Full Answer

Does PayPal charge fees to sellers?

Something important to consider when it comes to PayPal fees is the “fixed fee.”. Whether the products you sell are economically priced or luxury items, you will have to pay 2.9% of the money you receive from the transaction. However, adding 30 cents to charges for items priced at $2.00 is not the same as for items priced at $200.

What is a good sentence with settlement?

use "settlement" in a sentence The government of Tunisia supports the peaceful settlement of conflicts, and dialog in its relations with foreign powers. A peace settlement in the Middle East would be a major triumph for American diplomacy. The last ice age had a profound effect upon the settlement patterns of man.

How much do lawyers charge to settle an estate?

Lawyers usually use one of three methods to charge for probate work: by the hour, a flat fee, or a percentage of the value of the estate assets. Your lawyer may let you pick how you pay—for example, $250/hour or a $1,500 flat fee for handling a routine probate case. Hourly Billing. Many probate lawyers bill clients by the hour.

Who pays closing costs when selling a house by owner?

Usually the buyer pays for most of the closing costs, but there are instances when the seller may have to pay some fees at closing too. We understand it can be confusing to those that have never been through the process before, so we’ve put together a review to help clear things up and get you feeling confident about the home-buying process.

What are sellers charges?

In an auction, a fee paid to the person or organization holding the auction on top of the highest bid. For example, if one bids $1,000 for an antique bed, the seller may have to pay a 10% buyer's fee (or $100) if that is the winning bid. A seller's fee is one way an auctioneer makes money from the auction.

Who pays closing costs in Iowa?

Typically, both buyers and sellers pay closing costs, with buyers generally paying more than sellers. The buyer's closing costs typically run 5 to 6 percent of the sale price, according to Realtor.com.

Do sellers pay closing costs in NC?

In North Carolina, closing costs are paid by both the buyer and seller. Your closing costs will vary depending on the home's purchase price, the location and whether you're paying in cash.

Who pays closing costs in Tennessee?

Both the buyer and seller share the responsibility for paying the total closing costs at the end of the transaction, though it will not be an exact 50-50 split. In Tennessee, sellers usually pay for the title service and closing fees, title transfer taxes, owner's title insurance, and recording fees.

Does the seller pay closing costs in Iowa?

Seller closing costs are fees you pay when you finalize the sale of your home in Iowa. These include the costs of verifying and transferring ownership to the buyer and many are unavoidable. In Iowa, you'll pay about 0.8% of your home's final sale price in closing costs, not including realtor fees.

What is the average closing cost on a house in Iowa?

Homebuyers in Iowa can breathe a big sigh of relief: Closing costs in the Hawkeye State are some of the lowest in the country, averaging $1,803 for a home priced at $156,726 according to a 2021 report by ClosingCorp. That price tag makes up 1.15 percent of the home's price tag.

Does the seller pay closing costs?

Typically, buyers and sellers each pay their own closing costs. A home buyer is likely to pay between 2% and 5% of their loan amount in closing costs, while the seller could pay 5% to 6% of the sale price to their real estate agent.

How much do you pay in taxes when you sell a house in NC?

Excise Tax/Revenue Stamps: The State of North Carolina charges an excise tax on home sales of $2.00 per $1,000.00 of the sales price. Excise tax is customarily paid by the Seller, but payment is dictated by the sales contract and can be negotiated for either party.

Who pays transfer taxes in North Carolina?

the sellerNORTH CAROLINA REAL ESTATE TRANSFER TAX When ownership in North Carolina real estate is transferred, an excise tax of $1 per $500 (or fraction thereof) is levied on the value of the property (i.e. $600 transfer tax on the sale of a $300,000 home). This tax is typically paid by the seller.

How much is closing cost in TN?

In Tennessee, closing costs usually amount to around 0.9% of a home's sale price, not including realtor fees. With a median home value of $303,453, sellers can expect to pay around $2,770 at closing.

Who pays title in Tennessee?

We've already clarified that in Tennessee, the seller in a real estate transaction is typically the one who pays for title insurance.

Who usually pays closing costs?

buyerClosing costs are paid according to the terms of the purchase contract made between the buyer and seller. Usually the buyer pays for most of the closing costs, but there are instances when the seller may have to pay some fees at closing too.

What are closing costs for buyer in Iowa?

Closing Costs for Iowa Homes: What to Expect As a general rule, you can expect to pay closing costs of between 2%–5% of the home's value. The median price of homes that sold in Iowa in the last year was $152,200. With that price and closing costs of 3%, you can expect to pay $4,566 in closing costs.

How many months are property taxes collected at closing in Iowa?

This happens on every real estate sale in Iowa. So yes, sellers pay property taxes usually equivalent to 9 to 14 month's of taxes at closing depending on the date of closing. BUT IF YOU HAVE BEEN ESCROWING FOR TAXES…

How much does a title search cost in Iowa?

