If your lender is charging the flat fee, there’s a host of things you cannot pay for, including: Loan application or processing fees Interest rate lock-in fees

Full Answer

What happens if the buyer does not settle?

If the buyer is unable to settle on settlement date, the seller can choose to terminate the contract, retain the deposit and may sue the buyer for damages and/or specific performance. If the Seller agrees to extend the settlement date, they can also charge penalty interest.

Do you pay broker fees before or after settlement?

You will pay some of these fees, such as for credit reports and appraisals, before settlement. Other fees, such as those to a mortgage broker, you will pay at settlement. Because costs may vary from one area to another and from one lender to another, the following example is an estimate only.

Who pays for what at settlement?

The less you have to pay in settlement costs, the more funds you will have for other things. Different regions have different customs and practices regarding who pays for what at settlement. Buyers and sellers are free to negotiate certain fees. In slow-moving real estate markets, the seller may agree to pay points or fees for the buyer.

What are the costs of a mortgage settlement?

A Consumer's Guide to Mortgage Settlement Costs 1 Loan origination fee. ... 2 Points. ... 3 Appraisal fee. ... 4 Title search. ... 5 Title insurance. ... 6 Settlement companies and others conducting the settlement. ... 7 The good faith estimate. ... 8 Truth in lending information. ... 9 The HUD-1 statement. ...

What is the Real Estate Settlement Procedures Act?

What is a referral in a settlement?

Is there an exception to RESPA Section 8?

Can a lender give a consumer a gift?

Is a gift a violation of RESPA?

See 2 more

About this website

What are two things that RESPA prohibits?

RESPA Section 8(a) and Regulation X, 12 CFR § 1024.14(b), prohibit giving or accepting a fee, kickback, or thing of value pursuant to an agreement or understanding (oral or otherwise), for referrals of business incident to or part of a settlement service involving a federally related mortgage loan.

Which Act prohibits the payment of kickbacks between settlement service providers?

§ 1024.14 Prohibition against kickbacks and unearned fees. (a) Section 8 violation. Any violation of this section is a violation of section 8 of RESPA (12 U.S.C.

Which of the following transactions is exempt from RESPA?

Transactions generally not covered under RESPA include: “an all cash sale, a sale where the individual home seller takes back the mortgage, a rental property transaction or other business purpose transaction.” “The sale of a loan after the original funding of the loan at settlement is a secondary market transaction.

What are the 6 RESPA triggers?

An application is defined as the submission of six pieces of information: (1) the consumer's name, (2) the consumer's income, (3) the consumer's Social Security number to obtain a credit report (or other unique identifier if the consumer has no Social Security number), (4) the property address, (5) an estimate of the ...

Which of the following would not be considered a settlement service?

Which of the following would not be considered a settlement service? The answer is servicing.

Which of the following activities is not allowed under the real estate Settlements and Procedures Act?

Which of the following activities is not allowed under the Real Estate Settlements and Procedures Act? A broker having any business relationship with an insurance company that is involved in the broker's transaction.

What does RESPA not apply to?

RESPA does not apply to extensions of credit to the government, government agencies, or instrumentalities, or in situations where the borrower plans to use property or land primarily for business, commercial, or agricultural purposes.

Which are prohibited by RESPA?

RESPA Section 8(a) prohibits the giving and accepting of kickbacks (e.g., cash or other “things of value” as defined in RESPA and Regulation X) pursuant to any agreement or understanding to refer settlement service business or business incident to a real estate settlement service in connection with those loans.

What transactions would be subject to RESPA?

Transaction Types Regulated by RESPAmost loans secured by a lien (first or subordinate position) on residential property;home purchase loans;lender approved assumptions;refinance loans;loans for property improvement;HELOC, home equity lines of credit; and.reverse mortgages.

What is the 3 7 3 rule in mortgage terms?

Timing Requirements – The “3/7/3 Rule” The initial Truth in Lending Statement must be delivered to the consumer within 3 business days of the receipt of the loan application by the lender. The TILA statement is presumed to be delivered to the consumer 3 business days after it is mailed.

What is the 3 day Trid rule?

One of the important requirements of the rule means that you'll receive your new, easier-to-use closing document, the Closing Disclosure, three business days before closing. This will give you more time to understand your mortgage terms and costs, so that you know before you owe.

What is the Trid 7 day rule?

Under the TRID rule, the creditor must deliver or place in the mail the initial Loan Estimate at least seven business days before consummation, and the consumer must receive the initial Closing Disclosure at least three business days before consummation.

