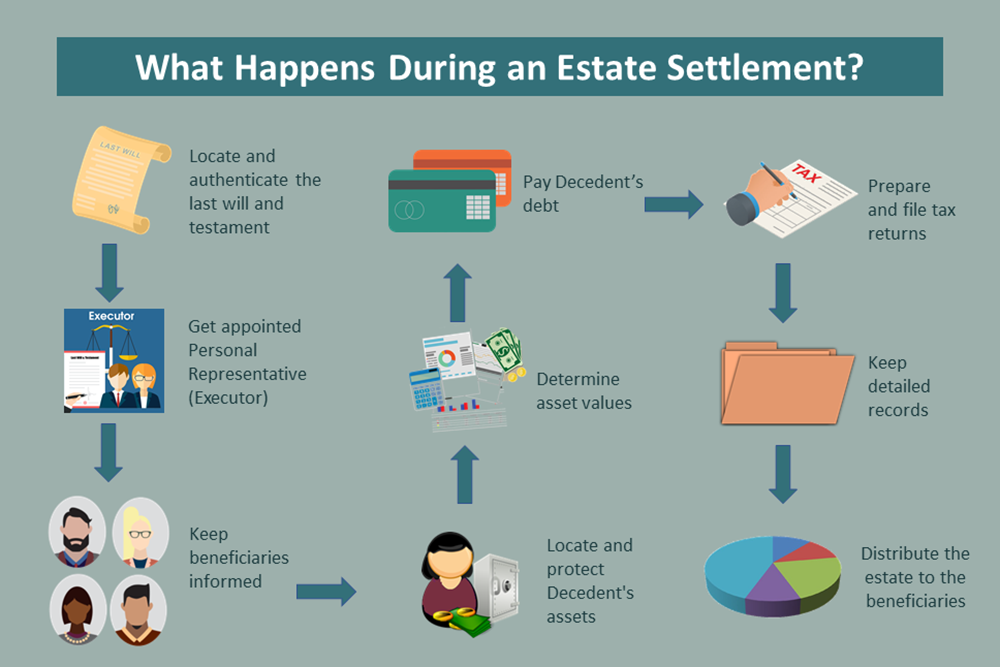

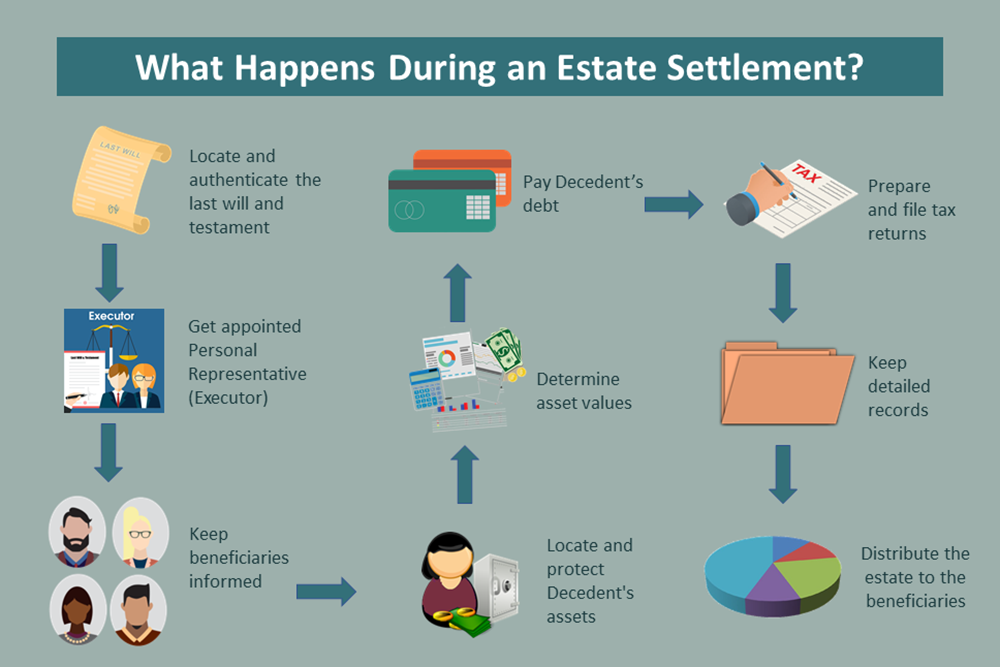

What is the first step in settling an estate?

