Undisbursed Funds means the Total Funds less any amounts already paid to the Recipient under this Funding Agreement. Unused Proportion the proportion that the sum of the unused Recipient Contributions and Other Contributions represents when compared to the total Recipient Contributions and Other Contributions.

What does undisbursed funds mean?

Undisbursed. Funds committed by the creditor but not yet utilized by the borrower. In BIS terminology, this refers to open lines of credit that are legally binding on lending banks. A transaction in the balance of payments or a position in the international investment position (IIP) is only recorded when an actual disbursement takes place.

What is the process of disbursing a settlement?

Once the settlement amount and terms have been agreed upon, the defendant must initiate the process of disbursing the settlement. The terms of the settlement typically dictate the disbursement process. Settlements for relatively minor injuries, for example, are generally paid in one lump sum shortly after the settlement is reached.

How are settlement funds handled at a law firm?

Certain types of funds require special handling, and settlement funds fall into this category. Settlement funds are always deposited directly into your law firm’s trust account and are paid to parties of the settlement from the trust account. A settlement check is never directly deposited into your firm’s operating account.

Can I write checks to all parties on a settlement statement?

Once funds are available, you can write checks to all of the parties listed on the settlement statement. All funds get disbursed directly out of your trust bank account and recorded in the client’s trust account ledger.

What are undisbursed funds?

Undisbursed balances are funds that the federal government has obligated by entering into a grant agreement, but the grantee has not drawn down ("disbursed"). These funds were obligated from the federal perspective.

What does undisbursed amount mean PPP?

The Active Un-disbursed status means you were approved for the PPP loan, have signed your contracts, and are waiting for your funds to be dispursed.

What do you mean by disburse?

to pay outDefinition of disburse transitive verb. 1a : to pay out : expend especially from a fund disburse money. b : to make a payment in settlement of disburse a bill.

How long does it take to get PPP after signing promissory note?

Lenders have up to 20 days after the date the SBA approves your application to fund your PPP loan. In most cases, this funding happens within 2 to 3 business days after you sign your promissory note.

Do companies have to pay back their PPP loans?

PPP loans (the full principal amount and any accrued interest) may be fully forgiven, meaning they do not have to be repaid. If you do not apply for forgiveness, you will have to repay the loan.

Did employers have to pay back PPP loans?

The program issued money to businesses as loans, but to encourage employers to keep workers, the loan was “forgiven” — it did not have to be repaid — if a company retained most of its employees and spent most of the money on payroll.

Can you fire an employee with PPP loan?

Since the majority of loan funds are supposed to be reserved for payroll, employers who receive PPP loans should be able to avoid layoffs and furloughs. Granted, loan recipients are permitted to reduce employees' pay by 25%, so you may be paid less than you were before quarantine.

What does ongoing loan status mean?

This generally occurs when the application is more complicated or has documents that aren't easily processed by the automated review. This process takes a little longer, and may be 7 days or longer, but typically the lender can get your loan application reviewed in a few days.

Featured term of the day

homeowners insurance is a contract between an insurance company and a homeowner to cover certain types of damage to the property and its contents, theft of personal possessions, and liability in case of lawsuits based on incidents or events that occur on the property.

Homeowner's Insurance

homeowners insurance is a contract between an insurance company and a homeowner to cover certain types of damage to the property and its contents, theft of personal possessions, and liability in case of lawsuits based on incidents or events that occur on the property.