Which of the following loans are covered by RESPA quizlet?

What loans are covered (regulated) by RESPA? Federally regulated mortgage loans that are secured by a first or subordinate lien on residential property. Residential property includes dwellings design for the occupancy of 1 to 4 families and individual units of condominiums, cooperatives, mobile homes, and trailers.

Which action is not a requirement under TILA RESPA?

The TILA-RESPA rule applies to most closed-end consumer credit transactions secured by real property, but does not apply to: HELOCs; • Reverse mortgages; or • Chattel-dwelling loans, such as loans secured by a mobile home or by a dwelling that is not attached to real property (i.e., land).

Which of these loans would RESPA rules apply to?

The Real Estate Settlement Procedures Act (RESPA) is applicable to all “federally related mortgage loans,” except as provided under 12 CFR 1024.5(b) and 1024.5(d), discussed below.

Which of the following is required by the Real Estate Settlement Procedures Act?

The Real Estate Settlement Procedures Act (RESPA) is a federal consumer law that requires certain disclosures about the mortgage and settlement process and prohibits certain practices that increase the costs of settlement services, such as kickbacks and referral fees that can increase settlement costs for home buyers.

Real Estate Settlement Procedures Act FAQs

1 RESPA FAQS Real Estate Settlement Procedures Act FAQs 1 VERSION 1 | LAST UPDATED 10/7/2020 This is a Compliance Aid issued by the Consumer Financial Protection Bureau.

Real Estate Settlement Procedures Act (RESPA)

Featured topic. On Oct. 7, 2020, the Bureau published a set of frequently asked questions (FAQs) discussing RESPA Section 8, and its application to Marketing Services Agreements and to Gifts and Promotional Activities.

GTranslate - HUD.gov / U.S. Department of Housing and Urban Development ...

Real Estate Settlement Procedures Act RESPA seeks to reduce unnecessarily high settlement costs by requiring disclosures to homebuyers and sellers, and by prohibiting abusive practices in the real estate settlement process. All borrowers must be given information about real estate transactions, settlement services, and relevant consumer protection laws, as well as the

CFPB Consumer Laws and Regulations RESPA

CFPB Consumer Laws and Regulations RESPA CFPB August 2013 RESPA 2 implementing regulations.4 In December 2011, the CFPB restated HUD’s implementing regulation at 12 CFR Part 1024 (76 Fed. Reg. 78978) (December 20, 2011).

What is the Real Estate Settlement Procedures Act?

The questions and answers below pertain to compliance with the Real Estate Settlement Procedures Act (RESPA) and certain provisions of Regulation X. This is a Compliance Aid issued by the Consumer Financial Protection Bureau. The Bureau published a Policy Statement on Compliance Aids, ...

What is a referral in a settlement?

Referrals include oral or written action directed to a person that has the effect of affirmatively influencing a person’s selection of a provider of a settlement service or business incident to or part of a settlement service. That effect can be on any person in connection with the settlement service or business incident thereto who will pay for the service or a charge attributable, in whole or in part, to that service or service provider. 12 CFR § 1024.14 (f) (1). Additionally, referrals include requiring the use by the person paying for the service of a particular provider of settlement service-related business. 12 CFR §§ 1024.14 (f) (2) and 1024.2 (b) (“required use”). Finally, note that prohibited referrals are not limited to those directed to consumers. They might be directed to a number of sources, such as appraisers, real estate agents, title companies and agents, lenders, mortgage brokers, or companies that provide information in connection with settlements, such as credit reports and flood determinations. 12 CFR § 1024.14 (b) and (f).

Is there an exception to RESPA Section 8?

There is no exception to RESPA Section 8 solely based on the value of the gift or promotion. Accordingly, settlement service providers should carefully analyze whether providing gifts or opportunities to win prizes to referral sources could violate the prohibitions under RESPA Section 8.

Can a lender give a consumer a gift?

Generally, yes. RESPA Section 8 does not prohibit a lender or other settlement service provider from giving a consumer a gift or an incentive (e.g., a discount, refund of fees, chance to win a prize, etc.) for doing business with that entity.

Is a gift a violation of RESPA?

Under RESPA Section 8 (a), gifts and promotions generally are “things of value” and therefore could, depending on the circumstances, violate RESPA Section 8 (a). If the gifts or promotion are given or accepted, as part of an agreement or understanding, for referral of business incident to or part of a real estate settlement service involving a federally related mortgage loan, they are prohibited.

