The Equifax settlement provides two compensation options for everyone affected: 10 years of free credit monitoring or a cash payout of up to $125. 10 years of free credit monitoring This option includes four years of three-bureau credit monitoring from Experian

Experian

Experian plc is a multinational consumer credit reporting company. Experian collects and aggregates information on over one billion people and businesses including 235 million individual U.S. consumers and more than 25 million U.S. businesses. Based in Dublin, Ireland, the compan…

When will Equifax pay settlement?

Settlement benefits for eligible time spent and out-of-pocket losses are likely to begin issuing in fall 2022. The Equifax Data Breach Settlement website will provide updates. If you still have your claim number, you can enter it on the website and check the status of your claim.

What is the Equifax data breach settlement?

Equifax Reaches $700M Settlement In Data Breach; 15M Californians May Be Eligible For ReliefEquifax will pay up to $700 million to settle with the U.S. and states over a 2017 data breach that ...

How to get Equifax report?

- A copy of the child’s birth certificate

- A copy of the child’s Social Security card or a document from the Social Security Administration showing the child’s Social Security number

- A copy of your driver’s license or government-issued identification, with current address

How to dispute an Equifax credit report online?

You can file a dispute on the following sites:

- Equifax: www.myequifax.com. New users will first need to create an account. Existing users can log in using their current credentials.

- Experian: www.experian.com

- TransUnion: www.transunion.com

See more

How much will Equifax settlement be?

Equifax will pay up to $425 million in restitution to those directly impacted by the massive data breach of the credit bureau in 2017. A federal court gave final approval to the class-action lawsuit settlement in mid-January.

How do I know if I qualify for Equifax settlement?

Go to the settlement website and click on "Find out if your information was impacted" to see if you're eligible. Identity restoration services include help dealing with companies, government agencies and credit bureaus. You can use the service even if you never make a claim from this settlement.

What credit monitoring service is Equifax offering?

Equifax Complete™ Family Plan Credit monitoring from Experian and TransUnion will take several days to begin. WebScan searches for your Social Security Number, up to 5 passport numbers, up to 6 bank account numbers, up to 6 credit/debit card numbers, up to 6 email addresses, and up to 10 medical ID numbers.

Is Equifax offering free credit monitoring?

This month, consumers impacted by the massive 2017 Equifax data breach finally began receiving their access codes for four free years of credit monitoring. The free service is offered through Experian, one of the nation's three largest credit reporting firms.

How much can you get from a data breach settlement?

Under the settlement terms, Equifax agreed to set up a fund to provide free credit monitoring and identity theft protection to consumers, as well as provide cash payments to people affected by the breach—up to $20,000 per person. The company also has to pay government fines and legal fees.

What happened to the Equifax lawsuit?

In 2017, hackers broke into Equifax in a breach that exposed the financial information of 147 million Americans. A federal court in 2020 approved a $380 million settlement of class actions lawsuits, with no finding or judgment of wrongdoing made.

What are the three credit monitoring?

Three-bureau credit monitoring alerts you of changes on credit reports from all three credit bureaus — Experian, Equifax and TransUnion.

What is the difference between my Equifax and Equifax?

Highlights: With a free myEquifax account, you can receive free Equifax credit reports, place a security freeze, fraud alert or submit a dispute. A myEquifax account is FREE, and for anyone to easily view and monitor their Equifax credit report and needs credit report assistance.

Does Equifax use FICO 8?

Even though it was released by FICO more than a decade ago, Score 8 is the version utilized most often by all three of the major credit reporting companies: Equifax, Experian, and TransUnion.

Is it worth paying for Equifax?

Equifax customer reviews Overall, it has been given a score of 1.1 out of 5, based on more than 800 reviews, with 97% of reviewers classifying Equifax as "bad", with fewer than 1% deeming it as either "excellent", "great" or "average".

Are Experian and Equifax the same?

Equifax: An Overview. Experian and Equifax are the two largest credit bureaus in the U.S. Both companies collect and research credit information of individuals and rate the overall ability to pay back a debt. Credit bureaus like Experian and Equifax provide the information they gather to creditors for a fee.

Do you have to pay for Equifax?

Equifax CompleteTM Premier $19.95 / month Equifax Consumer Services LLC (“ECS”) is a company based in the United States.

How Much Will Indiana residents get from the Equifax settlement?

approximately $79The Indiana Attorney General will start sending settlement payments on Wednesday to Hoosiers whose data was leaked in a 2017 Equifax breach. More than 236,000 past and current Indiana residents will get approximately $79 as part of a settlement that Indiana reached with the credit company.

How much will I get from Indiana Equifax settlement?

“Each person who filed an eligible claim for restitution at IndianaEquifaxClaims.com will receive approximately $79," a statement from the Attorney General's Office said. "The Office will begin distributing digital and check payments on March 31.

What is the Indiana Equifax settlement?

As part of the settlement, Equifax agreed to pay $19.5 million to the State of Indiana. That money is being directed to consumer restitution payments and costs associated with the settlement. If your personal information was impacted in the data breach, you are eligible for a consumer restitution payment.

What is the difference between my Equifax and Equifax?

Highlights: With a free myEquifax account, you can receive free Equifax credit reports, place a security freeze, fraud alert or submit a dispute. A myEquifax account is FREE, and for anyone to easily view and monitor their Equifax credit report and needs credit report assistance.