The first step (and one of the most important ones) in the process of settling an estate is getting organized . You’ll want to keep track of both your expenses and all the time you spend working on settling the estate, as you’re entitled to be compensated. You should look for a Will.

How Long Does an Executor of a Will have to Settle an Estate?

In short, an Executor generally has as long as he or she needs to settle an estate, provided all statutory deadlines are met.

How to Settle an Estate without a Will?

When it happens, the resolution of the estate will depend on how big it is, how complex it is and how many heirs claim to have rights to a piece of it. State law comes heavily into play in these cases, and the courts would determine who should be appointed to administer and settle the estate.

What happens if a deceased person has a will?

If the deceased only had a Will, it’s likely the estate will have to go through what’s known as probate. What is probate? Probate is the court proceeding that validates a Will. Keep in mind, not all estates will need to go through probate - probate laws can vary significantly depending on what state you’re in and the size of the estate. If there was a Trust set up, or if the estate is very small in value, it may avoid probate all together.

How much is a probate estate worth?

The baseline number to qualify for a simplified probate can range anywhere from $20,000 to up to $150,000 or more.

Where do you file a will?

If there is a Will, it must be filed in the probate court. Beneficiaries need to be notified, and if there is a Trust, any successor trustees should also be informed. Other people to notify include: creditors/banks, the post office, the utility companies and any other business the deceased had accounts with.

Can you distribute assets after a deceased person dies?

After debts and taxes are paid, and if probate is closed (if the estate needed to go through the probate process), then you can distribute assets according to the deceased party’s final wishes.

What is a trust settlement agreement?

A trust settlement agreement protects a successor trustee by making sure that all beneficiaries agree who gets what. A successor trustee would be in an awful spot if he/she distributed the trust in full, only to find out that one or more of the trust beneficiaries disputes which trust controls, or disputes an interpretation of the trust language.

What happens if a successor trustee distributes a trust in full?

A successor trustee would be in an awful spot if he/she distributed the trust in full, only to find out that one or more of the trust beneficiaries disputes which trust controls, or disputes an interpretation of the trust language.

What is a successor trustee in Florida?

The successor trustee needs to deal with the possibility of creditor claims BEFORE distributing trust assets to trust beneficiaries. In Florida the typical “living trust” is responsible for any debts or claims that could be filed in a probate case for the decedent.

How many notices are required for a trust in Florida?

As a successor trustee takes over the trust, there are two formal trusts notices that are required by Florida law. Each notice has a separate format: one notice goes to the Clerk of Court and one to Trust Beneficiaries.

What is the responsibility of a successor trustee?

Settling an Estate or Trust is a big responsibility. The executor or successor trustee needs to: 1) design and execute a communications plan with beneficiaries, 2) design accounting methods to track estate and trust assets so that accountings can be delivered later in the process, 3) retain qualified professionals (attorneys, accountants, etc), 4) gather assets, 5) carefully follow and adhere to the relevant documents (Trust or Will), 6) follow all applicable laws, and avoid conflicts of interest, self dealing and mismanagement.

Do assets in a trust go through probate?

Note the key language that all assets are funded into the trust. If assets are outside the trust, and not in beneficiary form or joint name, then a probate results even despite the fact that the clients created a living trust. Besides assets funded in a living trust, assets in joint name or with a beneficiary named also do not go through probate.

Does a will create probate?

Does the existence of a Will, or Filing it with the Clerk of Court create probate? NO! The existence of the Last Will and Testament alone does not create probate. The custodian of the Will has a duty to deliver the Will to the Clerk of Court, but doing so does NOT “create probate.”.

What are the purposes of a trust?

Trusts for Specific Purposes 1 A spendthrift trust can be used to preserve your assets, allotting bequests incrementally and under certain terms, for beneficiaries who are less than responsible with money. 2 A special needs trust ensures that an heir with special needs will have sufficient assets to provide for those needs without jeopardizing their government benefits. 8 3 A life insurance trust collects insurance on the grantor’s life and administers it to beneficiaries. It’s irrevocable and can be used to avoid estate taxes. 4 A QTIP trust provides income for a spouse, then passes the remainder of the assets to other heirs.

What Makes Up Your Estate?

Your “estate” is everything you own—all your property and property rights, even assets with loans against them . They don’t die when you do. They have to move into the ownership of a living beneficiary, because a decedent can’t own property.