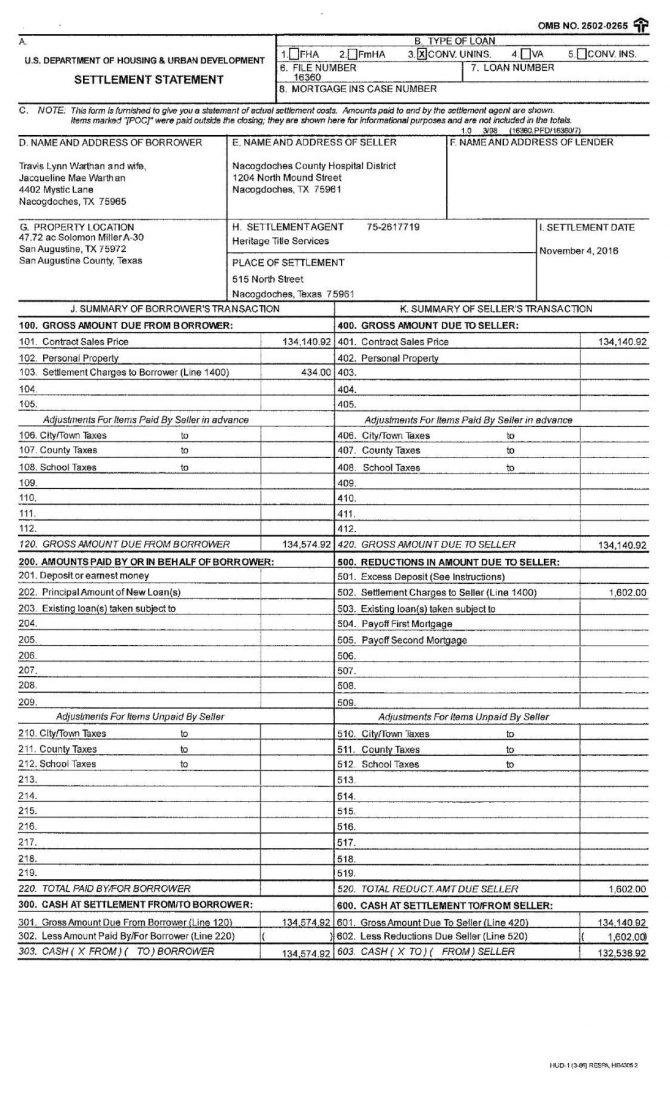

What is a settlement statement?

A settlement statement is an itemized list of fees and credits summarizing the finances of an entire real estate transaction. It serves as a record showing how all the money has changed hands line by line.

Who is responsible for preparing the settlement statement?

Whoever is facilitating the closing — whether it be a title company, escrow firm, or real estate attorney — will be responsible for preparing the settlement statement.

Is a settlement statement the same as a closing statement?

Yes, a settlement statement is the same as a closing statement, though “settlement” is the formal term most likely to be used by the real estate industry.

What is an ‘excess deposit’ at closing?

A particular line item that causes confusion on the seller’s settlement statement is the “Excess Deposit.” What is an excess deposit, and who will receive the funds listed on that line?

What does an impound account do at closing?

At closing the buyer sets up an impound account that allows them to bundle the cost of their mortgage principal, taxes, mortgage insurance, and other monthly costs into one payment. The lender likes this because they can make sure the new owner will keep up to date with all the payments associated with the home.

Do you get a copy of closing disclosure?

Sellers do not typically receive a copy of the Closing Disclosure. In a cash transaction, there is no need for a Closing Disclosure since no one is borrowing money — however, buyer and seller would still receive a settlement statement summarizing their costs and any payouts.

Does the seller get a closing statement?

Buyers tend to sign the bulk of the paperwork at closing, making some sellers wonder if they will even receive a settlement statement.

What is settlement statement?

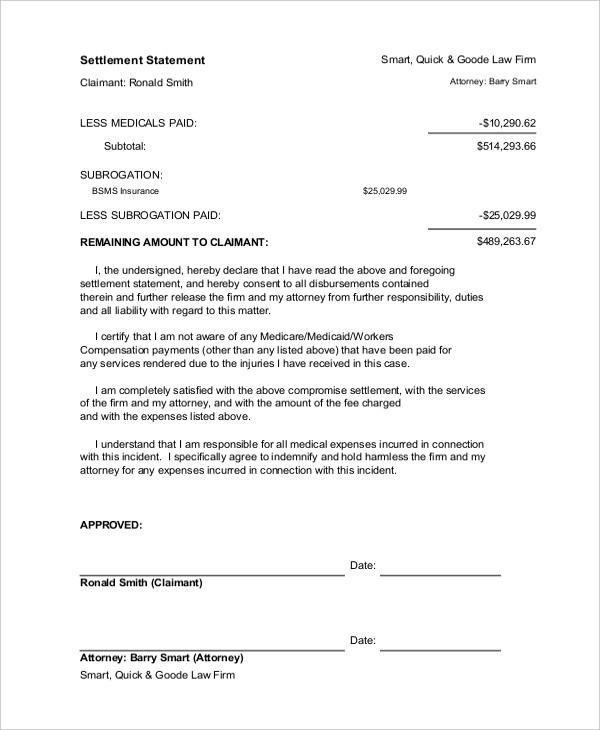

The settlement statement is your audit trail and it should be reviewed and signed by both the client and the lawyer. It defines the proposed disposition of the settlement fund check and should include the following:

Where are settlement funds deposited?

Settlement funds are always deposited directly into your law firm’s trust account and are paid to parties of the settlement from the trust account. A settlement check is never directly deposited into your firm’s operating account.

How long does it take to get a settlement check?

Remember, the settlement check must get deposited into your trust account and the funds need to be available to withdraw. This may take two to three days, depending on your bank’s deposit rules and the amount of the check being deposited. Trust accounting has rules that need to be followed.

What should a contingent fee agreement explain?

In the case when a settlement is not reached and there is no settlement check for the client, the fee agreement should also explain what expenses or fees the client will be responsible for paying, if any. As an example, below is a sample of text that may be used in a contingent fee agreement.

What do you write on a trust check?

On the check, write the case number, client name and case description. (This is good risk management if you ever need to re-create your trust accounting records.)

What is the best practice for handling settlement funds?