Our FeesNew AbstractsVariable*Pre-Closing Lien Search or Title Report$200Lien Search Title Report (including follow up Title Report after closing)$250Tax Certificate Holder – Lien Search Title Report$250Pre-Closing Search (after prelim or title report)$506 more rows

What closing costs do buyers face?

Buyers face numerous closing fees, including for lender origination, appraisal, credit report, escrow, and mortgage recording. That's in addition t...

What closing costs are legally required in my state?

The exact closing costs vary from state to state — even among counties and cities. Before closing, talk to your real estate agent or real estate at...

Does the seller have to pay the buyer's closing costs?

No, who pays for closing costs is part of negotiation. However, offering to cover a portion of the buyer's fees (also known as a seller concession)...

How to find out when a utility settlement is due?

Call your various utility companies and let them know the date of settlement.

What are closing costs?

Closing costs include taxes, lender fees and title fees that a homebuyer pays at settlement . Watch this video to prepare for the process.

How much does a seller pay for closing costs?

Closing costs for sellers of real estate vary according to where you live, but as the seller you can expect to pay anywhere from 6% to 10% of the home’s sales price in closing costs at settlement. This won’t be cash out of the seller’s pocket; rather it will be deducted from the profit on your home—unless you are selling with very low equity on your mortgage. In this case, sellers may need to bring a little cash to the table to satisfy your lender—and some closing costs may be held in escrow.

What are closing costs for sellers?

Additional closing costs for sellers of real estate include liens or judgments against the property; unpaid homeowners association dues; prorated property taxes; escrow fees; and homeowners association dues included up to the settlement date.

What are the taxes that are included in closing costs?

Transfer taxes, recording fees, and property taxes are key parts of a seller’s closing costs. Transfer taxes are the taxes imposed by your state or local government to transfer the title from the seller to the buyer. Transfer taxes are part of the closing costs for sellers.

How much commission does a real estate agent get for a $350,000 purchase?

For a $350,000 purchase price, the real estate agent’s commission would come to $21,000. Buyers have the advantage of relying on sellers to pay real estate agent commissions. 2. Loan payoff costs. Most home sellers often seek out a sales price for their home that will pay off their mortgage and satisfy their lenders.

Do you have to include closing costs when selling a house?

Also, don’t forget to estimate some of the closing costs associated with preparing to sell, such as cosmetic repairs or improvements to make your home more attractive to buyers. Those closing costs may be returned with a higher sales price, but you should still include them in your calculations.

Do you have to pay attorney fees for a real estate sale?

If you have your own attorney represent you at the settlement of your real estate sale, the seller may have to pay attorney fees as part of closing costs. Market traditions vary, so while in some areas both the buyers and sellers have their own attorneys, in others it’s more common to have one settlement attorney for the real estate transaction.

Do you factor closing costs into the sale price?

If you’re monitoring the value of your home so you can sell it and reap a worthwhile profit, don’t forget to factor in the closing costs for sellers into the sale price.

What fees do sellers pay at closing?

Here are the most common closing costs that sellers face at closing, along with how much each typically costs.

How much does a seller owe in closing costs?

Meanwhile, sellers owe closing costs equivalent to 8-10% of the final sale price. Given the U.S. median home value of $247,084, this comes out to an average of $19,000-$24,000, which is a huge weight on sellers. The biggest chunk of a seller’s closing costs goes to real estate agent fees. Because the seller usually pays for both their own agent and the buyer’s agent fees, commissions average 5-6% of the home sale. An additional 2-4% of the seller’s closing costs come from taxes and fees.

What is seller concession?

Buyers can ask sellers to cover some of their closing costs. These requests are known as seller concessions. They can cover specific closing costs or be a percentage of total costs. Common seller concessions include:

Why should a buyer include closing costs into a loan?

Why should a buyer include closing costs into a loan? If you need money upfront for repairs or building an emergency fund after spending lots of savings, including your closing costs into the loan is a wise financial decision.

How much can a seller contribute to a VA loan?

In the sale of an investment property, the seller can contribute up to 2%. With a VA loan, the seller can contribute up to 4%. With FHA & USDA loans, the seller can contribute up to 6%. Now, let’s talk about what sellers can do to reduce their closing costs.

What is escrow fee?

Escrow fee: These fees are paid to a title company or to an escrow company for their services (e.g. paperwork) in setting up escrow. Typically, earnest money is included in escrow. In a real estate transaction, this closing fee is split between buyer and seller.

How much does a buyer pay at closing?

A majority of these costs go to the mortgage loan lender. According to CostCorp, the average cost to buyers at closing is $5,749 including taxes. These fees typically consist of the lender’s title, owner’s title, appraisals, settlement fees, recording fees, ...