What is probate in a will?

It can also make probate of your estate much easier. Probate is the legal process by which ownership of your property is transferred to living beneficiaries. The court also uses the probate process to establish the validity of a will, when the deceased left one. 2. You will designate an executor in your will.

Why is the intestate administration so expensive?

Intestate administration is often a lengthy, inefficient, and expensive proceeding because the administrator is usually required to seek permission from the court for each of these actions . The administrator will spend much time requesting court orders and attending hearings.

Why do you leave a will?

Leaving a will ensures that your wishes are carried out, if possible, and your property is distributed in the way you choose. It can also make probate of your estate much easier.

What is your estate?

Your “estate” is everything you own—all your property and property rights, even assets with loans against them. They don’t die when you do. They have to move into the ownership of a living beneficiary, because a decedent can’t own property.

Why do assets transfer automatically?

Some assets transfer automatically because they’re contractual in nature—you designated a beneficiary who will take ownership when you die. They include life insurance proceeds, annuities with death benefits, and many retirement accounts.

What is a Trust Settlement Agreement?

A trust settlement agreement, also called a non-judicial settlement agreement, is a contract between the trust’s beneficiaries. According to the trust agreement, the beneficiaries of the trust are the people or nonprofit institutions who received assets from the trust.

Who Can Enter a Trust Settlement Agreement?

Any person can enter into a non-judicial settlement agreement that is legally binding. These types of settlement agreements do not need to be supported by consideration.

Benefits of a Trust Settlement Agreement

Many benefits come from entering into a trust settlement agreement. The settlement agreement gives everyone involved versatility regarding the matters the agreement addresses. The non-judicial settlement agreement can address many different legal matters, including, but not limited to, the following:

Trust Settlement Mediation

If you cannot agree on the provisions of your trust settlement, you may benefit from going to mediation, whether court-ordered or voluntary. Mediation is a process in which a neutral third party facilitates communication between disputing parties to help them reach a mutually acceptable agreement.

Your Trust Agreement Must be in Writing

Whether you go through a mediation process or negotiate using your trust attorneys, the final trust agreement must be in writing. The mediator will typically create a document at the end of the process that includes a short summary agreement during the mediation process.

Discuss Your Case with a Trust Lawyer

Entering into a trust settlement agreement can give you a versatile and effective way to modify an irrevocable or revocable trust. These types of agreements are also effective for settling disputes. Many trust settlements resolve issues regarding the interpretation of a trust agreement or the administration of the agreement.

What is a testamentary trust?

Testamentary trust. Outlined in a will and created through the will after the death, with funds subject to probate and transfer taxes; often continues to be subject to proba te court supervision thereafter. Irrevocable life insurance trust (ILIT)

What are the benefits of a trust?

Other benefits of trusts include: 1 Control of your wealth. You can specify the terms of a trust precisely, controlling when and to whom distributions may be made. You may also, for example, set up a revocable trust so that the trust assets remain accessible to you during your lifetime while designating to whom the remaining assets will pass thereafter, even when there are complex situations such as children from more than one marriage. 2 Protection of your legacy. A properly constructed trust can help protect your estate from your heirs' creditors or from beneficiaries who may not be adept at money management. 3 Privacy and probate savings. Probate is a matter of public record; a trust may allow assets to pass outside of probate and remain private, in addition to possibly reducing the amount lost to court fees and taxes in the process.

Why is an irrevocable trust preferred over a revocable trust?

An irrevocable trust is generally preferred over a revocable trust if your primary aim is to reduce the amount subject to estate taxes by effectively removing the trust assets from your estate. Also, since the assets have been transferred to the trust, you are relieved of the tax liability on the income generated by the trust assets ...

What is an irrevocable trust?

Irrevocable trust designed to exclude life insurance proceeds from the deceased’s taxable estate while providing liquidity to the estate and/or the trusts' beneficiaries

What is a Grantor Retained Annuity Trust?

Used to provide income for a surviving spouse. Upon the spouse’s death, the assets then go to additional beneficiaries named by the deceased. Often used in second marriage situations, as well as to maximize estate and generation-skipping tax or estate tax planning flexibility. Grantor Retained Annuity Trust (GRAT)

What is the purpose of a properly constructed trust?

A properly constructed trust can help protect your estate from your heirs' creditors or from beneficiaries who may not be adept at money management. Privacy and probate savings.