Best practices for handling settlement funds starts with a properly written and executed contingent fee agreement. This document should clearly communicate to the client how funds from a settlement check will be disbursed. In the case when a settlement is not reached and there is no settlement check for the client, the fee agreement should also explain what expenses or fees the client will be responsible for paying, if any.

Can you write checks to all parties on a settlement?

Write checks and receive payments for your portion of the settlement. Once funds are available, you can write checks to all of the parties listed on the settlement statement. All funds get disbursed directly out of your trust bank account and recorded in the client’s trust account ledger.

What is escrow disbursement?

Disbursing Funds As An Escrow Agent After A Settlement Or Judgment

How does an attorney handle money paid in a settlement?

When you are involved in any sort of accident or injury case, the money paid by the defendant as part of the case will go to an escrow account . A truck accident attorney or injury attorney for the plaintiff will have control ...

What happens if you contact a defendant in a court case?

If you get involved or contact your defendant, you could be found in breach of your settlement or judgment agreement . A judge could nullify your damages, and you will receive nothing. Conclusion.

Can you complain about escrow payments?

For example, a defendant may stop paying into the escrow account as agreed. You cannot complain to the defendant or their attorney because you do not have the legal authority to force them to make the payments. Tell your lawyer that you need to be paid, and your lawyer will take the matter back to court.

Can you take escrow money back to court?

A proper escrow attorney will ensure that you are paid from the escrow account that was established, and you can take your case back to court if you believe that the defendant has not fulfilled their obligations.

What is disbursement accounting?

Disbursement Accounting. If you are represented by an attorney, she is required to provide you with a detailed accounting of the disbursement of your settlement funds. The accounting should indicate the initial settlement amount, amount paid to the attorney and any expenses deducted from the settlement.

How are settlements paid?

Settlements for relatively minor injuries, for example, are generally paid in one lump sum shortly after the settlement is reached. Larger settlements, however, may be paid in installments over a period of months, or even years. Regardless of whether the agreement is for a lump sum or installment payments, the funds are generally sent to your attorney, if you are represented by one. The reason for this is so your attorney's fees can be deducted from the funds, and any other bills for which your attorney has agreed to be responsible. The remainder is paid out to you.

What happens if you settle a lawsuit out of court?

If you filed a lawsuit against someone and subsequently reached an out-of-court settlement, the funds representing the settlement must be disbursed to you. How long it takes to disburse the funds and the process for disbursement, or payment of funds, varies depending on the type of lawsuit, jurisdiction and amount and terms of the settlement.

Do you have to file a lawsuit to settle a lawsuit?

Reaching a Settlement. Technically, a lawsuit does not have to be filed in order to reach a settlement for injuries you have suffered. Often, your attorney will contact the negligent party and attempt to negotiate a settlement without filing a lawsuit.

Can you pay a settlement in installments?

Larger settlements, however, may be paid in installments over a period of months , or even years. Regardless of whether the agreement is for a lump sum or installment payments, the funds are generally sent to your attorney, if you are represented by one. The reason for this is so your attorney's fees can be deducted from the funds, ...

Can a lawsuit be settled out of court?

Oftentimes, the parties are free to reach an out-of-court settlement until, and even after, the lawsuit is presented to a judge or jury. Once the settlement amount and terms have been agreed upon, the defendant must initiate the process of disbursing the settlement.

What is escrow settlement?

The escrow/settlement company is responsible for carrying out the instructions from the various parties involved including lenders, other financial institutions, real estate agents, and borrowers. The responsibilities include but are not limited to receiving funds, wiring funds, ordering payoffs and surveys, examining the title abstract and clearing title, preparing and issuing a title commitment, preparing and distributing a preliminary HUD-1, recording deeds, mortgages, and deeds of trust, preparing and issuing a policy of title insurance, and returning all documentation to the correct companies/government agencies. The escrow/settlement company is also responsible for disbursing funds to lenders (payoffs), sellers (proceeds), and third parties as instructed.

What is Excalibur Title and Escrow?

Excalibur Title & Escrow, LLC is a licensed, bonded, and insured Maryland title company with its headquarters conveniently located in Frederick, in central Maryland. As a part of our licensing and bonding we are authorized to receive and disburse funds pursuant to the terms of any contract for the sale of real property and the instructions provided by lenders. We can do this for any transaction that closes anywhere in the State of Maryland, not just in Frederick. Receiving and disbursing funds is an integral part of the settlement and closing process. Funds from a buyer’s lender, or an owner’s lender, in the case of a refinance, must be received and held by a third party for settlement. Title companies perform this function. The funds are held in escrow until the day of settlement, at which time they are disbursed to various local and state authorities, as payoffs to lenders, for liens and taxes, to pay fees and closing costs, and as net proceeds to sellers, and in the case of a refinance, to the borrowers. All funds are received and disbursed according to the contract, lenders’ instructions, and the HUD-1 settlement statement which is reviewed and approved by all parties prior to signing any other closing documents.