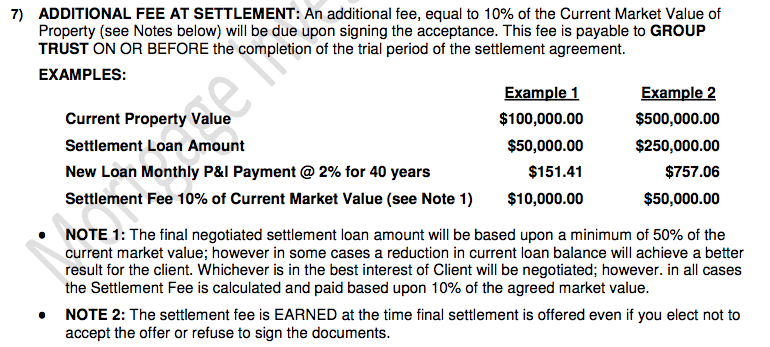

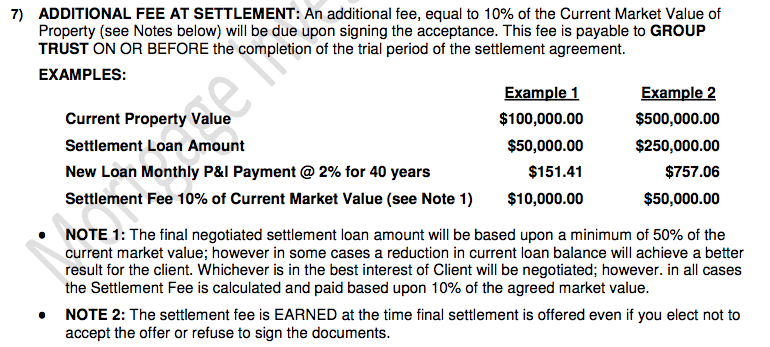

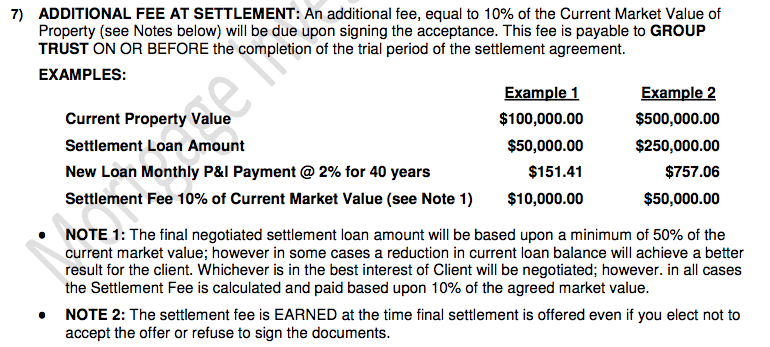

What is mortgage debt settlement?

Mortgage debt settlement has become an increasingly popular concept, with rising foreclosures and government bailout programs designed to help struggling homeowners. Mortgage debt settlement can take one of two forms: you can restructure or modify your mortgage with your lender, adjusting the principle that you owe if you are underwater on your ...

What is the best way to sell a house if you don't want to keep it?

Short sell your home. This is the best alternative for those who don't want to keep the house. With a short sale, you get your bank to agree to let you sell the home for below the amount you owe, and to accept the full proceeds from the sale as satisfaction of the debt, forgiving the remaining balance.

Can you renegotiate your mortgage?

Generally, you can try to: Renegotiate the terms of your mortgage. Usually, when you do this, the bank will try to get you to agree to pay back the full amount that you owe but will either lower your interest rate or stretch out your repayment terms so the monthly payment becomes more affordable.

Can you settle mortgage debt?

Mortgage debt settlement has become an increasingly popular concept, with rising foreclosures and government bailout programs designed to help struggling homeowners. Mortgage debt settlement can take one of two forms: you can restructure or modify your mortgage with your lender, adjusting the principle that you owe if you are underwater on your house, or you can arrange a short sale if you are underwater on your house. With the former, you keep your home while with the later, you sell your home.

How much can a seller pay for closing costs?

In addition, sellers can pay up to 4 percent of the loan amount in concessions.

Who Pays Closing Costs?

Negotiation between VA loan homebuyers and sellers dictates who pays how much of the closing costs. There is no VA maximum concerning how much sellers can cover in terms of loan-related closing costs, so buyers can ask home sellers to pay for everything.

What to do with VA loan estimate?