The Equifax settlement options

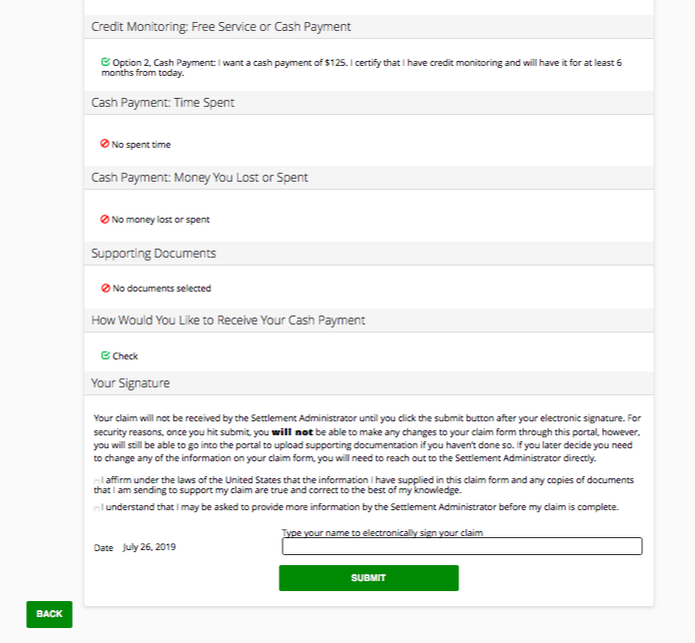

The Equifax settlement provides two compensation options for everyone affected: 10 years of free credit monitoring or a cash payout of up to $125.

Should you choose cash or credit monitoring?

Here's the problem with taking the cash -- the fund for this alternative reimbursement only has $31 million available. That money will be divided between everyone who chooses the cash payout, which means if too many people choose this option, the payout amounts will be reduced.

Additional compensation

Whether you take the cash or credit monitoring, the settlement also allows you to claim compensation for time spent or unreimbursed out-of-pocket losses you suffered that can be traced back to the data breach.

How to file a claim

The settlement administrator has created an Equifax data breach settlement site where you can read more about it and file your claim.

Getting the most value from the Equifax settlement

When news of the Equifax settlement first broke, it wasn't clear that the cash settlements could be reduced, so there was plenty of talk about "claiming your $125". Based on the number of people who have already filed, the cash payout won't amount to much.

Top credit card wipes out interest into 2023

If you have credit card debt, transferring it to this top balance transfer card secures you a 0% intro APR into 2023! Plus, you’ll pay no annual fee. Those are just a few reasons why our experts rate this card as a top pick to help get control of your debt. Read The Ascent's full review for free and apply in just 2 minutes.

About the Author

Lyle is a writer specializing in credit cards, travel rewards programs, and banking. His work has also appeared on MSN Money, USA Today, and Yahoo! Finance.

How much does credit reporting cost?

Credit-reporting services can cost $10 to $30 a month -- or you could use a free service like the one from Credit Karma -- but if you choose one of the lower-priced services, you can walk away with $60 or so.

How long to keep $125 in credit?

Option 1: Take the money after signing up for six months of monitoring, and keep whatever is left over after six months. To request the $125, you need to certify you are using a credit monitoring service on the date you submit your claim and will keep it for six months.

What happens if you are impacted by Equifax?

If you were impacted by the Equifax data breach, you may seek reimbursement for valid Out of Pocket losses or Time Spent (excluding losses of money and time associated with freezing or unfreezing credit reports or purchasing credit monitoring or identity theft protection) incurred during the Extended Claims Period if you have not received reimbursement for the claimed loss through other means.

When is the deadline to file a claim against Equifax?

The deadline to file a claim for Out-of-Pocket Losses or Time Spent that occurred through January 22, 2020 has passed.

How much time can you spend on a data breach?

You may be eligible for the following reimbursement cash payments for: Time Spent during the Extended Claims Period recovering from fraud, identity theft, or other misuse of your personal information caused by the data breach up to 20 total hours at $25 per hour.

When is the deadline for Equifax?

If you are a class member, the deadline to file Initial Claims Period claim (s) for free credit monitoring or up to $125 cash payment and other cash reimbursement passed on January 22, 2020.

When is the deadline for credit monitoring in 2024?

January 22, 20 24 (For future losses and time) File a claim for Credit Monitoring Services or Alternative Reimbursement Compensation. The deadline to submit a claim to receive the Free Credit Monitoring Services offered under the Settlement, or Alternative Reimbursement Compensation has passed.

When is the extended claim period for credit monitoring?

You may seek reimbursement for valid Out-of-Pocket Losses or Time Spent (excluding losses of money and time associated with freezing or unfreezing credit reports or purchasing credit monitoring or identity theft protection) incurred during the Extended Claims Period (between January 23, 2020 and January 22, 2024) if you have not received reimbursement for the claimed loss through other means.

Can you claim out of pocket time spent?

Submit a claim to receive reimbursement for Out-of-Pocket Losses and/or Time Spent. You may claim Out-of-Pocket Losses, Time Spent, and Credit Monitoring Services under the Settlement depending on whether you file claim(s) during the Initial or Extended Claims Period.