When are sellers charged for taxes?

Seller is charged their portion of the current year taxes from January 1st to the closing date. Based on either prior year taxes or most recent mill levy and assessed value. This determines pursuant to the contact.

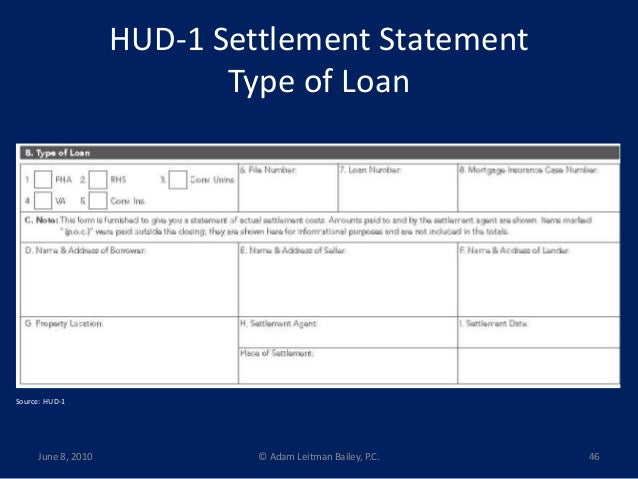

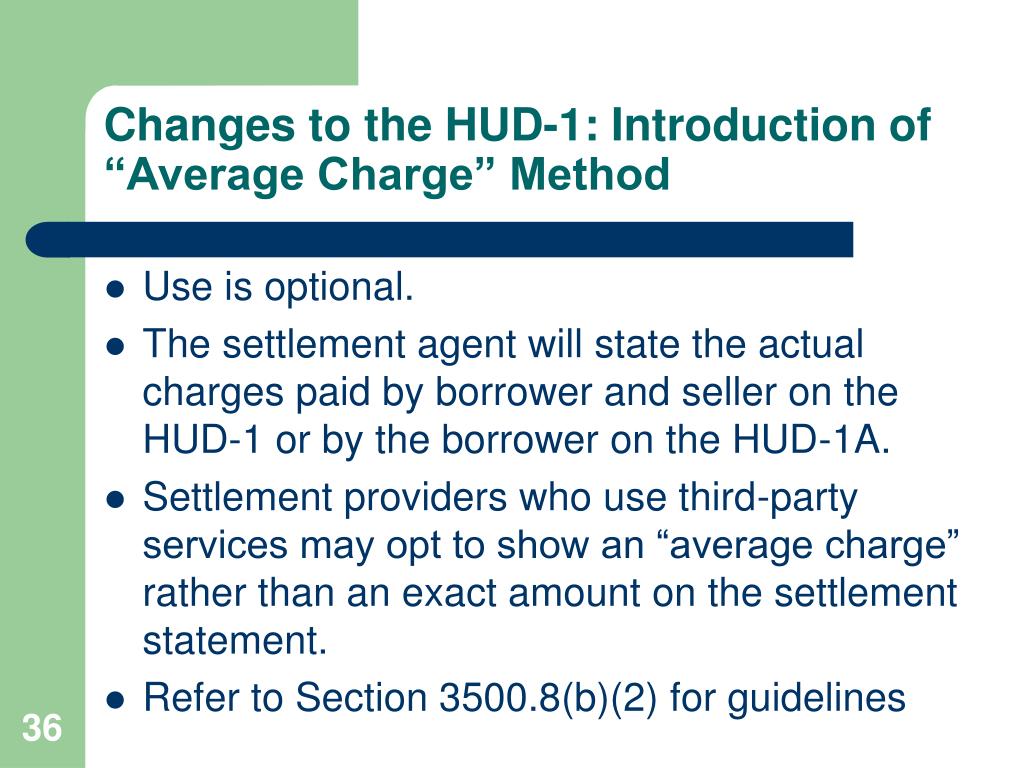

What is settlement statement?

A settlement statement is the statement that summarizes all the fees and charges that both the home-buyer and seller face during the settlement process of a housing transaction. The table below gives further explanation as to what these fees and charges are for both buyer and seller.

What is a mortgage payoff?

Mortgage Payoff. The payoff amount is sent to the existing mortgage company and includes additional interest a few days beyond closing. Title Insurance (Owner’s Policy) Typically paid for by the seller, however the contract gives the option for either buyer or seller to pay.

What are the costs associated with selling a house?

Costs associated with selling a house: Home preparations. While not the typical closing costs, these are some of the contributing costs to sell a house: Cleaning: Before your first open house or showing, consider hiring a house cleaner to do a deep clean.

How much does it cost to sell a house?