Using the Loan Estimate as a launching point, borrowers should talk with their VA loan specialist and real estate agent about the best closing cost approach. Some VA loan users have the capital to pay some closing costs, while others prefer to find sellers who are willing to pay more upfront to sell their property.

Can you pay closing costs on a VA loan?

VA Loan Fees the Borrower Cannot Pay. When you go to purchase a home with a VA guaranteed mortgage, you’ll typically encounter fees like closing costs and other expenses. How those get paid is often a matter of negotiation between you and the seller. But there are also fees the VA does not allow the buyer to pay.

Do you get compensation for listing a lender?

When listing lenders or partners we may also receive compensation that impacts how, where and in what order those partners appear. Our partnerships allow us to provide a non-intrusive, user-friendly way to learn about mortgage finance options.

Can a buyer be charged for a lawyer?

If the buyer chooses to pay for his or her own attorney, that's the buyer's call, but the buyer can't be charged for the bank's legal representation. The VA also prohibits a real estate agent from charging the buyer a commission.

Can you pay for a termite inspection?

Cost of termite inspection ( except in nine states) It is legal for a house hunter to contact and use a "buyer broker" to find a suitable property, but buyers cannot pay brokerage fees and commissions.

What happens if a buyer doesn't settle on a contract?

If the buyer is unable to settle on settlement date, the seller can choose to terminate the contract, retain the deposit and may sue the buyer for damages and/or specific performance. If the Seller agrees to extend the settlement date, they can also charge penalty interest.

Why is my loan settlement delayed?

Problems with obtaining timely financial approval are one of the most common causes of settlement delay for buyers. Buyers need to sign loan documents and other associated documentation before settlement.

What is a shortfall in a mortgage settlement?

A shortfall occurs when the value of a seller’s remaining mortgage is greater than the property’s sale price, forcing the seller to pay the difference to discharge the mortgage. Most sellers are aware of whether they have a shortfall or not.

What happens if a seller forgets to return a transfer document?

If the seller forgets to return the transfer documents (which will transfer ownership of the property to the buyer), this can cause significant delays to settlement. That’s why we recommend that all sellers have a conveyancing lawyer who can attend to these details and remind the seller when documents are due.

How long does it take to release a mortgage?

Each financial institution has a different turnaround time for releasing a mortgage, but often they require a minimum of 21 business days.

How long does a seller have to release a property before it is settled?

Some sellers do not give the release authority to the bank until the property goes unconditional and this may leave only one or two weeks before settlement. Some banks can turn it around with such short notice, but we certainly do not recommend this approach.

What is a pre settlement inspection?

A pre-settlement inspection is your buyer’s opportunity to inspect your property before the final payment is made. Occasionally, buyers leave it too late to perform a pre-settlement inspection and discover that something unexpected has happened to the property since they signed the contract.

What is the mortgagee letter 06-04?

Mortgagee Letter 06-04 virtually eliminated the prohibited closing costs, with the exception of the tax service fee. The same letter prohibited loan origination fees of more than 1 percent; however, FHA removed the cap in 2010.

Why do FHA loans require impound accounts?

As such, FHA requires impound accounts to ensure that necessary, recurring fees such as property taxes and hazard insurance payments remain up-to-date. Unpaid property taxes can become liens upon the property, allowing the government to seize it.

What is a reverse mortgage?

FHA offers a reverse mortgage known as the Home Equity Conversion Mortgage (HECM). Borrowers are prohibited from paying more than $6,000 for a HECM lender's origination fee and lenders may not charge more than this total amount on any loan, according to Mortgagee Letter 08-34. This change eliminated a previous 1 percent origination fee cap on HECM loans.

Why did FHA eliminate closing costs?

Before FHA's elimination of most non-allowable closing costs, FHA borrowers were at a disadvantage when competing for homes. Because FHA prohibited buyers from paying many buyer costs, sellers had to cover them, thus diminishing their net profit on the sale of their home.

What is mortgage insurance?

The Federal Housing Administration's mortgage insurance program accounts for about one-third of the nation's home loans. FHA loan dependence by low- to moderate-income home buyers and the cash-poor or credit-challenged has re-emerged since the fall of subprime mortgages.

Can unpaid property taxes be a lien?

Unpaid property taxes can become liens upon the property, allowing the government to seize it. A tax service agency provides the lender with the property's tax bills so it can pay them on time. Lenders pass the tax service fee on to the buyer at closing. Get the Best Mortgage Rate for You | SmartAsset.com.