What is a marital trust?

Marital or "A" trust. Designed to provide benefits to a surviving spouse; generally included in the taxable estate of the surviving spouse. Bypass or "B" trust. Also known as credit shelter trust, established to bypass the surviving spouse's estate in order to make full use of any federal estate tax exemption for each spouse.

How long does it take to administer a trust?

There is no set timetable for completing a trust administration. A typical trust administration will take at least 4 to 6 months, however circumstances such as dealing with an active business or disposing of real property could extend the administration somewhat.

What is the responsibility of a trustee?

This is a very important task that should not be taken lightly. As trustee, you have a fiduciary responsibility to the Trust beneficiaries. They have a legal right to look over your shoulder, and unless they waive this requirement, you will need to give them a written accounting of all Trust receipts and expenses.

What are my responsibilities as a successor trustee?

Most successor trustees use an attorney to help with trust administration. Usually the attorney then makes sure they do most of the work. It is not uncommon for an attorney to charge upwards of 1 percent of the net estate value for this service. While there are some legal requirements involved in settling a Living Trust, most of the steps can be completed without undue burden by the successor trustee, saving thousands to tens of thousands of dollars for the heirs.

How long does a trustee have to send a notice of death in California?

The notice must comply with Probate Code Section 16061.7 and must be sent within 60 days of the date of death.

How long does probate take?

An average probate can cost upwards of 5 to 10 percent of the gross estate and take anywhere from 9 to 18 months to complete. If your mom or dad, for example, had a funded Living Trust, you would not have to go through probate, but you will have to handle the trust administration . While trust administration is less complicated ...

How long does it take to lodge a will?

Lodge the Original Will. Probate Code Section 8200 (a) requires the custodian of the original Will to “lodge” it with the probate court within 30 days of death. “Lodge” is an old fashioned legal term for “file.”. The court filing fee is $50. You will need to attach an original Death Certificate to the Will.

What is a small estate affidavit?

Small Estate Affidavit. If there are assets not titled in the Trust, such as small bank accounts, those accounts can usually be transferred using a Small Estate Declaration under Probate Code Section 13100, so long as combined value of such accounts are worth less than $150,000.

Who settles a trust after the trustee dies?

The person named as the successor trustee (s) to settle the trust, as well as anyone named trustee (s) of any trusts that need to be created, now that the trustmaker has died

How to settle a revocable trust?

The first step in settling a revocable living trust is to locate all of the decedent's original estate planning documents and other important papers. Aside from locating the original revocable living trust agreement and any trust amendments, you will need to locate the decedent's original pour-over will .

What is the purpose of a successor trustee?

Most people have little experience being named as the successor trustee in charge of settling their loved one's revocable living trust after the loved one's death . The purpose of this guide is to provide a general overview of the six steps required to settle and then terminate a revocable living trust after the trustmaker dies.

How long does it take to administer a trust?

If administration of the trust is expected to take more than a year , the successor trustee should work closely with the trust attorney and accountant to plan for setting aside enough assets to pay the ongoing trust expenses and then making distributions to the trust beneficiaries in multiple stages instead of in one lump sum.

What assets can pass outside of a trust?

Assets that can pass outside of the trust may include those that were owned as tenants by the entirety or joint tenants with right of survivorship; payable-on-death or transfer-on-death accounts; and life insurance, IRAs, 401 (k)s, and annuities with named beneficiaries. Take the time to understand what the non-probate assets are, too.

What assets do you need to get a date of death?

All financial institutions where the decedent's assets are located must be contacted to obtain the date-of-death values. Some assets, including real estate; personal effects such as jewelry, artwork, and collectibles; and closely held businesses, will need to be appraised by a professional appraiser.

Who is the beneficiary of a residuary trust?

Beneficiaries of the decedent's residuary trust. The person named as the successor trustee (s) to settle the trust, as well as anyone named trustee (s) of any trusts that need to be created , now that the trustmaker has died. The date and location where the trust agreement was signed.

Can an estate be complex without a self assessment?

the estate is not regarded as complex, so it can be dealt with without the personal representatives having to complete a Self Assessment return.

Can personal representatives make an informal payment of the total liability for the whole period of administering the deceased's estate?

Provided that the conditions referred to above are met, the personal representatives may make an informal payment of the total liability for the whole period of administering the deceased’s estate .