The overall transaction costs of selling a house include standard closing costs as well as potential charges associated with preparing the home for sale, relocating your belongings (and sometimes yourself), and offering concessions to the buyer.

What is closing cost?

To clarify, closing costs include up to 6% in commissions (to your agent and the buyer’s agent), and an additional 2% to 4% in transfer taxes and property taxes, attorney fees, and real estate fees like title insurance, HOA transfers, and escrow fees.

What happens if you pay off your mortgage at closing?

Outstanding mortgage balance: If you’re still paying a mortgage on the home, part of the closing process will include paying off the balance of your mortgage, prorated to the date of sale. You’ll want to check with your mortgage company to see if there is a prepayment penalty as well.

How much does a one year warranty cost?

A one-year home warranty can cost $300-$500, depending on coverage. Credits toward closing costs: Another concession buyers often request is that the seller cover all or part of the buyer’s closing costs, which effectively minimizes the amount of cash a buyer needs to bring to the closing.

How much commission do you pay for closing costs?

Agent commission: The majority of your closing costs come from paying commission to real estate agents. It’s typical that the seller pays both 3% to their own agent and 3% to the buyer’s agent. You can sometimes negotiate down your own agent’s commission, or consider using a discount agent, who offers limited services in exchange for a lower cut.

How much does it cost to take professional photos of a house?

The investment is small, but the payoff can be huge. Standard professional photos cost $150-$200, depending on the market. If you’re using a full-service listing agent, they may cover the cost for you.

What is a settlement statement?

A settlement statement is an itemized list of fees and credits summarizing the finances of an entire real estate transaction. It serves as a record showing how all the money has changed hands line by line.

How much does it cost to sell a house in 2021?

A 2021 study we conducted found that it costs $31,000 on average to sell a home. But ideally your sale price covers the costs of all the transaction fees, your mortgage payoff, and then some, leaving you with a tidy sum to add to your bank account.

Is a settlement statement the same as a closing statement?

Yes, a settlement statement is the same as a closing statement, though “settlement” is the formal term most likely to be used by the real estate industry.

What is a seller's net sheet?

The seller’s net sheet is not an official document but an organizational worksheet that your agent will fill out to estimate how much you’ll pocket from your home sale after factoring in expenses like taxes , your real estate agent’s commission, your remaining mortgage, and escrow fees.

When are property taxes prorated?

For instance, say you get billed for property taxes in February to cover the previous year. If you’re closing on a sale on April 30, the yearly property tax is “prorated” or calculated for the first four months of the year, and it’s reflected in this section.

Do you have to pay taxes at closing?

A buyer might be required to pay some charges, like homeowners insurance premiums or county taxes, in advance at closing.

Who is responsible for preparing the settlement statement?

Whoever is facilitating the closing — whether it be a title company, escrow firm, or real estate attorney — will be responsible for preparing the settlement statement.

Who provides settlement services?

The decision about who provides settlement (also known as closing or escrow) services varies from one market to another. In many places, the buyer chooses the settlement company, but in others the seller chooses. When closing on a house, the buyer will provide funds to buy your home and the settlement agent will review the sales agreement to determine what payments you’ll receive. The title to the property is transferred to the buyers and arrangements are made to record that title transfer with the appropriate local records office.

What happens if the appraisal comes in higher than the sales price?

If the appraisal comes in higher than the sales price, then the buyers can relax and be happy that they have purchased a home for less than its market value. Once the contract has been signed, you as the seller cannot renegotiate the price higher. However, if the appraisal comes in lower than the sales price, then the buyer’s lender will limit the loan amount to that lower value. The buyer may have to come up with additional cash to cover the financing gap or may ask you to renegotiate the contract. Your REALTOR® can advise you about the best way to handle this situation, but in any case you and the buyer are also bound by the contract terms.

What are adjustments at closing?

At a typical closing, adjustments are made to the final amounts owed by the buyer and you as the seller. For example, if you’ve been paying your property taxes through an escrow account, you may be credited extra for prepaid taxes or you may receive less money at settlement if the property taxes haven’t been paid properly.

What do you need to do before closing on a house?

Before closing on a house, you need to get to the settlement table. You’re near the end of the process of selling your home, but don’t breathe a sigh of relief just yet. While it’s certainly true that you can lighten up on the perfectionism required to show your home at any moment, as a seller you still need to cooperate with your buyer, ...

Can you move onto your next home after a settlement?

Once the settlement papers are signed and the house keys are transferred, you’re free to move onto your next home.

Can you negotiate a settlement date with a buyer?

Buyers and sellers typically negotiate a settlement date that is mutually agreeable. If you have sold your home and are not yet ready to move into your next residence, you can sometimes negotiate a “rent-back” with the buyer that allows you to stay in the home after the settlement by paying rent to the buyer.