Do FHA borrowers have to pay closing costs?

Before FHA's elimination of most non-allowable closing costs, FHA borrowers were at a disadvantage when competing for homes. Because FHA prohibited buyers from paying many buyer costs, sellers had to cover them, thus diminishing their net profit on the sale of their home. FHA's guideline revision allows borrowers to pay any borrower closing costs considered "fair, reasonable, and customary fees and charges," HUD says.

Where is the homeowner's insurance number on a settlement statement?

The homeowner’s insurance numbers are found XXX on the settlement statement and XXX on the seller’s closing disclosure. There are two places on the settlement statement where homeowner’s insurance is addressed. However the buyer is not double paying for it.

Can you double pay for homeowner's insurance?

However the buyer is not double paying for it. First, there is always a collection of the first year’s homeowner’s insurance premium to the extent not already paid by the buyer. This takes care of the premium from the effective date of the insurance until the first year anniversary when the second year premium becomes due.

How to avoid penalties when buying a house?

To help you navigate the entire buying process and help you avoid these penalties by ensuring you’ll meet the closing date, work with an experienced, local Clever Partner Agent. Not only will your Partner Agent help you find an amazing home in your budget, but they’ll be able to manage your expectations and create a realistic timeframe so you don’t run into any surprises when in escrow and miss the closing date.

How long do you have to accept a loan offer before closing?

Once your offer is accepted, you typically have 30 to 45 days before your closing date. During this time buyers will get an inspection and finalize their financing with their lender. But, it’s also during this time when your previous champagne-popping excitement can end quite abruptly.

How much cash back do clever buyers get?

Eligible buyers receive 0.5% of the purchase price back after closing (on homes over $150,000). Reach out to Clever to connect with your Partner Agent.

What happens to earnest money deposit?

Your earnest money deposit, or your good faith money proving to the seller you have the funds to purchase the home, will be relinquished to the seller for all the trouble.

What happens if you miss a closing date?

Even if the reason you missed the closing date was out of your control and unintentional, a seller could take legal action as, technically, you are in breach of contract.

How long do you have to wait to close on a home offer?

Once your offer is accepted, you typically have 30 to 45 days before your closing date.

Can you cancel a sale if you missed the closing date?

However, depending on the contract the seller may not be able to legally cancel the sale. If you have a legitimate reason why you missed the closing date, the courts will likely rule in your favor allowing a reasonable postponement that generally gives the buyer an additional 30 days to close the sale.

What is the Real Estate Settlement Procedures Act?

The questions and answers below pertain to compliance with the Real Estate Settlement Procedures Act (RESPA) and certain provisions of Regulation X. This is a Compliance Aid issued by the Consumer Financial Protection Bureau. The Bureau published a Policy Statement on Compliance Aids, ...

What is a referral in a settlement?

Referrals include oral or written action directed to a person that has the effect of affirmatively influencing a person’s selection of a provider of a settlement service or business incident to or part of a settlement service. That effect can be on any person in connection with the settlement service or business incident thereto who will pay for the service or a charge attributable, in whole or in part, to that service or service provider. 12 CFR § 1024.14 (f) (1). Additionally, referrals include requiring the use by the person paying for the service of a particular provider of settlement service-related business. 12 CFR §§ 1024.14 (f) (2) and 1024.2 (b) (“required use”). Finally, note that prohibited referrals are not limited to those directed to consumers. They might be directed to a number of sources, such as appraisers, real estate agents, title companies and agents, lenders, mortgage brokers, or companies that provide information in connection with settlements, such as credit reports and flood determinations. 12 CFR § 1024.14 (b) and (f).

Is there an exception to RESPA Section 8?

There is no exception to RESPA Section 8 solely based on the value of the gift or promotion. Accordingly, settlement service providers should carefully analyze whether providing gifts or opportunities to win prizes to referral sources could violate the prohibitions under RESPA Section 8.

Can a lender give a consumer a gift?

Generally, yes. RESPA Section 8 does not prohibit a lender or other settlement service provider from giving a consumer a gift or an incentive (e.g., a discount, refund of fees, chance to win a prize, etc.) for doing business with that entity.

Is a gift a violation of RESPA?

Under RESPA Section 8 (a), gifts and promotions generally are “things of value” and therefore could, depending on the circumstances, violate RESPA Section 8 (a). If the gifts or promotion are given or accepted, as part of an agreement or understanding, for referral of business incident to or part of a real estate settlement service involving a federally related mortgage loan, they are prohibited.